MAX IM US SE CUR IT IE SLTD

advertisement

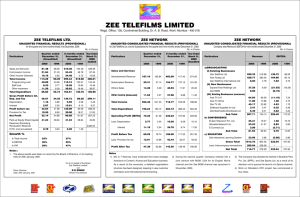

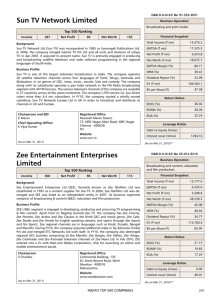

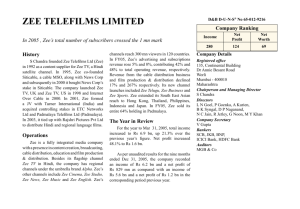

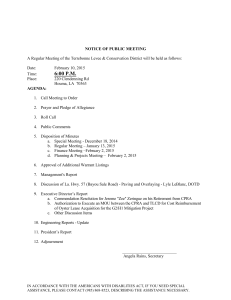

T Company Report: Zee Entertainment Enterprises LTD. Date: 09th October, 2015 CMP: - 401.40 Target Price: - 482.00 MAXIMUS SECURITIES LTD Highlights: • Zee Entertainment Enterprises Ltd (ZEEL)., is a global media brand with a strong presence in over 169 countries. • Zee has a total viewership of over 959 Million people around the world. It has 33 domestic channels. It offers content in multiple languages and comprises over 36 international channels, making ZEE an all encompassing, universally appealing brand. 48 • ZEE Music Company’s portfolio of projects comprise 36 Hindi movies, 15 Marathi movies, 2 Punjabi movies and 30 popular single numbers. • Ditto TV, the OTT (Over the top) platform from ZEE has a 20 mn+ users and nearly 50,000 hours of content, and is consistently growing. • Zee is amongst the largest producers and aggregators of Hindi programming in the world, with an extensive library, housing over 2,10,678 hours of television content. It has rights to more than 3,500 movie titles from foremost studios featuring iconic film stars. • Zee houses the world’s largest Hindi film library. Its offerings also include a rich bouquet of 33 popular domestic channels. • Zee has been ranked as the #1 brand by almost every reputed brand-ranking survey (ET 500, Fortune India 500 and BS 1000 rankings, to name a few). In fact, ZEE is the only Indian entertainment company to feature in Nikkei Inc’s ‘India40’ list. • Zee has set itself an ambitious target of five times viewership growth and four times content consumption Source: Capitaline Database growth by the year 2020. Financial Summary: Source: Capitaline Database, MSL Research Valuations: Considering the scope for increasing advertisement revenues, subscription revenues backed by strong balance sheet and an improving economy. We value the company with a P/E of 35x FY17E EPS to arrive at a target price of Rs. 482/share to be achieved within 18 months. Analyst: Jaipal. Shetty Maximus Securities Research ZEE ENTERTAINMENT ENTERPRISES LTD Zee Entertainment Enterprises Ltd started in 1992 (previously known as Zee Telefilms Ltd.) with one channel, in a 23year span it offers a bouquet of 33 domestic channels and 36 international channels. For more than 20 years, ZEEL has provided quality entertainment, touching lives and emotions of a wide cross-section of people globally The company is a pioneer of television entertainment industry in India. Their well known brands include Zee TV, Zee Cinema, Zee Premier, Zee Action, Zee Classic, Ten Sports, Ten Cricket, Ten Action+, Zee Cafe, Zee Studio, Zee Trendz, Zee Khana Khazana, Zee Salaam, Zee Jagran, Zing, ETC Music and ETC Punjabi. The company also has a strong offering in the regional language domain with channels such as Zee Marathi, Zee Bangla, Zee Telugu, Zee Kannada, Zee Talkies and Zee Cinemalu. In the year 1992, the company launched their flagship television channel Zee TV. Since then, they have transformed themselves into an integrated media conglomerate with operations spanning the entire media spectrum including television programming; satellite broadcasting; production and distribution of films; music publishing, long distance education and the creation of animation software. In the year 1994, Zee Records, the music-publishing arm of Zee, commenced their operations. Also, they launched Zee Education as a division of the company. The company's 100% owned subsidiary, Siticable Networks Ltd (Siticable) commenced their operations as an MSO in Delhi for cable distribution system in India. In the year 1995, Newscorp acquired a 50% stake in Siticable Networks Ltd in an equal joint venture with the company. The company launched Zee TV in the UK / Europe. Also, they launched Zee News and Zee Cinema. In the year 1996, the company started their first cable channel in India under the name of Siti Channel. In the year 1997, they launched Zee Music (originally known as Music Asia). In the year 1998, the company launched Zee TV in the USA. Also, they launched Zee Cine Awards. During the year 1998-99, the company obtained 'A' category license for providing Internet services in India.During the year 1999-2000, the