The challenges of benchmarking diversified

alternative investments

Eric Stein, CFA

Senior Director, Investments

September 2013

Diversified alternative investments include a wide array of investments that can have very

different characteristics and investing styles.

Benchmarking is a useful and purposeful tool in evaluating asset classes and managers.

However, compared to traditional investments, there are additional challenges when it

comes to benchmarking diversified alternative investments.

With the diverse set of strategies included in the diversified alternative universe,

there is no single benchmark for performance evaluation purposes that is appropriate

for all strategies.

Before pursuing this topic further, let’s define two key terms:

Diversified alternative investment: McGladrey Wealth Management defines diversified

alternative investments as those that represent a different implementation strategy from

traditional investments, often with looser constraints (e.g. ability to short, increased use of

derivatives). These investments are designed to complement traditional equity and fixed

income investments and reduce, or buffer, overall portfolio volatility. Specifically, we aim for the

diversified alternative category as a whole to have a volatility range of between 6-8% per year

on average.

Benchmark: A benchmark is a standard against which the performance of an investment can be

measured. As an example, managers in the domestic large cap core equity category most often

use the S&P 500 or Russell 1000 as their benchmark. Said differently, the manager’s goal is to

beat, or outperform, the returns of these benchmarks over various time periods. In order for

benchmarks to be effective, the CFA Institute believes benchmarks must be:

Unambiguous (i.e. securities and their weights are clearly identifiable)

Investable (i.e. it is possible to hold the benchmark)

Measurable (i.e. returns can be frequently measured)

Appropriate (i.e. the benchmark is consistent with the manager’s investment style)

Reflective of current investment opinion (i.e. the investments are known and understood)

Specified in advance (i.e. the benchmark is constructed prior to a performance review)

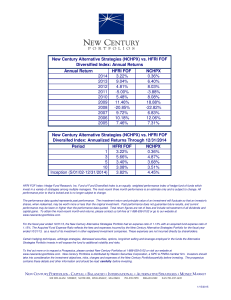

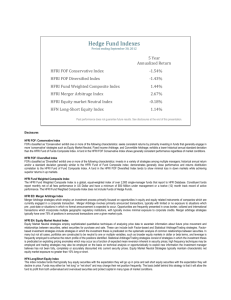

Since McGladrey WM started investing in diversified alternatives, we have utilized the HFRI

Fund of Funds Composite Index (HFRI FoF) as the category benchmark. The HFRI FoF is a

non-investable index comprised of 500 constituent funds of hedge funds and is calculated on an

equal weighted basis. Only fund of funds are included in the index and they must each have at

least $50M under management and have been actively trading for at least twelve months.

There are some positive aspects of having the HFRI FoF as the benchmark for diversified

alternatives:

As a fund of funds structure, the HFRI FoF includes most, if not all, of the broad hedge

fund strategies being widely implemented in the industry.

The HFRI FoF is a well known index in the hedge fund universe, created by a well

known provider in Hedge Fund Research (HFR).

However, there are also several aspects of the HFRI FoF that conflict with the previously listed

makeup of an effective benchmark:

The reporting of hedge fund returns, unlike mutual fund returns, is voluntary.

The voluntary reporting of hedge fund returns can lead to survivorship bias, which is

when performance returns from investment managers are excluded from a database

because the manager has gone out (or is going out) of business or no longer wishes to

report results due to poor performance.

The HFRI FoF can also be subject to backfill bias, which is the practice of investment

managers not reporting their performance results to databases until after a period in

which they have success. In other words, only when the manager achieves success do

they report their positive returns (and the historical returns are backfilled). It is assumed

the manager would choose to not report returns at all if the returns were poor.

As a result of these and other biases, published returns for the HFRI FoF likely

need to be adjusted downward.

The HFRI FoF is a non-investable index.

The returns for the HFRI FoF are only available and published on a monthly basis

whereas most other index returns are published daily.

The diversified alternative investments that McGladrey WM currently recommends have

different investing styles and characteristics. There is no one index that is appropriate

for each distinct investment.

The issue of benchmarking diversified alternatives comes down to what a benchmark is

ultimately used for. As described earlier, a benchmark is a standard against which to be

measured. However, if the benchmark is not a fair comparison or a similar strategy to the

investment being reviewed, how can you compare performance? In short, you shouldn’t

make the comparison.

Therefore, we think of the HFRI FoF as more of a proxy or representative peer group for the

entire diversified alternatives category rather than something each individual investment should

be compared against or is trying to outperform. Instead, we choose to judge the merits of

each diversified alternative investment vs. their own distinct benchmarks to test whether

they are meeting their stated objectives.

As always, please contact your Wealth Management advisor with any questions or comments.

800.274.3978

www.mcgladrey.com

This publication does not constitute professional or investment advice. Financial information is for illustrative purposes only, and

past performance is not indicative of future results. The indices discussed are unmanaged and do not incur management fees,

transaction costs or other expenses associated with investable products. It is not possible to directly invest in an index.

This document contains general information, may be based on authorities that are subject to change, and is not a substitute for

professional advice or services. This document does not constitute assurance, tax, consulting, business, financial, investment, legal

or other professional advice, and you should consult a qualified professional advisor before taking any action based on the

information herein. McGladrey LLP, its affiliates and related entities are not responsible for any loss resulting from or relating to

reliance on this document by any person.

Tax and accounting services are provided by McGladrey LLP, a registered CPA firm. Investment advisory, financial planning and

other wealth management services are provided by McGladrey Wealth Management LLC, an SEC-registered investment advisor.

Insurance services and products are offered and/or facilitated through Birchtree Financial Services LLC, a licensed insurance

agency and a wholly-owned subsidiary of McGladrey Wealth Management LLC.

McGladrey LLP is an Iowa limited liability partnership and the U.S. member firm of RSM International, a global network of

independent accounting, tax and consulting firms. The member firms of RSM International collaborate to provide services to global

clients, but are separate and distinct legal entities that cannot obligate each other. Each member firm is responsible only for its own

acts and omissions, and not those of any other party.

McGladrey®, the McGladrey logo, the McGladrey Classic logo, The power of being understood®, Power comes from being

understood®, and Experience the power of being understood® are registered trademarks of McGladrey LLP.

© 2013 McGladrey LLP. All Rights Reserved.