FI Weekly Primer 01-26-15

advertisement

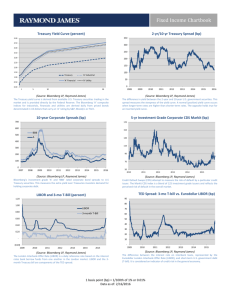

th th January 26 – 30 DAY Tues Wed Thurs Fri EVENT Durable Goods Orders FOMC Rate Decision Initial Jobless Claims GDP (QoQ) PERIOD Dec 1/28 1/24 4Q SURVEY 0.30% 0.25% 300k 3.10% PRIOR -0.90% 0.25% 307k 5.00% NOTE Last week it was the European Central Bank (ECB) and its announcement of monetary easing that moved the markets. This week, eyes will turn back towards the Federal Reserve and its plans for the future of interest rates here at home. Treasury Yield Gap at Lowest Since 2008 on Global Growth Concern (Bloomberg) Owners of Negative-Yield Sovereign Debt Say They’re No Fools (Bloomberg) Muni: The Week Ahead – Rarity Value Highlights a Slimmer Slate (Bond Buyer) TREASURIES Rates initially fell ahead of last week’s announcement from the European Central Bank (ECB) but abruptly changed course after the statement officially arrived on Thursday. It was a classic case of “buy the story, sell the news” as rates across the curve ended the week generally flat post-announcement of monetary easing in Europe. Many had anticipated that Treasuries would rally in the face of EuroQuantitative Easing (QE), as Treasury yields here at home are significantly higher than other “risk free” assets overseas. The strong relative value (higher yields) of US debt compared to Europe and parts of Asia could provide a continued bid for US Treasuries moving forward. Eyes will shift from the ECB to the Fed on Wednesday as the group will comment on its 2015 outlook, plans for the possibility of rate hikes, the effect of oil on the economy, and the continued uptrend in US job creation. BROKERED CDs CD rates were mixed when compared to the previous week with the front-end being relatively flat while the longer-end moved lower. The 3-month rate was up 5bp from a 0.30% to a 0.35% yield. The table on the right highlights that 6- and 12-month rates were unchanged while anything beyond a 2-year maturity was lower. The 6-month spread got a little tighter, ranging from 0.25% to 0.45%.Once again, Goldman Sachs Bank had the highest rates out there on the longer-end of the curve and Bank India in NY had the highest coupon on the short end of the curve. As far as volume was concerned, we finally saw some program names come back into the market after the MLK holiday as BMW, American Express, Ally and Bank of China all came out with new offerings after being out of the market for a few weeks. MUNICIPALS Municipal volume is expected to reach ~$6 billion in the week ahead, which is down from the nearly $7 billion that priced last week. This week, Pennsylvania (Aa3 / AA-) steps up with the largest issue, an expected $1 billion competitive sale set for Tuesday. PA saw its rating lowered one notch in 2014, in part due to its nearly $50 billion unfunded pension liability. Utah Transit Authority (Aa2 / AAA / AA) is bringing to market an ~$830 million issue as senior and subordinated refunding bonds. Glendale, AZ, home to this year’s Super Bowl, will be selling four negotiated deals totaling $277 million. And now for the numbers… Municipals and Treasuries decoupled this week, with Treasuries rallying and munis selling off --- pushing relative values even higher --- at 10 years a remarkable 100%. After two weeks of double digit moves, the 10-year Treasury declined 2bp to end the week at 1.81%; the 30-year was down 6bp to finish at 2.38%. On the muni side, the AAA MMD yields at 10- and 30-years moved up 6 and 5 basis points respectively to end the week at 1.81% and 2.59%. CORPORATES Corporates performed well last week and are starting the morning off strong, as well. Five year IG swaps are about 6.5 basis points tighter than the wides of last week, in all the way to about 66.7bp. This is the tightest level the index has read since blowing out a bit right after the New Year’s holiday. Even more encouraging is that this strength is on high volume, as well – the $16.6 billion TRACE count for secondaries on Friday was the highest volume Friday trading session in at least two years and higher than 97% of days since January 2005. Institutional account activity is likely helping dictate this