company acquired 50% stake in Asia Today Ltd, Siticable and Programme Asia Trading Company Ltd. They launched four regional channels under the umbrella brand of Alpha, namely Alpha Marathi, Alpha Bangla, Alpha Punjabi and Alpha Gujarati. Also, they launched two new 24-hour channels, namely Zee English and Zee Movies to enter the English language market. They launched two new channels namely Zee Bangla and Musia Asia in UK and launched Zee Gold in USA.During the year, the education division of the company was demerged and transferred to a separate subsidiary company namely, Zee Interactive Learning Systems Ltd. In September 1999, the company acquired Zee Multimedia Worldwide Ltd and thus all the international operations including the broadcasting business of ZMWL came under the company's control.During the year 2000-01, the company launched the Direct-to-Operator (DTO) encrypted channel bouquet comprising of Zee Cinema, four Alpha channels and two English channels. Also, they divested their stake in Buddha Films Ltd (BFL), Zee Sports Ltd (ZSL) and Zee Publishing Ltd (ZPL). During the year 2001-02, the company produced their first big budget movie 'Gadar -Ek Prem Katha'. They formed a joint venture company 'Zee Turner Pvt Ltd' to market and distribute the pay channel bouquet consisting of 14 channels of Zee and 3 channels of Turner in the Indian sub-continent, thereby creating a formidable combination of highly popular channels. They consolidated their operations by linking their various control rooms through HFC. Master Control Rooms (MCR) was established at Hyderabad and Bangalore linking the control rooms through optic fibre, thereby ensuring improvement in the quality of signal delivery to customers.During the year, Zee Interactive Multimedia Ltd, a company set up to provide broadband and conditional access services, merged with Siticable Network Ltd. The company acquired a controlling stake in ETC Networks Ltd, a company engaged in production, marketing and distribution of two television channels with a leading presence in Music and Punjabi language segment. With these acquisitions ETC Networks Ltd became a subsidiary of the company. Also, the company acquired a controlling stake in Padmalaya Telefilms Ltd, a company engaged in production and distribution of feature films (in Telugu and Hindi languages) and television serials. During the year 2002-03, the company hived off two of the foreign subsidiaries namely Hokushan Trading Company Ltd and Asia TV USA, Inc. Also, three wholly owned subsidiaries were merged with the company.During the year 2003-04, the company entered into an MoU with Zee News Ltd, a company 100% owned by Indian nationals, for transfer of physical infrastructure, the editorial and other staff etc, related to production and Broadcast of News and Current Affairs programme on Zee television channels including Zee News. Dakshin Media Ltd, a wholly owned subsidiary company was amalgamated with the company. Maximus Securities Research Further, the company consolidated operations of their foreign subsidiary company located at Mauritius by merging of Aisa TV (Africa) Ltd, Software Supplies (International) Ltd, Zee Telefilms International Ltd and Zee MGM Ltd with Asia Today Ltd, Mauritius. Also, another overseas subsidiary, Asia T.V. (Netherlands) Ltd, BVI had been liquidated. During the year 2004-05, the company launched a new channel, namely Zee Sports to the meet the insatiable quest of Indian viewers to enjoy telecast of sports event in India and abroad. The company divested their stake in Padamalaya Enterprises Pvt Ltd, which was the holding company of Padamalaya Telefilms Ltd. Expand Fast Holdings Ltd, one of the overseas subsidiaries, merged with Asia Today Ltd, Mauritius (ATL). Also, ATL, the wholly owned subsidiary of Winterheath Company Ltd (WCL) merged with the holding company, WCL. After the merger, WCL changed its name to Asia Today Ltd. Also, ATL acquired 100% stake in Pan Asia Infrastructure Ltd, a Mauritius based company, engaged in the business of broadcast of television channel in middle east in South Asian language and development of media city in Dubai. During the year 2005-06, Siti Cable Network Ltd, a wholly owned subsidiary of the company acquired entire shares in Indian Cable Net Company Ltd.During the year 2006-07, the company completed the process of de-merger of