business administration department

advertisement

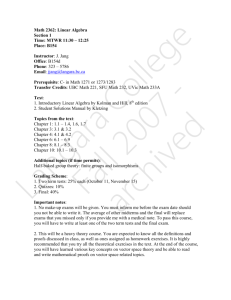

La ng a Fa ra l C l ar 2 o ch 01 lle iv 1 - ge ed Course Outline Department: School of Management Course Number: Course Title: FMGT 2474 Financial Management I Semester Year: Days: Classroom: Fall 2011 Mondays & Wednesdays B148 Credits: 3 Section: 001 Hours: 12:30 – 14:20 Instructor Contact Name: Aziz Rajwani, CA Office (Room No.) B253k Phone: 604-323-5845 Office Hours: Mon & Wed 11:30 – 12:20 Tue & Thurs 2:30 – 4:20 and Tuesdays 4:30−5:20 Other times by appointment. E-Mail: arajwanil@langara.bc.ca E-Mails will be answered within 24 hours (during weekdays). Course Description FMGT 2474 builds upon essential financial concepts introduced and developed in Financial Management I (FMGT 2371). In this course, the focus lies with investment and rate of return analysis of major business investments, with capital budgeting analysis, with cost of capital and with capital structure. While 2371 concerned itself more with operational, shortterm and medium-term financial analysis and strategies, 2474 looks at more fundamental, longer-term decision-making and its relationship to capital markets. Page 1 La ng a Fa ra l C l ar 2 o ch 01 lle iv 1 - ge ed Learning Objectives/Outcomes Learning Objectives/Outcomes Calculate the net present value (NPV) of a capital budgeting project and decide whether it should be undertaken. Calculate the payback period, the discounted payback period, the profitability index and internal rate of return of a capital budgeting project. Calculate the NPV of a capital budgeting project where revenues and/or expenses are growing at a certain rate for a period of time. Calculate the equivalent annual cost of projects with dissimilar lives. Calculate the NPV of bond and/or preferred share refinancing and whether refinancing should occur. Describe the differences between bonds, preferred shares and common shares. Calculate a company’s weighted average cost of capital. Calculate the indifference EBIT between different capital structures. Describe the different capital structure theories. Calculate the NPV of a lease vs. buy decision. Describe the different dividend policy theories. Measurement Assignments, Midterm 1 Assignments, Midterm 2 Assignments, comprehensive Final exam Prerequisite(s) None University Transferability Refer to www.bccat.bc.ca for transferability and whether credits are assigned or unassigned. Required Textbook and Calculator Introduction to Corporate Finance, by Laurence Booth and W. Sean Cleary, 2nd Edition, Wiley 2010. You can also use the First Edition. We do NOT use WileyPlus. The textbook’s website has (useful) materials for students: www.wiley.com/canada/booth A business calculator which can perform discounted cash-flow calculations is required. Page 2 La ng a Fa ra l C l ar 2 o ch 01 lle iv 1 - ge ed I will be using a Hewlett Packard 10BII (or 10B, or 10BII+) for in-class demonstration. Thus, unless you already have a business calculator, I highly recommend that you purchase the HP 10BII. The Texas Instruments Business Analyst II, the Sharp Business Calculator (EL733-A and EL-738) and the TI-83/84 Graphing Calculator are also capable of performing discounted cash-flow calculations; however, the Texas Instruments Business Analyst (BA35) is not capable of performing certain discounted cash-flow calculations.) The website www.tvmcalcs.com has some useful/helpful materials. Recommended Readings Any readings (in addition to the required textbook readings) will be announced in class. Blackboard Assignment templates and other instructional materials will be posted on Blackboard. Students are expected to regularly check Blackboard (and their Langara email accounts) for messages from the instructor. Grade Allocation Assignments Midterms 1 and 2 Comprehensive Final TOTAL A+ A A- 95-100% 90-94% 85-89% 10% 55% 35% 100% B+ B B- 80-84% 75-79% 70-74% C+ C C- 65-69% 60-64% 55-59% D F 50-54% <50% Students will have to pass the examination portion of the grade in order to pass the course- i.e., obtain at least a 45/90 on the mark derived from the midterms