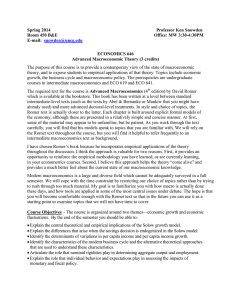

Answer the question in Part 1 and 1 of the... You have 4 hours to complete the exam. The purpose...

advertisement

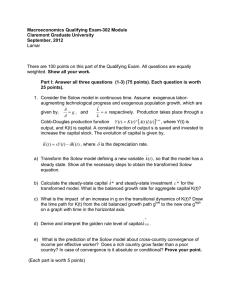

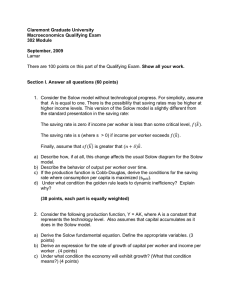

Answer the question in Part 1 and 1 of the 2 questions in Part 2. You have 4 hours to complete the exam. The purpose of Part 1 is to show the breadth of your macroeconomic knowledge and how to apply the different tools to real problems. The purpose of Part 2 is to show the depth of your knowledge in using specific tools to find solutions to technical problems. Part 1 In the final chapter of his textbook, David Romer writes that leading macroeconomists were stunned and humbled by the financial crisis of 2007-2008, that macroeconomic theory will change significantly as a result, but that at this point it is not clear what the changes will be. With that in mind, answer the following questions. In each case, you may use whatever tools—verbal analysis, graphical analysis, or equations—and cite whatever authors o schools of thought best help you answer the question. 1. What caused the financial crisis. Compare and contrast the most important causes of the global financial crisis put forward by two leading schools of economic thought: the New Classical school (Lucas, Prescott,…) and the New Keynesian school (Romer, Mankiw,…). 2. Quantitative Easing and the Euro crisis. In response to the crisis, the major central banks have engineered an unprecedented increase in bank reserves and monetary base for the US, UK, Japan, and Switzerland. Last week the ECB was the last to fall into line, promising to buy more than $1 trillion in assets over the next year. Have these measures worked to end the crisis and restore growth? In light of such policy, how would you explain the recurring headlines about deflation danger? What has made the output and price response to QE take so long? What needs to be done to ‘unwind’ QE as conditions return to normal? 3. Oil Price collapse. How would you explain the causes of the recent collapse in oil prices? What are it’s likely effects on growth, inflation, and stock markets over time for a major producer like Russia? For a major buyer like China? 4. Lessons Learned. What is the most promising approach and most fruitful direction of research to help us understand, prevent or mitigate, or cure future financial crises? 5. State of global economy. Using all that you have learned to date, write a brief summary of the current state of the global macro-economy and prospects for output, prices, interest rates, and asset prices over the next few years. What is the biggest risk to global growth? What policies could improve growth prospects. Part 2 Question 2.1 Consider a Solow economy with a Cobb Douglas production function with technological progress, Y = AF(K, L) = AKa L(1-a) where 0 < a < 1, Y is output, K is capital stock, L is labor, and A represents the level of technology. Output is made up of consumer goods and capital goods, Y = C + I. The fraction of output that is saved, s, is constant. All savings are used to produce capital goods. Assume that labor grows at constant annual rate n, technology grows at constant annual rate g, and the capital stock depreciates at the constant annual rate d. There is no government and no foreign sector. Output is assumed to be at full employment. 6. Express the production function in intensive terms, per unit of labor. 7. Show the production function has constant returns. 8. Show the production function has positive and diminishing returns to labor and that the production function satisfies the Inada conditions. 9. Show the equation describing the net growth in the capital stock. 10. Derive the Solow fundamental equation for the model. 11. Show a graphical depiction of the steady state, or balanced growth path. 12. Show the effect of a permanent increase in the rate of population growth on steady state income per unit of labor. Is the change in growth temporary or permanent? 13. How is growth accounting used to decompose growth into contributions from population growth, capital accumulation, and technological progress? In empirical studies, what fraction of growth is explained by capital accumulation? 14. How would you revise the production function to extend the basic Solow model to include the contribution of human capital as well as physical capital to output? How would you think about estimating the share of income earned by physical capital, human capital, and labor? Are you aware of the results of any empirical work doing this? 15. What predictions does the Solow model make about the possibility that international differences in income per capita will converge over time? To what degree do international differences in return on capital lead to capital flows that would accelerate convergence? Are you aware of any empirical evidence on the convergence question? What are the main results? Question 2.2 Considered the problem where households live for 2 periods and leave no bequests (there are no assets left at the end of period 2). Households choose consumption in period t and labor supply in both periods to maximize utility at the beginning of period 1 given the following utility function: 𝑏𝑙𝑛(1 − ℓ1 )1−𝛾 𝑏𝑙𝑛(1 − ℓ2 )1−𝛾 −𝜌 −𝜌 𝑢 = ln(𝑐1 ) + + 𝑒 ln(c2 ) + 𝑒 1−𝛾 1−𝛾 where 𝑐1 represents consumption in period 1, 𝑐2 represents consumption in period 2, ℓ1 represents the proportion of time devoted to labor in period 1, ℓ2 represents the proportion of time devoted to labor in period in period 2, 𝜌 is the discount rate representing time preference, 𝑏 > 0,and 0< 𝛾 <1. The lifetime budget constrain for households is given by: 𝐶1 + 𝐶2 𝑌2 = 𝑌1 + + 𝐴𝑡 1+𝑟 1+𝑟 Household income in period t is 𝑌𝑡 = 𝑤𝑡 ℓ𝑡 , 𝑤𝑡 is the wage rate in period t, r is the market interest rate, and 𝐴𝑡 represents initial assets. a. Set up the lagrangian problem for maximizing utility subject to the lifetime budget constraint. b. Find the first order conditions for 𝑐1 , 𝑐2 , ℓ1 , ℓ2 . c. Find the equation which shows the marginal rate of intertemporal substitution between consumption in period 1 and period 2 d. Derive the expression showing the impact of an increase in the interest rate on consumption in period 2. e. What is the impact of an increase in w1 and w2 that leaves w1 /w2 unchanged on optimal leisure in period 2? f. What is the impact of an increase in w2 on 𝑐1 , 𝑐2 , ℓ1 , and ℓ2 ? g. What is the impact of an increase in the value of initial assets on period 2 consumption?