their News, Cable and Direct Consumer Services business undertakings. Respective resultant entities namely, Zee News Ltd (ZNL) for news business, Wire & Wireless (India) Ltd (WWIL) for cable business and Dish TV India Ltd (formerly known as ASC Enterprises Ltd) (Dish TV). Consequent to demerger of Cable and DCS Business Undertakings of the company, the subsidiaries of the company pertaining to the said Business Undertakings, namely, Siti Cable Network Ltd, Central Bombay Cable Networks Pvt Ltd, Integrated Subscribers Management Services Ltd, New Era Entertainment Network Ltd, Siti CableBroadband South Ltd and Indian Cable Net Company Ltd ceased to be subsidiaries of the company. The company exited from their investment in 25 FPS Media Pvt Ltd (25 FPS) and consequently 25 FPS ceased to be a subsidiary with effect from July 24, 2006. In November 2006, Zee Sports International Ltd, Mauritius, acquired 50% stake with majority representation in the board in Taj TV Ltd, Mauritius, which owns 'Ten Sports' channel. Also, the company acquired 50% stake with majority representation in the board in Taj Television India Pvt Ltd, Mumbai which is the distribution arm of Ten Sports in India. The name of the company was changed from Zee Telefilms Ltd to Zee Entertainment Enterprises Ltd with effect from January 10, 2007.During the year 2007-08, pursuant to a scheme of amalgamation, ETC Networks Ltd, a listed subsidiary of the company, merged with Zee Interactive Learning Systems Ltd. The merged entity was subsequently renamed as ETC Networks Ltd. Asia Today Ltd., Mauritius, a wholly owned overseas subsidiary of the company acquired entire equity stake in APAC Media Ventures Ltd, a company registered in Hongkong, effective October 30, 2007, for the purpose of its broadcasting foray in the Asia Pacific Region. During the year 2008-09, Asia Today Ltd., Mauritius, a wholly owned overseas subsidiary of the company, acquired the balance 40% equity stake in Asia Business Broadcasting (Mauritius) Ltd, a company registered in Mauritius and divested their entire 100% holding in Pan Asia Infrastructure Ltd, Mauritius. Additionally with a view to comply with the regulatory requirements for Russian Broadcasting Operations, Asia TV Ltd, UK, an overseas subsidiary created/ acquired an indirect subsidiary called 'OOO Zee CIS Holdings Ltd' in Russia.During the year, the company ventured into the film production and distribution business, with launch of two labels, namely Zee Motion Pictures and Zee Limelight for mainstream and niche films, respectively. For that purpose, they acquired/created, direct/ indirect subsidiaries namely, ZES Holdings Ltd, Mauritius, Zee Entertainment Studios Ltd, British Virgin Islands, ZES Mauritius Ltd, Mauritius, ZES International Ltd, United Kingdom and Zee Motion Pictures Pvt Ltd., India. During the year 2009-10, as per the scheme of arrangement, the company demerged the Regional General Entertainment Channel Business Undertaking (comprising of Zee Marathi, Zee Bangla, Zee Talkies, Zee Telugu, Zee Cinemaalu and Zee Kannada television channels) of Zee News Ltd (ZNL) vesting with the company on the appointed date, January 1, 2010. The scheme became effective from March 29, 2010. Also, ETC Networks Ltd (ETC), a listed subsidiary of the company merged with the company with effect from appointed date, March 31, 2010. Upon such merger, the Education Business Undertaking of the company was demerged from the company and transferred to Zee Learn Ltd on the appointed date, April 1, 2010. Also, the 9X Channel Business Undertaking of INX Media Pvt Ltd (now known as 9X Media Private Ltd) was demerged and transferred to the company. During the year, ETC Networks Ltd (ETC), the listed subsidiary of the company acquired the entire shareholding in Cornershop Entertainment Company Pvte Ltd which in turn held 100% stake in Cornershop Animation Pvt Ltd, Digital Media Convergence Ltd and Re-Med Services Pvt Ltd. Subsequently, these subsidiaries amalgamated with ETC from the appointed date January 1, 2010 in pursuance of a scheme of amalgamation which became effective on April 29, 2010. Asia TV Ltd, United Kingdom, one of the overseas subsidiary along with its subsidiary OOO Zee CIS Holding Ltd, Russia jointly acquired 100% stake in OOO Zee CIS Ltd, a broadcasting operating company in Russia. Maximus Securities Research During