August 14, 2013

Strategy

THEMATIC

Greatness ‘at risk‘: Asian Paints, Titan

and Sun Pharma

Analyst contacts

Saurabh Mukherjea, CFA

Tel: +91 99877 85848

saurabhmukherjea@ambitcapital.com

In our 7 June note, we had highlighted that 85% of successful Indian

firms slide to mediocrity within five years of achieving great success. Gaurav Mehta

We had also laid out a five-part path to decline which seems to be Tel.: +91 22 3043 3255

gauravmehta@ambitcapital.com

followed by most Indian firms. In this note, we highlight specific

markers which investors can use to identify ‘great’ firms which are on Consultant: Anirudha Dutta

the cusp of entering the path to mediocrity. Using Asian Paints, Titan Tel: +91 9820134825

and Sun Pharma as case studies, we point out that these markers anirudha0765.dutta@gmail.com

include overconfidence, abrupt changes in strategy, and tension within

the promoter family/ management.

85% of ‘great’ Indian companies self-destruct

As highlighted in our 7th June note, 50% of the Nifty churns every decade (a

much higher churn ratio than seen in other major markets). Note that 85% of

the most successful Indian companies (measured in terms of superior financial

performance over a six-year period) slide towards mediocrity after a phase of

strong performance. Given investors’ interest in spotting impending signs of

decline in the most successful companies, we have identified and elaborated

upon the following four markers of impending decline:

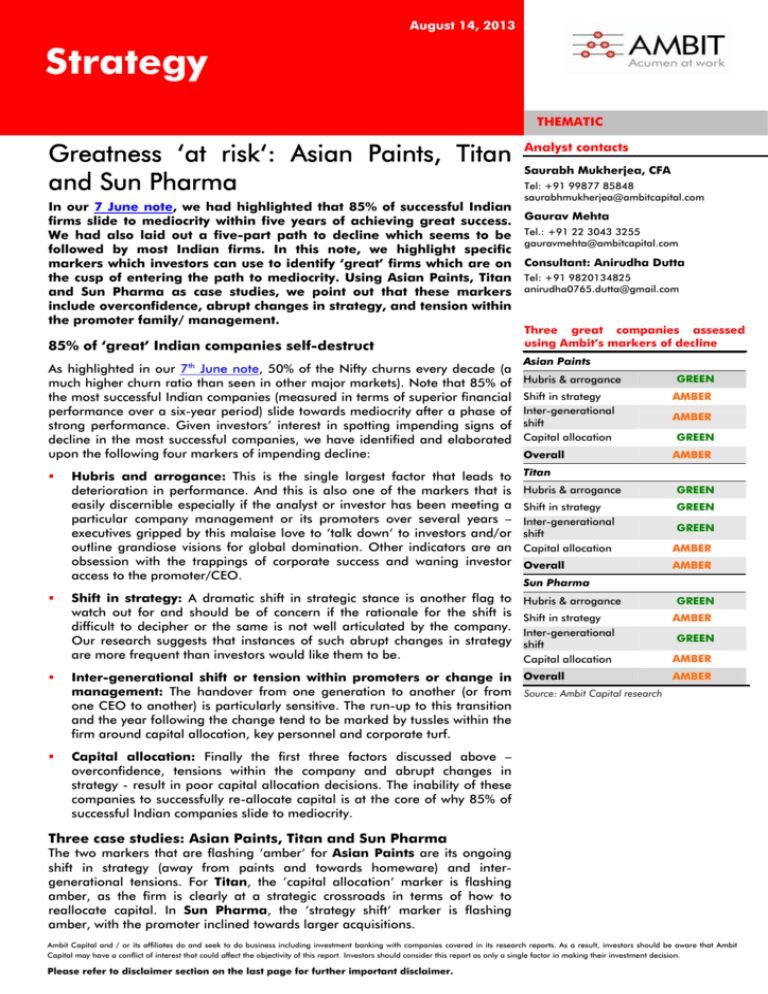

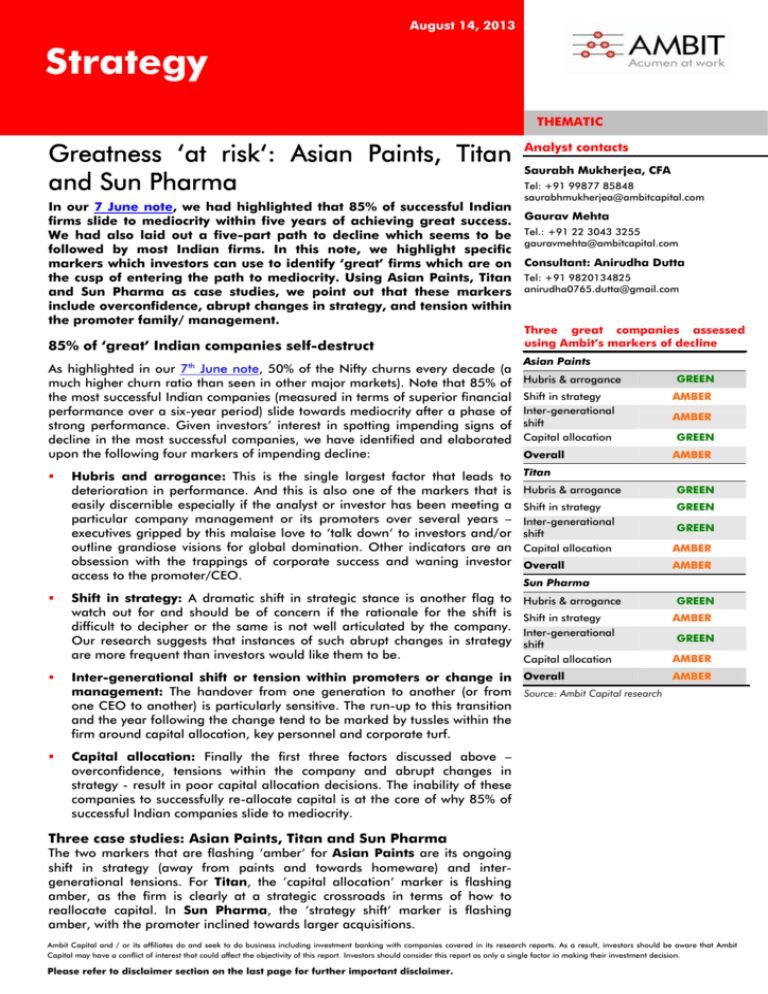

Three great companies assessed

using Ambit’s markers of decline

Asian Paints

Hubris & arrogance

GREEN

Shift in strategy

Inter-generational

shift

Capital allocation

AMBER

Overall

AMBER

Hubris and arrogance: This is the single largest factor that leads to

deterioration in performance. And this is also one of the markers that is

easily discernible especially if the analyst or investor has been meeting a

particular company management or its promoters over several years –

executives gripped by this malaise love to ‘talk down‘ to investors and/or

outline grandiose visions for global domination. Other indicators are an

obsession with the trappings of corporate success and waning investor

access to the promoter/CEO.

Titan

Shift in strategy: A dramatic shift in strategic stance is another flag to

watch out for and should be of concern if the rationale for the shift is

difficult to decipher or the same is not well articulated by the company.

Our research suggests that instances of such abrupt changes in strategy

are more frequent than investors would like them to be.

Hubris & arrogance

AMBER

GREEN

Hubris & arrogance

GREEN

Shift in strategy

Inter-generational

shift

Capital allocation

GREEN

AMBER

Overall

AMBER

GREEN

Sun Pharma

Shift in strategy

Inter-generational

shift

Capital allocation

GREEN

AMBER

GREEN

AMBER

AMBER

Inter-generational shift or tension within promoters or change in Overall

management: The handover from one generation to another (or from Source: Ambit Capital research

one CEO to another) is particularly sensitive. The run-up to this transition

and the year following the change tend to be marked by tussles within the

firm around capital allocation, key personnel and corporate turf.

Capital allocation: Finally the first three factors discussed above –

overconfidence, tensions within the company and abrupt changes in

strategy - result in poor capital allocation decisions. The inability of these

companies to successfully re-allocate capital is at the core of why 85% of

successful Indian companies slide to mediocrity.

Three case studies: Asian Paints, Titan and Sun Pharma

The two markers that are flashing ‘amber‘ for Asian Paints are its ongoing

shift in strategy (away from paints and towards homeware) and intergenerational tensions. For Titan, the ’capital allocation‘ marker is flashing

amber, as the firm is clearly at a strategic crossroads in terms of how to

reallocate capital. In Sun Pharma, the ‘strategy shift‘ marker is flashing

amber, with the promoter inclined towards larger acquisitions.

