Practice Problems for Chapters 5,6

advertisement

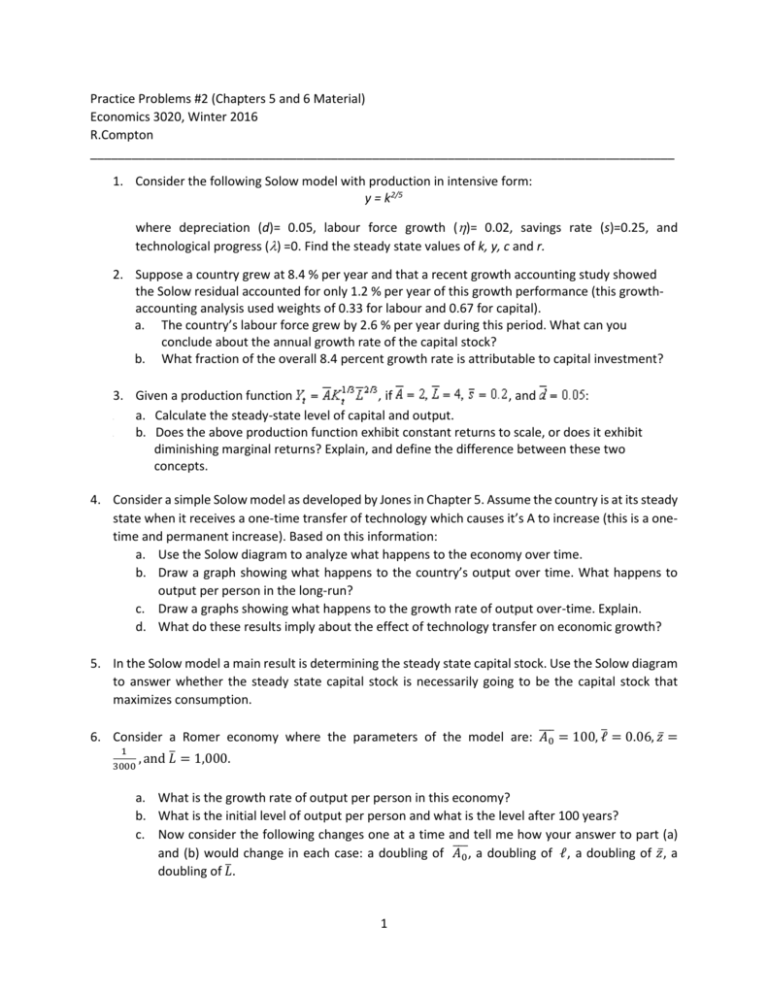

Practice Problems #2 (Chapters 5 and 6 Material) Economics 3020, Winter 2016 R.Compton _____________________________________________________________________________________ 1. Consider the following Solow model with production in intensive form: y = k2/5 where depreciation (d)= 0.05, labour force growth (η)= 0.02, savings rate (s)=0.25, and technological progress (λ) =0. Find the steady state values of k, y, c and r. 2. Suppose a country grew at 8.4 % per year and that a recent growth accounting study showed the Solow residual accounted for only 1.2 % per year of this growth performance (this growthaccounting analysis used weights of 0.33 for labour and 0.67 for capital). a. The country’s labour force grew by 2.6 % per year during this period. What can you conclude about the annual growth rate of the capital stock? b. What fraction of the overall 8.4 percent growth rate is attributable to capital investment? 3. Given a production function , if , and : a. Calculate the steady-state level of capital and output. b. Does the above production function exhibit constant returns to scale, or does it exhibit diminishing marginal returns? Explain, and define the difference between these two concepts. 4. 5. 4. Consider a simple Solow model as developed by Jones in Chapter 5. Assume the country is at its steady state when it receives a one-time transfer of technology which causes it’s A to increase (this is a onetime and permanent increase). Based on this information: a. Use the Solow diagram to analyze what happens to the economy over time. b. Draw a graph showing what happens to the country’s output over time. What happens to output per person in the long-run? c. Draw a graphs showing what happens to the growth rate of output over-time. Explain. d. What do these results imply about the effect of technology transfer on economic growth? 5. In the Solow model a main result is determining the steady state capital stock. Use the Solow diagram to answer whether the steady state capital stock is necessarily going to be the capital stock that maximizes consumption. 6. Consider a Romer economy where the parameters of the model are: ��� 𝐴𝐴0 = 100, ℓ� = 0.06, 𝑧𝑧̅ = 1 , and 𝐿𝐿� = 1,000. 3000 a. What is the growth rate of output per person in this economy? b. What is the initial level of output per person and what is the level after 100 years? c. Now consider the following changes one at a time and tell me how your answer to part (a) ���0 , a doubling of ℓ, a doubling of 𝑧𝑧̅, a and (b) would change in each case: a doubling of 𝐴𝐴 doubling of 𝐿𝐿�. 1 7. Consider the following variation of the Romer model: 1 𝑌𝑌𝑡𝑡 = 𝐴𝐴2𝑡𝑡 𝐿𝐿𝑦𝑦𝑦𝑦 a. b. c. ∆𝐴𝐴𝑡𝑡=1 = 𝑧𝑧̅𝐴𝐴𝑡𝑡 𝐿𝐿𝑎𝑎𝑎𝑎 𝐿𝐿𝑦𝑦𝑦𝑦 + 𝐿𝐿𝑎𝑎𝑎𝑎 = 𝐿𝐿� 𝐿𝐿𝑎𝑎𝑎𝑎 = ℓ𝐿𝐿� Provide an economic interpretation of our output production equation. What is the growth rate of knowledge in this economy? What is the growth rate of output per person in this economy? 8. Consider the Cobb-Douglas production function . a. Write this in growth-rate terms. b. Next, define this in terms of per capita growth and identify the contributions of the components of per capita growth. c. If the growth rate of capital per worker is 1.3 percent, the labor composition growth rate is 0.4 percent, TFP growth is 1.2 percent, and , what is the growth rate of output per worker? 2