the year 2010-11, the company dissolved ZES International Ltd, UK, a wholly owned subsidiary of ZES Entertainment Studios Ltd, BVI and Zee Sports Americas Ltd, Mauritius. Asia Business Broadcasting (Mauritius) Ltd, Mauritius was amalgamated with its holding company Asia Today Ltd, Mauritius. Also, Zee Entertainment Studios Ltd, BVI and ZES Mauritius Ltd, Mauritius amalgamated with their holding company ZES Holdings Ltd, Mauritius with effect from March 31, 2011 and March 18, 2011 respectively. Also, ZES Mauritius Ltd, Mauritius divested their entire stake in the Indian subsidiary, Zee Motion Pictures Pvt Ltd.During the year, the joint ventures of the company in digital distribution viz. ITM Digital Pvt Ltd, and in India branded Entertainment Portal viz. India Webportal Pvt Ltd commenced their operations. The company has in-principle approved the acquisition of the balance shareholding of 5% in Taj TV Ltd., Mauritius (Taj) by Zee Sports International Ltd, Mauritius (ZSIL), thus making Taj a wholly owned subsidiary of ZSIL and the amalgamation of ZSIL with their holding company Asia Today Ltd, Mauritius. Source: Company, MSL Research. LTM- latest twelve months. Advertisement (Rs. Crs) Subscription (Rs. Crs) Media Content+OOR+Commission (Rs. Crs) 3,000 2,500 2,000 1,500 2,660 2,380 1,964 1,701 1,584 1,325 1,624 1,802 1,794 1,126 1,000 500 430 182 131 112 239 FY11 Source: Company, MSL Research. FY12 FY13 FY14 FY15 Maximus Securities Research Investment Rationale Our investment rationale is based on following premises: 1 – Leading player in Indian television market. 2 – Scope for rise in advertising revenue. 3 – Rising subscription revenue. 4 – Strong financials. 5 – Improvement in the economic environment going forward. Leading player in Indian television market. Zee TV is the largest Hindi entertainment channel of the world. ZEE has been able to demonstrate its leadership acumen and forward thinking abilities consistently. The management is working on concrete strategies to ensure that ZEE leverages its leadership and experience and maximises the global opportunity of rapidly expanding media industry. As per the annual report of FY15 the key elements of Zee’s strategy going forward will be to consistently invest in growth opportunities to safeguard and grow its leadership, in a competitive environment. The following charts give a snapshot of Zee’s product offering and its relative position in Indian television space. Zee is a leading player in India’s regional general entertainment category. Source: Company, MSL Research. Source: Company, During April 2014 – March 2015. Maximus Securities Research Source: Company, During April 2014 – March 2015. Scope for rise in advertising revenue. INDIAN MEDIA SECTOR Source: FICCI-KPMG report 2015, Company. Zee continues to experience growth in both advertising and subscription revenues through the launch of new and innovative programming. The management believes that they can deliver excellent content which in turn will lead to an increase in advertisement revenues. According to the management’s address to analysts in the concall of first quarter FY16, the launch of new television channel “&tv” has gained substantial viewership along with existing portfolio of channels which are also gaining viewership share. This rise in viewership according to us will lead to a rise in income from advertisements. The upcoming elections in major states such as Bihar, Assam, TamilNadu, West Bengal, Kerala (between 2015-2016) will mean additional spending on promotions via television by the major political parties which could be an additional source of advertisement income for Zee since it has a strong regional presence. Rising subscription revenue. As per the concall the management believes that digitisation led growth in subscription revenues could be substantial. st Currently the deadline on Phase III/PhaseIV digitisation is 31 December 2015/2016. The average revenue per user (ARPU) for Phase III digitisation will be lower than Phase I & II since it covers the interior parts of the country but the increase in volumes should compensate for low ARPU. Thus we believe that going forward as soon as implementation of digitisation of remaining Phases gains more traction the revenue contribution from the subscription segment will also go up. Maximus Securities Research Strong financials. PAT