Fixed Income Investments

advertisement

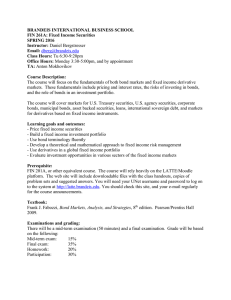

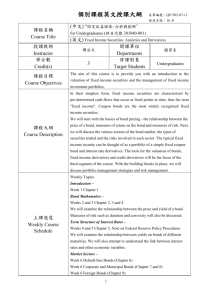

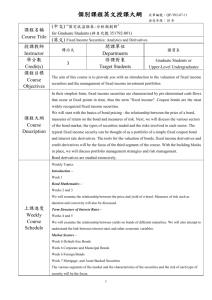

AY 2016 Course Summary MSc in Finance Program Instructor Toshiki Yotsuzuka Course Title Fixed Income Investments Overview: Course Description This course focuses on fixed income securities (bonds, interest rate derivatives and other related securities) whose valuation is mostly determined by interest rates. The concepts and analytical tools covered in the course are essential for anyone who wants to make effective use of fixed income markets for the purpose of financing, investment, market making or risk management. The types of securities discussed in class include fixed-coupon bonds, floating-rate notes, interest rate swaps, bond futures and options, callable bonds and mortgage-backed securities (MBS). Analytical topics, such as yield curve construction, factor analysis of the yield curve, the duration and convexity of bonds, mortgage calculations and credit risk valuation, are discussed in conjunction with actual data from US and Japanese fixed income markets. The course assumes some knowledge of elementary calculus and statistics. Objective of this course The primary objective of this course is to provide students with a solid background in fixed income securities. At the end of the course, students will be (i) familiar with the basic concepts of fixed income securities, such as yields, duration and convexity; (ii) capable of applying analytical techniques to extract information (such as spot, forward and par rates) from bond price data; (iii) comfortable with the use of basic term structure models and risk-neutral probabilities for derivatives pricing; (iv) able to understand the pricing of a wide array of fixed income securities, such as zero-coupon bonds, fixed-coupon bonds, floating-rate notes, interest rate swaps, bond futures and options, callable bonds, MBS, and bonds with credit risk; and (v) thus sufficiently equipped to understand the interest rate risks of typical bond portfolios. 1