Ambit Capital and / or its affiliates do and seek to do business including investment banking with companies covered in its research reports. As a result, investors should be aware that Ambit

Capital may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making their investment decision.

Please refer to disclaimer section on the last page for further important disclaimer.

Strategy

CONTENTS

Executive summary of our findings on Asian Paints,

Titan and Sun Pharma

3

Greatness ’at risk’

8

Where are today's 'great' companies headed?

15

-

Asian Paints

15

-

Titan

23

-

Sun Pharma

31

Issues raised about our 7 June note by investors

Ambit Capital Pvt Ltd

38

2

Strategy

Executive summary of our findings on

Asian Paints, Titan and Sun Pharma

Exhibit 1: A summary of how the ‘great’ firms highlighted in this note stack up on various qualitative parameters

Company Name

Hubris & Arrogance

Shift in Strategy

Inter-generational shift

Capital Allocation

Conclusion

Asian Paints

GREEN

AMBER

Titan Inds

GREEN

GREEN

AMBER

GREEN

AMBER

GREEN

AMBER

AMBER

Sun Pharma

GREEN

AMBER

GREEN

AMBER

AMBER

Source: Company, Ambit Capital research

Asian Paints (the detailed section on this company is on page 15)

Hubris and arrogance: We have not discerned any signs of hubris and

arrogance. The three promoter families have always maintained a low profile and

have kept away from the limelight over the past 20 years. We have not seen any

signs of this changing in spite of the tremendous success of the company.

Shift in strategy: This is the one marker that is flashing ‘amber’. The signals from

Asian Paints is that they are looking at new growth areas and the one area they

seem to have zeroed in on is home improvement solutions. The firm has to this

end acquired Sleek, a modular kitchen company. We have not come across any

cogent explanation for this shift in strategy to focus on a new area. Furthermore,

the fragmented and service-oriented nature of the modular kitchen business

means that there are not many synergies with Asian Paints’ core business. The

question is whether these diversifications are planned to accommodate a growing

number of promoter family members who are in the business today as compared

to, say, 15 years ago.

Over FY04-13, operating cash flows (Rs55bn in total) were deployed almost

entirely towards capex (Rs28bn) and dividends (Rs21mn). There is no debt

currently outstanding on the balance sheet and with surplus manufacturing

capacity available, no major capex is planned over the next 2-3 years. Therefore,

surplus cash is likely to get accumulated at a rate of Rs15bn annually going

forward. As a result, unlike in the past, going forward, there will be a need for

active capital allocation decisions at a Board level. In this context, the first bet in

the form of the Sleek acquisition was small and not a cause for concern. However,

investors need to watch out if the bets become larger and/or more such businesses

are started.

Inter-generational shift or tension within promoters: Here too, we assign the

company an ’amber‘ flag. There are three promoter families who are represented

on the Board. The balancing act is achieved by giving different responsibilities to

different promoter groups with the SBUs being run by professional CEOs. There

are two issues of which investors should be cognizant about: first, in 2010 the

Dani family increased its stake in the company from ~18% to ~21% (source: trade

press). Prior to this, the three families had almost an equal stake in the company.

Second, it would appear that some tension did crop up a few years back (in 2002)

when Asian Paints acquired Berger International (based in Singapore, with

operations across 11 countries). Whilst two of the families were not completely in

favour of the decision, the Dani side of the family, wanted to go ahead, and the

company did go ahead. In the international business, over the last ten years, the

company has capital employed ranging from 24% to 55% of overall capital

employed (vs 26% in FY13) and the return on capital employed has been a poor 6% to +8%. By any yardstick, the returns in the international business have been

inadequate.

Ambit Capital Pvt Ltd

3

Strategy

Our discussions (not with the company's management) indicate that the

relationship between the different family groups is “difficult” and the company is

considering other possible diversification initiatives like entering into into the

ceramics business. Once again, to be fair to the company, it has earlier survived a

split within the promoter families.

Capital allocation: With an average RoCE of 34% over 10 years, one cannot fault

Asian Paints’ capital allocation. Its average dividend payout ratio has been 51%

over the same period and general reserves have been capitalised by a generous

issue of bonus shares with unerring regularity. However, the sterling performance

in the domestic business masks the fact that the company's capital allocation in the

overseas business has not borne fruit even after more than 10 years of consistent

investment.

Exhibit 2: Asian Paints’ capital employed and returns generated in the international and consolidated business

Capital employed in consolidated

business (Rs mn)

Capital employed in international

business (Rs mn)

International CE as % of overall CE

FY04

FY05

FY06

FY07

FY08

FY09

FY10

FY11

FY12

FY13

6,988

8,067

9,075

10,840

12,576

15,118

19,392

24,167

30,844

36,220

3,870

4,226

4,899

4,738

4,871

7,150

6,256

6,491

7,438

9,248

55%

52%

54%

44%

39%

47%

32%

27%

24%

26%

ROCE in international business

-2.4%

-5.8%

2.8%

-0.4%

2.9%

3.9%

6.4%

7.5%

2.5%

5.8%

Consolidated ROCEs

23.4%

24.3%

26.4%

30.2%

38.5%

31.8%

52.3%

41.2%

38.1%

35.3%

Source: Company, Ambit Capital research

Conclusion: The track record of the company favours a continued strong

performance. But there are some issues that are signalling ‘amber’, as discussed

above. Investors should take cognizance of the same and quiz the management to

satisfy themselves so that there are no surprises ahead.

Titan (the detailed section on this company is on page 23)

Hubris and arrogance: Titan has had an outstanding run over the last ten years

under the stewardship of its MD, Bhaskar Bhat. Mr. Bhat is an old hand at Titan

and took over the reins from Xerxes Desai. Inside the company, Mr. Bhat is seen as

an approachable CEO and everyone addresses him by his first name, a rarity in

Indian companies. To the analyst and investor community, Titan's success has

made Bhaskar Bhat and the Titan management more open to the investment

community. In recent years, the company has been a regular at select investor

conferences and has improved its disclosures to investors. None of the arrogance

that usually comes with success and awards is visible in Titan’s management.

Shift in strategy: The company has largely stuck to its core jewellery and watches

business over the last decade. However, over a period of time, it has articulated its

intention to morph into a lifestyle company - it wants to add other product

categories and brands to become a consumer lifestyle company. Whilst it looks for

diversification opportunities, the company has clearly articulated its criteria for

entering into new product categories. The categories that it would look to enter

are ones which have a large market size and are not consolidated, where Titan

can act as the consolidator, and the trust that the Titan and/or Tata brand evokes

will be an advantage. There is no discernible shift in strategy visible yet.

Inter-generational shift or tension within promoters or change in

management: There is no change in promoters, and therefore, there is unlikely

to be any tension that family-run companies usually face. The professional

management is likely to continue without any major upheavals. However, within

the Tata Group, there has been a change at the very top - Cyrus Mistry has

assumed charge from Ratan Tata. Will Cyrus Mistry look to consolidate the various

retail businesses within the Tata Group? The Tata Group has a presence in

Ambit Capital Pvt Ltd

4

Strategy

different formats and categories of retailing through group companies, Trent

Limited and Infiniti Retail. Any consolidation will result in tensions which could rock

Titan's performance.

Capital allocation: Titan’s biggest challenge is capital allocation. Over the last

ten years, Titan has invested its capital to expand the watch and jewellery

business. Based on reported segmental capital employed, 58% of incremental

capital over FY04-13 has been invested in the jewellery business. Our discussions

with market participants indicate that Fastrack has required limited capital

allocation since most of the growth has been franchisee-driven.

The watches business faces the challenge of being a tired brand. How will Titan

move up the price points in watches and rejuvenate the brand? The road map it

chooses will determine its capital allocation to the watches business, which will

likely be primarily in marketing and brand building.

Due to the recent regulatory changes (which while temporary, may last a few

years), growth may be muted, margins will come under pressure, and working

capital requirements will increase in the gold and jewellery business. However, the

management has already indicated that the expansion in jewellery stores will slow

down.

Therefore, the challenge for Titan is the deployment of its free cash flows. Will it

aggressively expand the prescription eyewear business? Will it add new product

categories to its portfolio? An indication of the same was seen when Titan

amended its Articles of Association to include multiple categories including sarees,

perfumes, etc. The five-year strategy will likely be rolled out in 2H2013. Based on

the categories that Titan wants to enter into, investors will have to evaluate the

investment opportunity.

