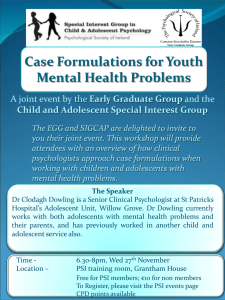

Empowerment Through Education

advertisement

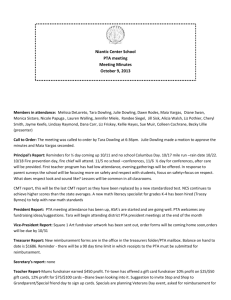

Promotion AMERICA’S F I NA NC I A L LEADERS As Seen In… Forbes, October 20, 2014 Empowerment Through Education Estate Planning Consultants, Inc. Helps Clients Make Informed Choices About Their Retirement Money Y ou’ve been getting ready for years, faithfully putting money into your 401(k), your IRA and other retirement accounts in anticipation of the time when you would no longer work. Now comes the hard part: generating a retirement income that will meet your needs and last your lifetime. “Figuring out what to do with your retirement money is one of the biggest decisions you’ll ever make,” says Ronald R. Dowling, founder of Estate Planning Consultants, Inc., in Mokena, Illinois. “It can also be one of the most daunting.” Equally important – and almost as daunting – is when and how to start receiving Social Security benefits. Married couples, for example, can draw their benefits in a variety of ways. It’s not that there’s a shortage of information or advice on how to retire successfully. Indeed, anyone who regularly surfs the Web or follows the news can easily suffer from a surfeit of advice, much of it contradictory and confusing. It’s easy to become overwhelmed. Fortunately, Estate Planning Consultants is here to help guide you. Ronald Dowling and his son, Joseph W. Dowling, the firm’s vice president, are dedicated to helping retirees and pre-retirees make informed and emotionally devastating; it can mean a significant reduction in income – around 40 percent, on average, in lost pension benefits and Social Security income. “We want to make sure we have a plan in place to replace that income,” Ronald Dowling says. In fact, every client receives a comprehensive financial plan based on his or her unique circumstances. Depending on the client’s needs, the document may cover estate planning and even Medicaid planning to protect assets from the Medicaid spend-down. Ronald R. Dowling and Joseph W. Dowling prudent decisions about their money, with an emphasis on managing risk and preserving capital. The practice devotes a great deal of time and attention to client education, and it also holds monthly workshops for the public. “You cannot make informed choices about your money unless you understand what you’re doing,” Joseph Dowling says. Many people fail to take into account, for example, that the loss of a spouse can be financially as well as ‘We’ve Got Your Back’ Ultimately, Joseph Dowling says, the client is in control of all financial decision-making. “We encourage them to decide how much of their money they want to risk in the marketplace, how much they want to allocate towards principal-protected products that can go up but not down, and how much they want to keep in the bank.” Still, clients can feel confident the team is keeping an eye on their portfolios at all times and recommending adjustments as necessary. “Most people want to know there’s somebody out there who’s got their back,” says Ronald Dowling. “At Estate Planning Consultants, we’ve got your back.” estateplanconsultants.com | 19614 South La Grange Rd. | Mokena, IL 60448 | 708-479-8771 | joe@estateplanconsultants.com Investment advisory services provided by Redhawk Wealth Advisors, Inc., an SEC-registered investment advisor. Insurance and annuity products sold separately through Estate Planning Consultants, Inc. ©2014 EMI Network Inc. • 800-999-1950 • eminetwork.com