Ch 14 : Long Term Liabilities

advertisement

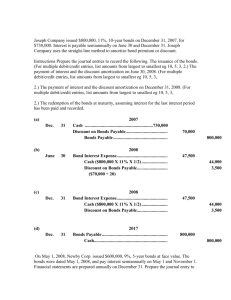

Ch 14 : Long Term Liabilities ► What is a Long term Liability?: (long-term debt) Consist of an expected outflow of resources arising from present obligations that are not payable within a year or the operating cycle of the company, whichever is longer. Examples: Bonds payable Long-term notes payable Mortgages payable Pension liabilities Lease liabilities ► Bonds Payable Bonds represent an obligation to repay sum of money (Face, Maturity, Par) Value at a future date (Maturity Date) تاريخ االستحقاق Paper certificate for each bond, typically a $1,000 face value. Pay a periodic interest at a contractual (stated) rate on the maturity amount (face value). Generally issued when the amount of capital needed is too large for one lender to supply. The Timelines of the bonds will be as follows: Year 1 Carrying Value Or Present Value Year 2 Year 3 $1000 $100 $100 $1000 $100 $1100 $900 Bond issued at Par Bond issued at Discount Bond issued at Premium ► Types of Bonds: 1. 2. 3. 4. Secured and Unsecured (debenture) bonds. Term and Serial bonds. Registered and Bearer (or coupon) bonds. Convertible and Callable bonds. ► Accounting for Bonds Payable Bonds Issued at Par Cash Received = Face Value $100,000 = $100,000 Stated Rate = Market Rate 10% = 10% Bonds not Issued at Par Bonds Issued at Discount Bonds Issued at Premium Cash received < Face Value Cash Received > Face Value $80,000 < $100,000 $120,000 > $100,000 Stated Rate < Market Rate Stated Rate > Market Rate 8% < 10% 12% > 10% تدفع الشركة فائدة أقل من السوق وبالتالي تدفع الشركة فائدة أعلى من السوق وبالتالي تقوم بتعويض حملة السندات في نهاية المدة تقوم بدفع مبلغ أقل لحملة السندات في نهاية .بدفع مبلغ أكبر .المدة Intermediate Accounting 2:IFRS Page 1 of 9 Ehab Abdou 97672930 Ch 14 : Long Term Liabilities Bonds Issued at Par: Exercise 1: On January 1, 2011, Candlestick, Inc. sells (Issues) $500,000, five-year, 10% bonds for $500,000 Interest is payable semi-annually on July 1 and January 1, The market yield for similar risk and maturity is 10% Instructions: Prepare all required journal entries. Solution: The Time Line of Bonds is as follows: Dec 31, 2011 Adjusting Entry Jan 1, 2011 (a) (b) (c) (d) (d) Jan. 2011 1 July 2011 1 Dec. 2011 31 Jan. 2012 1 Jan. 2016 1 July 1, 2011 Jan 1, 2012 Cash ....................................................................... Bonds Payable ................................................ 500,000 Bond Interest Expense ............................................. Cash ($500,000 X 10% X 6/12)....................... 25,000 Bond Interest Expense ............................................. Bond Interest Payable ..................................... 25,000 Bond Interest Payable .............................................. Cash ............................................................... 25,000 Bond Payable ........................................................... Cash ............................................................... 500,000 Intermediate Accounting 2:IFRS Page 2 of 9 500,000 25,000 25,000 25,000 500,000 Ehab Abdou 97672930 Ch 14 : Long Term Liabilities Bonds Not Issued at Par: Exercise 2: On January 1, 2011, Piper Co. issued ten-years bonds with a face value of $1,000,000 and a stated interest rate of 10%, payable semiannually on June 30 and December 31. The bonds were sold to yield 12%. Table values are: Present value of 1 for 10 periods at 10% ................................. .386 Present value of 1 for 10 periods at 12% ................................. .322 Present value of 1 for 20 periods at 5% ................................... .377 Present value of 1 for 20 periods at 6% ................................... .312 Present value of annuity for 10 periods at 10% ........................ 6.145 Present value of annuity for 10 periods at 12% ........................ 5.650 Present value of annuity for 20 periods at 5% ......................... 12.462 Present value of annuity for 20 periods at 6% ......................... 