IQHIX

IQ Hedge Multi-Strategy Plus Fund IQHOX

®

Fact Sheet 9/30/2015

Fund Description

Fund Data

Features and Benefits

The Fund seeks to track, before fees and

expenses, the performance of the IQ

Hedge Multi-Strategy Plus Index.

Index Description

The IQ Hedge Multi-Strategy Plus Index

seeks to replicate the risk-adjusted return

characteristics of hedge funds using

multiple hedge fund investment styles,

including long/short equity, global macro,

market neutral, event-driven, fixed income

arbitrage, and emerging markets.

The Fund does not invest in hedge funds

and the Index does not include hedge

funds as components. The Fund is not

suitable for all investors.

Seeks hedge fund-like performance

Seeks low correlation to equity markets

Low fees ±

Daily liquidity

Portfolio transparency – holdings

available monthly

• No hedge fund manager-specific risk –

Fund tracks rules-based index1

•

•

•

•

•

Risk Considerations

•

•

•

•

•

Investment in underlying ETFs

Tracking error to the Index

Use of derivatives

Use of leverage

Use of short selling

Class I

Ticker

IQHIX

CUSIP

454076209

Management Fee & Other Expenses

1.16%

Acquired Fund Fees

.23%

Total Annual Fund Operating Expenses

1.39%

Minimum Investment6

$5,000,000

Class A

Ticker

CUSIP

Management Fee, 12b-1 Fees, and

Other Expenses

Acquired Fund Fees

Total Annual Fund Operating Expenses

Minimum Investment6

IQHOX

454076100

1.55%

.23%

1.78%

$25,000

Index Data2 Since Inception (10/31/2007)

Index Symbol

Index Dividend Yield5

See risk discussion on reverse side.

IQHGALPH

3.13

Alpha*

1.98%

Beta*

* vs. S&P 500

®

0.35

Index

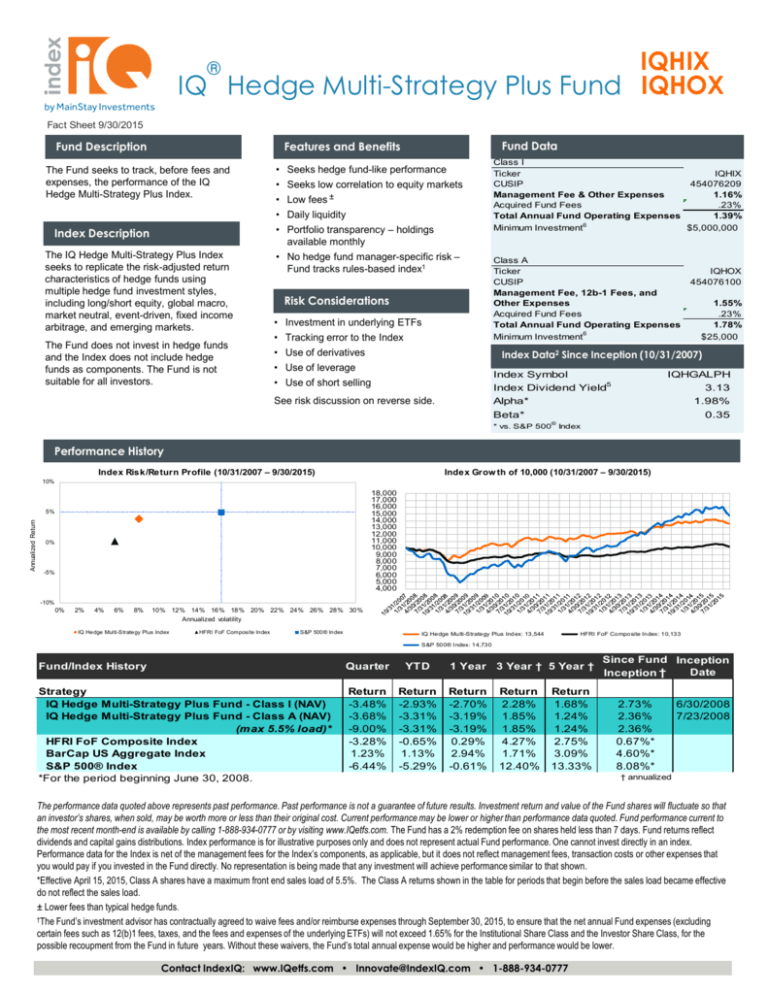

Performance History

Index Grow th of 10,000 (10/31/2007 – 9/30/2015)

Index Risk/Return Profile (10/31/2007 – 9/30/2015)

