Macroeconomics Qualifying Exam-302 Module Claremont Graduate University September, 2007 Lamar

advertisement

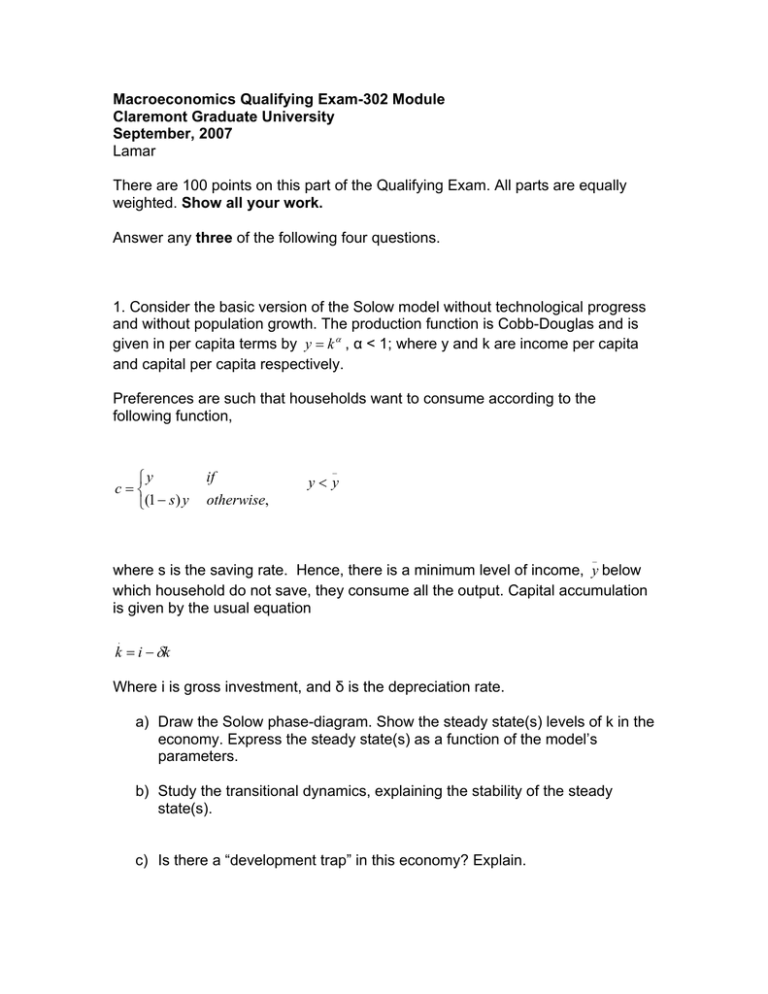

Macroeconomics Qualifying Exam-302 Module Claremont Graduate University September, 2007 Lamar There are 100 points on this part of the Qualifying Exam. All parts are equally weighted. Show all your work. Answer any three of the following four questions. 1. Consider the basic version of the Solow model without technological progress and without population growth. The production function is Cobb-Douglas and is given in per capita terms by y = k α , α < 1; where y and k are income per capita and capital per capita respectively. Preferences are such that households want to consume according to the following function, ⎧y c=⎨ ⎩(1 − s ) y if otherwise, _ y< y _ where s is the saving rate. Hence, there is a minimum level of income, y below which household do not save, they consume all the output. Capital accumulation is given by the usual equation . k = i − δk Where i is gross investment, and δ is the depreciation rate. a) Draw the Solow phase-diagram. Show the steady state(s) levels of k in the economy. Express the steady state(s) as a function of the model’s parameters. b) Study the transitional dynamics, explaining the stability of the steady state(s). c) Is there a “development trap” in this economy? Explain. 2. The Labor Market a) Graph and explain the labor market in the Classical model. b) What happens to employment in this model when prices fall? Explain your answer. c) Now assume that each firm has the following production function: Y = F [e( w) L] where L is the number of workers, e is the effort per worker, and w is the real wage, effort depends positively on real wages. _ Labor is the only productive input. The labor supply is given by L identical workers, each offering labor inelastically. Assuming that firms are profit-maximizers show what must be the relation between real wages and effort. d) What is the implication of the condition you derived in c for unemployment? Please discuss all the possibilities. 3. Show how output and prices will react to an increase in the money supply in the following macroeconomic models. Please provide a graph and a detailed explanation of the implications of the assumptions for your result. If is appropriate distinguish between the short run and the long run. a) b) c) d) e) IS-MP Mundell-Fleming with perfect capital mobility and rational expectations AD/AS with adaptive expectations Lucas’ Island Model Fischer Model 4. Show how the appointment of a conservative central banker (a central banker that dislikes inflation) is an alternative to a predetermined monetary rule to achieve low levels of inflation. Use an appropriate model to show your result.