Taxes Notesheet Taxation Formulas and Tax Fairness

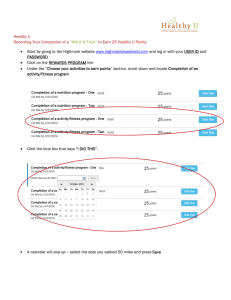

advertisement

Handout # 7 Taxes Notesheet Taxation Formulas and Tax Fairness The three terms below are not specific types of taxes. They are descriptive terms to help explain how a tax will affect those who pay that tax. Specifically they describe who will have the heaviest burden trying to pay the tax. Regressive Taxes: this is a tax that does not change with a person’s ability to pay the tax; this impacts those with lower incomes more severely (example: if every citizen has to pay a $500 tax regardless of how much they earn, this will be a much bigger portion of earnings for people with $20,000 incomes than it will for people with $50,000 incomes) Proportional Taxes: the percentage rate stays the same regardless of how much you earn; but because it charges a percentage rate, the dollar amount you pay will increase as your salary increases (example: 6% tax for all citizens would mean a $600 bill for people with $10,000 incomes and a $1,200 bill for people with $20,000 incomes) Progressive Taxes: the percentage rate increases as the person’s income increases -people with higher incomes are expected to pay a higher percentage rate in taxes (example: if you earn $20,000, you might have to pay 20% of your income; but if you earn $50,000, you might have to pay 25% of your income) Various Forms of Taxes Sales tax: A tax placed on the sale of various items. It is paid by the purchaser. Sales taxes are the most productive source of income for state governments today - - providing about 1/3 of all tax monies collected by States each year. Sales taxes are generally considered regressive. Since low income earners have to spend almost all of what they earn in order to live, they therefore pay sales taxes on virtually all of their income. Higher wage earners are often able to save some of what they earn and therefore don’t pay sales tax on those saved earnings. This means higher wage earners pay a lower percentage of their total income on sales taxes. General Sales Tax: a sales tax applied to the sale of most items (in PA the major exceptions are food, clothing, newspapers, and medicine); rates for these taxes range from 3% to 8% in the 45 states that levy such a tax on the people Selective Sales Tax: an additional sales tax that is placed on the sale of only certain commodities, such as cigarettes, liquor, or gasoline -- every state levies these taxes. In addition, some selective sales taxes are charged to the seller rather than the buyer of the product and are usually calculated per unit of product sold (i.e. packs of cigarettes or gallons of gasoline) rather than as a percentage. These are called excise taxes. Income Tax: A tax levied on the yearly earnings of individuals and/or corporations. This brings in a little less than 1/3 of state revenue. 43 states have a personal income tax and 45 states have income taxes on corporations. These taxes are either progressive or proportional and have rates that vary from 1% to 10% in state governments. In the federal government, the progressive income tax rates vary between 10% at the lowest bracket and 35% in the top income bracket. Property Tax: A tax levied on the assessed value of property that you own. This is the largest source of income for local governments. Taxed property falls into the category of either “real” or “personal” property. Property taxes, perhaps more than any other tax, are regressive (not geared toward one’s ability to pay). Real Property: land, buildings, and improvements that go with that property if it is sold Personal Property: either tangible or intangible tangible personal property: movable wealth that is visible and the value of which can be easily assessed (farm implements, livestock, pianos, cars, jewelry, fir coats, etc.) intangible personal property: stocks, bonds, mortgages, bank accounts, etc. Assessment: the process of determining property value. Assessments are usually at less than a property’s true value since people are less likely to argue about the accuracy of an assessment if it is too low and because property assessors are often elected and do not want to make local voters angry. Estate Tax: A tax levied by the federal government. It is taxed on the full value estate (all of the property a person owned) after that person’s death. These taxes are calculated before the property is divided among its recipients and must be paid by the estate. This tax is a federal tax levied on very valuable estates only. Inheritance Tax: This is a state tax paid on the value of specific items that a person inherits. It is paid by the people receiving inherited goods. Licenses and Fees: Charges from specific government agencies for things such as court fines, hunting and fishing licenses, bingo licenses, car registration, etc. Licenses for different professions: medical, legal, cosmetic, construction, etc. may also require fees to be paid. Such charges are often considered regressive, but may also be considered fair since they are paid by the specific user that is benefiting.