Exhibit 3: Titan's capital allocation over FY04-13

FY04-13

Debt repayment,

13%

Increase in cash

and cash

equivalents, 36%

Dividend paid,

17%

Purchase of

Investments Subsidiaries &

Others, 2%

Net Capex in

Others incl.

precision engg.,

4%

Interest paid,

11%

Net Capex in

Jewellery, 7%

Net Capex in

Watches, 9%

Source: Company, Ambit Capital research; Note: Size of the pie which represents total capital available for

deployment is Rs 31.3bn. Of this, net proceeds from issuance of equity/preference shares accounts for 1%,

interest income received accounts for 9% and the balance 90% is cash generated from operating activities.

Ambit Capital Pvt Ltd

5

Strategy

Conclusion: Titan's strategic decisions over the next 3-6 months will determine

whether the company repeats the performance of the last decade or slides away to

mediocrity. Moreover, Titan, scarred by some of its failures in the 1990s, is no

longer willing to take bold decisions (as mentioned in our 7th June note). Will this

be its Achilles’ heel over the next decade?

Sun Pharma (the detailed section on this company is on page 31)

Hubris and arrogance: We have not detected any signs from the management

of hubris or arrogance. The promoter families of Dilip Shanghvi and Sudhir Valia

have always maintained a low profile. People close to the company say that Dilip

Shanghvi is almost obsessive about his privacy and in his attempts to avoid

publicity.

Shift in strategy? This marker is flashing ’amber‘: Sun’s growth and Dilip

Shanghvi’s reputation have been built on by successfully acquiring and profitably

integrating ten firms over the past decade or so. However, with the exception of

the latest acquisition, DUSA, Sun has hitherto focused on acquiring small

businesses which are in trouble and then turning around their performance. Our

concern is that Sun’s acquisition strategy now seems to be changing, as the firm

becomes more confident of its own abilities.

Exhibit 4: Major M&A deals in the US for Sun Pharma

Year

Deals

Deal Value

(US$ mn)

1997

Caraco

8

2005

Formulation plant in Bryan

NA

2005

Assets of Able Labs

NA

2008

Chatten Chemicals

52

2009

Caraco acquired some

products of Forest’s Inwood

business

NA

Increased generic product offerings

2010

Taro

NA

Dermatology and topical product

manufacturing plant in Israel and Canada

2011

100% ownership of Caraco

50

Privatisation

2012

Acquired DUSA Pharma

230

2013

Acquired URL Pharma's

generic business*

100-120

Comments

Dosage form plant

Dosage form plant in Ohio

Dosage form plant in New Jersey and

Intellectual property for the products

Import registration with Drug Enforcement

Administration (DEA); API plant approved by

DEA in Tennessee, US

Entry into dermatological treatment devices

Adds 107 products to the US portfolio

Source: Company, Industry, Ambit Capital research. Note: * indicates Ambit estimate

This is one marker which is clearly flashing ‘amber’ for investors. Unlike many

successful companies which diversify into unrelated areas, Sun has remained

focussed on the pharma sector itself. However, what has changed is its appetite for

larger M&As. Over the past few years, Sun has articulated a more aggressive M&A

strategy towards expansion of its branded generics business both in the US as well

as in other developed and emerging markets. News reports related to multibillion-dollar acquisition by Sun Pharma also makes us nervous.

A seasoned strategic advisor to the Pharma sector says that “After the Protonix atrisk penalty, there is a high probability that Sun Pharma will pursue a big acquisition

to show that the US$550mn payment is not a significant setback. The only question

is whether it will be a sub-US$1bn acquisition or a multi-billion-dollar affair. If it is

the latter, I would be worried as I don’t see Sun having the management bandwidth

to integrate a large European or American acquisition…In a way, the unsuccessful

bid for Bausch & Lomb is a sign of things to come.”

Ambit Capital Pvt Ltd

6

Strategy

Inter-generational shifts or tension amongst promoters/management: We

have not detected any signs of differences amongst the promoter families.

Moreover, from all accounts, it appears that Dilip Shanghvi has been focussed on

strengthening the management bandwidth over the past few years at Sun Pharma.

The most prominent moves in this regard have been to appoint Israel Makov, the

former chief of Teva, as the Chairman of Sun Pharma, and to appoint Kal

Sundaram, the former head of GSK Pharma in India, as the head of its US

business.

Despite this apparent deepening of management bandwidth, industry participants

highlight that Dilip Shanghvi remains utterly central to decision-making on almost

every issue of significance within the group. “Dilip Shanghvi takes every single

intellectual property decision Sun has to make, he determines capital allocation and

he decides which markets the firm should enter. Everything in Sun hinges around the

promoter…that might be why Sun ended up paying for Protonix. Sun had a strong

case for Protonix and yet they ended up having to pay…Can Sun Pharma really

become a global player with this sort of dependence on the promoter?” asks the

recently retired CEO of a rival pharma company.

Capital allocation: Sun has consistently generated higher-than-sector RoEs and

RoCEs over the past ten years. The focus on the then niche chronic therapeutic

segments in India back in the nineties has largely paid off given the rather staid

growth in the acute segment. This has enabled the company to steadily increase

market share to 4.9% in FY13 (vs 3.2% in FY07), making it amongst the largest

branded formulations players in India. The international business growth has also

helped sustain the high RoEs, given its presence in high-margin areas such as

injectables and dermatology (through Taro).

Conclusion: Given Sun Pharma’s extremely strong track record, investors have

largely shrugged away concerns arising from the large acquisitions that Sun may

commit to. However, the decisions arising from these future capital allocation

questions do raise flags regarding the strategy going forward. Investors should

quiz the management as to what is the threshold beyond which the management

would be uncomfortable raising debt for a large acquisition.

Ambit Capital Pvt Ltd

7

Strategy

Greatness ’at risk’

We have stopped flying commercial.

In our note dated 7 June 2013 (Why do ‘great‘ Indian companies self-destruct?),

we attempted to build a framework to analyse why ‘great’ companies self-destruct

with metronomic regularity. In this note, we discuss:

flags that the company's performance direction may be changing trajectory, for

better or for worse,

three companies that have had a great run over the last decade - Asian Paints,

Sun Pharma and Titan Industries - and the flags that investors should watch

out for, and

issues raised about our 7th June note by investors.

The flags or markers are not sufficient to say that a company's performance is set

for a dramatic change but they provide sufficient reason to do more research, to

understand and to ask appropriate questions to arrive at a conclusion.

Exhibit 5: The five-stage framework

Source: From the book ’How The Mighty Fall’

To summarise what we highlighted in our 7 June note, 50% of the Nifty churns

every decade (a much higher churn ratio than seen in other major markets). Note

that 85% of the most successful Indian companies (measured in terms of superior

financial performance over a six year period) slide towards mediocrity after a

phase of strong performance. Thus, only 15% of successful companies are able to

sustain a strong performance over decades. This is not surprising given that it is

extremely difficult to maintain disciplined capital allocation decade after decade.

Whether a company invests capital in new projects/ acquisitions/ diversifications or

hoards capital, can often be value-destructive.

So why do successful India companies self-destruct? In our 7 June note, drawing

inspiration from the frameworks put down by Jim Collins, William Thorndike and

the Conference Board, we laid out a five-step framework which 85% of successful

Indian firms use to drag themselves towards mediocrity (see the exhibit above):

Ambit Capital Pvt Ltd

Stage 1 - Hubris and arrogance: The company is on top of its game.

Operating margins, RoCE, growth, valuation multiples, etc., are at all-time

highs. Captivated by the success in its core business, the management starts

believing its own press. Success and adulation intoxicates the top brass.

Arrogance sets in. The company loses sight of the factors which made it

successful in the first place.

8

Strategy

Stage 2 – Unbridled expansion: In search of more growth and more

adulation, the management begins an expansion drive which is often

inorganic. The firm ’overreaches‘ into new geographies and product lines

where it has no real experience or expertise. Sub-par capital allocation begins.

Stage 3 – Stuck in a rut: Often cost discipline and/or product excellence

erodes and prices are then raised. Profits, return multiples and valuation

multiples start sliding. Company politics thrives. The leader becomes

increasingly autocratic and announces 'recovery plans' that are not based on

accumulated experience.

Stage 4 – Grasping for solutions: The company thrashes around and looks

for a solution even as profits and financial strength continue to slide. Senior

management jobs are on the line. Often a new leader comes in and

sometimes he tries to fire silver bullets (eg. a 'transformative' acquisition, a

blockbuster product, a cultural revolution, etc). However, a new leader (ideally,

someone from inside) who takes a long, hard look at the facts and then acts

calmly to put in place a measured recovery strategy with sensible use of cash

and capital at its centre, could be the saviour.

Stage 5a – Capitulation: The firm is sold or fades into insignificance or, and

this happens rarely, shuts down.

