NCHPX V HFRI FOF DIV IDX 12.31.14.xlsm

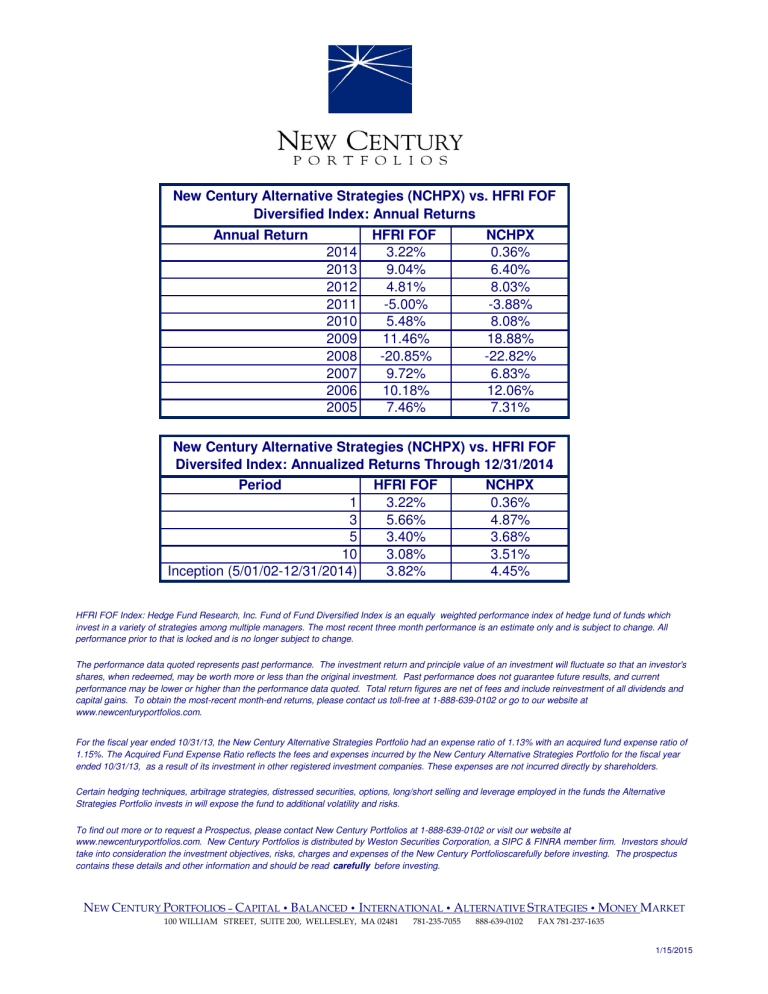

New Century Alternative Strategies (NCHPX) vs. HFRI FOF

Diversified Index: Annual Returns

Annual Return

2014

2013

2012

2011

2010

HFRI FOF

3.22%

9.04%

4.81%

-5.00%

5.48%

2009 11.46%

2008 -20.85%

2007 9.72%

2006 10.18%

2005 7.46%

NCHPX

0.36%

6.40%

8.03%

-3.88%

8.08%

18.88%

-22.82%

6.83%

12.06%

7.31%

New Century Alternative Strategies (NCHPX) vs. HFRI FOF

Diversifed Index: Annualized Returns Through 12/31/2014

Period

5

10

Inception (5/01/02-12/31/2014)

1

3

HFRI FOF

3.22%

5.66%

3.40%

3.08%

3.82%

NCHPX

0.36%

4.87%

3.68%

3.51%

4.45%

HFRI FOF Index: Hedge Fund Research, Inc. Fund of Fund Diversified Index is an equally weighted performance index of hedge fund of funds which invest in a variety of strategies among multiple managers. The most recent three month performance is an estimate only and is subject to change. All performance prior to that is locked and is no longer subject to change.

The performance data quoted represents past performance. The investment return and principle value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than the original investment. Past performance does not guarantee future results, and current performance may be lower or higher than the performance data quoted. Total return figures are net of fees and include reinvestment of all dividends and capital gains. To obtain the most-recent month-end returns, please contact us toll-free at 1-888-639-0102 or go to our website at www.newcenturyportfolios.com.

For the fiscal year ended 10/31/13, the New Century Alternative Strategies Portfolio had an expense ratio of 1.13% with an acquired fund expense ratio of

1.15%. The Acquired Fund Expense Ratio reflects the fees and expenses incurred by the New Century Alternative Strategies Portfolio for the fiscal year ended 10/31/13, as a result of its investment in other registered investment companies. These expenses are not incurred directly by shareholders.

Certain hedging techniques, arbitrage strategies, distressed securities, options, long/short selling and leverage employed in the funds the Alternative

Strategies Portfolio invests in will expose the fund to additional volatility and risks.

To find out more or to request a Prospectus, please contact New Century Portfolios at 1-888-639-0102 or visit our website at www.newcenturyportfolios.com. New Century Portfolios is distributed by Weston Securities Corporation, a SIPC & FINRA member firm. Investors should take into consideration the investment objectives, risks, charges and expenses of the New Century Portfolioscarefully before investing. The prospectus contains these details and other information and should be read carefully before investing.

N EW C ENTURY P ORTFOLIOS – C APITAL • B ALANCED • I NTERNATIONAL • A LTERNATIVE S TRATEGIES • M ONEY M ARKET

100 WILLIAM STREET, SUITE 200, WELLESLEY, MA 02481 781-235-7055 888-639-0102 FAX 781-237-1635

1/15/2015