Case study: Mobilicity's Canadian outsourcing strategy

advertisement

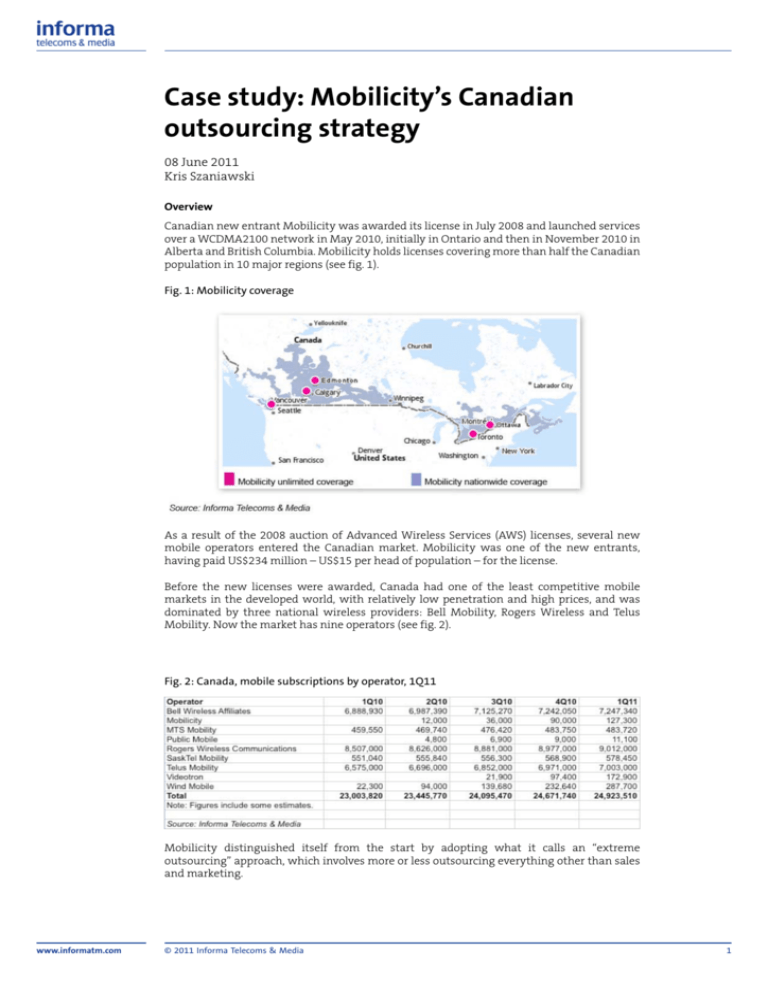

Case study: Mobilicity’s Canadian outsourcing strategy 08 June 2011 Kris Szaniawski Overview Canadian new entrant Mobilicity was awarded its license in July 2008 and launched services over a WCDMA2100 network in May 2010, initially in Ontario and then in November 2010 in Alberta and British Columbia. Mobilicity holds licenses covering more than half the Canadian population in 10 major regions (see fig. 1). Fig. 1: Mobilicity coverage As a result of the 2008 auction of Advanced Wireless Services (AWS) licenses, several new mobile operators entered the Canadian market. Mobilicity was one of the new entrants, having paid US$234 million – US$15 per head of population – for the license. Before the new licenses were awarded, Canada had one of the least competitive mobile markets in the developed world, with relatively low penetration and high prices, and was dominated by three national wireless providers: Bell Mobility, Rogers Wireless and Telus Mobility. Now the market has nine operators (see fig. 2). Fig. 2: Canada, mobile subscriptions by operator, 1Q11 Mobilicity distinguished itself from the start by adopting what it calls an “extreme outsourcing” approach, which involves more or less outsourcing everything other than sales and marketing. www.informatm.com © 2011 Informa Telecoms & Media 1 Strategic goals Mobilicity has set itself ambitious growth targets in what is now a crowded market. The company still has a small subscription base, compared with its main competitors: At end-1Q11 it had 127,300 subscriptions (see fig. 2). Dave Dobbin, the company’s president and CEO, admits that in the first six months Mobilicity was still trying to find its feet, but he says the company has hit its stride and is growing faster than expected. Mobilicity decided to follow what it called the “Bharti model,” because it did not want to spend too much on capital outlay up front. As a late entrant to a suddenly highly competitive market, Mobilicity concluded that it would be difficult to differentiate itself on coverage or price and therefore decided to try to improve speed and efficiency and focus on specific market segments. The operator points out that it has gone a lot further down the outsourcing route than any of the other operators it spoke to before making this decision but also stresses that it is much more than just an MVNO. Business model Mobilicity has managed-services contracts with two main suppliers, Ericsson and Amdocs. The operator has only about 300 employees and has adopted a radical outsourcing approach in which it effectively leaves it to Ericsson to decide what is required to effectively run the network and to Amdocs to decide which OSS/BSS systems are required. In addition, customer service and the contact center have been outsourced to BPO company Sitel, and handset distribution and logistics have been outsourced to technology distributor Ingram Micro (see fig. 3). Fig. 3: Mobilicity outsourcing partners Mobilicity announced a five-year managed-network-operations contract with Ericsson in April 2010, after having previously chosen Ericsson to design and build its 3G network. Ericsson handles Mobilicity’s day-to-day network operations and is responsible for front- and back-office operations and field maintenance. However, the managed-network relationship with Ericsson is the less unusual aspect of Mobilicity’s radical outsourcing approach, so this case study concentrates on the relationship with Amdocs. Amdocs describes itself as the operator’s de facto IT department, running as it does billing, CRM and other IT systems and processes. Amdocs Managed Services provides end-to-end support for its own products as well as third-party sales and enterprise systems, including financials, content management, fraud, data warehousing and business intelligence. The data center is located in Toronto rather than at a regional network-operations center over the border in the US. www.informatm.com © 2011 Informa Telecoms & Media 2 Of Mobilicity’s 300 employees, a large percentage are project managers, contract managers and report analysts, who communicate with business units and report to Amdocs. According to Dobbin, their conversations with Amdocs are to a large extent about SLA management. Mobilicity expects Amdocs to come to it with new ideas. There is a flat fee structure, with bonus payments linked to savings and the acquisition of new subscribers to encourage the vendor to bring new things to the table to encourage new subscribers. Mobilicity points out that Amdocs’ managed-services group has thousands of employees worldwide and is therefore well positioned to add value to Mobilicity’s business by coming up with suggestions about best practices and functionality that might have been deployed by operators elsewhere. Dobbin claims rhetorically that Amdocs does everything for the company except manage its laptops and e-mail. One of the arguments the operator gives for taking so radical a step is its wish to have as few choke points as possible and thus prevent the inevitable problems that arise from having multiple points where IT vendors interconnect. The RFP process that led to the appointment of Amdocs apparently focused more on outcomes than technical issues. Mobilicity instructed the vendors to advise them not just about technology and equipment but also about the processes they should adopt, for