Or Stage 5b – Recovery: The firm turns the corner and begins the long, slow

climb to recovery.

However, as clients pointed out when we met them to discuss the 7 June note,

what investors need is a set of markers which suggest that a successful firm has

embarked upon this slide to mediocrity (as opposed to still being on the upward

portion of its arc to greatness). The main aim of this note is to list these markers

and then illustrate them with case studies (Asian Paints, Titan and Sun Pharma). In

the third section of the note, we have addressed some of the other questions

raised by investors on the framework we presented on 7 June.

Greatness ’at risk‘: Markers to watch out for

How can investors assess when the greatness of a supremely successful company

is ’at risk‘? After all, as we have seen with the Bharti-Zain deal or the Apollo

Tyres–Cooper Tire deal or with Hero’s divorce from Honda, the Indian market

rarely gives investors a second chance once that critical announcement which

results in the loss of ’greatness‘ is made.

Bharti has underperformed the Sensex by 4% (1% in CAGR terms) since the

announcement of the Zain deal on 15 February 2010. In the three months

following Bharti's announcement, the stock was down 7%.

Apollo Tyres has underperformed the Sensex by 30% since the announcement

of the Cooper deal on 12 June 2013.

Hero MotoCorp’s stock was down 10% in the three months following the

announcement of its divorce with Honda on 16 December 2010. It has trailed

its peer, Bajaj Auto, by 13% since the deal announcement.

Our discussions with companies, corporate financiers and investors, point to four

qualitative ’red flags‘ which we believe are signals that a great company is on the

cusp of losing its greatness:

1. Hubris and arrogance: Hubris and arrogance is the single largest factor that

leads to deterioration in performance. And this is also one of the markers that is

easily discernible especially if the analyst or investor has been meeting a particular

company or its management or promoters over several years – executives gripped

by this malaise love to ‘talk down‘ to investors and/or outline grandiose visions for

global domination. One of the memorable lines that this analyst has heard is from

Ambit Capital Pvt Ltd

9

Strategy

the CFO of a mid-sized company who started off a meeting with a group of fund

managers by saying, "We have stopped flying commercial."

The other way to gauge the step up in hubris over time is if first the promoter, then

the CEO and then the CFO pulls away from interactions with market participants

(leaving the job largely in the hands of an IR manager), not because the company

has grown its scale and complexity, but because the senior management believes

that communication and discussions with stakeholders is no longer important.

Spotting hubris and arrogance is about spotting the incremental change in

behaviour.

2. Shift in strategy: A dramatic shift in strategic stance is another flag to watch

out for and should be of concern if the rationale is difficult to decipher or the same

is not well articulated by the company. For example, a carbonated drinks company

turning its focus on health drinks seems like a rational strategy as the world

focuses on health. But for a steel company to articulate the virtues of electric arc

furnace (EAF) in a power-starved and high-power-cost country is not

understandable and more so when the country has no scrap reservoir. Similarly, if

the market leader in paints suddenly decides that its primary growth focus will

henceforth be home decoration, it is time for shareholders to re-examine the

investment case for holding the stock. Instances of such abrupt changes in strategy

are not as rare as one would like them to be.

3. Inter-generational shift or tension within promoters or change in

management: The handover from one generation to another (or from one CEO

to another) is a particularly sensitive time. What will gen-next's priorities be? More

often than not gen-next wants to make an impression and make its own mark,

which also means a shift in strategies and big capital allocation decisions. The

tensions that mark the handing over from one generation to the next, in many

cases, also manifests itself in tussles between different power centres within the

same firm.

Whilst every generation wants to make its mark or carve out its own empire, within

different promoter groups it is often about who will control what, particularly in

successive generations. One of the more respected CFOs in the Indian corporate

sector says that promoters have to learn to change their roles over a period of time

from entrepreneurs to managers to investors.

An entrepreneur is someone who starts a venture and is completely hands on

in almost every major decisions of the company. The company then is usually a

one-man show.

As the company grows bigger and also goes public, the entrepreneur has to

evolve into a manager, where he/ she is one of the shareholders and is

managing the business on behalf of all stakeholders.

In the last stage, the entrepreneur-manager becomes an investor and the

company passes on to professional hands with an oversight by the board. The

entrepreneur's interests are represented at the Board level. This stage usually

comes after two or three generations, although in the Indian context there is a

reluctance to part with managerial control.

Giving up control (i.e. entering the last stage) is easier said than done, as seen in

company after company. A company that has managed this transition successfully

is, for example, Dabur. Among large companies, Bharti is one where the Mittals

have made the transition from entrepreneur to manager to investor, although

anecdotal evidence suggests that they still retain significant control over day-today decision making.

Ambit Capital Pvt Ltd

10

Strategy

A change at the top is more often than not also accompanied by a change in

strategy, once again fuelled either by the environment or very often by the desire

of the new incumbent to make his mark. A very good example of a major shift in

strategies as the person at the helm changes is ICICI Bank (when N Vaghul

handed over charge to KVK Kamath and then when Mr Kamath handed over

charge to Chanda Kochhar). Note that we are not commenting on the efficacy of

one person's strategy over the other or on the need for the change in strategy

under the then given circumstances. The point we are making is that more often

than not, a change at the top – either in the CEO’s office or in the promoter family

– leads to a change in strategy, and the change has an impact on the stock price.

The table below highlights how stock price performance was impacted with

management changes and in many of these cases the management changes were

also accompanied by significant changes in strategic direction. There are times

when a successor also benefits from decisions taken in his predecessor's time and

then of course there is the macro environment, which has a large role to play in

corporate performance in the near term.

Exhibit 6: Management changes at various Indian entities

Month of

change

Relative share price

perf (pre)*

5yr

3yr

1yr

Relative share price

perf (post)#

1yr

3yr

5yr

Company Name

Management changes

Aditya Birla Group

K M Birla**

Jan-95

NA

24%

45%

4%

3%

-3%

P Jayendra Nayak

Jan-00

NA

NA

-20%

103%

33%

45%

Shikha Sharma

Jun-09

22%

22%

7%

48%

6%

NA

Axis Bank

Bajaj Hindusthan

HUL

ICICI Bank

Infosys

ITC

Kushagra Nayan Bajaj

Apr-07

60%

10%

-89%

25%

-16%

-31%

MS Banga

May-00

25%

22%

-21%

15%

-2%

-17%

Douglas Baillie

Mar-06

-20%

-34%

9%

-53%

7%

-8%

Nitin Paranjpe

Apr-08

-27%

-10%

2%

25%

-4%

10%

Chanda Kochhar

May-09

-6%

-5%

-13%

44%

7%

NA

Nandan Nilekani

Mar-02

NA

30%

-23%

30%

13%

7%

Senapathy Gopalakrishnan "Kris"

Jun-07

2%

-2%

-9%

-7%

6%

2%

SD Shibulal

Aug-11

-3%

5%

-10%

0%

NA

NA

YC Deveshwar

Jan-96

23%

-4%

-14%

33%

45%

24%

Arun Kumar Purwar

Nov-02

3%

12%

29%

37%

13%

8%

2%

-19%

-41%

72%

25%

16%

SBI

O.P.Bhatt

Jul-06

Pratip Chaudhri

Apr-11

14%

11%

24%

-12%

NA

NA

Tata Steel

B Muthuraman

Jul-01

-12%

-5%

2%

43%

42%

26%

Titan Inds

Wipro

Bhaskar Bhat

Apr-02

-3%

-9%

33%

7%

39%

43%

Vivek Paul

Jul-99

NA

NA

87%

242%

30%

12%

post-Vivek Paul

Sep-05

-19%

-15%

-22%

-10%

-17%

-6%

Source: Company, Bloomberg, Ambit Capital research; Note: * indicates 1-year, 3-year and 5-year share price performance relative to Sensex

preceding the change in management. # indicates 1-yr,3-yr & 5-yr share price performance relative to Sensex post the change in management,**

indicates the performance of Hindalco Ltd-the largest company in the Aditya Birla Group

4. Capital allocation: Finally, the first three factors discussed above –

overconfidence, tensions within the company and abrupt changes in strategy result in poor capital allocation decisions. The inability of these companies to

successfully re-allocate capital is at the core of why 85% of successful Indian

companies slide to mediocrity. Since most Indian promoters do not want to return

surplus capital to shareholders, they have to make significant fresh capital

allocation decisions. These decisions bring the following ’paths‘ into play:

Ambit Capital Pvt Ltd

The acquisition is very large as compared to the present size of a company and

results in the debt:equity ratio shooting up. For example, Tata Steel's

acquisition of Corus lifted the acquirer’s debt:equity from 0.9x to 1.4x, Havells’

acquisition of Sylvania lifted the acquirer’s debt:equity from 0.1x to 1.5x, and

Apollo Tyres’ acquisition of Cooper Tires lifted the acquirer’s debt:equity from

0.6x to 3.8x.

