the specter of premature death

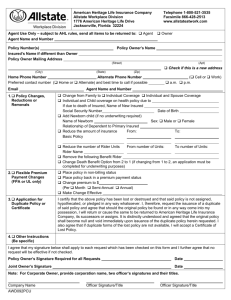

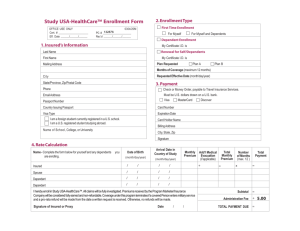

advertisement