13.7 THE EQUATION OF MOTION FOR k

advertisement

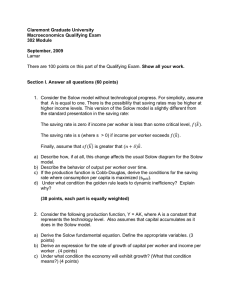

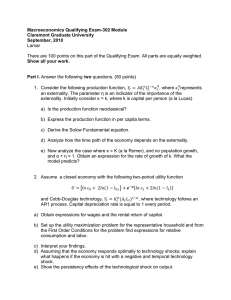

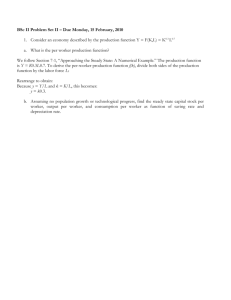

LECTURE 13: ECONOMIC GROWTH 13.1 THE SOLOW GROWTH MODEL Robert Solow won Nobel Prize for contributions to the study of economic growth. It is a major paradigm which is widely used in policy making and a benchmark against which most recent growth theories are compared. The Solow Growth Model is designed to show how growth in the capital stock, growth in the labour force, and advances in technology interact in an economy, and how they affect a nation’s total output of goods and services. How Solow Model Is Different: Assumptions K is no longer fixed: investment causes it to grow, depreciation causes it to shrink. L is no longer fixed: population growth causes it to grow. The consumption function is simpler. • No G or T (only to simplify presentation; we can still do fiscal policy experiments) • Cosmetic differences. 13.2 THE PRODUCTION FUNCTION Let’s analyze the supply and demand for goods, and see how much output is produced at any given time and how this output is allocated among alternative uses. The production function represents the transformation of inputs (labour (L), capital (K), and production technology) into outputs (final goods and services for a certain time period). In aggregate terms: Y = F (K, L) y = Y/L = output per worker k = K/L = capital per worker Assume constant returns to scale: zY = F (zK, zL) for any z >0 Pick z = 1/L. Then Y/L = F (K/L, 1) y = F (k, 1) y = f (k) 1 ©St Paul’s University Where f (k) = F (k, 1) 13.4 THE NATIONAL INCOME IDENTITY Y = C + I (remember, no G) In “per worker” terms: y = c + i where c = C/L and i = I/L 13.4 THE CONSUMPTION FUNCTION s = the saving rate, the fraction of income that is saved (s is an exogenous parameter). Note: s is the only lowercase variable that is not equal to its uppercase version divided by L. Consumption function: c = (1–s) y (per worker) 13.5 SAVING AND INVESTMENT Saving (per worker) = sy National income identity is y = c + i Rearrange to get: i = y – c = sy (investment = saving) Using the results above, i = sy = sf (k) 2 ©St Paul’s University 13.6 CAPITAL ACCUMULATION Investment makes the capital stock bigger, depreciation makes it smaller. Change in capital stock= investment – depreciation ∆k = i – δk Since i = sf (k), this becomes: ∆k = s f (k) – δk 13.7 THE EQUATION OF MOTION FOR k The equation of motion for k can be written as: ∆k = s f (k) – δk It is the Solow model’s central equation. It determines behavior of capital over time which, in turn, determines behavior of all of the other endogenous variables because they all depend on k. e.g. Income per person: y = f (k), Consumption per person: c = (1–s) f (k) 13.8 THE STEADY STATE If investment is just enough to cover depreciation, [sf (k) = δk], then capital per worker will remain constant: ∆k = 0. This constant value, denoted k*, is called the steady state capital stock. 3 ©St Paul’s University 4 ©St Paul’s University 5 ©St Paul’s University A Numerical Example Production function (aggregate): Y = F ( K , L ) = K ×L K=1 / 2 L1 / 2 To derive the per-worker production function, divide through by L: Then substitute y = Y/L and k = K/L to get y =f (k ) =k 1 / 2 Assume: s = 0.3, δ= 0.1, initial value of k = 4.0 Exercise: Solve For The Steady State Continue to assume s = 0.3, δ= 0.1, and y = k1/2 Use the equation of motion: ∆k = s f (k) −δk to solve for the steady-state values of k, y, and c. 6 ©St Paul’s University Solution: PREDICTION: Higher s ⇒ higher k*, and since y = f (k), higher k* ⇒ higher y*. Thus, the Solow model predicts that countries with higher rates of saving and investment will have higher levels of capital and income per worker in the long run. 7 ©St Paul’s University 8 ©St Paul’s University