Chapter 10 Budgetary Planning and Control

advertisement

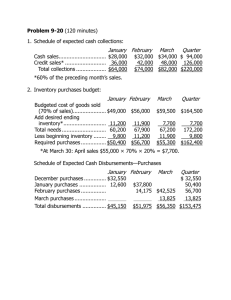

Chapter 10 Budgetary Planning and Control QUESTIONS 1. Budgets are useful in the planning process because they increase communication and coordination. Also, they force managers to carefully consider their goals and means to achieve them. 2. Budgets are useful in the control process because they provide benchmarks for evaluating performance. 3. In a top-down approach, budgets are prepared by high level managers without much input from subordinates. In a bottom-up approach, budgets are set with substantial input from subordinates. 4. In a zero-based budget, expenses are justified afresh in each budgeting period. Thus, no continuing project or activity receives funding automatically. 5. A spreadsheet allows you to change assumptions quickly and easily, facilitating “what-if” analysis. You can set up the spreadsheet with formulas representing your assumptions. Then you can change the assumptions in one cell and the spreadsheet will update automatically. 6. Cash receipt and disbursement budgets are prepared so that necessary loans can be arranged to deal with cash shortages (or so that the company can plan to deal with cash surpluses). 7. A static budget is a budget for one anticipated level of business activity. A flexible budget is a set of budget relationships that can be used to prepare budgets for various activity levels. 8. The costs of spoilage, rework, warranty repairs, and returns are some of the financial measures that capture the effect of defects in a process. 9. In absence of budgets, performance in a period might be compared to performance in prior periods to evaluate positive or negative trends. 10. Effective planning requires that managers provide truthful information and estimates for setting budgets. However, because a manager’s performance may be evaluated in comparison to a budget, he or she has an incentive to provide biased information so that budget goals are easier to achieve. Thus, there is inherent conflict between the planning and control uses of budgets. 10-2 Jiambalvo Managerial Accounting EXERCISES E1. If a manager knows that income will exceed the upper bound, he/she may shift income to the next period to increase budget-based compensation in that period. If a manager knows that income will be below the lower bound, he/she may shift income from the next period to obtain the hurdle and variable bonus. E2. Budgets can be padded by decreasing revenue estimates and increasing expense estimates. Padding makes it more likely that a manager will receive the hurdle bonus and the maximum variable bonus. E3. The following features are listed on the Hyperion Web site. Scalable Web infrastructure enables flexible data entry, analysis and frequent real-time updates from anywhere, using a standard Web browser. Powerful workflow and process management including e-mail notification and alerts empowers users to track and communicate the progress of their plans and budgets; create, validate and change plans; identify bottlenecks; conduct “what if” analysis and scenario testing. Flexible modeling and business rules and easy-to-use graphical interface creates and communicates corporate and user-defined rules and assumptions, complex calculations, company standards and allocations at all levels. Set toplevel targets, test scenarios, and perform detailed bottom up calculations. Supporting Plan Details – from the web browser, users can add their own supporting detail to aggregated lines such as travel and construct their own ‘supporting plan’, that they can drill-down to an alternative stage and adjust if necessary. Powerful reporting and analysis empowers users to check progress of each planning unit, analyze variances and change plans in real-time, all