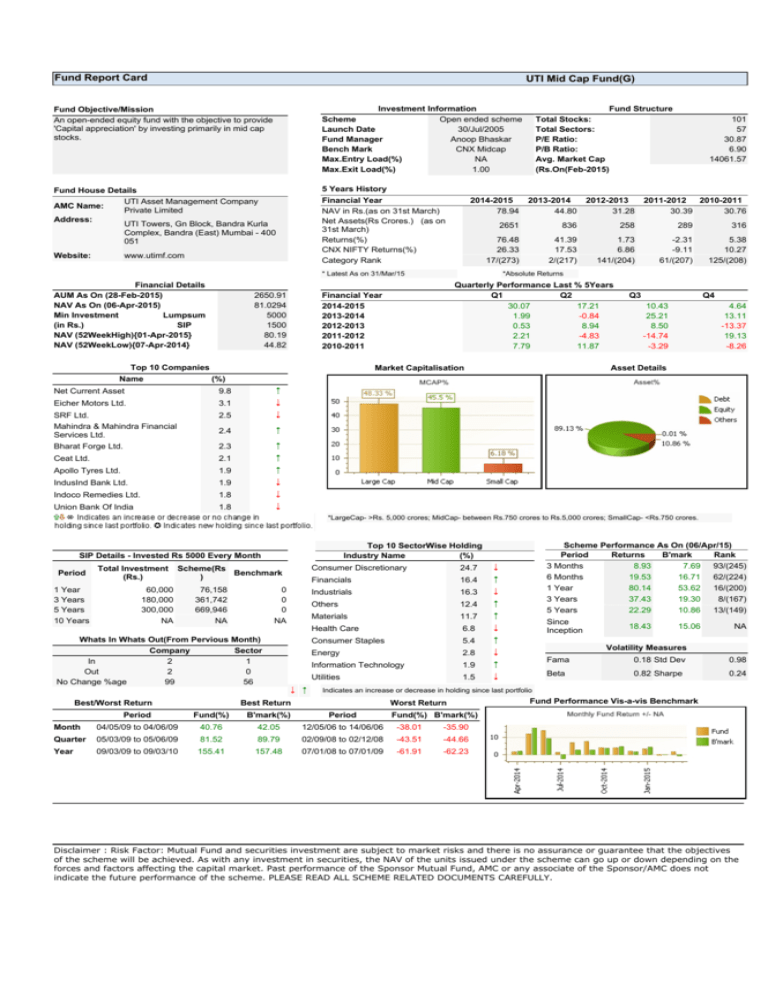

UTI Mid Cap Fund(G) Fund Report Card 5 6 6 5 5 5 5

advertisement

Fund Report Card

UTI Mid Cap Fund(G)

Fund Objective/Mission

An open-ended equity fund with the objective to provide

'Capital appreciation' by investing primarily in mid cap

stocks.

Investment Information

Scheme

Open ended scheme

Launch Date

30/Jul/2005

Fund Manager

Anoop Bhaskar

Bench Mark

CNX Midcap

Max.Entry Load(%)

NA

Max.Exit Load(%)

1.00

Fund House Details

UTI Asset Management Company

AMC Name:

Private Limited

Address:

UTI Towers, Gn Block, Bandra Kurla

Complex, Bandra (East) Mumbai - 400

051

5 Years History

Website:

Financial Year

NAV in Rs.(as on 31st March)

Net Assets(Rs Crores.) (as on

31st March)

Returns(%)

CNX NIFTY Returns(%)

Category Rank

www.utimf.com

2013-2014

44.80

2012-2013

31.28

Top 10 Companies

Name

2011-2012 2010-2011

30.39

30.76

2651

836

258

289

316

76.48

26.33

17/(273)

41.39

17.53

2/(217)

1.73

6.86

141/(204)

-2.31

-9.11

61/(207)

5.38

10.27

125/(208)

*Absolute Returns

Quarterly Performance Last % 5Years

Q1

Q2

30.07

17.21

1.99

-0.84

0.53

8.94

2.21

-4.83

7.79

11.87

Financial Year

2014-2015

2013-2014

2012-2013

2011-2012

2010-2011

2650.91

81.0294

5000

1500

80.19

44.82

101

57

30.87

6.90

14061.57

2014-2015

78.94

* Latest As on 31/Mar/15

Financial Details

AUM As On (28-Feb-2015)

NAV As On (06-Apr-2015)

Min Investment

Lumpsum

(in Rs.)

SIP

NAV (52WeekHigh){01-Apr-2015}

NAV (52WeekLow){07-Apr-2014}

Fund Structure

Total Stocks:

Total Sectors:

P/E Ratio:

P/B Ratio:

Avg. Market Cap

(Rs.On(Feb-2015)

Market Capitalisation

Q3

Q4

10.43

25.21

8.50

-14.74

-3.29

4.64

13.11

-13.37

19.13

-8.26

Asset Details

(%)

Net Current Asset

9.8

Eicher Motors Ltd.

3.1

SRF Ltd.

Mahindra & Mahindra Financial

Services Ltd.

Bharat Forge Ltd.

2.5

5

6

6

2.4

5

2.3

Ceat Ltd.

2.1

Apollo Tyres Ltd.