example asking for advice on how the provisioning process should work. Mobilicity says it received 25 submissions in response to the RFP from vendors, consulting firms and systems integrators. Amdocs’ proposal wasn’t the most expensive or the cheapest. The operator says Amdocs won points by being the only vendor to answer the RFP without involving a systems integrator. The operator was clearly eager to have a single company to deal with rather than multiple interconnection points and therefore was won over by the prospect of an end-to-end turnkey offering that combined software and systems integration. Results Mobilicity says its radical outsourcing approach has reduced its bottom-line costs, made its costs more predictable, added value to the top line and boosted other areas, such as efficiency and time-to-market. Given the number of new entrants, Mobilicity placed a lot of emphasis on speed-to-market. With Amdocs’ assistance, Mobilicity says it took less than six months to become fully operational, with the entire server infrastructure and software customized and implemented in that short period of time largely because Amdocs was able to take advantage of existing networks and resources. According to Dobbin, its relationships with a small set of suppliers are by their very nature close. He jokes that he likes his vendors because they have nobody else to blame when something goes wrong. Considering the number of new entrants, Mobilicity decided that it would be difficult to differentiate on coverage and price. Instead, it has focused on simple, easy-to-understand offerings and on speed and efficiency. For example, Mobilicity says it can fully provision a BlackBerry device within five minutes, compared with the 40 minutes it claims it takes competitors to activate a new phone. According to Mobilicity, simplicity of product aids satisfaction. With this in mind there is no bill: The customer simply receives a statement. The operator does not have customer contracts either, but customers can look up terms and conditions on the website. The operator also relies heavily on self-service channels and IVR in order to limit the pressure on call centers. Mobilicity also sets great store by its real-time billing system. It points out that companies with less-frequent billing cycles, such as two cycles a month, frequently suffer from a big spike in activity around that point, with a big drain on the call center and website. By comparison, real-time billing requires more staggered support and is less of a drain on resources. In terms of initial sales strategy, Mobilicity has made a point of emulating Metro PCS in the US, focusing on offering “unlimited data” and relatively straightforward price plans. Mobilicity has targeted immigrants and low-income groups, among others, but is also increasingly focusing on data-centric services targeted at smartphone users and also sees wireline substitution as an opportunity. www.informatm.com © 2011 Informa Telecoms & Media 3 Strategic outlook Amdocs is looking to expand deals that are technology-focused and provide opportunities for innovation. The vendor says it is not interested in managed-services relationships that are primarily focused on cost containment or based on a labor-arbitrage model. This is also increasingly true of operators that are looking for efficiencies and new opportunities rather than cost savings alone. Amdocs says there is strong operator appetite for outsourcing holistically, which is to say working with a single partner. Most of the Amdocs’ managed-services engagements involve subcontracting, but the vendor is building on its relationships and engaging in partnership discussions with major network-equipment vendors to expand these further. There have been suggestions that Mobilicity might consider reducing the number of managed-services-provider contracts it has to one. In theory, there could be some cost advantage to so radical a move, but it would not be easy and the operator would lose visibility of operations and processes. Informa viewpoint Mobilicity’s decision to focus on what it sees as core selling and marketing functions and to adopt a radical outsourcing approach to everything else from day one is a good example of how far an operator can go down the outsourcing path. But the extent of what has been outsourced is unusual and will remain so, because it is a strategy most appropriate to a greenfield operator racing to outstrip other new entrants. Other operators, such as Bharti Airtel, have adopted a radical outsourcing approach, but it has tended to be introduced over a period of time and in stages rather than as a big bang, and this will remain the more common approach. Mobilicity has a mountain to climb in Canada, considering its low starting point in terms of market share. It says that simplicity, speed, efficiency and automation will all help it make inroads into what is turning into a highly competitive market. The outsourcing relationships the operator has established and its focus on a lean approach to delivering services win points for being innovative. However, there can be a trade-off between simplicity, speed and efficiency on the one hand and quality of experience on the other. The current approach is well focused and should deliver results with the audiences being targeted, but it might prove more difficult when Mobilicity seeks to broaden its appeal to a broader range of customers. www.informatm.com © 2011 Informa Telecoms & Media 4