from a central data platform. Chapter 10 Budgetary Planning and Control 10-3 E4. b, d, a, and c. E5. Locksafe Company Sales Budget For the Year Ending December 31, 2007 First Quarter Sales for 2006 in units 21,000 Projected sales at 130% of prior year 27,300 Sales price per unit $ 20 Budgeted revenue for 2007 $546,000 E6. Second Quarter 26,000 Third Quarter 25,000 Fourth Quarter 30,000 Year 102,000 33,800 32,500 $ 20 $ 20 39,000 132,600 $ 20 $ 20 $676,000 $650,000 $780,000 $2,652,000 Sunny M Production Budget January 15,600 Unit sales Plus desired ending inventory of finished units 1,650 Total needed 17,250 Less beginning inventory of finished units 1,600 Units to be produced 15,650 *Equals 10% of April sales of 18,500 units. February 16,500 March 16,000 Quarter 48,100 1,600 18,100 1,850* 17,850 1,850 49,950 1,650 16,450 1,600 16,250 1,600 48,350 10-4 E7. Jiambalvo Managerial Accounting Ajax Chemical Company Direct Materials Purchases Budget For the Year Ending December 31, 2006 $710,400 $747,200 $667,200 $2,882,400 Quarter 1 Quarter 2 Quarter 3 Quarter 4 Year 46,000 42,000 50,000 39,000 177,000 16 $ 16 $ 16 $ 16 $ 16 $ $736,000 $672,000 $800,000 $624,000 $2,832,000 201,600 240,000 187,200 230,400 230,400 937,600 912,000 987,200 854,400 3,062,400 180,000 201,600 240,000 187,200 180,000 $757,600 Equals 30% of next quarter’s material requirements. Units to be produced Cost of raw material per unit (4 × $4) Cost of raw material needed for production Add desired ending inventory of raw material a Total material needed Less beginning inventory of raw material Required raw material purchases a E8. Labor hours per unit Labor rate per hour Labor cost per unit Units to be produced Labor cost Total hours Average hours per quarter Approximate number of employees needed Chapter 10 Budgetary Planning and Control Quarter 1 2.5 $ 20 50 46,000 $2,300,000 115,000 450 233 Quarter 2 2.5 $ 20 50 42,000 $2,100,000 105,000 450 278 Quarter 3 2.5 $ 20 50 50,000 $2,500,000 125,000 450 217 Quarter 4 2.5 $ 20 50 39,000 $1,950,000 97,500 450 Ajax Chemical Company Direct Labor Budget For the Year Ending December 31, 2006 256 10-5 Year 2.5 $ 20 50 177,000 $8,850,000 10-6 E9. 80,000 30,000 4,100 114,100 $332,600 $103,500 69,000 46,000 218,500 Quarter 1 46,000 80,000 30,000 4,100 114,100 $313,600 $ 94,500 63,000 42,000 199,500 Quarter 2 42,000 80,000 30,000 4,100 114,100 $351,600 $112,500 75,000 50,000 237,500 Quarter 3 50,000 80,000 30,000 4,100 114,100 $299,350 $ 87,750 58,500 39,000 185,250 Quarter 4 39,000 320,000 120,000 16,400 456,400 $1,297,150 $ 398,250 265,500 177,000 840,750 Year 177,000 Ajax Chemical Company Manufacturing Overhead Budget For the Year Ending December 31, 2006 Jiambalvo Managerial Accounting Units to be produced Variable costs: Indirect material ($2.25/unit) Indirect labor ($1.50/unit) Utilities ($1.00/unit) Total variable overhead Fixed Costs: Supervisory salaries Factory depreciation Other Total fixed overhead Total overhead Chapter 10 Budgetary Planning and Control January E10. Collection of credit sales Collection of December sales Collection of January sales Collection of January sales Collection of February sales Collection of February sales Collection of March sales E11. Cash disbursements for purchases Payment of December purchases Payment of January purchases Payment of January purchases Payment of February purchases Payment of February purchases Payment of March purchases February 10-7 March $20,000 48,000 $12,000 64,000 $68,000 $76,000 $16,000 72,000 $88,000 January $63,000 4,200 February March $37,800 5,600 $67,200 $43,400 $50,400 6,300 $56,700 10-8 E12. Jiambalvo Managerial Accounting April Collection of credit sales Collection of February sales $17,000 Collection of March sales 28,500 Collection of April sales 37,500 Collection of March sales Collection