11

Strategy

The size of the capex is very large as compared to the current size of the

company. For example, TVS’s expansion into Indonesia accounts for almost

40% of the company’s standalone net worth as at end-FY13. Tata Steel’s

Kalinganagar project will account for ~75% of the capital employed of the

Indian business (post completion of Odisha Phase I). Judging by press reports,

Tata Motors, spent over US$1bn, ~0.6x FY08 shareholders’ equity of the

standalone entity, in creating the Nano.

Extreme risk aversion: This is the opposite of the points made in the preceding

bullets. Here a great company stops innovating, stops experimenting with new

concepts, and stops launching new/improved products. As a result, its success

attracts imitators – often with disruptive products or disruptive business

models. The new entrant then increases the intensity of competition in the

sector and pulls down the incumbent’s profit margins and growth rates. Whilst

Infosys’s unwillingness to invest its cash hoard (now amounting to US$4.0bn or

0.6x its shareholders’ equity) is legendary, other Indian companies have also

fallen into the trap of doing too little. For example:

Punjab Tractors in the late 1990s owned the leading tractor brand in India

(called ’Swaraj‘). The company sold a premium priced tractor and asked

for payment in advance. As it became complacent with its leadership

position, Mahindra & Mahindra (M&M) moved in by launching a much

cheaper tractor with a much longer payment cycle. Subsequently, Punjab

Tractors’ margins fell sharply and its working capital cycle expanded

rapidly. As Punjab Tractors’ share price fell by 81% from its peak, guess

who bought the firm – M&M.

Six years ago, Hawkins’ topline was Rs1,735mn whereas that of its rival

from south India, TTK Prestige, was Rs 2,814mn. TTK Prestige then

launched a raft of new products, expanded aggressively into north India

and opened ’Prestige Smart Kitchens‘ stores across India. Now, TTK’s

revenues and profits are 3.2x and 3.9x that of Hawkins, respectively.

Capital allocation is a tricky one in the sense that clearly one knows what is good

or bad only with the benefit of hindsight. For example, as described in our 7 June

note, most experts thought that the Corus acquisition was a more sensible decision

for Tata Steel than the acquisition of JLR by Tata Motors. However, as highlighted

in our first note, Tata Motors was better prepared for its acquisition of JLR whereas

Tata Steel's break from its stated strategy of raw material security was perplexing,

as Corus obviously did not have any raw material security. Our view, while based

on the facts available at the time of the acquisitions, of course, has benefitted from

hindsight.

That said, a few points can be made clearly on the back of our 7 June note and on

the back of our 31 July capital allocation note: (a) Companies which return cash to

investors – through dividends, buybacks, etc – have significantly higher RoCEs than

those that don’t; (b) Companies which make large capex decisions or make

acquisitions have materially lower RoCEs; while (c) Companies which hoard cash

have significantly lower RoCEs than RoICs (see the exhibits that follow).

For the BSE200 universe (ex-financials), we look at the use of cash flow from

operations by each of these firms over the last ten years towards capital

expenditure, acquisitions, payback to shareholders (dividends plus share buybacks)

and cash retained on balance sheets.

We then contrast the FY12 median RoCEs of the first quintile of firms based on

their expenditure on each of these items versus the average RoCE for the universe,

i.e. the top quintile on cash returned (dividends plus buybacks) as a proportion of

cash flows from operations over the last ten years, top quintile on capex as a

proportion of cash flows from operations, etc.

Ambit Capital Pvt Ltd

12

Strategy

Exhibit 7: Capital allocation decision impacts RoCE – FY12 RoCEs of top quintiles

based on use of cash

Median FY12 ROCE

Universe

Cash returned (Q1)

Capex (Q1)

Acquisition (Q1)

Cash retained (Q1)

0%

10%

20%

30%

40%

Source: Bloomberg, Capitaline, Ambit Capital research; Note: This is pre-tax RoCE

These results indicate that firms that have indulged in excessive acquisitions or

excessive capex have had mediocre return ratios (‘excessive’ here refers to being in

the top quintile of BSE200 firms in terms of capex or acquisitions). This suggests

that whilst organic and inorganic expansion may be necessary for a firm to

expand, overdoing it comes at a cost. On the other hand, firms that were generous

in returning surplus cash to shareholders in the form of dividends or buybacks

have materially higher RoCEs (‘generous’ here refers to being in the top quintile of

BSE200 firms in terms of returning cash through buybacks and dividends).

Some may argue that looking at the FY12 RoCEs is misleading given that these

may be cyclically depressed return ratios. To take care of this issue, in the next two

exhibits, we reproduce this analysis for two different time frames: FY03-FY12

period and FY03-FY07 period.

Exhibit 8: Capital allocation decision impacts RoCE – FY03-12 median RoCEs of top

quintiles based on use of cash

Last ten year median ROCE

Universe

Cash returned (Q1)

Capex (Q1)

Acquisition (Q1)

Cash retained (Q1)

0%

10%

20%

30%

40%

Source: Ambit Capital research, Bloomberg, Capitaline; Note: This is pre-tax RoCE

Ambit Capital Pvt Ltd

13

Strategy

Exhibit 9: Capital allocation decision impacts RoCE – FY03-07 median RoCEs of top

quintiles based on use of cash

Median ROCE (FY03-FY07)

Universe

Cash returned (Q1)

Capex (Q1)

Acquisition (Q1)

Cash retained (Q1)

0%

5%

10%

15%

20%

25%

30%

35%

Source: Bloomberg, Capitaline, Ambit Capital research; Note: This is pre-tax RoCE

As would have been expected, the inferences remain unchanged. Firms that were

generous in terms of returning cash have had significantly higher RoCEs than the

rest of the firms. On the other hand, firms that were either too conservative in

capital deployment (as evidenced by hoarding of cash) or were too aggressive in

capital deployment (as evidenced by excessive capex, excessive acquisitions) have

had lower RoCEs as compared to the rest of the firms.

The one result, however, that appears counterintuitive is that firms that chose to

retain cash on their balance sheets without using it either for profitable expansion

or payback to shareholders have not been penalised for doing so, as reflected in a

healthy RoCE. The reason for this, in our view, is that higher return ratios in the

first place eventually lead to healthy cash flow generation (for it to be retained on

the balance sheet). This, thus, masks the damaging impact that unnecessary

hoarding of cash on balance sheets has on return ratios. In order to understand

this impact, we would be better served to look at the difference between RoCEs

and RoICs for these firms.

(We calculate RoCEs by dividing the pre-tax operating profit, including interest and

dividend income, by total capital employed. Calculation of RoICs, on the other

hand, involves dividing pre-tax operating profit, after subtracting interest and

dividend income, by total assets excluding cash and marketable investments. Thus,

whilst ROIC denotes the return only on business capital, RoCE denotes return on

all capital - that deployed towards business as well as that held in cash and

marketable investments.)

Exhibit 10: The cost of hoarding cash - RoCEs lower than RoICs for the top quintile

on cash retention

Return ratios (pre-tax)

Cost of retaining cash

40%

Cost of

hoarding

30%

20%

10%

0%

Median FY12 ROIC

Median FY12 ROCE

Source: Ambit Capital research; Note: The return ratios are pre-tax; whilst for RoIC calculation we remove

interest plus dividend income and cash from numerator and denominator respectively; for RoCE, we retain

these; the difference thus accounts for the cash drag to RoCEs

Arguably, the over 10% median differential between RoICs and RoCEs of the top

quintile of cash hoarders could be erased by returning the cash to shareholders,

thus forcing the RoCE up towards the RoIC.

Ambit Capital Pvt Ltd

14

Strategy

Where are today's 'great' companies

headed?

In our first note, we had stated that in our subsequent notes we will try and answer

the question on which of the currently 'great' companies are likely to see a decline

in performance over the next few years. In this section we look at three companies

- Asian Paints, Sun Pharmaceuticals and Titan Industries. The three companies

have had a strong run over the last decade and more and they are clearly at the

top of their game. Using our framework, we analyse what stage of the lifecycle are

these companies in and how do they measure up against the flags that we have

highlighted in the first section of the report.

