Macroeconomics Qualifying Exam-302 Module Claremont Graduate University September, 2012 Lamar

advertisement

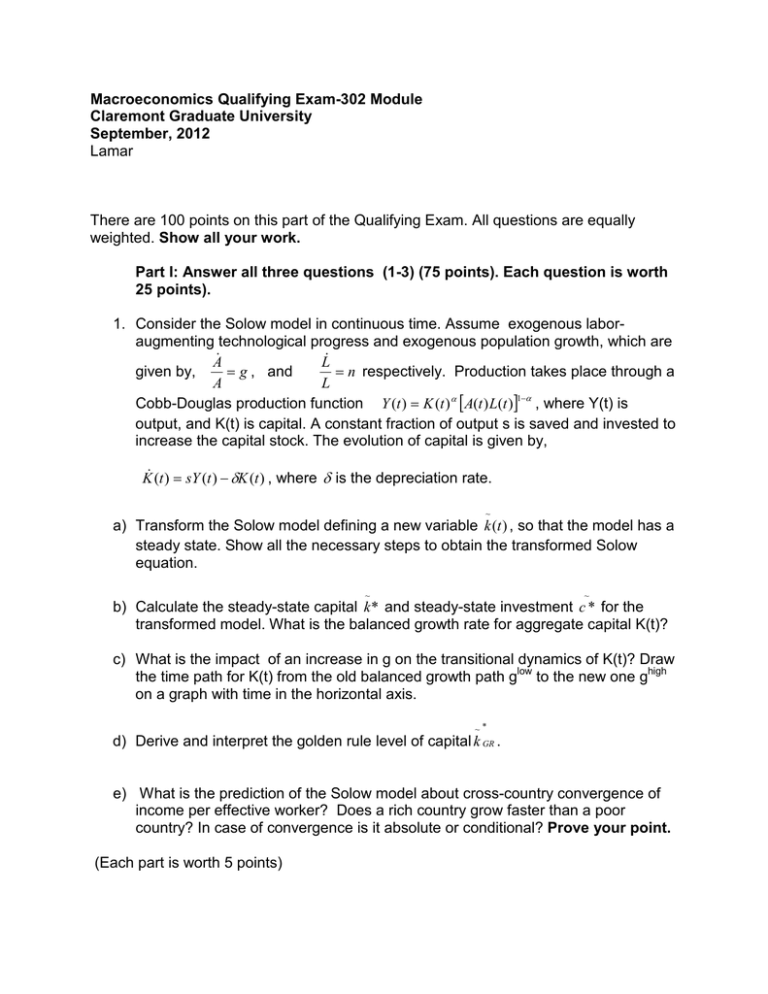

Macroeconomics Qualifying Exam-302 Module Claremont Graduate University September, 2012 Lamar There are 100 points on this part of the Qualifying Exam. All questions are equally weighted. Show all your work. Part I: Answer all three questions (1-3) (75 points). Each question is worth 25 points). 1. Consider the Solow model in continuous time. Assume exogenous laboraugmenting technological progress and exogenous population growth, which are A L given by, = g , and = n respectively. Production takes place through a A L Cobb-Douglas production function Y (t ) = K (t ) α [A(t ) L(t )]1−α , where Y(t) is output, and K(t) is capital. A constant fraction of output s is saved and invested to increase the capital stock. The evolution of capital is given by, K (t ) = sY (t ) − δK (t ) , where δ is the depreciation rate. ~ a) Transform the Solow model defining a new variable k (t ) , so that the model has a steady state. Show all the necessary steps to obtain the transformed Solow equation. ~ ~ b) Calculate the steady-state capital k * and steady-state investment c * for the transformed model. What is the balanced growth rate for aggregate capital K(t)? c) What is the impact of an increase in g on the transitional dynamics of K(t)? Draw the time path for K(t) from the old balanced growth path glow to the new one ghigh on a graph with time in the horizontal axis. ~* d) Derive and interpret the golden rule level of capital k GR . e) What is the prediction of the Solow model about cross-country convergence of income per effective worker? Does a rich country grow faster than a poor country? In case of convergence is it absolute or conditional? Prove your point. (Each part is worth 5 points) 2. Assume a closed economy where firms produce output using only labor, i.e., Y= F(L) under the assumptions of diminishing and positive marginal product of labor. Households live forever and derive utility from consumption and holding real money balances, and disutility from working. The representative household’s utility function is given by 𝑀 𝑡 𝑡 𝑈 = ∑∞ 𝑡=0 𝛽 �𝑈(𝐶𝑡 ) + Γ � 𝑃 � − 𝑉(𝐿𝑡 )�, 0<β<1, with 𝑈 ′ (.) >0, 𝑈 ′′ (. ) < 0, 𝑡 Γ ′ (. ) > 0, Γ ′′ (. ) < 0, 𝑉 ′ > 0, 𝑉 ′′ > 0. U and Γ have relative-risk-aversion forms, 𝑈(𝐶𝑡 ) = 𝐶𝑡1−𝜃 1−𝜃 , θ > 0, and 𝑀𝑡 Γ �𝑃 � = 𝑡 𝑀 ( 𝑡 )1−𝑣 𝑃𝑡 1−𝑣 , v > 0. There are two assets: Money which pays no interest and Bonds which pay an interest rate of 𝑖𝑡 . Households have a labor income WtLt per period, its consumption expenditures are PtCt., W and P represent nominal wages and the price level respectively. At is the household’s wealth at the start of period t. a) Write down an equation describing the evolution of wealth. (3 points) b) Set up the maximization problem of the household. (3 points) c) Using First Order Condition find, graph, and interpret the IS and LM curves. (10 points) d) Show and explain the effect of an increase in nominal Money supply.