of April sales Collection of May sales Collection of April sales Collection of May sales Collection of June sales $83,000 E13. Cash disbursements for purchases April Payment of March purchases $40,000 Payment of April purchases 11,000 Payment of April purchases Payment of May purchases Payment of May purchases Payment of June purchases $51,000 May June $19,000 22,500 42,500 $84,000 $15,000 25,500 54,000 $94,500 May June $44,000 13,000 $57,000 $52,000 17,600 $69,600 Chapter 10 Budgetary Planning and Control E14. Variable costs: Direct material Direct labor Variable overhead Variable cost per unit $5.30 2.50 1.20 $9.00 Fixed costs: Supervisory salaries Depreciation Other fixed costs Fixed costs per month $14,000 8,500 1,100 $23,600 10-9 Manufacturing costs for 8,000 units = $9 (8,000) + $23,600 = $95,600. Manufacturing costs for 10,000 units = $9 (10,000) + $23,600 = $113,600. Manufacturing costs for 12,000 units = $9 (12,000) + $23,600 = $131,600. E15. Number of units Variable costs: Direct material Direct labor Variable overhead Fixed costs: Supervisory salaries Depreciation Other fixed costs Total overhead Flexible Budget 12,000 Actual 12,000 Difference 0 $ 63,600 30,000 14,400 108,000 $ 71,900 28,500 15,300 115,700 $8,300 (1,500) 900 7,700 14,000 8,500 1,100 23,600 $131,600 13,750 8,500 1,360 23,610 $139,310 (250) 0 260 10 $7,710 10-10 Jiambalvo Managerial Accounting E16. The following performance report assumes that material and labor are variable costs and the remaining costs are fixed. Flexible Budget Actual Difference Sales $600,000 $600,000 $ 0 Variable costs: Material $120,000 $119,000 ($ 1,000) Labor 240,000 260,000 20,000 360,000 379,000 19,000 Fixed costs: Owner’s salary 60,000 60,000 0 Rent 50,000 50,000 0 Depreciation 40,000 40,000 0 ( 1,000) Utilities 20,000 19,000 170,000 169,000 ( 1,000) Total cost $530,000 $548,000 $18,000 The only expense that Girard should focus on is labor—it is $20,000 (8.33%) higher than the flexible budget. E17. Walter has an incentive to understate revenue and overstate expense in his budget. With biased estimates, it will be easier to beat the budget and achieve a bonus. Chapter 10 Budgetary Planning and Control 10-11 PROBLEMS P1. a. Sales Less variable cost of sales Contribution margin Less fixed production costs Less fixed selling and administrative expenses Income before taxes Less taxes on income Net income $525,000 315,000 210,000 $101,840 50,860 5% increase over prior quarter 5% increase over prior quarter $8,000 + 1.02 ($100,000 - $8,000) 152,700 57,300 22,920 $ 34,380 $7,000 + 1.02 ($50,000 - $7,000) 40% of income before taxes b. Cash collected from sales: (.5 x $500,00 + .5 x $525,000) Cash payments: Payment of material (.4 x $300,000 x .4) + (.4 x $315,000 x .6) Payment for labor (.4 x $315,000) Payment for variable overhead (.2 x $315,000) Payment for fixed production costs ($101,840 - $8,000) Payment for fixed sell. and adm. expense ($50,860 - $7,000) Payment of income taxes Plus beginning cash balance Ending cash balance $512,500 $123,600 126,000 63,000 93,840 43,860 22,920 473,220 $ 39,280 150,000 $189,280 10-12 Jiambalvo Managerial Accounting c. Assets: Cash Accounts receivable Inventory Total current assets Property, plant, and equipment Less accumulated depreciation Total assets Liabilities and owners’ equity Accounts payable Common stock Retained earnings Total liabilities and owners’ equity $ 189,280 262,500 .5 x $525,000 350,000 No change 801,780 400,000 (115,000) $100,000 + $8,000 + $7,000 $1,086,780 $ 50,400 500,000 536,380 $1,086,780 .4 x .4 x $315,000 $502,000 + $34,380 Chapter 10 Budgetary Planning and Control P2. Part A: Budgeted Cash Receipts and Disbursements For January 2007 Cash receipts Collection of December 2006 tuition Collection of January 2007 tuition Total cash receipts $30,000.00 