Quiz Chapter 17 Accounting 3312 Name: __________________________

Quiz Chapter 17 Accounting 3312 Name: __________________________

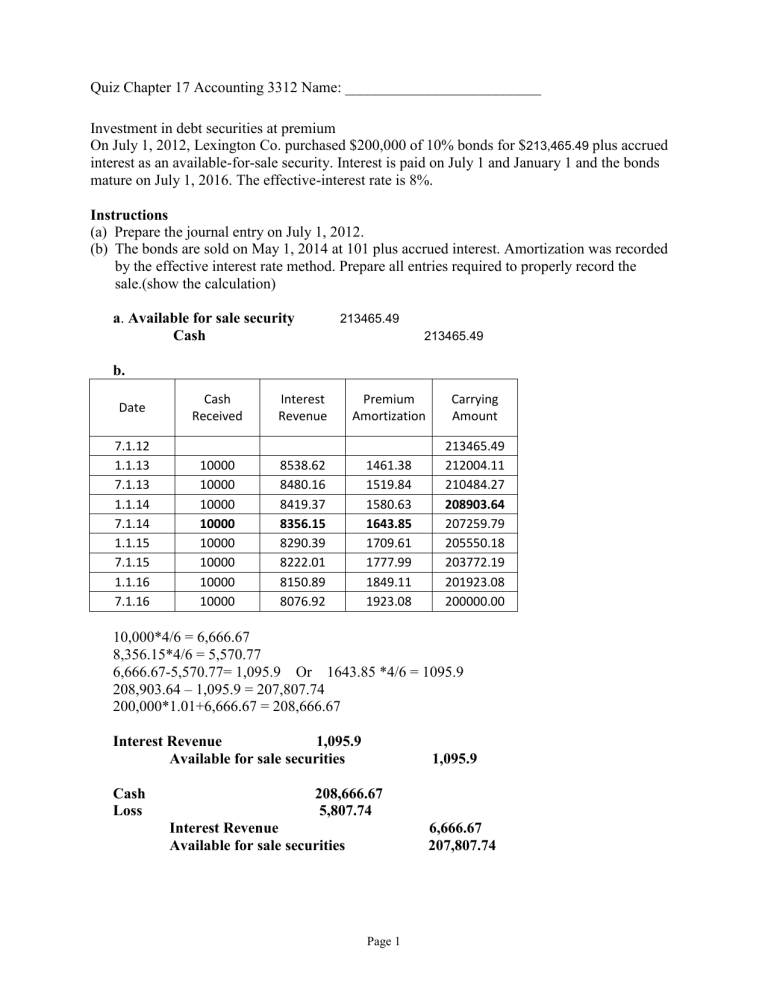

Investment in debt securities at premium

On July 1, 2012, Lexington Co. purchased $200,000 of 10% bonds for $ 213,465.49 plus accrued interest as an available-for-sale security. Interest is paid on July 1 and January 1 and the bonds mature on July 1, 2016. The effective-interest rate is 8%.

Instructions

(a) Prepare the journal entry on July 1, 2012.

(b) The bonds are sold on May 1, 2014 at 101 plus accrued interest. Amortization was recorded by the effective interest rate method. Prepare all entries required to properly record the sale.(show the calculation) a . Available for sale security 213465.49

Cash 213465.49

b.

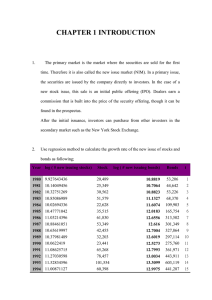

Date

Cash

Received

Interest

Revenue

Premium

Amortization

Carrying

Amount

7.1.12

1.1.13

7.1.13

1.1.14

7.1.14

10000

10000

10000

10000

8538.62

8480.16

8419.37

8356.15

1461.38

1519.84

1580.63

1643.85

213465.49

212004.11

210484.27

208903.64

207259.79

1.1.15

7.1.15

1.1.16

7.1.16

10000

10000

10000

10000

8290.39

8222.01

8150.89

8076.92

1709.61

1777.99

1849.11

1923.08

205550.18

203772.19

201923.08

200000.00

10,000*4/6 = 6,666.67

8,356.15*4/6 = 5,570.77

6,666.67-5,570.77= 1,095.9 Or 1643.85 *4/6 = 1095.9

208,903.64 – 1,095.9 = 207,807.74

200,000*1.01+6,666.67 = 208,666.67

Interest Revenue 1,095.9

Available for sale securities 1,095.9

Cash 208,666.67

Loss 5,807.74

Interest Revenue 6,666.67

Available for sale securities 207,807.74

Page 1