11.470 Instructions (a) Calculate the issue price of the bonds. (b) Prepare the discount amortization schedule. (c) Prepare all required Journal entries for the first year. Solution: (a) Calculation of the issue price of the bonds: 1- Periodic Interest = Face Value × Stated Rate × (Period/12) = $1000,000 × 10% × (6/12) = $50,000 2- P.V of Interest = Periodic Interest × PVF-A n,i = $50,000 × 11.470 [ n= 20 , i= 6% ] – Table 6-4 = $573,500 3- P.V of Bonds = Bond Payable × PVF n,i = $1,000,000 × 0.312 [ n= 20 , i= 6% ] – Table 6-2 = $312,000 4- Price of Bonds = P.V of Interest + P.V of Bonds = $573,500 + $312,000 = $885,500 (b) Discount amortization Schedule. Date Interest Paid Interest Expenses Discount Amortization 01/01/2011 06/30/2011 $ 885,500 $ 50,000 1,000,000 × 10% × 6/12 12/31/2011 $ 50,000 1,000,000 × 10% × 6/12 06/30/2012 Carrying Amount $ 50,000 1,000,000 × 10% × 6/12 Intermediate Accounting 2:IFRS $ 53,130 885,500 × 12% × 6/12 $ 53,318 888,630 × 12% × 6/12 $ 53,517 891,948 × 12% × 6/12 Page 3 of 9 $ 3,130 53,130 – 50,000 $ 3,318 53,130 – 50,000 $ 3,517 53,517 – 50,000 888,630 885,500 + 3,130 891,948 888,630 + 3,318 895,465 891,948 + 3,517 Ehab Abdou 97672930 Ch 14 : Long Term Liabilities (c) Journal Entries. Jan. 01, 2011 Cash ....................................................................... Bonds Payable ................................................ 885,500 June 30, 2011 Bond Interest Expense (885,500 X 12% X 6/12)... [1] Bond Payable ($53,130 - $50,000) ............. [3] Cash ($1,000,000 X 10% X 6/12)................ [2] 53,130 Dec 31, 2011 Bond Interest Expense ............................................. ([885,500+3,130] X12%X 6/12) Bond Payable ($53,130 - $50,000) ................. Cash ($1,000,000 X 10% X 6/12).................... 53,318 June 30, 2012 Bond Interest Expense ............................................. ([885,500+3,130+3,318] X12%X 6/12) Bond Payable ($53,130 - $50,000) ................. Cash ($1,000,000 X 10% X 6/12).................... 53,517 885,500 3,130 50,000 3,318 50,000 3,517 50,000 Additional Requirement: Assume That Piper Co. Calls (Retire) the entire issue at 101 after paying of interest on June 30, 2012. Prepare the necessary journal entry to record the early extinguishment of bonds? June 30, 2012 Bond Payable ........................................................... Loss on Early extinguishment ................................... Cash ($1,000,000 × 101%) ............................. 895,465 114,535 1,010,000 DO IT !! Exercise 3: On January 1, 2011, Piper Co. issued ten-years bonds with a face value of $1,000,000 and a stated interest rate of 14%, payable semiannually on June 30 and December 31. The bonds were sold to yield 12%. Table values are: Present value of 1 for 10 periods at 10% ................................. .386 Present value of 1 for 10 periods at 12% ................................. .322 Present value of 1 for 20 periods at 5% ................................... .377 Present value of 1 for 20 periods at 6% ................................... .312 Present value of annuity for 10 periods at 10% ........................ 6.145 Present value of annuity for 10 periods at 12% ........................ 5.650 Present value of annuity for 20 periods at 5% ......................... 12.462 Present value of annuity for 20 periods at 6% ......................... 11.470 Instructions (a) Calculate the issue price of the bonds. (b) Prepare the discount amortization schedule. (c) Prepare all required Journal entries for first year of bonds. Intermediate Accounting 2:IFRS Page 4 of 9 Ehab Abdou 97672930 Ch 14 : Long Term Liabilities Special Cases: 1- Bonds Issued between interest dates Exercise 3: On May 1, 2011, Piper Co. issued $100,000 of five-year bonds for $108,039 with a stated interest rate of 8%, payable semiannually on July 1 and January 1. The bonds were sold to yield 6%. Instructions: 1- Prepare all required journal entries. Solution: The Time Line of the Bonds is as follows: Dec 31, 2011 Adjusting Entry 2M 4 Month Jan 1, 2011 July 1, 2011 Jan 1, 2012 May 1, 2011 Issue Date Journal Entries: Date May 1, 2011 July 1, 2011 Accounts [3] [2] [1] [1] [3] [2] Dec 31, 2011 [1] [3] [2] Jan 01, 2012 [1] [2] Cash Bonds Payable Bond Interest Expense (100,000 x 8% x 4/12) Bond Interest Expenses (108,039 x 6% x 6/12) Bond Payable Cash (100,000 x 8% x 6/12) Bond Interest Expenses [(108,039 – 253) x 6% x 6/12) Bond Payable Bond Interest Payable (100,000 x 8% x 6/12) Bond Interest Payable Cash Intermediate Accounting 2:IFRS Page 5 of 9 Dr. 110,706 Cr. 108,039 2,667 3,747 253 4,000 3,233 767 4,000 4,000 4,000 Ehab Abdou 97672930 Ch 14 : Long Term Liabilities 2- Accruing interest at end of year Exercise 4: Holden