35,000.00 65,000.00 Cash Disbursements Payment of salaries Payment of rent Payment of utilities Payment of other expenses Payment for purchases of computer equipment Payment of interest on note Payment of taxes Total cash disbursements 30,000.00 2,000.00 500.00 1,000.00 30,000.00 417.00 10,879.05 (74,796.05) Plus beginning cash balance Ending cash balance 40,000.00 $30,203.95 10-13 10-14 Jiambalvo Managerial Accounting Part B. Budgeted Income Statement For January 2007 Tuition revenue Less: Salaries Rent Utilities Other Expenses Depreciation Interest expense Total expense Income before taxes Taxes on income Net income $70,000.00 $30,000.00 2,000.00 500.00 1,000.00 5,000.00 417.00 38,917.00 31,083.00 10,879.05 $20,203.95 Chapter 10 Budgetary Planning and Control Part C. Budgeted Balance Sheet As of January 30, 2007 Assets Cash Accounts receivable Equipment (net) Total assets Liabilities Accounts payable Note payable Total liabilities Owner equity Retained earnings Common stock Total owner’s equity Total liabilities and owner’s equity $ 30,203.95 35,000.00 115,000.00 $180,203.95 $ 20,000.00 50,000.00 70,000.00 90,203.95 20,000.00 110203.95 $180,203.95 10-15 10-16 Jiambalvo Managerial Accounting P3. a. Botanical Soap Company Budgeted Income Statement for the First Quarter, 2007 Sales ($200,000 × 1.1) Less cost of sales (50% of sales) Gross margin Less selling, general and administrative expenses ($7,000 increase) Income before taxes Less income taxes (35%) Net Income $220,000 110,000 110,000 47,000 63,000 22,050 $ 40,950 Chapter 10 Budgetary Planning and Control 10-17 b. Botanical Soap Company Cash receipts and disbursements budget for the First Quarter, 2007 Cash Receipts Collections of sales: 10% of Quarter 4, 2006 sales 90% of Quarter 1, 2007 sales Total cash receipts Cash Disbursements Payment for inventory purchases 20% of Quarter 4, 2006 purchases 80% of Quarter 1, 2007 purchases* Selling, general and adm. expenses (excludes $1,000 of depreciation) Income taxes Total disbursements Plus beginning cash balance Ending Cash balance $ 20,000 198,000 $218,000 16,000 94,600 46,000 22,050 (178,650) 24,000 $ 63,350 *Beginning inventory in 2007 is $82,500. Cost of goods sold in the first quarter is $110,000 (50% of $220,000 sales). Ending inventory is $90,750 [75% of $121,000 (cost of goods sold in second quarter of 2007)]. Thus, purchases in the first quarter of 2007 are $118,250 (cost of goods sold plus ending inventory minus beginning inventory). 10-18 Jiambalvo Managerial Accounting c. Botanical Soap Company Budgeted Balance Sheet As at the end of the First Quarter, 2007 Assets: Cash (from cash receipts and disbursements budget) $ 63,350 Accounts receivable (10% of first quarter, 2007 sales) 22,000 Inventory (75% of cost of sales in second quarter of 2007—$121,000) 90,750 Furniture and fixtures ($40,000 less $1,000 depreciation) 39,000 Total assets $215,100 Liabilities: Accounts payable (20% of purchases in first quarter of 2007—$118,250) Stockholder's equity: Common stock Retained earnings ($90,500 plus net income) Total stockholder's equity Total liabilities and stockholder's equity $ 23,650 60,000 131,450 191,450 $215,100 d. As the ending cash balance for January is $63,350, a minimum desired cash balance of $25,000 will leave only $38,350 for opening the store. However, a store opening requires $40,000. Thus, the company requires a small amount of additional cash to open the store. Chapter 10 Budgetary Planning and Control P4. 