Annual Report

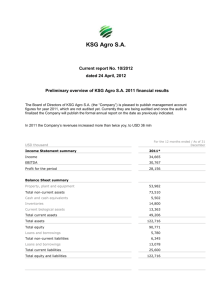

advertisement