Co. sells $300,000 of 10% bonds on March 1, 2011. The bonds pay interest on September 1 and March 1. The due date of the bonds is September 1, 2014. The bonds yield 12%, selling for $283,250. Give entries through March 1, 2012. Instructions: (a) Prepare all required Journal entries for the first year. Solution: The Time Line of the Bonds is as follows: Dec 31, 2011 Adjusting Entry 6 Month Jan 1 2011 4 Month July 1 2011 March 1, 2011 Issue Date Jan 1 2012 Sep 1, 2011 Receive Interest March 1, 2012 Receive Interest 6 Month Journal Entries 3/1/11 Cash......................................................................................... Bonds Payable .............................................................. 283,250 283,250 Interest Expense ($283,250 × 12% × 6/12).................................... 16,995 Bonds Payable .............................................................. Cash ($300,000 ×10% × 6/12) ....................................... 1,995 15,000 12/31/11 Interest Expense [($283,250 + $1,995) × 12% × 4/12]................ 11,410 Bonds Payable .............................................................. Interest Payable ($300,000 × 10% x 4/12) ..................... 1,410 10,000 9/1/11 3/1/12 Interest Expense [($283,250 + $1,995) × 12% × 2/12]................. Interest Payable ..................................................................... Bonds Payable .............................................................. Cash .............................................................................. Date 3/1/11 9/1/11 3/1/12 Cash Paid Interest Expense Discount Amortized $15,000 15,000 $16,995 17,115 1,995 2,115 Intermediate Accounting 2:IFRS Page 6 of 9 5,705 10,000 705 15,000 Carrying Amount $283,250 285,245 287,360 Ehab Abdou 97672930 Ch 14 : Long Term Liabilities 3- Extinguishment of Bond Payable Exercise 5: Evermaster bonds issued at a discount for $92,278 on January 1, 2011. These bonds are due in five years. The bonds have a par value of $100,000, a coupon rate of 8% paid semiannually, and were sold to yield 10%, Two years after the issue date on January 1, 2013, Evermaster calls the entire issue at 101 and cancels it. Instructions: Prepare the journal entry to record the early extinguishment of Bonds Date Jan 1, 2013 [2] [3] [1] Accounts Bonds Payable Loss on extinguishment of bonds Cash (100,000 x 101%) Intermediate Accounting 2:IFRS Page 7 of 9 Dr. 94,925 6,075 Cr. 101,000 Ehab Abdou 97672930 Ch 14 : Long Term Liabilities Long-Term Notes Payable Accounting for Note Payable is Similar to Bonds payable A note is valued at the present value of its future interest and principal cash flows. Company amortizes any discount or premium over the life of the note. Notes Issued at Face Value BE14-9: Coldwell, Inc. issued a $100,000, 4-year, 10% note at face value to Flint Hills Bank on January 1, 2011, and received $100,000 cash. The note requires annual interest payments each December 31. Prepare Coldwell’s journal entries to record (a) the issuance of the note and (b) the December 31 interest payment Date Jan 1, 2011 Dec 31, 2011 Accounts Cash Note Payable Interest Expenses Cash ( $100,000 × 10% ) Dr. 100,000 Cr. 100,000 100,000 100,000 Notes Not Issued at Face Value a. Zero-Interest-Bearing Notes BE14-10: Samson Corporation issued a 4-year, $75,000, zero-interest-bearing note to Brown Company on January 1, 2011, and received cash of $47,663. The implicit interest rate is 12%. Prepare Samson’s journal entries for (a) the Jan. 1 issuance and (b) the Dec. 31 recognition of interest. Date Jan 1, 2011 Dec 31, 2011 Accounts Cash Note Payable Interest Expenses Note Payable ( $47,663 × 12% ) Intermediate Accounting 2:IFRS Page 8 of 9 Dr. 47,663 Cr. 47,663 5,720 5,720 Ehab Abdou 97672930 Ch 14 : Long Term Liabilities b. Interest-Bearing Notes BE14-11: McCormick Corporation issued a 4-year, $40,000, 5% note to Greenbush Company on Jan. 1, 2011, and received a computer that normally sells for $31,495. The note requires annual interest payments each Dec. 31. The market rate of interest is 12%. Prepare McCormick’s journal entries for (a) the Jan. 1 issuance and (b) the Dec. 31 interest. Date Jan 1, 2011 Dec 31, 2011 Accounts Computer Note Payable Interest Expenses ( $31,495 × 12% ) Cash ( $40,000 × 5% ) Note Payable Intermediate Accounting 2:IFRS Page 9 of 9 Dr. 31,495 Cr. 31,495 3,779 2,000 1,779 Ehab Abdou 97672930