10-19 Modern Healthcare Budgeted Income for 2007 Revenue (decrease of 5 percent) Less operating expenses: Salaries Physicians(no change) Physician assistant (new position) Nurses (no change) Nursing aid (no change) Receptionist (no change) Accounting services (no change) Training (increase of $15,000) Supplies (increase to 8.5 percent of revenue) Phone and fax (no change) Insurance (no change) Depreciation on office and equipment (increase of $20,000) Utilities (increase of 5 percent) Miscellaneous (increase of 5 percent) Total operating expenses Income before taxes Less taxes on income (35 percent) Net income $2,280,000 1,000,000 70,000 140,000 62,375 45,200 34,450 170,000 193,800 2,500 250,000 220,000 18,900 63,000 2,270,225 9,775 3,421 $ 6,354 10-20 Jiambalvo Managerial Accounting P5. a. Unit sales Plus: Desired ending inventory of finished units (20% of next quarter sales) Total needed Less: beginning inventory of finished units Units to be produced 10,000 50,000 Quarter 1 40,000 10,000 58,600 18,600 68,600 Quarter 2 50,000 18,600 81,600 7,200 100,200 Quarter 3 93,000 7,200 40,800 12,000 48,000 Quarter 4 36,000 11,000 220,000 12,000 231,000 Year 219,000 BugAway Inc Production Budget for 2007 11,000 39,000 b. Units to be produced Ounces of chemical A per unit Ounces of chemical A required for production Chapter 10 Budgetary Planning and Control Quarter 1 39,000 6 351,600 Quarter 2 58,600 6 36,720 526,320 489,600 Quarter 3 81,600 6 60,000 304,800 244,800 Quarter 4 40,800 6 60,000 1,380,000 1,320,000 Year 220,000 6 BugAway Inc Material Purchases Budget 2007 Chemical A 234,000 73,440 425,040 73,440 452,880 $0.12 $54,345.60 36,720 57,000 268,080 1,323,000 $0.12 $0.12 $32,169.60 $158,760.00 52,740 372,300 $0.12 $44,676.00 Plus desired ending inventory of chemical A (15% of next quarter production needs) 52,740 Total needed 286,740 Less: beginning inventory of finished units 57,000 Ounces to be purchased 229,740 Cost per ounce $0.12 Cost of purchases of chemical A $27,568.80 10-21 10-22 Jiambalvo Managerial Accounting Quarter 3 40,800 10 220,000 10 c. Quarter 2 81,600 10 BugAway Inc Material Purchases Budget 2007 Chemical B Quarter 1 58,600 10 Year 39,000 10 2,200,000 Quarter 4 Units to be produced Ounces of chemical B per unit 408,000 102,000 2,302,000 816,000 102,000 510,000 586,000 61,200 877,200 390,000 122,400 708,400 122,400 754,800 $0.09 $67,932.00 61,200 97,000 448,800 2,205,000 $0.09 $0.09 $40,392.00 $198,450.00 87,900 620,500 $0.09 $55,845.00 Ounces of chemical B required for production Plus desired ending inventory of chemical B (15% of next quarter production needs) 87,900 Total needed 477,900 Less: beginning inventory of finished units 97,000 Ounces to be purchased 380,900 Cost per ounce $0.09 Cost of purchases of chemical B $34,281.00 d. Sales Less variable costs: Variable cost of goods sold Variable selling and adm. Contribution margin Less fixed costs: Fixed production costs Fixed selling and adm. Net income Variable cost of sales per bottle: Chemical A Chemical B Direct labor Variable overhead Total Chapter 10 Budgetary Planning and Control $398,000 156,000 19,900 321,600 $497,500 Quarter 2 40,000 50,000 $508,176 290,160 37,014 598,176 $925,350 Quarter 3 40,000 50,000 $141,552 112,320 14,328 231,552 $358,200 Quarter 4 160,000 200,000 $1,048,608 683,280 87,162 1,408,608 $2,179,050 Year BugAway Inc Budgeted Income, 2007 124,800 15,920 257,280 40,000 50,000 $231,600 Quarter 1 40,000 50,000 $167,280 $ 0.72 0.90 0.60 0.90 $3.12 10-23 10-24 Jiambalvo Managerial Accounting Cash disbursements Payment for purchases: Payment of previous quarter's purchases (20%) Payment of current quarter's purchases (80%) Cash receipts Collection of credit sales: Collection of previous quarter's sales (40%) Collection of current quarter's sales (60%) Total cash receipts 190,000 0 35,000 565,000 60,000 280,000 $200,000 360,000 560,000 Quarter 1 $ 27,500 190,000 0 52,500 632,500 70,000 320,000 $240,000 420,000 660,000 Quarter 2 $ 60,000 190,000 0 70,000 700,000 80,000 360,000 $280,000 480,000 760,000 Quarter 3 $ 54,500 190,000 50,000 87,500 805,500 90,000 388,000 $320,000 540,000 860,000 Quarter 4 $ 