Claremont Graduate University Macroeconomics Qualifying Exam 302 Module

advertisement

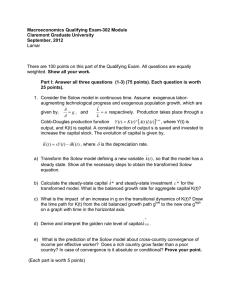

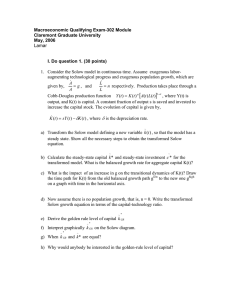

Claremont Graduate University Macroeconomics Qualifying Exam 302 Module September, 2009 Lamar There are 100 points on this part of the Qualifying Exam. Show all your work. Section I. Answer all questions (60 points) 1. Consider the Solow model without technological progress. For simplicity, assume that A is equal to one. There is the possibility that saving rates may be higher at higher income levels. This version of the Solow model is slightly different from the standard presentation in the saving rate: The saving rate is zero if income per worker is less than some critical level, ݂ሺ݇ሻ. The saving rate is s (where s > 0) if income per worker exceeds ݂ሺ݇ሻ. is greater that ሺ݊ ߜሻ݇. Finally, assume that ݂ݏሺ݇ሻ a) Describe how, if at all, this change affects the usual Solow diagram for the Solow model. b) Describe the behavior of output per worker over time. c) If the production function is Cobb-Douglas, derive the conditions for the saving rate where consumption per capita is maximized (sgold). d) Under what condition the golden rule leads to dynamic inefficiency? Explain why? (30 points, each part is equally weighted) 2. Consider the following production function, Y = AK, where A is a constant that represents the technology level. Also assumes that capital accumulates as it does in the Solow model. a) Derive the Solow fundamental equation. Define the appropriate variables. (3 points) b) Derive an expression for the rate of growth of capital per worker and income per worker . (4 points) c) Under what condition the economy will exhibit growth? (What that condition means?) (4 points) d) What is the relation between the rate of growth of output per capita and the level of capital per capita? (3 points) e) Assume a natural disaster happens (it destroys part of the capital), how this affects the short and long-run rates of growth? Justify your answer. (3 points) f) Paul Romer’s 1986 article is an attempt to provide microfoundations to a model like the one you developed above. This part of the question asks you to provide in detail how Romer justifies the possibility of a model like this. (10 points) g) Provide a brief critique to what you did in f). (3 points) (30 points) Section II (40 points) Answer two of the following three questions. Each question is worth 20 points 3. The following comment appeared in the “New York Times” in October 10, 2006. “Edmund S. Phelps, a Columbia University professor, was awarded the Nobel Memorial Prize in Economic Science yesterday for his contribution to a sophisticated explanation of how wages, unemployment and inflation interact with one another. The explanation holds, in essence, that wages and inflation tend to rise in tandem, one pushing up the other, until the unemployment rate reaches an ‘equilibrium’ or ‘natural’ level at which prices no longer rise.” I want you to analyze the consistency of this comment under: a) The traditional Phillips Curve. b) The Expectations-Augmented Phillips Curve. In both cases you must support your arguments with the appropriate equations/graphs. 4. Explain why a policy rule may be superior to a discretionary policy. In answering this question assume that aggregate supply is given by the Lucas Supply Curve − y = y + b(π − π e ) b >0, policy makers have a loss function given by 1 1 L = ( y − y*) + a (π − π *) 2 , where * represent optimal levels of output and 2 2 inflation respectively. Assume a policy maker chooses the inflation rate. What is the role of reputation in this model? 5. What is the “policy ineffectiveness proposition”? Provide a model that reflects this important macroeconomic result and prove and illustrate the proposition. What are the key assumptions of this result? What was the Stanley Fischer answer to this result? Here I do not want you to develop the full model, only the intuition of Fischer’s answer.