DO It

advertisement

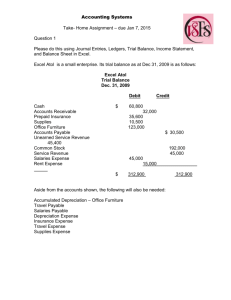

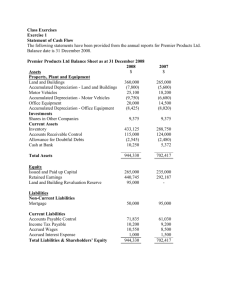

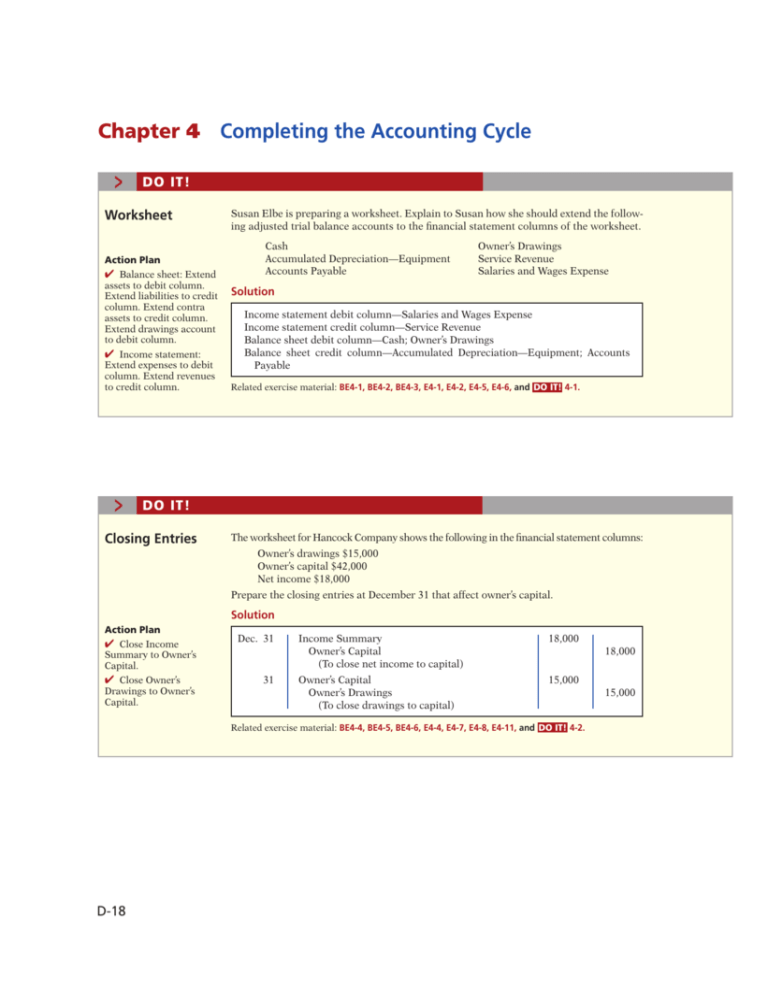

Chapter 4 > DO IT! Worksheet Action Plan ✔ Balance sheet: Extend assets to debit column. Extend liabilities to credit column. Extend contra assets to credit column. Extend drawings account to debit column. ✔ Income statement: Extend expenses to debit column. Extend revenues to credit column. > Completing the Accounting Cycle Susan Elbe is preparing a worksheet. Explain to Susan how she should extend the following adjusted trial balance accounts to the financial statement columns of the worksheet. Cash Accumulated Depreciation—Equipment Accounts Payable Owner’s Drawings Service Revenue Salaries and Wages Expense Solution Income statement debit column—Salaries and Wages Expense Income statement credit column—Service Revenue Balance sheet debit column—Cash; Owner’s Drawings Balance sheet credit column—Accumulated Depreciation—Equipment; Accounts Payable Related exercise material: BE4-1, BE4-2, BE4-3, E4-1, E4-2, E4-5, E4-6, and DO IT! 4-1. DO IT! Closing Entries The worksheet for Hancock Company shows the following in the financial statement columns: Owner’s drawings $15,000 Owner’s capital $42,000 Net income $18,000 Prepare the closing entries at December 31 that affect owner’s capital. Solution Action Plan ✔ Close Income Summary to Owner’s Capital. ✔ Close Owner’s Drawings to Owner’s Capital. Dec. 31 31 Income Summary Owner’s Capital (To close net income to capital) 18,000 Owner’s Capital Owner’s Drawings (To close drawings to capital) 15,000 18,000 Related exercise material: BE4-4, BE4-5, BE4-6, E4-4, E4-7, E4-8, E4-11, and DO IT! 4-2. D-18 15,000 DO IT! > D-19 DO IT! Assets Section of Classified Balance Sheet Baxter Hoffman recently received the following information related to Hoffman Company’s December 31, 2014, balance sheet. Prepaid insurance Cash Equipment $ 2,300 800 10,700 Inventory Accumulated depreciation— equipment Accounts receivable $3,400 2,700 1,100 Prepare the assets section of Hoffman Company’s classified balance sheet. Solution Action Plan ✔ Present current assets first. Current assets are cash and other resources that the company expects to convert to cash or use up within one year. ✔ Present current assets in the order in which the company expects to convert them into cash. ✔ Subtract accumulated depreciation—equipment from equipment to determine the book value of equipment. > Assets Current assets Cash Accounts receivable Inventory Prepaid insurance $ 800 1,100 3,400 2,300 Total current assets $ 7,600 Property, plant, and equipment Equipment Less: Accumulated depreciation—equipment 10,700 2,700 Total assets 8,000 $15,600 Related exercise material: BE4-10 and DO IT! 4-3. DO IT! Balance Sheet Classifications The following accounts were taken from the financial statements of Callahan Company. ________ Salaries and wages payable ________ Service revenue ________ Interest payable ________ Goodwill ________ Debt investments (short-term) ________ Mortgage payable (due in 3 years) ________ Stock investments (long-term) ________ Equipment ________ Accumulated depreciation— equipment ________ Depreciation expense ________ Owner’s capital ________ Unearned service revenue Match