Asian Paints

"It is the task of leadership to create and nurture an environment in which a

multitude of talented minds work in harmony so that mutual competence is

reinforcing rather than debilitating.''- Champaklal Choksey

“When the rules of the game shift constantly, lessons learnt yesterday are not

enough to meet the challenges of tomorrow. Staying ahead calls for a refreshingly

newer paradigm and a leadership willing to trust its `feel' rather than search in

`vain' for facts.'' - Champaklal Choksey

Asian Paints is India's leading decorative paints company with a dominant market

share. Over the last 15 years, the company's revenues have increased to Rs110bn,

at a CAGR of 19% and net profits have increased to Rs11bn, at a CAGR of 19%. In

these 15 years, the company's market cap has recorded a CAGR of 29% as against

the Sensex return of 11%. Currently, the stock is trading at 33.0x FY14E

(Bloomberg consensus). Out of 40 analysts covering the stock, 7 analysts have a

BUY rating, 17 have a HOLD rating and 16 have a SELL rating on the stock. We

have a BUY rating on the stock.

Exhibit 11: Asian Paints has delivered 23% share price CAGR vs 10% by the Sensex

over the past 20 years

7000

6000

5000

4000

3000

2000

1000

Sensex

Aug-12

Aug-11

Aug-10

Aug-09

Aug-08

Aug-07

Aug-06

Aug-05

Aug-04

Aug-03

Aug-02

Aug-01

Aug-00

Aug-99

Aug-98

Aug-97

Aug-96

Aug-95

Aug-94

Aug-93

0

Asian Paints

Source: Bloomberg, Ambit Capital Research.

Ambit Capital Pvt Ltd

15

Strategy

500

450

400

350

300

250

200

150

100

50

-

Exhibit 13: Asian Paints’ historical P/B multiples

32x

27x

22x

17x

Jan-02

Oct-02

Jul-03

Apr-04

Jan-05

Nov-05

Aug-06

May-07

Feb-08

Nov-08

Sep-09

Jun-10

Mar-11

Dec-11

Sep-12

Jul-13

12x

500

450

400

350

300

250

200

150

100

50

-

11x

9x

7x

5x

3x

Jan-02

Oct-02

Jul-03

Apr-04

Jan-05

Nov-05

Aug-06

May-07

Feb-08

Nov-08

Sep-09

Jun-10

Mar-11

Dec-11

Sep-12

Exhibit 12: Asian Paints’ historical P/E multiples

Source: Company, Bloomberg, Ambit Capital research

Source: Company, Bloomberg, Ambit Capital research

Exhibit 14: Asian Paints’ market cap has increased by

69x over the past 20 years

Exhibit 15: Asian

trends

500

450

400

350

300

250

200

150

100

50

0

Paints’

sales

and

sales

growth

120,000

28%

100,000

25%

Asian Paints' market cap (Rs bn)

Source: Bloomberg, Ambit Capital research

Ambit Capital Pvt Ltd

22%

13%

-

10%

Sales (Rs mn)

FY12

20,000

FY10

16%

FY08

40,000

FY06

19%

FY04

60,000

FY02

Apr-13

Apr-12

Apr-11

Apr-10

Apr-09

Apr-08

Apr-07

Apr-06

Apr-05

Apr-04

Apr-03

Apr-02

80,000

Sales growth (%)

Source: Company, Ambit Capital research

16

Strategy

Exhibit 16: Asian Paints’ EBITDA and EBITDA margin

EBITDA (Rs mn)

19%

14,000

120%

18%

12,000

100%

17%

10,000

80%

16%

8,000

60%

15%

6,000

40%

14%

4,000

20%

13%

2,000

0%

12%

-

EBITDA Margin (%)

Source: Bloomberg, Ambit Capital research

PAT (Rs mn)

FY13

FY12

FY11

FY09

FY10

FY08

FY07

FY05

FY06

FY04

FY03

-20%

FY02

FY13

FY12

FY11

FY10

FY09

FY08

FY07

FY06

FY05

FY04

FY03

FY02

20,000

18,000

16,000

14,000

12,000

10,000

8,000

6,000

4,000

2,000

-

Exhibit 17: Asian Paints’ PAT and PAT growth trends

PAT growth (%)

Source: Company, Ambit Capital research

We will now see how the company stacks up against our various flags/ markers.

To emphasise, this is not a complete research report on Asian Paints and so we

have not analysed in detail the strength or the financials of the company and have

refrained from commenting on near-term outlook and valuations.

Hubris and arrogance: We have not discerned any signs of hubris and

arrogance. The three promoter families have always maintained a low profile and

kept away from the limelight over the past 20 years. We have not seen any signs

of this changing in spite of the tremendous success of the company over the last

decade and more. People close to the promoter groups say their behaviour

towards various stakeholders remains unchanged. An interesting comment by a

close observer was that no one in the family plays golf.

Shift in strategy: This is the one marker that is flashing ’amber‘. Whilst the

decorative paint market continues to expand in India, the signals from Asian Paints

is that they are looking at new growth areas and the one they seem to have

zeroed in on is home improvement solutions. Asian Paints to this end has acquired

Sleek, a modular kitchen company. We have not come across any cogent

explanation for this shift in strategy to focus on a new area, away from its core

area. Furthermore, the fragmented and service-oriented nature of the modular

kitchen business means that there are not many synergies with Asian Paints core

business. The question is whether some diversifications are planned to

accommodate a growing number of promoter family members who are in the

business today as compared to say 15 years back. Whilst the promoter families

currently have around 15-17 members in the middle and senior management, 15

years ago, this number was only 10-12 members.

Over FY04-13, operating cash flows (Rs55bn in total) were deployed almost

entirely towards capex (Rs28bn) and dividends (Rs21mn). There is no debt

currently outstanding on the balance sheet and with surplus manufacturing

capacity available, no major capex is planned over the next 2-3 years. Therefore,

surplus cash is likely to get accumulated at a rate of Rs15bn annually going

forward. As a result, unlike in the past, going forward, there will be a need for

active capital allocation decisions at a Board level. In this context, the first bet in

the form of the Sleek acquisition is small and not a cause for concern. However,

investors will need to watch out if the bets become larger and/ or more such

businesses are started. As often happens, companies whilst diversifying also suffer

from a lack of adequate management bandwidth.

Ambit Capital Pvt Ltd

17

Strategy

To be fair, this is not the first time that Asian Paints is considering diversification

options. In the late 1990s, based on the announcement in their annual report

(FY94), the company had planned to get into granites. Thankfully the decision was

not pursued further although we do not know why they had considered an entry

into granites and why they did not pursue that course. Therefore, the benefit of

doubt will be in favour of the management for the time being.

Inter-generational shift or tension within promoters: Here too the issue is

flashing ’amber‘. There are three promoter families who are represented on the

board of the company. The balancing act is achieved by giving different

responsibilities to different promoter groups with the SBUs being run by

professional CEOs. There are two issues about which investors should be

cognizant of: first, in 2010, the Dani family increased its stake in the company

from ~18% to ~21% (source: trade press). Prior to this, the three families had an

almost equal stake in the company. Changes in shareholding can over a period of

time become a source of tension.

Secondly, apparently, some tensions did crop up a few years back (in 2002) when

Asian Paints acquired Berger International (based in Singapore, with operations

across 11 countries in South East Asia, the Middle East and the Caribbean Islands).

Whilst two of the families were not completely in favour of the decision, the Dani

side of the family, wanted to go ahead, and the company did go ahead. In the

international business, over the last ten years, the company has capital employed

ranging from 24% to 55% of overall capital employed (vs 26% in FY13) and the

return on capital employed has been a poor -6% to +8%. By any yardstick, the

returns in the international business have been inadequate but the company has

persisted with its growth ambitions.

Our discussions (not with the company's management) indicate that the

relationship between the different family groups is “difficult”, and the company is

considering other possible diversification initiatives like getting into the ceramics or

sanitaryware or electricals business, even as the company remains very upbeat

about its business prospects. Once again to be fair to the company, it has earlier

survived a split within the promoter families.

Asian Paints was set up by four families, and Atul Choksey, the then MD, sold his

family's stake in 1997. This was reported in the press to be the fallout of a major

difference of opinions among the Chokseys and the other three promoter families

(the Danis, the Choksis and the Vakils) on the funding of the company's expansion

plans. Mr. Choksey’s plan for a GDR issue was reportedly rejected by other

promoters as it would have diluted their holdings. After his departure, he had said,

"The sale of shares held by the family was planned as per the desire of my father. I

will be here till a smooth transition is over .... I hope the new management would

be able to deliver goods" (emphasis added). His unsaid fears proved to be

premature as the company subsequently went from strength to strength. Once

again the benefit of doubt should go to the company's promoter groups – they

pulled Asian Paints successfully through Atul Choksey’s exit from the business and

the odds should be loaded in their favour in terms of being able to hold together

the current construct.

