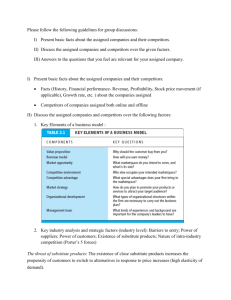

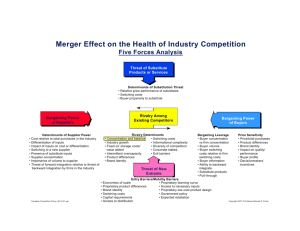

Class 3 FIVE FORCES MODEL EFE MATRIX Five Forces Model of Industry

advertisement

Class 3 FIVE FORCES MODEL EFE MATRIX Five Forces Model of Industry Competition - characteristics of an industry that influence firms’ profitability *Should remember at least 4 of each High Threat Numerous competitors Equally balanced competitors Diverse competitors No differentiation or no switching costs Large capacity increments required Threat of Rivalry Low Threat Few competitors One or a few strong competitors Similar competitors Significant Minimal Threat of Potential Entrants High Threat Low Threat No or low economies of scale Significant economies of scale No other potential cost disadvantages Cost disadvantages from other aspects Weak product differentiation Strong product differentiation Minimal capital requirements Huge capital requirements Open access to distribution channels Controlled access to distribution channels No government policy protection Government policy protection Substitute Products High Threat Low Threat There are many good substitutes There are few good substitutes High improvement of substitute product low improvement of substitute product Large scale commercialization of substitute small scale commercialization of substitute industries industries High sideways competition low sideways competition Bargaining Power of Suppliers High Threat Low Threat Supplying industry has few companies Supplying industry has many companies Supplier's products are differentiated Supplier's products aren't differentiated Industry isn’t an important customer Industry is an important customer Supplier's product is an important input Supplier's product isn’t an important input Significant switching costs Minimal switching costs in supplier's products Supplier has ability to do Supplier doesn't have ability to do Bargaining Power of Buyers High Threat Low Threat Buyer purchases large volumes Buyer purchases small volumes Purchases are significant part Purchases aren't significant part of buyer's costs Purchases standard or undifferentiated Purchases highly differentiated and unique Buyer faces few switching costs Buyer faces significant switching costs Buyer's profits are low Buyer's profits are strong Buyers have full information Buyers have limited information Five Forces Analysis: Key Questions and Implications • What are the key forces at work in the competitive environment? • Are there underlying forces driving competitive forces? • Will competitive forces change? • What are the strengths and weaknesses of competitors in relation to the competitive forces? • Can competitive strategy influence competitive forces (eg by building barriers to entry or reducing competitive rivalry)? EFE Matrix Purpose of External Audit Identify Opportunities Threats Industry Analysis EFE • Weight = how important is each factor = 0.00 to 1.00 scale (or 1 to 100) • Rating = indicates how effective the firm’s current strategies respond to the factor = can be 1 to 4 (1) poor, (2) below average, (3) average, (4) satisfactory Total weighted score of 4.0 Firm’s response is outstanding to threats and opportunities Total weighted score of 1.0 Firm’s strategies not capitalizing on opportunities or avoiding threats Rating: (1) poor, (2) below average, (3) average, (4) satisfactory External Factor Evaluation Matrix (EFE) Interpretation? • score 1-2 = business has slightly less than average ability to respond to external factors • score 2-3 = business has the average ability to respond to external factors • socre 3-4 = business has ability to respond to external factors **Industry Analysis EFE Important -- Understanding the factor used in the EFE Matrix is more important than the actual weights and ratings assigned. ** When analyze to give recommendations should analyze at point high in Weigh that our company cannot respond to opportunities and threats.