Budgeting & Financial Statement Problem Set

advertisement

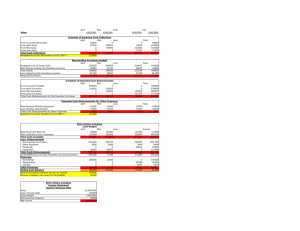

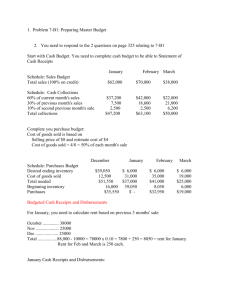

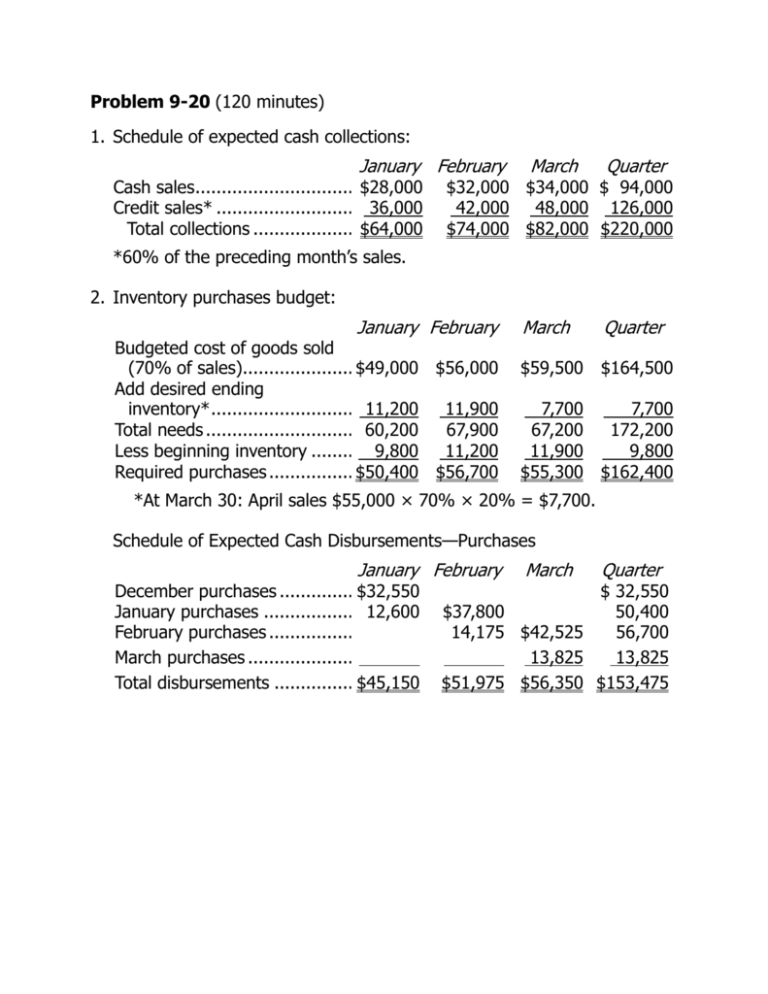

Problem 9-20 (120 minutes) 1. Schedule of expected cash collections: January February March Quarter Cash sales...................................................................... $28,000 $32,000 $34,000 $ 94,000 Credit sales* .................................................................. 36,000 42,000 48,000 126,000 Total collections ........................................................... $64,000 $74,000 $82,000 $220,000 *60% of the preceding month’s sales. 2. Inventory purchases budget: January February March Quarter Budgeted cost of goods sold (70% of sales)............................................................. $49,000 $56,000 $59,500 $164,500 Add desired ending inventory* ................................................................... 11,200 11,900 7,700 7,700 Total needs .................................................................... 60,200 67,900 67,200 172,200 Less beginning inventory ................................................ 9,800 11,200 11,900 9,800 Required purchases ........................................................ $50,400 $56,700 $55,300 $162,400 *At March 30: April sales $55,000 × 70% × 20% = $7,700. Schedule of Expected Cash Disbursements—Purchases January February March Quarter December purchases ...................................................... $32,550 $ 32,550 January purchases ......................................................... 12,600 $37,800 50,400 February purchases ........................................................ 14,175 $42,525 56,700 March purchases ............................................................ 13,825 13,825 Total disbursements ....................................................... $45,150 $51,975 $56,350 $153,475 Problem 9-20 (continued) 3. Schedule of Expected Cash Disbursements—Operating Expenses January February March Salaries and wages......................................................... $12,000 $12,000 $12,000 Rent .............................................................................. 1,800 1,800 1,800 Other expenses .............................................................. 5,600 6,400 6,800 Total disbursements ....................................................... $19,400 $20,200 $20,600 Quarter $36,000 5,400 18,800 $60,200 4. Cash budget: January February March Cash balance, beginning ................................................. $ 6,000 $ 5,450 $ 5,275 Add cash collections ....................................................... 64,000 74,000 82,000 Total cash available ...................................................... 70,000 79,450 87,275 Less disbursements: For inventory ............................................................... 45,150 51,975 56,350 For operating expenses ................................................ 19,400 20,200 20,600 For equipment ............................................................. 3,000 8,000 0 Total disbursements ....................................................... 67,550 80,175 76,950 Excess (deficiency) of cash ............................................. 