Ambit Capital Pvt Ltd

18

Strategy

Exhibit 18: Vakil Family Tree - Shareholding (in %) and responsibilities (where

information was available)

Arvind Vakil (family heads

Domestic decoratives business)

Abhay Vakil (Age 62) (2.97%)

Bhairavi Vakil

(0.23%)

Nehal Vakil

(0.25%)

Amar Vakil (Age 61) (1.36%)

Vivek Vakil (Age 26)

(0.33%) (Executive

Trainee – Finance)

Amrita Vakil

(0.27%)

Dipika Vakil

(0.21%)

Varun Vakil (Age 29)

(0.23%) (Manager –

Customer Centricity)

Source: Ambit Capital research; Note: The family trees have been drawn based on the information garnered

and may not be completely accurate.

Exhibit 19: Dani Family Tree - Shareholding (in %) and responsibilities (where

information was available)

Suryakant Dani (family heads

international business

Ashwin Dani

(0.22%)

Hasit Dani (Age 41) (0.42%) (Non exec

director in APNT from 2001-2011;

Presently, Director of Gujarat Organics

Shubhlakshmi

Dani (0.01%)

Wife

Ina Dani

(0.05%)

Malav Dani (Age

38) (0.34%)

Ishwara

Dani

Jalaj Dani (Age 43)

(0.17%) (President International Business

Smiti Dani

(0.01%)

Mudit Dani

(0.02%)

Vita Dani

(0.05%)

Source: Ambit Capital research

Exhibit 20: Choksi Family Tree - Shareholding (in %) and responsibilities (where information was available)

Chimanlal Choksi (family heads

domestic non-decorative business)

Ashwin Choksi (Age 70)

(0.08%)

Margi

Choksi

Rupen Choksi (Age 36)

(0.1%) (ED, Resins & Plastics

Ltd. (Associate of APNT)

Anay Choksi

(0.01%)

Nysha Choksi

(0.01%)

Urvashi Choksi

(0.09%)

Druhi Choksi

(0.01%)

Ashish Choksi

(0.09%) (Not

with the Group)

Ashay Choksi

(0.01%)

Shailesh Choksi

(0.45%)

Prafulika

Choksi (0.22%)

Binita Choksi

(0.01%)

Vishal Choksi

(0.31%) (Was

management

trainee with APNT

Mahendra Choksi

(Age 72) (0.23%)

Jigish Choksi

(0.21%)

(Executive –

Marketing )

Rupal Anand

Bhat (0.2%)

Ami Choksi

(0.05%)

Manish Choksi (age 38)

(0.25%) (President – Home

Improvement, IT & Supply

Rhea Choksi

(0.07%)

Rita Choksi

(0.1%)

Richa Choksi

(0.02%)

Source: Ambit Capital research

Capital allocation: With an average RoCE of 34% over 10 years, one cannot fault

Asian Paints’ capital allocation. Its average dividend payout ratio has been 51%

over the same period of time and general reserves have been capitalised by a

generous issue of bonus shares with unerring regularity. However, the sterling

performance in the domestic business masks the fact that the company's capital

allocation in overseas business has not borne fruit even after more than 10 years

of consistent investment. The encouraging part is that the share of overseas

business in capital employed has reduced over a period of time although it still

remains significant.

Ambit Capital Pvt Ltd

19

Strategy

Exhibit 21: Asian Paints’ capital employed and returns generated in the international and consolidated business

Capital employed in consolidated

business (Rs mn)

Capital employed in international

business (Rs mn)

International CE as % of overall CE

FY04

FY05

FY06

FY07

FY08

FY09

FY10

FY11

FY12

FY13

6,988

8,067

9,075

10,840

12,576

15,118

19,392

24,167

30,844

36,220

3,870

4,226

4,899

4,738

4,871

7,150

6,256

6,491

7,438

9,248

55%

52%

54%

44%

39%

47%

32%

27%

24%

26%

ROCE in international business

-2.4%

-5.8%

2.8%

-0.4%

2.9%

3.9%

6.4%

7.5%

2.5%

5.8%

Consolidated ROCEs

23.4%

24.3%

26.4%

30.2%

38.5%

31.8%

52.3%

41.2%

38.1%

35.3%

Source: Company, Ambit Capital research

Conclusion: The track record of the company favours a continued strong

performance. However, there are some issues that are signalling amber, as

discussed above. Investors should take cognizance of the same and quiz the

management to satisfy themselves that there are no surprises ahead.

Questions to ask Asian Paints’ management

1. Why is the management saying that the paints market in India is maxed out

when the smaller players are finding abundant growth in the same market?

2. Why is Asian Paints targeting the modular kitchens market? What exactly is it

about this business which is prompting Asian Paints to invest in it?

3. What will Asian Paints do with the surplus capital it generates? Can it really

execute in homeware properly? What are the challenges in this business? Who

are the key executives they have deputed to manage this business and what is

their experience? Which promoter family will be responsible for this business?

4. What will the latest generation of the promoters’ offsprings do? Given that

some of them already work in the business, how is this impacting decision

making by executives?

5. Is management grooming the next generation of leaders? How is this being

done?

6. How will KBS Anand’s successor as CEO be chosen when Mr Anand’s term

expires?

7. What is the strategy for the international business? What justifies continued

investments given weak RoCEs to date? Will the company consider divesting its

international business or is it critical from the perspective of supply of raw

materials and bulk paints for India?

8. How do the promoter families decide on who enters Asian Paints and who

does not?

9. Some Indian promoter families have put together a council that meets

formally, albeit confidentially, to take strategic decisions. Do the three

promoter families have any such decision-making body?

Ambit Capital Pvt Ltd

20

Strategy

Exhibit 22: Background of Board of Directors of Asian Paints

Name

Designation

Age

(yrs)

Ashwin

Choksi

Non-executive

Chairman

70

No. of

years

on

board

43

Ashwin Dani

Non-executive

Vice-Chairman

71

43

Asian PPG Industries

Limited, Resins & Plastics

Limited, Gujarat Organics

Limited, Sun

Pharmaceuticals Industries

Limited, Hitech Plast

Limited, Rangudyan

Insurance Broking Services,

ACC Limited

Abhay Vakil

Non-executive

Promoter

Director

63

30

Asian Paints Industrial

Coatings Limited, Resins

and Plastics Ltd, Vikatmev

Containers

KBS Anand

Managing

Director & CEO

58

1

Mahendra

Choksi

Non-executive

Promoter

72

21

Ultramarine & Pigments Ltd

Amar Vakil

Non-executive

Promoter

61

18

Elcid Investments Ltd.,

Resins and Plastics Ltd.,

Pragati Chemicals Ltd.

Ina Dani

Non-executive

Promoter

71

3

Coatings Specialties (India)

Ltd., Dani Finlease Ltd.,

Hitech Plast Ltd.

Dipankar

Basu

Non-executive

Independent

Director

77

13

Mahendra

Shah

Non-executive

Independent

Director

73

12

Securities Trading Corp. of

India Ltd., Deepak

Fertilizers & Petrochemicals

Corporation Ltd., STCI

Primary Dealer Ltd.,

Peerless General Finance &

Investment Co. Ltd.,

Peerless Securities Ltd.,

Chambal Fertilizers &

Chemicals Ltd., Saregama

India Ltd.

The Indian Card Clothing

Co. Limited, ICC

International Agencies

Limited, Tech-Knit Limited

Ambit Capital Pvt Ltd

Other directorships

Experience

NA

Mr. Ashwin C. Choksi, M.Com., served as the Managing

Director of Asian Paints Limited since 1984. He joined

Asian Paints in 1965 in the materials function of the

company. He rose to the position of Managing Director in

1984 and subsequently became Executive Chairman in

1997 and served until 31 March 2009. He holds a Master’s

degree in Commerce from the University of Mumbai, India.

He started his career in 1967, with Inmont Corp (now

BASF). He joined Asian Paints in 1968 and served as Vice

Chairman and MD from 1998 to 2009. He is the past

President of the Indian Paint Association and is a member

of the Board of Management of Institute of Chemical

Technology. He completed his B.Sc. (Hons) from the

Institute of Science University of Bombay and B.Sc. (Tech)

(Pigments and Varnishes) from U.D.C.T. University of

Bombay. He holds a Master’s Degree in Polymer Science

from the University of Akron, Ohio, and a Diploma in

Colour Science from Rensellaer Polytechnic, New York.

Prior to becoming Managing Director in 1998, he was a

Wholetime Director in the company. He oversaw the

Decoratives India SBU of the company. He was in charge of

the supply chain/sales and marketing activities of the

Decoratives Business Unit of the company. He is a science

graduate from Mumbai University and BS from Syracuse

University, USA.

