File

advertisement

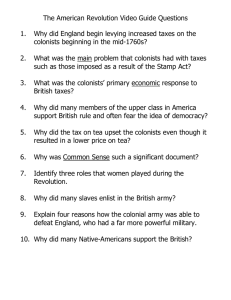

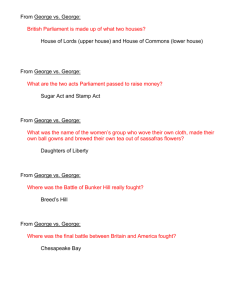

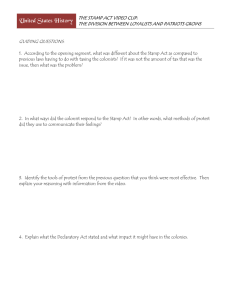

Cause and Effect The Navigation Acts (1650) Colonists were required to transport goods only on British ships Certain goods (sugar, tobacco, indigo, furs) could only go to England. Imported goods must be purchased from England or pay taxes in British port if purchased from a foreign nation. Purpose: To make England a wealthy nation The Navigations Acts (1650) COLONIAL REACTION: many colonists ignored these laws. Smuggling was prominent. BRITISH RESPONSE: Passed Sugar Act and Writs of Assistance Proclamation of 1763 Prohibited all settlement and fur trapping west of the Appalachian Mountains Britain passed this law to pacify the Indians and to save them the expense of protecting colonists who settled on the frontier. The colonists resented the Proclamation. Many defied the Proclamation and moved anyway. Writs of Assistance (1764) Legal papers which gave custom officials the right to search any building for any reason. The writs were an attempt to stop smuggling. The colonists complained that these writs violated their rights as English subjects. Sugar Act (1764) Reduced the tax on sugar/molasses but also provided for stricter enforcement of the Navigation Acts by sending suspected smugglers to England for trial with Crown-appointed judges (not jury). This law was an attempt to stop smuggling by lowering the tax and give the British government the tools to crackdown on smugglers. Sugar Act (1764) The colonists felt that this Sugar Act took away their rights of trial by jury and taxation with representation as guaranteed to them as English subjects. Stamp Act (1765) The Stamp Act was a direct tax on the colonies which placed a tax on almost all printed materials. It was attempt to raise revenue for Britain. You Mad Bro? People in Britain were shocked at the uproar in the colonies. Britain had spent a great deal of $$$ protecting the colonists from the French British paid 26 TIMES the taxes of the colonists. Here’s Why… Britain taxing the colonies went against the long- established British principle of no taxation without representation (see Magna Carta 1215) ONLY the colonists or their elected representatives had the right to pass taxes No colonial representation in Parliament = No British taxes Colonists were willing to pay taxes passed by colonial legislatures Stamp Act Crisis (1765) In response to the Stamp Act the colonists did the following: Formed the Sons and Daughters of Liberty protested in the streets harassed tax collectors boycotted trade with England non-importation agreements Stamp Act Congress and Resolves A Call for Unity The Stamp Act crisis brought a sense of unity to the colonies. Critic of the law called for delegates from every colony to meet in New York. The purpose of this “Stamp Act Congress” was to consider action against the hated Stamp Act. Delegates from nine colonies sent delegates. The Stamp Act Congress Drew up petitions, or letters, to King George III and to Parliament. These petitions rejected the Stamp Act and asserted that Parliament had no right to tax the colonies. Parliament paid little attention to these petitions. The Stamp Act Congress Besides petitions, the colonists took more direct action. They called for a boycott (to refuse to buy certain goods or services) of British goods The boycott took its toll, trade fell off by 14%. British merchants and workers suffered. Finally, in 1766 Parliament repealed (cancelled) the Stamp Act Stamp Act (1765) In reaction to the protests of the Stamp Act the British government repealed the law. In its place, they passed the Declaratory Act. Declaratory Act (1766) The Declaratory Act repealed the Stamp Act but also asserted British authority to tax the colonists in “all cases whatsoever.” The British asserted their authority to tax the colonists whenever they wanted. The colonists considered this act a victory. Townshend Act (1767) Placed duties (taxes) on glass, paper, paint, lead, and tea brought into the colonies. These duties were to be paid in gold or silver only and paid at the port of entry. Also, suspended the New York legislature. The Townshend Act was an effort by England’s new Finance Minister to tax the colonies “without offense”. Townshend Acts (1767) This act challenged the colonists basic notions of taxation without representation and liberty. In response, the colonists renewed their boycotts of British goods. Five colonists killed in a clash with British troops in 1770 known as “The Boston Massacre”. The Townshend Act was repealed one month after the Boston Massacre. Tea Act (1773) Kept the tax on tea and gave the East India Company a monopoly over the American tea trade. The British kept the tax on tea to show the colonists it still had the right to tax them. Tea Act (1773) In response to the Tea Act the colonials: Organized Committees of Correspondence The Boston Tea Party was staged by the Sons of Liberty. The King was furious. Parliament passed four new laws (Intolerable Acts) to punish the colonists. Intolerable Acts (1774) also called the Coercive Acts These acts were meant to punish Boston for the Boston Tea Party and to isolate Boston from the rest of the colonies. Closed Boston harbor until the colonists paid for all the tea they dumped. Greatly restricted colonial government Allowed British commanders to house troops wherever necessary. Allowed British officials accused of crimes to stand trial in England. Intolerable Acts (1774) Colonists sent supplies to aid Boston; Boycotted British goods; Established the First Continental Congress Britain stood firm and tension between Britain and the American colonies increased; the colonists prepared for war; Fighting begins at Lexington and Concord (the shot heard ‘round the world)