CBA Exam Review Part 3

advertisement

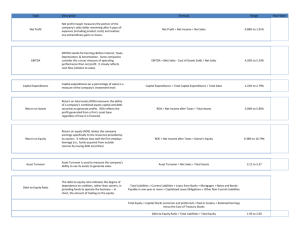

CBA Exam Review Part 3 James A. McIntyre, CCE NACM 1 What Do Financial Statements Indicate? •Liquidity •Solvency •Management Efficiency 2 Financial Statements •Balance Sheet (Resource Sheet) •Shows the financial position at a point in time •Income Statement (Activity Statement) •Profit or loss for the accounting period •Statement of Retained Earnings •Reconciles the change in retained earnings account – profits, dividends and adjustments •Statement of Cash Flows •Separates cash flows into operating activities, investing activities, and financing activities 3 Accountant’s Opinions •Unqualified opinion •Unqualified opinion – with explanatory language •Qualified opinion •Disclaimer of opinion •Adverse opinion •Compilation 4 Assets Balance Sheet Liabilities Current Assets: Cash Marketable Securities Receivables Merchandise or Inventory Prepaid Expense ________________________ Current Assets (total of above) Accounts Payable – Trade Notes Payable – Banks Notes Payable – Others Accruals Unearned Revenue Provision for Taxes Current Maturities on Long-Term Liabilities ___________________________ Current Liabilities (total of above) Fixed Assets: Plant, Property and Equipment Less: Accumulated Depreciation _________________________ Total Net Fixed Assets Long-Term Liabilities Deferred Taxes ___________________________ Total Liabilities Stockholders Equity Long-Term Investments Intangible Assets Miscellaneous _________________________ Total Assets Capital Stock Paid-in Capital Retained Earnings Treasury Stock __________________________ Total Liabilities and Equity Assets = Liabilities + Stockholder’s Equity 5 Income Statement Gross Sales - returns and allowances = Net Sales - Cost of goods sold = Gross Profit - Expenses Selling General and Administrative = Income from operations + Interest revenue - Expense = Net income before taxes - Provisions for income tax = Net Income 6 Statement of Cash Flows •Statement consists of three basic parts: •Cash flows from operating activities •Cash flows from investing activities •Cash flows from financing activities •Change in cash is caused by cash flows generated by or used by operations, investments and financing activities of the company. The sum of these three activities equals the change in the cash on the balance sheet. 7 Statement of Cash Flows •Inflow/Source •Decrease in any asset •Increase in any liability •Increase in any net worth •Outflow/Use •Increase in any asset •Decrease in any liability •Decrease in any net worth 8 Common-size Analysis •Overview •Vertical analysis •Horizontal analysis •Income Statement •Balance Sheet 9 CBA Exam Ratio Sheet Revenue Growth/Decline (Current Year Sales – Prior Year Sales)/ Prior Year Sales Return on Equity Net Income/Equity Return on Assets Net Income /Assets Gross Profit Margin Gross Profit/Net Sales Operating Profit Margin Operating Profit/Net Sales Net Profit Margin Net Profit/Net Sales Cash Flow Margin Cash Flow from Operating Activities/Net Sales 10 CBA Exam Ratio Sheet Earnings Per Share Net Earnings/Average Common Shares Outstanding Total Asset Turnover Total Sales/Total Assets Inventory Turnover Cost of Goods Sold/Inventory Inventory Carrying Period AKA Days Inventory Held or Days Inventory Outstanding Inventory/(Cost of Goods Sold/360) Accounts Receivable Carrying Period AKA Days Sales Outstanding or Average Collection Period Accounts Receivable/(Sales/360) 11 CBA Exam Ratio Sheet Accounts Payable Deferral Period AKA Days Payable Outstanding Accounts Payable/(Cost of Goods Sold/360) Fixed Asset Turnover Net Sales/Net Property, Plant, Equipment Leverage Total Assets/Equity Debt to Equity Total Debt/Stockholder’s Equity Debt Ratio Total Debt/Total Assets Long-term Debt to Total Capitalization Long-term Debt/(Long Term Debt + Stockholders’ Equity) Long-term Debt to Net Working Capital Long-term Debt/(Current Assets – Current Liabilities) Times Interest Earned Operating Profit/Interest Expense 12 CBA Exam Ratio Sheet Working Capital Current Assets – Current Liabilities Cash Flow Liquidity Ratio (Cash + Marketable Securities + CFOA*)/Current Liabilities Trade Cycle/Operating Cycle (Inventory Carrying Period + Accounts Receivable)/Carrying Period Cash Conversion Cycle (Inventory Carrying Period + Accounts Receivable)/(Carrying Period – Accounts Payable Deferral Period) Current Ratio Current Assets/Current Liabilities Quick or Acid-Test Radio (Current Assets – Inventory)/Current Liabilities * Cash Flow from Operating Activities 13 Out of Court Settlement •Extension Agreement •Composition Agreement •Assignment 14 Bankruptcy Acts •Chapter 13 •Wage earner plan/small business •Chapter 11 •Business reorganization •Chapter 7 •Straight liquidation •Chapter 9 •Municipalities and governmental units •Chapter 12 •Family farm reorganization 15 Chapter 7 Liquidation Priorities 1. Secured Creditors 2. Administrative expenses 3. Unsecured claims for sales to a debtor-in-possession 4. Wages & compensation claims 5. Customer deposits 6. Taxes 7. Unfunded pension liability 8. Unsecured creditors 9. Preferred stockholders 10. Common stockholders 16