MN3365 Strategic Finance

advertisement

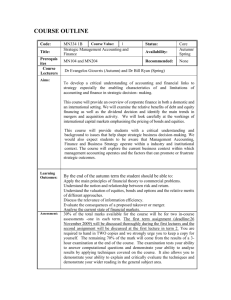

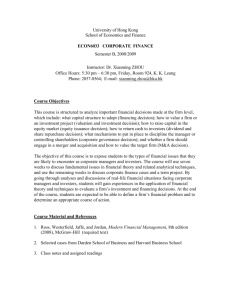

COURSE OUTLINE Code: Title: Prerequis ites Course Lecturers Aims: Course Value: MN3365 Strategic Finance MN104 and MN204 1 Status: Availability: Core Autumn Recommended: None Dr Evangelos Giouvris To develop a critical understanding of financial links to strategy especially the enabling characteristics of and limitations of finance in strategic decisionmaking. This course will provide an overview of corporate finance in both a domestic and an international setting. We will look carefully at the workings of international capital markets emphasising the pricing of bonds and equities. We will also discuss NPV & other investment criteria, risk & return, options and M&A This course will provide students with a critical understanding and background to issues that help shape strategic business decision-making. We would also expect students to be aware that Finance and Business Strategy operate within a industry and institutional context. The course will explore the current business context within which finance operates and the factors that can promote or frustrate strategic outcomes. Learning Outcomes: Assessment: By the end of the autumn term the student should be able to: Apply the main principles of financial theory to commercial problems. Understand the notion and relationship between risk and return. Understand the valuation of equities, bonds and options and the relative merits of different approaches. Discuss the relevance of information efficiency. Evaluate the consequences of a proposed takeover or merger. Analyse the current state of financial markets. This course is assessed by an assignment (essay question) and an exam at the end of the year. The assignment (deadline: you will be notified in lectures & seminars) will be discussed thoroughly during the lectures and seminars. You are required to hand in TWO copies and we strongly urge you to keep a copy for yourself. Finally there is a 3 hour exam at the end of the year. Exam questions for this course are mostly quantitative in nature. The examination tests your ability to answer computational questions and demonstrate your ability to analyse results by applying techniques covered on the course. It also allows you to demonstrate your ability to explain and critically evaluate the techniques and demonstrate your wider reading in the general subject area. Please have a look at past exam papers to get an idea of the exercises. Teaching & Learning Methods Key Bibliography There will normally be a one-hour lecture plus a one-hour workshop every second week. Lectures start in week 1 of autumn term. The workshops start the following week (i.e. week 2 of autumn term). Attendance is compulsory! Autumn term: Main Textbook: Brealey, Myers and Marcus. Fundamentals of Corporate Finance, Mc-Graw Hill, 7th Edition. Supplementary: Berk, J, DeMarzo, P & Harford. J (2009) Fundamentals of Corporate Finance, Pearson International Brealey and Myers (2005) Principles of corporate finance, McGraw-Hill, 8th Edition. Arnold, G, (2005) Corporate Financial Management, London, FT Publishing, 3rd Edition. In-course Feedback: Contact info. Formal formative assessment will comprise an assignment (which requires students to have developed and to demonstrate some independent research skills). Informal formative assessment will take place in workshops when students discuss the work they have undertaken to prepare for the workshop. The essay assignment will be returned with a standard cover sheet that includes the lecturer’s comments. Feedback on answers to workshop questions and readings will be given in the seminars. Students are also welcome to discuss course-related issues with the lecturer involved during weekly office hours or by appointment. Dr Evangelos Giouvris Founder’s East 134 Tel. 01784 276115 Email: evangelos.giouvris@rhul.ac.uk Date Lecture Autumn Term Readings Week 2 Valuation of bonds Chapters 1, 2 and 5 (chapters 1 & 2 are not presented in the lecture. It is up to you to read those two chapters yourselves. Chapters 1 & 2 are really easy and you already know those things) Chapter 6 Week 3 Valuation of stocks Chapter 7 Week 4 NPV and other investment criteria Chapter 8 Week 5 Intro to risk, return, opportunity cost and portfolio diversification Risk, return and capital budgeting/ CAPM/ efficiency Valuation of options I Chapter 11 Week 1 Week 6 Week 7 Week 8 Goals and governance of the firm (Chapter 1). Financial markets and institutions (Chapter 2). Time value of money (Chapter 5) Week 9 Valuation of options II: Risk management M&A Week 10 Questions and Answers Chapter 12 Chapter 23 +extra notes Chapter 24 + extra notes Seminar questions/exercises will be given during the lecture Chapter 21