1.9

IndusInd Bank Ltd.

1.9

Indoco Remedies Ltd.

1.8

Union Bank Of India

1.8

5

5

5

6

6

6

*LargeCap- >Rs. 5,000 crores; MidCap- between Rs.750 crores to Rs.5,000 crores; SmallCap- <Rs.750 crores.

Period

1 Year

3 Years

5 Years

10 Years

Total Investment

(Rs.)

Scheme(Rs

Benchmark

)

60,000

180,000

300,000

NA

76,158

361,742

669,946

NA

0

0

0

NA

Whats In Whats Out(From Pervious Month)

Company

Sector

In

2

1

Out

2

0

No Change %age

99

56

Best/Worst Return

Scheme Performance As On (06/Apr/15)

Period

Returns

B'mark

Rank

3 Months

8.93

7.69 93/(245)

6 Months

19.53

16.71 62/(224)

1 Year

80.14

53.62 16/(200)

3 Years

37.43

19.30

8/(167)

5 Years

22.29

10.86 13/(149)

Top 10 SectorWise Holding

Industry Name

(%)

SIP Details - Invested Rs 5000 Every Month

6 5

Consumer Discretionary

24.7

Financials

16.4

Industrials

16.3

Others

12.4

Materials

11.7

Health Care

6.8

Consumer Staples

5.4

Energy

2.8

Information Technology

1.9

Utilities

1.5

6

5

6

5

5

6

5

6

5

6

Since

Inception

18.43

15.06

NA

Volatility Measures

Fama

0.18 Std Dev

0.98

Beta

0.82 Sharpe

0.24

Indicates an increase or decrease in holding since last portfolio

Best Return

Worst Return

Period

Fund(%)

B'mark(%)

Period

Month

04/05/09 to 04/06/09

40.76

42.05

12/05/06 to 14/06/06

-38.01

-35.90

Quarter

05/03/09 to 05/06/09

81.52

89.79

02/09/08 to 02/12/08

-43.51

-44.66

Year

09/03/09 to 09/03/10

155.41

157.48

07/01/08 to 07/01/09

-61.91

-62.23

Fund Performance Vis-a-vis Benchmark

Fund(%) B'mark(%)

Disclaimer : Risk Factor: Mutual Fund and securities investment are subject to market risks and there is no assurance or guarantee that the objectives

of the scheme will be achieved. As with any investment in securities, the NAV of the units issued under the scheme can go up or down depending on the

forces and factors affecting the capital market. Past performance of the Sponsor Mutual Fund, AMC or any associate of the Sponsor/AMC does not

indicate the future performance of the scheme. PLEASE READ ALL SCHEME RELATED DOCUMENTS CAREFULLY.

Disclaimer: This document/report has been prepared by Bajaj Capital Centre for Investment Research (BCCIR), a unit /division within Bajaj Capital

Limited (“BCL”).

This document/report does not constitute an offer or solicitation for the purchase or sale of any financial instrument/product/ security (ies) through BCL

or as an official confirmation of any transaction. BCL is distributor of financial products and not an Investment Adviser.

Disclaimer: This document/report has been prepared by Bajaj Capital Centre for Investment Research (BCCIR), a unit /division within Bajaj Capital

Limited (“BCL”).

This document/report does not constitute an offer or solicitation for the purchase or sale of any financial instrument/product/ security (ies) through BCL

or as an official confirmation of any transaction. BCL is distributor of financial products and not an Investment Adviser.

The information/data contained in this document/report is from publicly available data or other sources believed to be reliable. We do not represent that

information/data contained herein is accurate or complete and it should not be relied upon as such. This document/report is prepared for assistance only

and is not intended to be and must not alone be taken as the basis for an investment decision. The user assumes the entire risk of any use made of this

information/data. Each recipient of this document should make such investigations as it deems necessary to arrive at an independent evaluation of an

investment in the financial product/securities of companies, if any, referred to in this document/report (including the merits and risks involved) and seek

independent investment advice from an Investment Adviser

Affiliates of BCL may have issued other documents/reports that are inconsistent with and reach to a different conclusion from the information/date

presented in this report.

This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of or located in any locality, state,

country or other jurisdiction, where such distribution, publication, availability or use would be contrary to law, regulation or which would subject BCL and

affiliates to any registration or licensing requirements within such jurisdiction. The securities described herein may or may not be eligible for sale in all

jurisdictions or to certain category of investors. Persons in whose possession this document may come are required to inform themselves of and to

observe such restriction.

In no event shall BCL, any of its affiliates or any third party involved in, or related to, computing or compiling the information/data herein have any

liability for any damages of any kind. Any comments or statements made herein are those of the analyst and do not necessarily reflect those of BCL

and/or its affiliates.

This document/report is subject to changes without prior notice and may contain confidential and/or privileged material/information and is not for any

type of circulation. Any retransmission, copying or any other use is strictly prohibited.

BCL will not treat recipients as its clients by virtue of their viewing, receiving this document/report. If you do not wish to receive this document/report,

please write back to us, we will remove your name from our mailing list.

BCL, its directors, employees and/or its associates/affiliates or their employees may have interest and/or hold position(s), financial or otherwise in the

securities mentioned in this document/report.