Pacific Sunwear of California, Inc. Equity Valuation

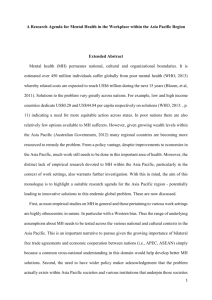

advertisement