(4 points) e) Show and explain the effect of an increase in the coefficient of relative risk aversion θ. (5 points) 3. Assume a closed economy with the following two-period utility function 𝑈 = �𝑙𝑛 𝑐0 + 2𝑙𝑛(1 − 𝑙0) � + 𝒆−𝝆 [𝑙𝑛 𝑐1 + 2𝑙𝑛(1 − 𝑙1 )] and Cobb-Douglas technology, 𝑌𝑡 = 𝐾𝑡𝛼 (𝐴𝑡 𝐿𝑡 )1−𝛼 , where technology follows an AR1 process. Capital depreciation rate is equal to 1 every period. a) Set up the utility maximization problem for the representative household and from the First Order Conditions for the problem find expressions for relative consumption and labor supply. Interpret your findings. (8 points) b) In Real Business Cycle Theory is it said that intertemporal labor substitution acts as a powerful propagation mechanism and random changes in technology are the impulse mechanism. Explain what that means? (6 points) c) Assuming that the economy responds optimally to technology shocks; explain logically what happens if the economy is hit with a negative and temporal technology shock. (5 points) d) Show the persistency effects of the technological shock on output. (6 points) II. Answer one of the following two questions (25 points). Each question is worth 25 points. 4. Consider the following production function, Y = AK, where A is a constant that represents the technology level. Also assumes that capital accumulates as it does in the Solow model. a) Derive the Solow fundamental equation. Define the appropriate variables. (3 points) b) Derive an expression for the rate of growth of capital per worker and income per worker. (4 points) c) Under what condition the economy will exhibit economic growth? (What that condition means?) (4 points) d) What can you say about convergence in this case? (3 points) e) Assume that a natural disaster happens, how this affects the short and long-run rates of growth? Justify your answer. (3 points) f) Paul Romer’s 1986 article is an attempt to provide microfoundations to a model like the one you developed above. This part of the question asks you to provide in detail how Romer justifies the possibility of a model like this. (10 points) g) Provide a brief critique to what you did in f). (3 points). 5. Show how the appointment of a conservative central banker is an alternative to a predetermined monetary rule to achieve low levels of inflation. Assume economic agents have rational expectations. Suppose the Central Bank announces that it will choose zero inflation rate buy it cannot commit to its announcement. The Central Bank (CBD) has following loss function 1 1 𝐿 = (𝑦 − 𝑦 ∗ )2 + 𝑎(𝜋 − 𝜋 ∗ )2 2 2 output and inflation are related through the Lucas Supply function, 𝑦 = 𝑦� + 𝑏(𝜋 − 𝜋 𝑒 ). a) What would be the equilibrium inflation rate, output, and social losses? (8 points) b) Explain why the inflation rate is not zero even though that CBD announces it. (5 points) c) Compare what you found in a) to monetary policy that follows strictly a rule. (6 points) d) Provide a critique to a monetary policy based on rules.(3 points) e) What is the effect of having a conservative central banker? (3 points)