and the final [(MTsx55% + FINALx35%) ≥ 45%]. Projects, Case Studies As directed by your instructor during the course. Page 3 La ng a Fa ra l C l ar 2 o ch 01 lle iv 1 - ge ed Expectations You are responsible for all course content and are therefore responsible for knowing what has been covered and said in all classes. Your instructor will not provide answers to e-mails requesting a restatement of what has been said in a previous class. Furthermore, you are expected to read and be prepared to discuss material assigned prior to the class. Langara College welcomes all students into an environment that creates a sense of community of pride and respect; we are all here to work cooperatively and to learn together. You are encouraged to participate actively in class and contribute to the creation of a positive learning environment. All assignments must be handed in at the beginning of the class on the due date. Students who arrive late should submit their assignments at that time. No late assignments will be accepted unless arrangements have been made with the instructor before the due date/time. Where applicable, assignment templates (.pdf files) will be posted for each assignment on Blackboard. Assignments/examinations should be submitted with your Last (Family) Name, First (Given) Name (e.g., Rajwani, Aziz). You are expected not to make any travel plans on exam dates. There will not be any alternative date and/or time for the midterms or the final exam without your instructor’s permission. There will be no exceptions to this rule unless there are exceptional circumstances (with appropriate supporting documentation) or medical reasons. Therefore, if you miss an exam, assignment or deadline, you are required to contact your instructor prior to the exam, assignment or deadline and provide a doctor’s note for verification or you will receive 0%. Any class work, which is not completed because you were late for, or missed, a class, will receive 0%. Remember that it is your responsibility to attend class, keep up with the course, know what has been covered etc. If you miss a class, information will not be repeated for your sole benefit. Attendance in class is expected. This course demands regular and continuous effort directed at problem solving preparation for examinations that integrate various topics. Each chapter has comprehensive review problems with solution and these are highly recommended for your study. Additionally, all electronic communication and music devices (e.g. cell phones, pager, CDplayers, mp3-players, etc.) must be turned off or muted while in class. Cellular phones, pagers, electronic translators and programmable calculators are not allowed during examinations. Buy a watch to keep track of time during examinations. Page 4 La ng a Fa ra l C l ar 2 o ch 01 lle iv 1 - ge ed Overall, you are expected to follow the ordinary rules of courtesy during class sessions. Students whose behaviour is unacceptable will be asked to leave the class. For more details, please refer to Langara’s Code of Conduct in the course calendar or Student Policies and Procedures on Langara’s website at www.langara.bc.ca. My role as your instructor is to help you and to provide any additional coaching or tutoring that you may need. Please use me as a resource. Plagiarism and Cheating Policy Plagiarism and cheating are serious educational offences, which may result in failure of an assignment, failure in a course, and possible suspension from Langara College. For further details, please refer to Langara’s Code of Conduct in the College calendar or Student Policies and Procedures on Langara’s website at www.langara.bc.ca School of Management It is the aim of the School of Management of Langara College to promote throughout each course the mastery of core skills such as reading and reading comprehension, writing fluency, verbal articulation, and math development. These core skills will be practiced by means of student presentations and/or class participation, and will be evaluated on submitted work. Critical thinking and problem solving exercises will be encouraged at every opportunity. As