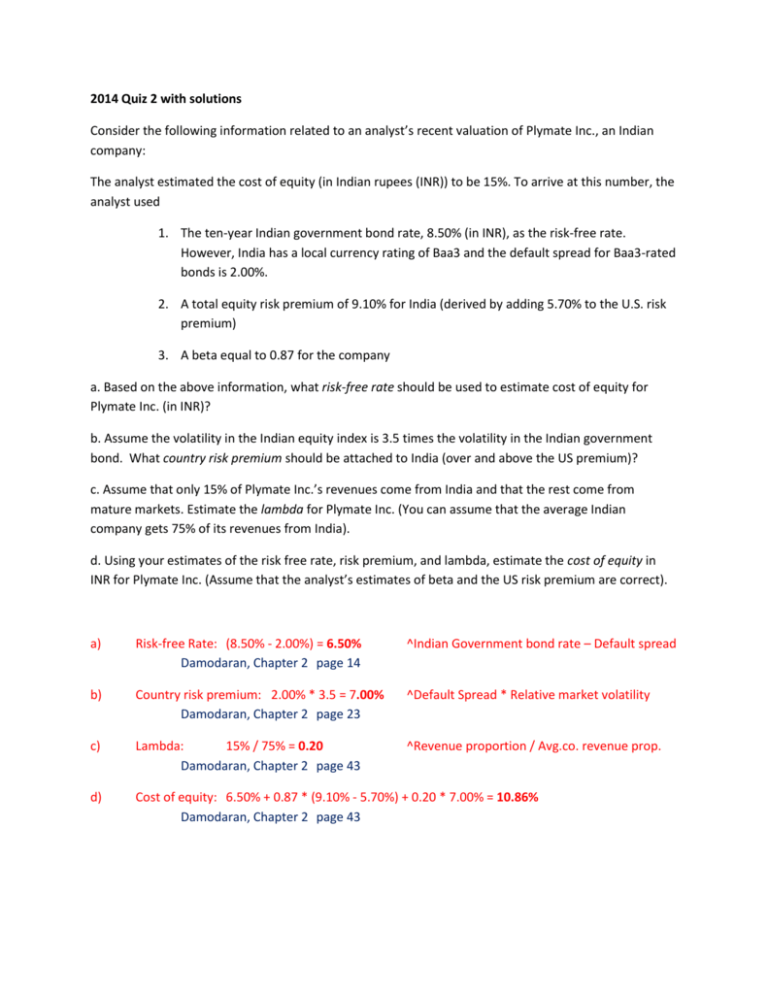

2014 Quiz 2 with solutions Consider the following information

advertisement

2014 Quiz 2 with solutions Consider the following information related to an analyst’s recent valuation of Plymate Inc., an Indian company: The analyst estimated the cost of equity (in Indian rupees (INR)) to be 15%. To arrive at this number, the analyst used 1. The ten-year Indian government bond rate, 8.50% (in INR), as the risk-free rate. However, India has a local currency rating of Baa3 and the default spread for Baa3-rated bonds is 2.00%. 2. A total equity risk premium of 9.10% for India (derived by adding 5.70% to the U.S. risk premium) 3. A beta equal to 0.87 for the company a. Based on the above information, what risk-free rate should be used to estimate cost of equity for Plymate Inc. (in INR)? b. Assume the volatility in the Indian equity index is 3.5 times the volatility in the Indian government bond. What country risk premium should be attached to India (over and above the US premium)? c. Assume that only 15% of Plymate Inc.’s revenues come from India and that the rest come from mature markets. Estimate the lambda for Plymate Inc. (You can assume that the average Indian company gets 75% of its revenues from India). d. Using your estimates of the risk free rate, risk premium, and lambda, estimate the cost of equity in INR for Plymate Inc. (Assume that the analyst’s estimates of beta and the US risk premium are correct). a) Risk-free Rate: (8.50% - 2.00%) = 6.50% Damodaran, Chapter 2 page 14 ^Indian Government bond rate – Default spread b) Country risk premium: 2.00% * 3.5 = 7.00% Damodaran, Chapter 2 page 23 ^Default Spread * Relative market volatility c) Lambda: 15% / 75% = 0.20 Damodaran, Chapter 2 page 43 ^Revenue proportion / Avg.co. revenue prop. d) Cost of equity: 6.50% + 0.87 * (9.10% - 5.70%) + 0.20 * 7.00% = 10.86% Damodaran, Chapter 2 page 43 Consider the following equity betas of four social media companies, and their debt/equity ratios. Company Facegram Twitbook My-Chat Lync-Out Beta 0.94 1.43 1.17 0.79 Debt/Equity Ratio 16.12% 28.06% 20.02% 36.16% (All the firms face a corporate tax rate of 36%) A. Estimate the unlevered beta of each firm. What do the unlevered betas tell you about these firms? B. Assume now that Lync-Out is planning to decrease its debt/equity ratio to 24%. Compute the new (levered) beta. C. If you were valuing an initial public offering in the social media industry, what beta would you use in the valuation? (Assume that the firm going public plans to have a debt/equity ratio of 32%.) a) Facegram: 0.94 / (1 + (1-36%)*16.12%) = 0.85 Twitbook: 1.43 / (1 + (1-36%)*28.06%) = 1.21 My-Chat: 1.17 / (1 + (1-36%)*20.02%) = 1.04 Lync-Out: 0.79 / (1 + (1-36%)*36.16%) = 0.64 The unlevered betas measure the business and operating leverage risk associated with each of