10%

18,000

17,000

16,000

15,000

14,000

13,000

12,000

11,000

10,000

9,000

8,000

7,000

6,000

5,000

4,000

Annualized Return

5%

0%

-5%

-10%

0%

2%

4%

6%

8%

10% 12% 14% 16% 18% 20% 22% 24% 26% 28% 30%

Annualized volatility

IQ Hedge Multi-Strategy Plus Index

HFRI FoF Composite Index

S&P 500® Index

IQ Hedge Multi-Strategy Plus Index: 13,544

HFRI FoF Composite Index: 10,133

S&P 500® I ndex: 14,730

Fund/Index History

Quarter

YTD

1 Year

3 Year † 5 Year †

Strategy

IQ Hedge Multi-Strategy Plus Fund - Class I (NAV)

IQ Hedge Multi-Strategy Plus Fund - Class A (NAV)

(max 5.5% load)*

HFRI FoF Composite Index

BarCap US Aggregate Index

S&P 500® Index

*For the period beginning June 30, 2008.

Return

-3.48%

-3.68%

-9.00%

-3.28%

1.23%

-6.44%

Return

-2.93%

-3.31%

-3.31%

-0.65%

1.13%

-5.29%

Return

-2.70%

-3.19%

-3.19%

0.29%

2.94%

-0.61%

Return

2.28%

1.85%

1.85%

4.27%

1.71%

12.40%

Return

1.68%

1.24%

1.24%

2.75%

3.09%

13.33%

Since Fund Inception

Date

Inception †

2.73%

2.36%

2.36%

0.67%*

4.60%*

8.08%*

6/30/2008

7/23/2008

† annualized

The performance data quoted above represents past performance. Past performance is not a guarantee of future results. Investment return and value of the Fund shares will fluctuate so that

an investor’s shares, when sold, may be worth more or less than their original cost. Current performance may be lower or higher than performance data quoted. Fund performance current to

the most recent month-end is available by calling 1-888-934-0777 or by visiting www.IQetfs.com. The Fund has a 2% redemption fee on shares held less than 7 days. Fund returns reflect

dividends and capital gains distributions. Index performance is for illustrative purposes only and does not represent actual Fund performance. One cannot invest directly in an index.

Performance data for the Index is net of the management fees for the Index’s components, as applicable, but it does not reflect management fees, transaction costs or other expenses that

you would pay if you invested in the Fund directly. No representation is being made that any investment will achieve performance similar to that shown.

*Effective April 15, 2015, Class A shares have a maximum front end sales load of 5.5%. The Class A returns shown in the table for periods that begin before the sales load became effective

do not reflect the sales load.

± Lower fees than typical hedge funds.

†The Fund’s investment advisor has contractually agreed to waive fees and/or reimburse expenses through September 30, 2015, to ensure that the net annual Fund expenses (excluding

certain fees such as 12(b)1 fees, taxes, and the fees and expenses of the underlying ETFs) will not exceed 1.65% for the Institutional Share Class and the Investor Share Class, for the

possible recoupment from the Fund in future years. Without these waivers, the Fund’s total annual expense would be higher and performance would be lower.