each of the following to its proper balance sheet classification, shown below. If the item would not appear on a balance sheet, use “NA.” Current assets (CA) Long-term investments (LTI) Property, plant, and equipment (PPE) Intangible assets (IA) Current liabilities (CL) Long-term liabilities (LTL) Owner’s equity (OE) Solution Action Plan ✔ Analyze whether each financial statement item is an asset, liability, or owner’s equity. ✔ Determine if asset and liability items are shortterm or long-term. __CL__ __NA__ __CL__ __IA__ __CA__ __LTL__ Salaries and wages payable Service revenue Interest payable Goodwill Debt investments (short-term) Mortgage payable (due in 3 years) __LTI__ __PPE__ __PPE__ __NA__ __OE__ __CL__ Stock investments (long-term) Equipment Accumulated depreciation— equipment Depreciation expense Owner’s capital Unearned service revenue Related exercise material: BE4-11, E4-14, E4-15, E4-16, E4-17, and DO IT! 4-4. D-20 > 4 Completing the Accounting Cycle Comprehensive DO IT! At the end of its first month of operations, Watson Answering Service has the following unadjusted trial balance. Action Plan ✔ In completing the worksheet, be sure to (a) key the adjustments; (b) start at the top of the adjusted trial balance columns and extend adjusted balances to the correct statement columns; and (c) enter net income (or net loss) in the proper columns. ✔ In preparing a classified balance sheet, know the contents of each of the sections. ✔ In journalizing closing entries, remember that there are only four entries and that Owner’s Drawings is closed to Owner’s Capital. WATSON ANSWERING SERVICE August 31, 2014 Trial Balance Debit Cash Accounts Receivable Supplies Prepaid Insurance Equipment Notes Payable Accounts Payable Owner’s Capital Owner’s Drawings Service Revenue Salaries and Wages Expense Utilities Expense Advertising Expense Credit $ 5,400 2,800 1,300 2,400 60,000 $40,000 2,400 30,000 1,000 4,900 3,200 800 400 $77,300 $77,300 Other data: 1. 2. 3. 4. Insurance expires at the rate of $200 per month. $1,000 of supplies are on hand at August 31. Monthly depreciation on the equipment is $900. Interest of $500 on the notes payable has accrued during August. Instructions (a) Prepare a worksheet. (b) Prepare a classified balance sheet assuming $35,000 of the notes payable are long-term. (c) Journalize the closing entries. Solution to Comprehensive DO IT! WATSON ANSWERING SERVICE (a) (a) Worksheet for the Month Ended August 31, 2014 Trial Balance Account Titles Cash Accounts Receivable Supplies Prepaid Insurance Equipment Notes Payable Accounts Payable Owner’s Capital Owner’s Drawings Service Revenue Salaries and Wages Expense Utilities Expense Advertising Expense Totals Dr. Cr. 5,400 2,800 1,300 2,400 60,000 Adjustments Dr. Cr. Adjusted Trial Balance Dr. Cr. Income Statement Dr. Cr. 5,400 2,800 (b) 300 1,000 (a) 200 2,200 60,000 40,000 2,400 30,000 1,000 1,000 4,900 3,200 800 400 Cr. 40,000 2,400 30,000 1,000 77,300 77,300 Dr. 5,400 2,800 1,000 2,200 60,000 40,000 2,400 30,000 4,900 3,200 800 400 Balance Sheet 4,900 3,200 800 400 DO IT! Insurance Expense Supplies Expense Depreciation Expense Accumulated Depreciation— Equipment Interest Expense Interest Payable (a) 200 (b) 300 (c) 900 200 300 900 (c) 900 (d) 500 Totals 1,900 200 300 