margin ROCE 35.0% 30.0% 25.0% 20.0% 28.8% 18.4% 30.8% 27.5% 25.9% 25.6% 21.2% ROE 19.4% 18.0% 19.5% 19.6% 20.2% 20.6% 20.0% 19.0% FY13 FY14 FY15 15.0% 10.0% 5.0% 0.0% FY11 FY12 Source: Company, MSL research. As visible from the above chart Zee has been giving a consistent performance for the last five years with Profit After Tax margin in the range of 19-20%, Return on Capital Employed in the range of 25 -28% and Return on Equity in the range of 18-19%. Zee is debt free on net of cash basis with cash and investments of around Rs 1700 Crores as of FY15. This strength in Balance Sheet will provide for investment in content and expansion to harness the opportunities which will lead to acceleration in earnings growth, that will be available as the economic cycle changes from recession to expansion going forward. The strong performance of the company over the past five years is a testimony to managements ability to deliver even in one of the worst recessionary phases. Improvement in the economic environment going forward. With inflation and growth both going down, the RBI and the Govt are both expected to turn their focus more on reviving th growth. RBI has given an unexpected 50 bps repo rate cut on 29 Sep, 2015 thus acknowledging the fall in long term infaltion and the need to revive growth. The Govt has also improved its capital expenditure compared to last couple of years. As the impact of these actions start flowing to the real economy the outlook for growth will improve which will lead to increase in advertisement spends by the corporates. As the per capita income increases there will be scope for further improvement in subscription revenues and increase In consumption of premium content such as High Definition (HD) channels. Risks & Concern • Slow economic recovery is a threat to the future earnings growth as both advertisement and subcription revenues of Zee will be impacted as consumption is hampered. But considering the performance of the company through one of the worst economic phases, we believe the slow recovery will be tackled by the management. • Slowdown in DTH/Digital rollout will lead to a slow down in subcription revenues. • Increasing competitive pressures regionally and nationally could lead to pressure on margins. To tackle this the management is focussing more on its content quality and expansion regionally as well as internationally. • It is too difficult to predict the audience taste/preference for a particular show. Repeated failures of shows/channels would have an adverse impact on the bottom line of the Company. The company is focussing more on the quality of its contents and taking steps to attract talent. • While a significant amount of rights have been signed on by the Company for leading sports properties, any future contracts may be at higher costs, which may put pressure on margins of the Company. Increase in sports viewership could compensate for the increase in cost. Sports franchise is a concern for Zee since they haven’t got the right for Indian Cricket Team and IPL matches. Even other popular non cricket sporting events such as Kabbadi and Indian Super League (ISL) broadcasting rights are with competitors. • The total minutes of advertisement in an hour has been capped to 12 minutes by the regulator. So now the game of pricing is the only thing that's left for increasing advertisement revenues growth. • The Company receives a significant portion of its revenues and incurs a significant portion of its expenses in foreign currencies, particularly US Dollars and UK Pounds. Accordingly, the Company is exposed to fluctuations in the exchange rates between those currencies and the Indian Rupee; the Company’s reporting currency, which may have an impact on its revenues and expenses. The company hedges its foreign currency receivables and payables to deal with the exchange rate fluctutations. Maximus Securities Research Highlights of the First quarter result • The net sales for the quarter increased by 27.00% yoy and by -0.5% qoq to Rs. 1339.86 Crs. • Ebitda for the quarter grew by 0.7% yoy and by 14.9% qoq to Rs. 311.2 Crs. • Profit before Tax (PBT) for the quarter came in at Rs. 360.84 Crs registering a growth of 10.6% yoy and 17.6% qoq. • The effective Tax Rate was 32.9% at 118.54 Crs for the quarter. • Profit After Tax and minority interest for the quarter came in at