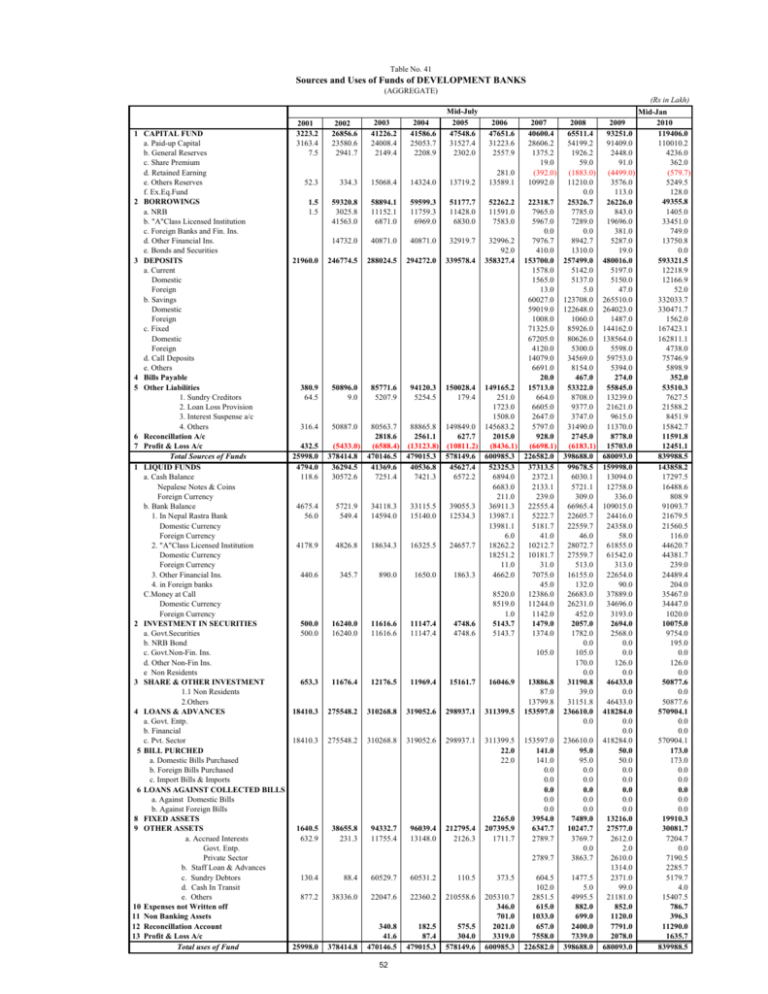

Sources and Uses of Funds of DEVELOPMENT BANKS

advertisement