137,000 760,000 50,000 245,000 2,703,000 300,000 1,348,000 $1,040,000 1,800,000 2,840,000 Year P6. Payment for selling and adm. expenses: (excludes depreciation of $10,000) Payment for capital expenditure Payment of taxes* Total cash disbursements ($5,000) Casey Wholesalers Cash Receipts and Disbursements Budget, 2007 Excess of receipts over disbursements * Taxes equal 35 percent of pretax income. For quarter 1, pretax income equals $100,000 [Sales ($600,000) minus cost of sales (300,000), minus selling and administrative expense (200,000)]. P7. Step 1 Step 2 Step 3 Step 4 Step 5 Chapter 10 Budgetary Planning and Control Expected sales in 2007 = (1.25 × sales of the same quarter previous year) Cost of sales = (.6 × Expected Sales) Ending inventory = (.5 × cost of sales next quarter) Beginning inventory = Previous quarter's ending inventory Purchases = Cost of sales + ending inventory - beginning inventory $862,500 84,000 75,000 $ 871,500 Quarter 1 Quarter 2 Quarter 3 Quarter 4 Year $200,000 $250,000 $300,000 $400,000 $1,150,000 250,000 312,500 375,000 500,000 1,437,500 300,000 84,000 150,000 $234,000 Sales in 2006 Expected sales in 2007 225,000 150,000 112,500 $262,500 150,000 93,750 75,000 $168,750 187,500 112,500 93,750 $206,250 Cost of sales Plus Ending inventory Less Beginning Inventory Equals Purchases 10-25 Q-1, 2008 $280,000 168,000 10-26 Jiambalvo Managerial Accounting P 8. Results for basic assumption: Q1, 2006 Sales 200,000.00 Q2, 2006 210,000.00 Q3, 2006 220,000.00 Q4, 2006 185,000.00 Q2, 2007 231,000.00 Q3, 2007 242,000.00 Q4, 2007 203,500.00 Q1, 2008 242,000.00 66,000.00 13,860.00 66,000.00 13,860.00 69,300.00 14,520.00 13,860.00 69,960.00 72,600.00 12,210.00 14,520.00 70,290.00 61,050.00 14,520.00 12,210.00 63,360.00 72,600.00 Q1, 2006 200,000.00 Q2, 2006 210,000.00 Q3, 2006 220,000.00 Q4, 2006 185,000.00 Q2, 2007 231,000.00 Q3, 2007 242,000.00 Q4, 2007 203,500.00 Q1, 2008 242,000.00 76,230.00 17,569.20 16,770.60 77,028.60 79,860.00 14,774.10 17,569.20 77,064.90 67,155.00 17,569.20 14,774.10 69,950.10 79,860.00 Sales growth Desired ending inventory % Cost of sales % Sales 1.10 0.20 0.30 Q1, 2007 220,000.00 Cost of sales Plus desired ending inventory Less beginning inventory Purchases Results for combination 1: Sales Sales growth Desired ending inventory % Cost of sales % Sales 1.10 0.22 0.33 Q1, 2007 220,000.00 Cost of sales Plus desired ending inventory Less beginning inventory Purchases 72,600.00 16,770.60 66,000.00 23,370.60 Chapter 10 Budgetary Planning and Control 10-27 Results for combination 2: Sales Q1, 2006 200,000.00 Q2, 2006 210,000.00 Q3, 2006 220,000.00 Q4, 2006 185,000.00 Q2, 2007 241,500.00 Q3, 2007 253,000.00 Q4, 2007 212,750.00 Q1, 2008 264,500.00 64,400.00 16,228.80 66,000.00 14,628.80 67,620.00 17,001.60 16,228.80 68,392.80 70,840.00 14,296.80 17,001.60 68,135.20 59,570.00 17,774.40 14,296.80 63,047.60 74,060.00 Q1, 2006 200,000.00 Q2, 2006 210,000.00 Q3, 2006 220,000.00 Q4, 2006 185,000.00 Q2, 2007 228,000.00 Q3, 2007 239,800.00 Q4, 2007 201,650.00 Q1, 2008 237,620.00 91,560.00 32,612.80 31,130.40 93,042.40 95,920.00 27,424.40 32,612.80 90,731.60 80,660.00 32,316.32 27,424.40 85,551.92 95,048.00 Sales growth Desired ending inventory % Cost of sales % Sales 1.15 0.24 0.28 Q1, 2007 230,000.00 Cost of sales Plus desired ending inventory Less beginning inventory Purchases Results for combination 3: Sales Sales growth Desired ending inventory % Cost of sales % Sales 1.09 0.34 0.40 Q1, 2007 218,000.00 Cost of sales Plus desired ending inventory Less beginning inventory Purchases 87,200.00 31,130.40 66,000.00 52,330.40 10-28 Jiambalvo Managerial Accounting P9. a. Both individuals are fighting for their self-interests, which are in conflict. Debra wants budgeted revenue low and budgeted expenses high so that she can easily achieve