Rs. 243.76 Crs increasing by 15.8% yoy and decreasing by 5.6% qoq. • Zee’s advertising revenue during the quarter were Rs 780 Crs, recording a growth of 25.4% year-on-year. Advertising growth on the nonSports part of the business is in mid to high twenty percent. • The total subscription revenue for the quarter were Rs 462 Crs. During the current quarter domestic subscription revenue stood at Rs 368 Crs growing by 13.6% over the last year, while international subscription revenues were Rs 95 Crs growing by 7% over corresponding period last fiscal. • On the cost front, programming and operating cost in the quarter were Rs. 611 Crs. • As of June 30th, 2015 the Company has a gross debt of Rs 2.1 Crs and Cash and Cash Equivalents of Rs 1783 Crs. • During the quarter Zee TV was ranked 3rd amongst the Hindi GECs. The channel delivered a weekly average of 9 shows among the top 50 shows during the quarter. The newly launched Hindi GEC &tv has picked up viewership and has been performing well. • • • Zee’s Hindi Movie Cluster, Zee Cinema, &Pictures, Zee Classic and Zee Action continue to lead the genre with the highest viewership share. The network operates two channels in the English entertainment and movie genre, Zee Café and Zee Studio. Zee Café is one of the leading channels in its genre and delivered a weekly average of 27 shows in the top 100 during the quarter. During the quarter Zee Marathi continued its lead as the No. 1 channel in the genre. The channel was a slot leader in 8 prime time slots. • Zee Bangla is one of the leading players in the Bangla GEC genre. During the quarter it continued to be the No. 2 player in the genre. The channel also extended its lead in the nonfiction genre. The channel was the slot leader in 7 out of 16 prime time bands. • During the quarter Zee Telugu became the No. 1 channel in Telugu GEC genre. The channel was a slot leader in 4 out of 10 prime time bands during the weekday prime time for the quarter. • Zee Kannada was No. 2 channel among the Kannada GECs during the quarter. • The key properties on our Sports channel bouquet during the quarter included telecast of Pakistan vs Zimbabwe cricket series, West Indies versus England cricket series, Sri Lanka versus Pakistan cricket series, UEFA Champions League Finals, WWE Specials and MotoGP among others. • The forthcoming quarter would see the telecast of events like India vs Zimbabwe cricket series, Tour de France, UEFA Champions League, US Open Tennis, UEFA Europa League, Copa del Rey and PGA Tour. The Sports business revenue in the 1st Quarter of fiscal 2016 were Rs 1,51.9 Crs while costs incurred in this quarter were Rs 1,50.4 Crs. • In America Zee TV continued to garner the highest viewership share amongst South Asian networks. Zee TV HD and Zee Bollywood HD were launched on additional platforms. • &tv, &tv HD were launched in the UK. Within the few weeks of its launch &tv currently ranks amongst the Top 5 Indian Channels in UK. • Zee TV and Zee Cinema continued to be the Number 1 South Asian channels in their respective genres in the UAE. Zee Aflam continued its successful run as the Number 3 movie channel in all Arabs target audiences in Saudi Arabia. • Zee World also continued its successful opening run as the second best performing GEC amongst its target audience in South Africa. • In APAC, Zee Variasi saw further gains in its viewership amongst Malay TG. Zee channels were launched on additional platforms in Sri Lanka and Australia. Maximus Securities Research Financial analysis (In Rs. Crs) Source: Capitaline Database, MSL Research Zee has been witnessing a growth in its advertisement revenue on the back of increase in viewership due its newly launched channel &tv which is gaining popularity and its existing portfolio of channels such as Zee Telugu, Zee Marathi, Zee Kanada etc also gaining viewership share. The Phase III & IV implementation of digitisation is expected to bring in incremental revenues from subscription. The upcoming state elections and improving economic environment will lead to increase in top line and bottom line growth of Zee. Zee’s strong balance sheet and good operational performance over the last five years provides reassurance about managements execution ability. Source: Capitaline Database, MSL Research Maximus Securities Research Financial estimates (In Rs. Crs) Source: Capitaline Database, MSL