these firms. Damodaran, Chapter 2 page 33 b) Lync-Out: 0.64 * (1 + (1 - 36%)*(24%)) = 0.74 Damodaran, Chapter 2 page 33 c) The average unlevered beta of these comparable firms should be re-levered using the debt/equity ratio of the IPO Average unlevered beta = 0.94 Beta of IPO: 0.94 * (1 + (1 - 36%)*(32%)) = 1.13 Damodaran, Chapter 2 page 34-35 Consider the following: Firm A is a large U.S. multinational firm, with operations in the Americas, Europe, and Asia. Every year, Firm A completes dozens of acquisitions. It is standard practice for Firm A to: i. ii. iii. estimate its own cost of equity simply by adding a three-year historical U.S. market premium to the three-year moving average of U.S. 10-year government bond rates; estimate its own cost of debt using the highest marginal tax rate among the countries in which it currently has significant operations; and discount target firms’ cash flows using Firm A’s own discount rate (9%), when computing expected return on investments Identify and briefly discuss three weaknesses in Firm A’s standard practices. The risk-free rate should be the current rate, not a moving average; a country risk premium should be added for operating in Europe and Asia; Firm A should use target firms’ cost of equity when valuing investment opportunities. Accountants Inc. (AI), a profitable service provider incorporated in Delaware, operates in three countries, the United States, Mexico, and Japan. Half of AI’s operating income is generated in the US; and the other half is split evenly between the other two countries. Assume the marginal tax rates in each country are as follows: United States: 34.00%; Mexico: 18.00%; Japan: 38.00% AI's bond rating is AA, which currently caries a typical default spread of 0.60%. Assume the risk-free rate is 2.40%. Calculate GC's after -tax cost of debt. Please provide a brief justification for all assumptions used in your calculation. After-tax Cost of Debt = (Risk-free rate + default spread) * (1 – marginal tax rate) After-tax Cost of Debt = (2.40% + 0.60%) * (1 – 31%) After-tax Cost of Debt = 2.07% * Alternatively, you can use Japan’s tax rate, assuming that interest expense will be directed to the country with the highest tax rate. Under this assumption, the after-tax cost of debt would equal 1.67% Source –Damodaran Chapter 2 (pages 50-54) According to a recent study, European companies in the Life Science & Healthcare industry reported (on average) a cost of equity of 7.0 percent, while European companies in the Automotive industry reported (on average) a cost of capital of 9.1 percent. Identify two key factors contributing to this difference (be specific). Average Levered beta: Life science = 0.83 Automotive = 1.15 Cost of Debt: Automotive = 5.5% Life science = 4.5% Source – ‘Cost of Capital Study 2011-2012: Developments in Volatile Markets’, KPMG, 2012