Fixed Income Securities

Fixed Income Securities

Syllabus

Department of Accountancy

Graduate Institute of Finance

National Cheng Kung University

Spring, 2012/13

Instructor: Alan T. Wang

Email: wangt@mail.ncku.edu.tw

Ext. 53439

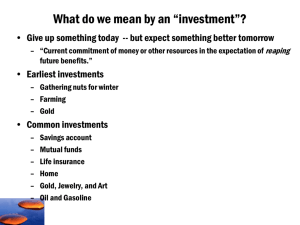

Purpose:

“Fixed-income securities” is a term for broader definition of bonds. Fixed-income securities include all types of financial assets such as bonds, convertible bonds, mortgage-backed securities, collateralized debt obligations, floaters, and the derivatives whose payoffs depend on these securities. Modern financial managers and investors are getting more subject to the risks associated with fixed-income securities: interest rate risk, credit risk, liquidity risk, etc, in the dynamic integrated global financial markets. Knowledge of traditional investment tools such as time deposits, stocks, and mutual funds is not enough in such an environment. The subprime mortgage crisis in 2007 causes CEOs of investment banks to step down. Dow Jones

Industrial Average has plummeted by more than 20% since then. On September 15,

2008, the fourth largest investment bank in the U.S., Lehman Brothers, filed for

Chapter 11 bankruptcy in Manhattan Court in New York. DJIA fell by 4.42% in a single day.

The purpose of this curse is to provide students the basic ideas in fixed-income securities. Other than understanding the fixed-income securities, three functions are to be emphasized: pricing, risk management and portfolio management. However, materials covered are only introductory, and students who are interested in these areas should read more related articles in academic journals or professional magazines.

Required textbook:

Frank J. Fabozzi, Bond markets, analysis, and strategies, 8 th

edition, 2013,

Pearson/Prentice Hall.

(雙葉代理)

Course outline:

Ch.1 Introduction

1

Ch.2 Pricing of bonds

Ch.3 Measuring bond yields

Ch. 4 Bond price volatility

Ch. 5 Bond yields and term structure of interest rates

Ch.6 Treasury and agency securities markets

Ch.7 Corporate debt instruments

Ch.9 International bonds

Mid-term exam

Ch. 10 Residential mortgage loans

Ch. 11 Agency mortgage pass-through securities

Ch. 12 Agency collateralized mortgage obligations

Ch. 15 Agency-backed securities

Ch.19 Analysis of convertible bonds

Ch.21 Credit risk modeling

Ch.26 Interest rate futures contracts

Ch.27 Interest-rate options

Ch.28 Interest-rate swaps

Ch.29 Credit default swap

Final Exam

Grade: Mid-term 45%

Final 45%

Participation 10%

2