900 900 900 500 (d) 500 D-21 500 500 500 1,900 78,700 78,700 6,300 4,900 72,400 73,800 Net Loss 1,400 Totals 1,400 6,300 6,300 73,800 73,800 Explanation: (a) insurance expired, (b) supplies used, (c) depreciation expensed, (d) interest accrued. (b) WATSON ANSWERING SERVICE Balance Sheet August 31, 2014 Assets Current assets Cash Accounts receivable Supplies Prepaid insurance $ 5,400 2,800 1,000 2,200 Total current assets Property, plant, and equipment Equipment Less: Accumulated depreciation—equipment $11,400 60,000 900 Total assets 59,100 $70,500 Liabilities and Owner’s Equity Current liabilities Notes payable Accounts payable Interest payable $ 5,000 2,400 500 Total current liabilities Long-term liabilities Notes payable Total liabilities Owner’s equity Owner’s capital Total liabilities and owner’s equity *Owner’s capital, $30,000 less drawings $1,000 and net loss $1,400. $ 7,900 35,000 42,900 27,600* $70,500 D-22 4 Completing the Accounting Cycle (c) Aug. 31 31 31 31 > Service Revenue Income Summary (To close revenue account) Income Summary Salaries and Wages Expense Depreciation Expense Utilities Expense Interest Expense Advertising Expense Supplies Expense Insurance Expense (To close expense accounts) Owner’s Capital Income Summary (To close net loss to capital) Owner’s Capital Owner’s Drawings (To close drawings to capital) 4,900 4,900 6,300 3,200 900 800 500 400 300 200 1,400 1,400 1,000 1,000 DO IT! Review Prepare a worksheet. (LO 1), C DO IT! 4-1 Bradley Decker is preparing a worksheet. Explain to Bradley how he should extend the following adjusted trial balance accounts to the financial statement columns of the worksheet. Service Revenue Notes Payable Owner’s Capital Prepare closing entries. (LO 2), AP Accounts Receivable Accumulated Depreciation Utilities Expense DO IT! 4-2 The worksheet for Tsai Company shows the following in the financial statement columns. Owner’s drawings Owner’s capital Net income $22,000 70,000 41,000 Prepare the closing entries at December 31 that affect owner’s capital. Prepare assets section of the balance sheet. DO IT! 4-3 Ryan Newton recently received the following information related to Ryan Company’s December 31, 2014, balance sheet. (LO 6), AP Inventory Cash Equipment Stock investments (long-term) $ 2,900 4,300 21,700 6,500 Debt investments (short-term) Accumulated depreciation Accounts receivable Prepare the assets section of Ryan Company’s classified balance sheet. $1,200 5,700 4,300 DO IT! D-23 Match accounts to balance sheet classifications. DO IT! 4-4 The following accounts were taken from the financial statements of Lee Company. (LO 6), C ________ Interest revenue ________ Utilities payable ment ________ Accounts payable ________ Supplies ________ Bonds payable ________ Goodwill ________ Owner’s capital ________ Accumulated depreciation—equip________ Equipment ________ Salaries and wages expense ________ Debt investments (long-term) ________ Unearned rent revenue Match each of the accounts to its proper balance sheet classification, as shown below. If the item would not appear on a balance sheet, use “NA.” Current assets (CA) Long-term investments (LTI) Property, plant, and equipment (PPE) Intangible assets (IA) Current liabilities (CL) Long-term liabilities (LTL) Owner’s equity (OE)