Research Source: Capitaline Database, MSL Research Maximus Securities Research Notes Maximus Securities Research Institutional Team____________________________________________________ Mrs. Megha Vazkar Anupam Laha Samir Patel Kiran Pakale Head of Institutional Dealing Equities Dealer - Equities Dealer - Equities Dealer - Equities 022 - 61418711 megha@maximussecurities.com 022 - 61418712 022 - 61418712 022 - 61418712 anupam@maximussecurities.com Equity Research______________________________________________________ Jaipal Shetty Research Analyst 022 61418713 report@maximussecurities.com Registered Office_____________________________________________________ MAXIMUS SECURITIES LTD. Sterling Centre, 1st Floor, Opp. Divine Child High School, Andheri-Kurla Road, Andheri (East) Mumbai 400093 Fax: 28302047 DISCLAIMER The projections and the forecasts described in this report were based upon a number of estimates and assumptions and are inherently subject to significant uncertainties and contingencies. Projections and forecasts are necessarily speculative in nature, and it can be expected that one or more of the estimates on which the projections are forecasts were based will not materialize or will vary significantly from actual results and such variations will likely increase over the period of time. All the projections and forecasts described in this report have been prepared solely by author of this report independently. All the forecasts were not prepared with a view towards compliance with published guidelines or generally accepted accounting principles. This report is for information purpose only and this document/material should not be construed as an offer to sell or the solicitation of an offer to buy, purchase or subscribe to any securities, and neither this document nor anything contained therein shall form the basis of or be relied upon in connection with any contract or commitment whatsoever. This document does not solicit any action based on material contained herein. It is for the general information of the clients of Maximus Securities Ltd (MSL hereafter). Though disseminated to the clients simultaneously, not all clients may receive this report at the same time. It does not constitute a personal recommendation or take into account the particular investment objective, financial situation or needs of individual clients. Persons who may receive this document should consider and independently evaluate whether it is suitable for its/his/her/ their particular circumstances and if necessary seek professional/financial advice. Any such person shall be responsible for conducting his/her/its their own investigation and analysis of the information contained or referred to in this document and of evaluating the merits and risks involved in securities forming the subject matter of this document. The price and value of the investment referred to in this document/material and income from them may go up as well as down, and investors may realize profit/loss on their investments. Past performance is not a guide for future performance. Actual results may differ materially from those set forth in the projection. Forward looking statements are not predictions and may be subjected to change without notice. MSL accepts no liabilities for any loss or damage of any kind arising out of use of this report. This report/document has been prepared by MSL based upon the information available to the public and the sources believed to be reliable. Though utmost care has been taken to ensure its accuracy, no representation or warranty, express or implied is made that it is accurate. MSL has reviewed this report and, in so far as it includes current and historical information, it is believed to be reliable, although its accuracy and completeness cannot be guaranteed. Following table contains the disclosure of interest in order to adhere to utmost transparency; Trading position of Clients / Company Associates may be different from recommendation given in this report at any point of time. This information is subject to change without any prior notice. MSL reserves the right to make modifications and alternations to this statement as may be required from time to time. Nevertheless, MSL is committed to providing independent and transparent recommendations to its clients. SEBI Research Analyst Registration Number INH000001147.