stated in the College Calendar and according to College policy, students are expected to attend all classes, lectures, laboratories, workshops, seminars, and practicum commitments, and be available to write final examinations where and when scheduled during the examination period. Students are also reminded to refer to policies and procedures related: Code of Academic Conduct, Improper/Disruptive Behaviour, Appeal of Final Grades, Concerns Related to Instruction, Attendance, etc. found in the College Calendar and in the current Student Handbook. For more information about the School of Management programs, please contact the School’s advisors (see Advising Schedule posted at the entrance to the B253 offices), or email business@langara.bc.ca. Page 5 La ng a Fa ra l C l ar 2 o ch 01 lle iv 1 - ge ed Course Schedule The course schedule is tentative and subject to change. Midterm dates will be confirmed in class. Date Sep. 7, 12, 14, 19 Topic Cash Flow Estimation and Capital Budgeting Decisions The Canadian Tax System Textbook Readings – 2nd Edition Chapter 14 (IGNORE CCA recapture and terminal losses and pages 572-575). Topic 14.5 to be covered on Sep. 28. Chapter 3: Topic 3.5 (pages 89-93 BUT IGNORE CCA recapture and terminal losses) Sep. 21, 26 Capital Budgeting, Risk Considerations, and Other Special Issues Inflation and Capital Budgeting Decisions Independent and Interdependent Projects Callable Bonds and Bond/Preferred share Refinancing Equity and Hybrid Instruments Midterm One [Chapters 3, 13 and 14] Chapter 13: Topic 13.3 to be covered on Oct. 3. Shareholders’ Equity Initial Public Offerings Chapter 19 (pp. 740-744) Chapter 17 (pp. 690-691 and 696-697) Sep. 28, Oct. 3 Oct. 5, 17 Oct. 12 Oct. 19 Oct. 24, Cost of Capital 26, 31, Nov. 2, 7 Oct. 28 Last day to Withdraw Chapter 14: Topic 14.5 (pp. 579-583) Chapter 13: Topic 13.3 (pp. 528-532) Class Handout (from different textbook) Chapter 19: Topic 19.2 (pp. 747-750) Chapter 20 (IGNORE “Fed Model” pp. 801-802 and Topic 20.7) Nov. 7, 9, 14 Nov. 16 Capital Structure Decisions, Chapter 21 (Financial Leverage: pp. 827-832; Question/Answer Session Topics 21.5, 21.6 and 21.7) Midterm Two [Chapters 19, 17, 20 and 21 and Handout (from different textbook)] Nov. 21, 23, 28 Nov. 30 Leasing Chapter 16 Dividend Policy Chapter 22: Topics 22.1, 22.2, 22.5 and 22.6 (IGNORE Repackaging Dividend-Paying Securities) Final exams will be held from Dec. 5 – Dec. 16. The date and location of the final exam is determined by the College and will be posted on the College’s website (usually) by the end of October. Page 6 Textbook Readings – 1st Edition Chapter 14 (IGNORE CCA recapture and terminal losses and pages 560-563). Topic 14.5 to be covered on Sep. 28. Chapter 3: Topic 3.5 (pages 83-88 BUT IGNORE CCA recapture and terminal losses) Chapter 13: Topic 13.3 to be covered on Oct. 3. La ng a Fa ra l C l ar 2 o ch 01 lle iv 1 - ge ed Topic Cash Flow Estimation and Capital Budgeting Decisions The Canadian Tax System Capital Budgeting, Risk Considerations, and Other Special Issues Inflation and Capital Budgeting Decisions Independent and Interdependent Projects Callable Bonds and Bond/Preferred share Refinancing Equity and Hybrid Instruments Shareholders’ Equity Initial Public Offerings Cost of Capital Chapter 14: Topic 14.5 (pp. 565-569) Chapter 13: Topic 13.3 (pp. 519-523) Class Handout (from different textbook) Chapter 19: Topic 19.2 (pp. 735-738) Chapter 19 (pp. 728-732) Chapter 17 (pp. 678-680 and 684-686) Chapter 20 (IGNORE “Fed Model” pp. 791-793 and Topic 20.7) Chapter 21 (Financial Leverage: pp. 817-822; Topics 21.5, 21.6 and 21.7) Chapter 16 Chapter 22: Topics 22.1, 22.2, 22.5 and 22.6 (IGNORE Repackaging Dividend-Paying Securities) Capital Structure Decisions Leasing Dividend Policy ASSIGNMENT SCHEDULE*** NUMBER DUE DATE*** 1 Sep. 21 2 Sep. 28 3 Oct. 5 4 Oct. 24 5 Nov. 9 6 Nov. 14 7 Nov. 30 *** Subject to change Assignments will be posted on Blackboard and (where applicable) should be submitted on the templates provided (print the .pdf file). Only submit the pages starting with “Name (Last, First) ____________________”. Page 7