The Home Depot Inc.

advertisement

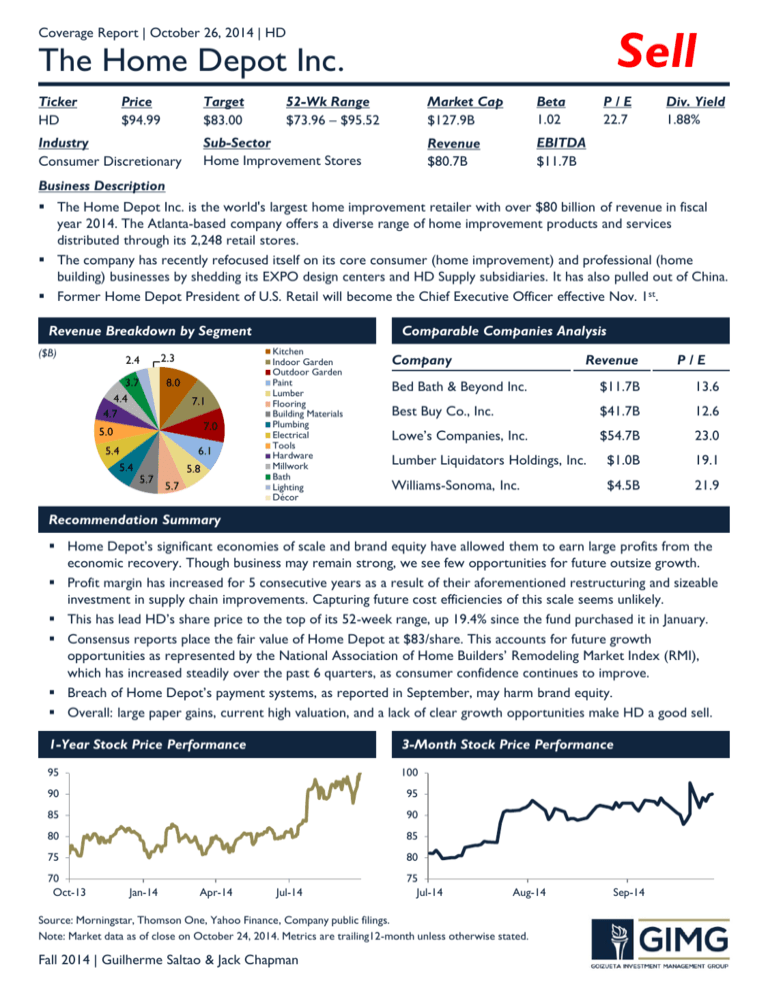

Sell Coverage Report | October 26, 2014 | HD The Home Depot Inc. Ticker HD Price $94.99 Target $83.00 Industry Consumer Discretionary 52-Wk Range $73.96 – $95.52 Sub-Sector Home Improvement Stores Market Cap $127.9B Beta 1.02 P/E 22.7 Revenue $80.7B EBITDA $11.7B Div. Yield 1.88% Business Description The Home Depot Inc. is the world's largest home improvement retailer with over $80 billion of revenue in fiscal year 2014. The Atlanta-based company offers a diverse range of home improvement products and services distributed through its 2,248 retail stores. The company has recently refocused itself on its core consumer (home improvement) and professional (home building) businesses by shedding its EXPO design centers and HD Supply subsidiaries. It has also pulled out of China. Former Home Depot President of U.S. Retail will become the Chief Executive Officer effective Nov. 1st. Revenue Breakdown by Segment ($B) 2.4 3.7 4.4 4.7 2.3 8.0 7.1 7.0 5.0 5.4 5.4 6.1 5.7 5.8 5.7 Comparable Companies Analysis Kitchen Indoor Garden Outdoor Garden Paint Lumber Flooring Building Materials Plumbing Electrical Tools Hardware Millwork Bath Lighting Décor Company Revenue P/E Bed Bath & Beyond Inc. $11.7B 13.6 Best Buy Co., Inc. $41.7B 12.6 Lowe’s Companies, Inc. $54.7B 23.0 Lumber Liquidators Holdings, Inc. $1.0B 19.1 Williams-Sonoma, Inc. $4.5B 21.9 Recommendation Summary Home Depot’s significant economies of scale and brand equity have allowed them to earn large profits from the economic recovery. Though business may remain strong, we see few opportunities for future outsize growth. Profit margin has increased for 5 consecutive years as a result of their aforementioned restructuring and sizeable investment in supply chain improvements. Capturing future cost efficiencies of this scale seems unlikely. This has lead HD’s share price to the top of its 52-week range, up 19.4% since the fund purchased it in January. Consensus reports place the fair value of Home Depot at $83/share. This accounts for future growth opportunities as represented by the National Association of Home Builders’ Remodeling Market Index (RMI), which has increased steadily over the past 6 quarters, as consumer confidence continues to improve. Breach of Home Depot’s payment systems, as reported in September, may harm brand equity. Overall: large paper gains, current high valuation, and a lack of clear growth opportunities make HD a good sell. 1-Year Stock Price Performance 3-Month Stock Price Performance 95 100 90 95 85 90 80 85 75 80 70 Oct-13 Jan-14 Apr-14 Jul-14 75 Jul-14 Aug-14 Source: Morningstar, Thomson One, Yahoo Finance, Company public filings. Note: Market data as of close on October 24, 2014. Metrics are trailing12-month unless otherwise stated. Fall 2014 | Guilherme Saltao & Jack Chapman Sep-14