2,450 (725) 10,325 Financing: Borrowings .................................................................. 3,000 6,000 0 Repayments ................................................................ 0 0 (5,000) Interest* ..................................................................... 0 0 (130) Total financing ............................................................... 3,000 6,000 (5,130) Cash balance, ending ..................................................... $ 5,450 $ 5,275 $ 5,195 * $3,000 × 12% × 3/12 = 2,000 × 12% × 2/12 = Total interest $ 90 40 $130 Quarter $ 6,000 220,000 226,000 153,475 60,200 11,000 224,675 1,325 9,000 (5,000) (130) 3,870 $ 5,195 Problem 9-20 (continued) 5. PICANUY CORPORATION Income Statement For the Quarter Ended March 31 Sales ($70,000 + $80,000 + $85,000) ............................. $235,000 Less cost of goods sold: Beginning inventory (Given) ......................................... $ 9,800 Add purchases (Part 2) ................................................. 162,400 Goods available for sale ................................................ 172,200 Less ending inventory (Part 2) ...................................... 7,700 164,500 Gross margin.................................................................. 70,500 Less operating expenses: Salaries and wages (Part 3) .......................................... 36,000 Rent (Part 3) ............................................................... 5,400 Depreciation (Given) .................................................... 2,400 Other expenses (Part 3) ............................................... 18,800 62,600 Net operating income ..................................................... 7,900 Less interest expense*.................................................... 210 Net income ....................................................................$ 7,690 *Interest paid of $130 plus accrued, but unpaid, interest on the outstanding loan of $4,000 × 12% × 2/12 = $80. Problem 9-20 (continued) 6. PICANUY CORPORATION Balance Sheet March 31 Assets Current assets: Cash (Part 4) ............................................................... $ 5,195 Accounts receivable ($85,000 × 60%)........................... 51,000 Inventory (Part 2) ........................................................ 7,700 Total current assets ........................................................ 63,895 Fixed assets—net ($110,885 + $3,000 + $8,000 – $2,400) ....................... 119,485 Total assets .................................................................... $183,380 Liabilities and Equity Accounts payable (Part 2: $55,300 × 75%) ...................... $ 41,475 Interest payable ............................................................. 80 Bank loan payable .......................................................... 4,000 Stockholders’ equity: Capital stock (Given) .................................................... $100,000 Retained earnings* ...................................................... 37,825 137,825 Total liabilities and equity ................................................ $183,380 * Retained earnings, beginning .......................................... $30,135 Add net income.............................................................. 7,690 Retained earnings, ending .............................................. $37,825