Contact IndexIQ: www.IQetfs.com • Innovate@IndexIQ.com • 1-888-934-0777

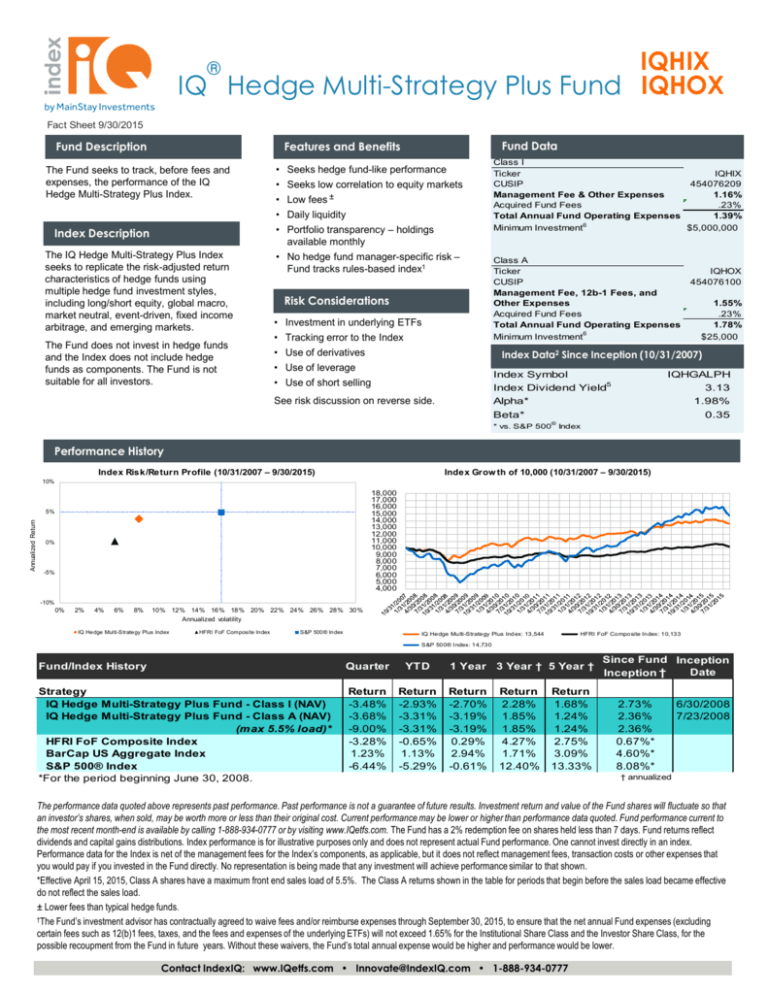

-15%

-5%

5%

15%

25%

35%

45%

55%

Monthly Strategy Allocation – 6 Month

Aggregate Bond: 38.64%

U.S. Short Term Treasury Bond: 38.31%

U.S. Small Cap Growth: 16.61%

Floating Rate: 13.51%

Convertible Bonds: 11.42%

U.S. Large Cap Value: 9.50%

Investment Grade Corporate Bond: 6.76%

International Equity: 5.46%

Currency Strategy: 3.69%

U.S. Large Cap Core: 2.54%

Europe Equity: 2.39%

Currencies: 2.12%

Emerging Equity: 1.86%

U.S. REITS: 0.88%

BRIC Equity: 0.12%

International Bond: -0.16%

Commodities: -0.34%

Volatility: -0.39%

U.S. Small Cap Core: -1.00%

International REITS: -1.02%

U.S. Large Cap Growth: -2.79%

Asia ex Japan Equity: -4.01%

High Yield Corporate Bond: -5.73%

U.S. Small Cap Value: -13.38%

% Allocation to IndexIQ Sub-Sectors

Index Asset Allocation4 - 9/30/15

40%

30%

20%

10%

0%

-10%

-20%

IQ Hedge

Emerging

Markets

Beta Index

4/30/2015

Name

Vanguard Total Bond Market Index Fund

6/30/2015

7/31/2015

8/31/2015

9/30/2015

Maximum Drawdown Analysis Since Index Inception

IQ Hedge MultiStrategy Plus

Index

Maximum Drawdown

-18.01%

Oct-07

Drawdown Start

Drawdown End

Oct-08

Recovery Date

Sep-09

Long Exposure

BND

5/31/2015

IQ Hedge

Global

Macro Beta

Index

% Allocation to Index Sub-Sectors

Top 10 Index Holdings4 - 9/30/15

Ticker

IQ Hedge

IQ Hedge

IQ Hedge

IQ Hedge

Market

Long/Short

Event-Driven

Fixed

Beta Index Neutral Beta Beta Index

Income

Index

Arbitrage

Beta Index

Weight

19.16%

BSV

Vanguard Short Term Bond Index Fund ETF

18.80%

AGG

iShares Core U.S. Aggregate Bond ETF

18.78%

SHY

iShares 1-3 Year Treasury Bond ETF

13.31%

BKLN

PowerShares Senior Loan Portfolio

11.92%

CWB

SPDR Barclays Convertible Securities ETF

11.42%

IWO

iShares Russell 2000 Growth ETF

7.62%

LQD

iShares iBoxx USD Investment Grade Corporate Bond ETF

6.53%

VBK

Vanguard Small Cap Growth Index Fund

5.08%

FXE

CurrencyShares Euro Trust

4.66%

S&P 500®

Index

-50.95%

Oct-07

Feb-09

Mar-12

HFRI FoF

Composite Index

-22.20%

Oct-07

Dec-08

Jun-14

The maximum drawdown analysis measures the largest decline

between any two points in the monthly return history of the respective

indexes, and indicates the time period during which such drawdown

occurred, as well as the date on which the index’s returns had fully

recovered (if applicable) all losses incurred during the drawdown

period.

