BRANDEIS INTERNATIONAL BUSINESS SCHOOL FIN 261A: Fixed

advertisement

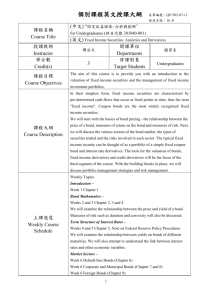

BRANDEIS INTERNATIONAL BUSINESS SCHOOL FIN 261A: Fixed Income Securities SPRING 2016 Instructor: Daniel Bergstresser Email: dberg@brandeis.edu Class Hours: Tu 6:30-9:20pm Office Hours: Monday 3:30-5:00pm, and by appointment TA: Anton Mokhovikov Course Description: The course will focus on the fundamentals of both bond markets and fixed income derivative markets. These fundamentals include pricing and interest rates, the risks of investing in bonds, and the role of bonds in an investment portfolio. The course will cover markets for U.S. Treasury securities, U.S. agency securities, corporate bonds, municipal bonds, asset backed securities, loans, international sovereign debt, and markets for derivatives based on fixed income instruments. Learning goals and outcomes: - Price fixed income securities - Build a fixed income investment portfolio - Use bond terminology fluently - Develop a theoretical and mathematical approach to fixed income risk management - Use derivatives in a global fixed income portfolio - Evaluate investment opportunities in various sectors of the fixed income markets Prerequisite: FIN 201A, or other equivalent course. The course will rely heavily on the LATTE/Moodle platform. The web site will include downloadable files with the class handouts, copies of problem sets and suggested answers. You will need your UNet username and password to log on to the system at http://latte.brandeis.edu. You should check this site, and your e-mail regularly for the course announcements. Textbook: Frank J. Fabozzi, Bond Markets, Analysis, and Strategies, 8th edition. Pearson/Prentiss Hall 2009. Examinations and grading: There will be a mid-term examination (50 minutes) and a final examination. Grade will be based on the following: Mid-term exam: 15% Final exam: 35% Homework: 20% Participation: 30% Class participation will carry a relatively high weight in the grading for the course. Class sessions will be interactive and preparation before class will be essential. Students will need to come to class prepared to discuss in detail each week’s reading assignment. To facilitate this discussion, students are absolutely required to bring their name-cards (with large and legible lettering) to class each day. To further facilitate classroom interaction, after the first week each student in the classroom will be assigned to a specific seat (more or less at random) for the remainder of the semester. Finally, electronic devices (including, but not limited to mobile phones and laptop computers) are not to be used during class sessions. Students will be required to arrive on time and be ready to start class at 6:30, with absolutely no exceptions. There will be a break every day from 7:50-8:00; students who arrive late are invited to enter the classroom during this break. The model for the class is the preparation – and often homework assignments – proceed precisely in advance of the class sessions. This is by design. The teaching philosophy is that class discussion is improved by pre-class preparation, including the preparation of homework assignments. There will be a 90-minute midterm and a final exam, as well as homework assignments. The final exam will be cumulative, reflecting the content covered in the mid-term examination as well as content from the final half of the course. This course is intended to be extremely challenging for most students. Planned schedule (subject to change): Week Topic 1: Introduction, course overview 2: Measuring yields 3 Bond price volatility 4: Term structure of interest rates 5: Treasury and Agency Securities 6: Corporate debt instruments 7: Asset-backed Securities 8: Interest rate models and embedded options, 1 9: Interest rate models and embedded options, 2 10: Convertible bonds 11: Non-US securities 12: Bond portfolio management 13: Municipal debt, review FINAL EXAM Reading Other Chapter 1,2 Chapter 3 Chapter 4 Chapter 5 Chapter 6 MIDTERM Chapter 7, 20 Chapter 15 Chapter 16,17, 27 Chapter 16,17, 27 Chapter 19 Chapter 9 Chapter 22,23 Chapter 8 Disabilities: If you are student with a documented disability on record at Brandeis University and wish to have a reasonable accommodation made for you in this class, please see me immediately. Academic honesty: You are expected to be honest in all of your academic work. Please consult Brandeis University Rights and Responsibilities for all policies and procedures related to academic integrity. Students may be required to submit work to TurnItIn.com software to verify originality. Allegations of academic dishonesty will be forwarded to the Director of Academic Integrity. Sanctions for academic dishonesty can include failing grades and/or suspension from the university. Citation and research assistance can be found in the LTS Library guides. Course Film: All course sessions will be filmed. The resulting film will be made available to students in the course as a resource. The IBS may also make the resulting film, edited or unedited, more widely available, without limitation. For example, the IBS may publicly disseminate film material from class sessions, including student comments and participation. Students will be required to arrive on time and be ready to start class at 6:30, with absolutely no exceptions. Communication Through Twitter: Students are strongly encouraged to ask questions via Twitter (#FIN261A). Please follow me (@dbergstresser), and I will hashtag posts related to the course.