Mr. KBS Anand served as the President of Asian Paints’

decorative business unit before becoming MD. Mr. Anand

served as Vice President of Sales & Marketing at Asian

Paints. He has over 33 years of experience. Mr. Anand has

been an Additional Director of Asian Paints Ltd since April

1, 2012. Mr. Anand holds B.Tech., P.G.D.M. degrees.

Mr. Mahendra Choksi has considerable knowledge and

experience in the Chemical industry, particularly in

‘Synthetic Resins’. Mr. Mahendra Choksi was DirectorProduction & Process Engineering till 1 March 1973 in

Asian Paints Limited. He joined the Board in 1992 and prior

to that held the position of MD in Resins and Plastics

Limited till 31 August 2002.

Mr. Amar Vakil holds a degree in BS from Rensselear

Polytechnic, U.S.A. Immediately after his graduation, he

joined Resins and Plastics Limited in 1974 and worked in

various positions till he retired as Managing Director. He

was the Hon. Secretary of the Colour Society for two years

and was one of the founder members of Indian Resin

Manufacturers Association.

Mrs. Ina Dani is a graduate in Fine Arts from M.S.

University, Baroda. She is also connected with various

social activities. She is a Trustee of Light on Yoga Research

Trust founded by Yogacharya BKS Iyengar. She was earlier

on the Board of the company between 31 March 1999 and

23 July 2001.

He holds a Master’s Degree in Economics from Delhi

University. He retired as Chairman of State Bank of India

(SBI) in August 1995. Mr. Basu served on the Boards of

several apex financial institutions of India (e.g. IDBI, Export

Import Bank of India, GIC of India Ltd., NABARD, etc.).

After retirement, Mr. Basu served as a member of the

Disinvestment Commission set up by the Government of

India from 1996 to 1999. During 1997, he was a member

of the Narasimham Committee on Banking Sector Reforms.

NA

He was the MD of The Indian Card Clothing Co. Limited

from 1985 until his retirement in 2001. Earlier, Mr. Shah

was the Managing Partner of the India operations of the

multinational trading cum-finance companies of The PanAfrica/The Plenum Group. Mr. Shah was also Chairman of

several panels of the Textile Machinery Manufacturers’

Associations. He holds a Bachelor’s degree in Electrical

Engineering from University of Mumbai and a Master’s

degree in Industrial Engineering from New York University

21

Strategy

Name

Designation

Age

(yrs)

No. of

years

on

board

Deepak

Satwalekar

Non-executive

Independent

Director

65

RA Shah

Non-executive

Independent

Director

82

12

S Sivaram

Non-executive

Independent

Director

67

12

S Ramadorai

Non-executive

Independent

Director

69

4

MK Sharma

Non-executive

Independent

Director

70

1

Other directorships

Experience

Infosys, Tata Power,

Piramal Enterprises, IL&FS

Transportation Networks,

NSE

Mr. Deepak Satwalekar holds a degree in Technology from

IIT, Bombay and an MBA from The American University,

Washington D.C. He has been a consultant to the World

Bank, the Asian Development Bank, United States Agency

for International Development (USAID) and the United

Nations Centre for Human Settlement (HABITAT). He was

holding the position of Managing Director & CEO of HDFC

Standard Life Insurance Co. Ltd., before his retirement in

November 2008. Earlier, he served as the Managing

Director of Housing Development Finance Corporation

(HDFC) from 1993 to 2000.

Mr. R. A. Shah is a Solicitor and Senior Partner of M/s.

Crawford Bayley & Co. He specialises in a broad spectrum

of Corporate Laws in general, with a special focus on

Foreign Investments, Joint Ventures, Technology and

Licence Agreements, Intellectual Property Rights, Mergers

and Acquisitions, Corporate Laws, Competition Law and

Insider Trading Regulations. He is a member of the

Managing Committee of Bombay Chamber of Commerce

and Indo German Chamber of Commerce and is a member

of the Governing Council of ASSOCHAM.

Piramal Health Care Ltd.,

Colgate Palmolive Ltd.,

Pfizer Ltd.,Procter &

Gamble Hygiene &

Healthcare Ltd., Clariant

Chemicals Ltd., The

Bombay Dyeing & Mfg. Co.

Ltd., Abbott India Ltd., BASF

India Ltd., Century Enka

Ltd., Wockhardt Ltd.,

Godfrey Phillips India Ltd.,

ACC Ltd., Deepak

Fertilizers & Petrochemicals

Corporation Ltd., Lupin Ltd.

Apcotex Industries Limited,

GMM Pfaudler Limited

Tata Consultancy Services

Limited, Tata Industries

Limited, Tata Technologies

Limited, CMC Limited,

Hindustan Unilever,

Piramal Enterprises, Tata

Elxsi Limited, Tata

Teleservices (Maharashtra)

Limited, Tata

Communications Limited,

Tata Advanced Systems

Limited, BSE Limited, Tata

Lockheed Martin

Aerostructures Limited,

Tara Aerospace Systems

Limited

ICICI Lombard Insurance

Company Limited, Thomas

Cook (India) Limited,

Fulford (India) Limited, KEC

International Limited,

Wipro Limited, The Andhra

Pradesh Paper Mills

Limited, Travel Corporation

(India) Limited, India

Infradebt Limited

Dr. S. Sivaram holds M.Sc. from Indian Institute of

Technology, Kanpur, Ph.D Purdue University, W. Lafayete,

USA and Research Associate from The Institute of Polymer

Science - Akron, USA. He has over 30 years of experience

in research on polymer-synthesis, high performance

polymers and surface chemistry of polymers. He was

bestowed with the “Padma Shri” award by the President of

India in January 2006. He is the Hon. Secretary of Society

of Polymer Science, India.

He holds a Bachelors Degree in Physics from Delhi

University, a B.E. degree in Electronics and

Telecommunications from the Institute of Science,

Bangalore and also a Master’s degree in Computer Science

from UCLA, (USA). He was awarded the Padma Bhushan by

the President of India. He was awarded the Commander of

the Order of the British Empire by Her Majesty Queen

Elizabeth II. He is also an advisor to the Prime Minister in

the Prime Minister’s National Skill Development Council.

He holds a Bachelor’s Degree in Arts and Bachelors of Law

Degree from Canning College University of Lucknow. He

has also completed Post Graduate Diploma in Personnel

Management from Department of Business Management,

University of Delhi and Diploma in Labour Laws from

Indian Law Institute, Delhi. Mr. M.K. Sharma began his

career with DCM Limited and subsequently joined HUL.

Source: Company filings

Ambit Capital Pvt Ltd

22

Strategy

Titan

“This year we should cross $2 billion and our goal for 2014-15 is $3 billion. But

more than just numbers, there is a vision — the dream is to serve the Indian public

with extremely good quality, well-styled products in the lifestyle space and bring an

Indian pride to consumers. The point is that if one excels, then money will

follow... We are looking at categories that have potential but are under-represented

and under-served... Going forward we are looking at several categories where the

consumer can afford better quality. We believe in better quality, greater

professionalism, transparency and good access through retailing, where the

customer gets well-designed products at a reasonable price and at conveniently

placed locations. The values of Titan have to come alive in every new product and

store, which means quality, styling, store experience and integrity — all at a

reasonable price.”-Bhaskar Bhat

Titan is India's leading manufacturer-retailer of watches and jewellery and

dominates the organised sector in these two segments with a market share of 65%

and 20% respectively. The company has some of the most well-regarded consumer

brands in its portfolio (Sonata, Titan, Tanishq and Fastrack) across these product

categories. Over the last five years, Fastrack has recorded a revenue CAGR of over

40% to emerge as the leading youth brand with a turnover of nearly Rs10bn. The

company has launched prescription eyewear stores as it attempts to consolidate

the market.

Over the last 15 years, the company's revenues have increased to Rs101.2bn, at a

CAGR of 23.9% and net profits have increased to Rs7.3bn, at a CAGR of 29.7%. In

these 15 years, the company's market cap has recorded a CAGR of 35% as against

the Sensex return of 11%. Currently, the stock is trading at 29.4x FY14E

(Bloomberg consensus). Out of 35 analysts covering the stock, 20 analysts have a

BUY rating, 10 have a HOLD rating and 5 have a SELL rating on the stock. We do

not cover the stock but it features in our annually published ten-baggers list.

Exhibit 23: 20-year stock price chart along with Sensex performance

12,000

10,000

8,000

6,000

4,000

2,000

Titan

cZ

Apr-13

Apr-11

Apr-09

Apr-07

Apr-05

Apr-03

Apr-01

Apr-99

Apr-97

Apr-95

Apr-93