Short Exposure

Ticker

Name

IWN

iShares Russell 2000 Value ETF

Weight

-5.27%

VBR

Vanguard Small Cap Value Index Fund

-5.10%

UUP

Powershares DB US Dollar Index Bullish Fund

-3.59%

WIP

SPDR DB International Government Inflation-Protected Bon

-3.56%

HYG

iShares iBoxx USD High Yield Corporate Bond ETF

-3.23%

Consider the Fund’s investment objectives, risks, charges and expenses carefully before investing. The prospectus and the statement of additional information include this and other relevant

information about the Fund and are available by visiting www.IQetfs.com or calling 1-888-934-0777. Read the prospectus carefully before investing.

Risk Discussion: Mutual fund investing involves risk, including loss of principal. There is no guarantee that the Fund will meet its objective. The Fund is not be suitable for all investors due to its use of

leverage, short selling, and derivatives, or for other reasons. Funds that use leverage to seek to increase return are subject to greater risk in adverse market conditions. There are particular risks

associated with funds that employ short sales, such as the fact that the potential loss from a short position theoretically is unlimited. The Fund's use of derivatives, such as swap agreements, may

expose the Fund to additional risks that it would not be subject to if it invested directly in the securities underlying those derivatives. The Fund's investment performance, because it is a fund of funds,

depends on the investment performance of the underlying ETFs in which it invests. There is no guarantee that the Fund itself, or each of the ETFs in the Fund's portfolio, will perform exactly as its

underlying index. An investor in the Fund will bear the operating expenses of the underlying ETFs in which the Fund invests. The Fund is non-diversified and may be susceptible to greater losses if a

single portfolio investment declines than would a diversified mutual fund. The Fund is not intended to provide a complete investment program and should be considered a speculative investment.

The IQ Hedge Multi-Strategy Plus Index seeks to replicate the risk-adjusted return characteristics of hedge funds using multiple hedge fund investment styles, including long/short equity, global macro,

market neutral, event-driven, fixed income arbitrage, and emerging markets. HFRI Fund of Funds Composite Index (“HFRI FoF Composite Index”) is an equally weighted hedge fund index including

over 650 domestic and off-shore fund of funds. The BarCap US Aggregate Index measures the performance of the U.S. investment grade bond market. The S&P 500 Index is based on the market

capitalizations of 500 large companies having common stock listed on the NYSE or NASDAQ. Sources for IndexIQ and benchmark data: IndexIQ, FactSet, Bloomberg.

1The Fund employs a “passive management” – or indexing – investment approach designed to track the performance of the Index. The Fund invests primarily in the Index components that make up

the Index.

2Alpha is a measure of a portfolio’s actual excess returns and expected performance, given its level of risk (as measured by Beta); Beta reflects the sensitivity of a portfolio’s return to fluctuations in

the market (in this case, as measured by the S&P 500® Index); Sharpe Ratio is a measure of a portfolio’s risk-adjusted performance (return per unit of risk)

3For performance reporting purposes, the inception date is the first day the Fund commenced operations, which is June 30, 2008 for the Institutional Class Shares and July 23, 2008 for the Investor

Class Shares. Performance is annualized.

4Demonstrates the allocations of the Index to the various asset classes represented by the Index's underlying ETFs. Negative values, if any, refer to short positions. Weights for each Index

component include application of 25% leverage. The asset allocation information and holdings are subject to change without notice.

5Index Dividend Yield is a measure of the annual dividends of the shares of all index components divided by the index value.

6Minimum investment may be waived for certain purchases. Please see the prospectus.

MainStay Investments® is a registered service mark and name under which New York Life Investment Management LLC does business. MainStay Investments, an indirect subsidiary of New York Life

Insurance Company, New York, NY 10010, provides investment advisory products and services. IndexIQ® is the indirect wholly owned subsidiary of New York Life Investment Management Holdings

LLC. ALPS Distributors, Inc. (ALPS) is the principal underwriter of the ETFs. NYLIFE Distributors LLC is a distributor of the ETFs and the principal underwriter of the mutual fund. NYLIFE Distributors

LLC is located at 169 Lackawanna Ave, Parsippany, NJ 07054. ALPS Distributors, Inc. is not affiliated with NYLIFE Distributors LLC. NYLIFE Distributors LLC is a Member FINRA/SIPC.

The IQ Hedge Multi-Strategy Plus Index is the exclusive property of IndexIQ, which has contracted with Solactive to maintain and calculate the Index. IndexIQ® and IQ® are registered service marks of

IndexIQ.

Not FDIC Insured • May Lose Value • Not BankContact

Guaranteed

• Copyright

© 2015 IndexIQ. •All Innovate@IndexIQ.com

rights reserved.

IndexIQ:

www.IQetfs.com

• 1-888-934-0777

NYLIM-1633834

IDX001656.063015

MEIQH05-10/15