income goals that affect her bonus. Barney is interested in the accuracy of budget numbers (i.e., he is interested in developing a realistic plan) and making sure that Debra does not receive bonus compensation that is not justified (at least, in his opinion). b. One option for the President is to ask Debra and Barney to bring all relevant information to the table and make sure they understand each other’s position. He should also ask for information on the factors—controllable and uncontrollable—that contributed to the exceptional performance in 2006, and whether or not they are likely to continue in 2007. Then, the president may let Debra and Barney reach an agreement or set a budget according to his/her own best judgment. Chapter 10 Budgetary Planning and Control 10-29 P10. a. Assumptions: Salaries of customer consultants are variable costs. Salaries of supervisors, office space expense, and depreciation are fixed costs. 12,000 calls 12,000 calls Flex. Budget Actual Salaries of customer consultants $144,000 $160,000 Salaries of supervisors 18,000 17,500 Office space charge 5,000 5,000 Depreciation of equipment 4,000 5,000 Total $171,000 $187,500 Difference $16,000 (500) 0 1,000 $(16,500) b. It appears that variances for salaries of customer consultants and depreciation of equipment are significant variances at about 11 percent and 25 percent of the flexible budget amounts. Some possible explanations: Call volume increased by 20 percent, this may have resulted in overtime premium paid to existing customer consultants. Or, possibly, additional consultants were hired at higher salaries. Possibly, additional consultants required additional telecom equipment. That might explain most of the increase in depreciation expense. c. Relevant non-financial measures might include: number of calls answered, average customer waiting time for a response, average duration of call, number of repeat calls for the same problem, level of customer satisfaction, and the number of customer complaints related to customer service. 10-30 Jiambalvo Managerial Accounting P11. The variances are “favorable” because the budget has not been adjusted for the actual number of units produced (which is less than planned). A flexible budget may indicate that actual costs are higher than expected (once the budget is adjusted for the actual level of production) The president is not likely to be impressed by favorable cost variances that are simply due to producing less than planned—especially if the lower output is due to quality problems in manufacturing! P12. a. Budget padding involves biasing estimates of sales downward and expenses upward so that actual profit is more likely to exceed budgeted profit. Jack has an incentive to pad his budget because exceeding the budget increases his budget-based bonus compensation. Budget padding may hurt company performance if the budget is less useful in terms of coordinating internal activities. This would be the case if the purchasing department bought too little material because they purchased a quantity consistent with budgeted sales (which are biased downward). b. The budget was set at $40,000,000 and budget compensation is capped when actual profit is more than 120% of budget or $48,000,000. Thus, there is no “need” to have profit higher than this amount. By delaying shipments for the last two weeks, Jack can shift the “excess” profit to the next quarter helping to ensure that he will maximize his bonus that quarter. This action could hurt shareholder value if customers become upset that they do not receive orders on time. P13. 1. 2. 3. 4. Customer satisfaction rating based on market survey data Percent of orders delivered at customers’ requested delivery date Production defect rate Percent of sales related to new products (a product innovation measure)