turn for the better in corporate bonds, as OWIC (offer wanted in competition) requests are far exceeding BWICs (bid wanted in competition) over the past couple of trading sessions. Raymond James Bond Market Commentary Weekly Rates, Index Monitor, and Chartbook External Links: Investing In Bonds and MSRB CURRENT WEEK AGO Equities (Price Appreciation) DJIA 17672.60 17511.57 S&P 500 2051.82 2019.42 Nasdaq 4757.88 4634.38 Treasuries 1 yr 0.17 0.17 2 yr 0.52 0.49 5 yr 1.33 1.29 10 yr 1.81 1.83 30 yr 2.38 2.44 Brokered CDs 3 mo 0.35 0.30 6 mo 0.40 0.40 1 yr 0.50 0.50 2 yr 0.85 0.90 3 yr 1.25 1.35 4 yr 1.65 1.70 5 yr 1.80 2.00 10 yr 2.80 2.90 Municipal G.O. (AAA) MMD Scale 1 yr 0.14 0.14 2 yr 0.42 0.42 5 yr 1.00 1.02 10 yr 1.81 1.75 30 yr 2.59 2.54 Municipal G.O. (AAA) MMD TEY @39.6% 1 yr 0.23 0.23 2 yr 0.70 0.70 5 yr 1.66 1.69 10 yr 3.00 2.90 30 yr 4.29 4.21 MBS 30-yr (Current Coupon) FNMA 2.56 2.58 GNMA 2.52 2.55 Corporate Index (A) 1 yr 0.69 0.68 2 yr 1.04 1.04 5 yr 1.99 1.98 10 yr 2.94 2.97 30 yr 3.79 3.85 Corporate Index (BBB) 1 yr 1.12 1.09 2 yr 1.51 1.48 5 yr 2.55 2.53 10 yr 3.55 3.57 30 yr 4.39 4.47 Corporate CDS Index (bps) 5 yr 67.77 71.93 Other Rates 3m LIBOR 0.26 0.26 Fed Funds* 0.25 0.25 CHANGE 1-YR AGO 161.03 32.40 123.50 16,458.56 1,838.70 4,197.58 0.00 0.03 0.04 -0.02 -0.06 0.11 0.40 1.64 2.84 3.75 0.05 0.00 0.00 -0.05 -0.10 -0.05 -0.20 -0.10 0.25 0.30 0.40 0.50 1.00 1.55 1.90 3.25 0.00 0.00 -0.02 0.06 0.05 0.17 0.32 1.09 2.54 3.81 0.00 0.00 -0.03 0.10 0.08 0.28 0.53 1.80 4.21 6.31 -0.02 -0.03 3.44 3.27 0.01 0.01 0.01 -0.03 -0.06 0.53 0.87 2.17 3.71 4.71 0.03 0.03 0.02 -0.02 -0.08 0.88 1.26 2.67 4.34 5.22 -4.17 72.87 0.00 0.00 0.24 0.24 (Source: Bloomberg LP, MMD, Raymond James) as of 1/26/15 *Upper bound of range. All entries are percentage (%) unless otherwise noted. The author of this material is a Trader in the Fixed Income Department of Raymond James & Associates (RJA), and is not an Analyst. Any opinions expressed may differ from opinions expressed by other departments of RJA, and are subject to change without notice. The data and information contained herein was obtained from sources considered to be reliable, but RJA does not guarantee its accuracy and/or completeness. Neither the information nor any opinions expressed constitute a solicitation for the purchase or sale of any security referred to herein. Links are being provided for information purposes only. Raymond James is not affiliated with and does not endorse, authorize or sponsor any of the third-party web sites or their respective sponsors. Raymond James is not responsible for the content of any web site or the collection or use of information regarding any web site's users and/or members. This material may include analysis of sectors, securities and/or derivatives that RJA may have positions, long or short, held proprietarily. RJA or its affiliates may execute transactions which may not be consistent with the report’s conclusions. RJA may also have performed investment banking services for the issuers of such securities. Investors should discuss the risks inherent in bonds with their Raymond James Financial Advisor. Risks include, but are not limited to, changes in interest rates, liquidity, credit quality, volatility, and duration. Past performance is no assurance of future results. CDs offer FDIC insurance and a fixed rate of return whereas both principal and yield of investment securities will fluctuate with changes in market conditions. CDs are insured by the Federal Deposit Insurance Corporation (FDIC), an independent agency of the United States government, for up to $250,000 per depositor. The coverage limit refers to the total of all deposits that an account holder(s) has at each FDIC‐insured bank. The DJIA (Dow Jones Industrial Average) is a price‐weighted index of 30 significant stocks. The S&P 500 is an index of 500 widely held securities meant to reflect the risk/return characteristics of the large cap universe. The NASDAQ Composite Index is an index of all stocks traded on the NASDAQ over‐the‐counter market. The Russell 2000 index is an index of small cap securities which generally involve greater risks. The Markit CDX indices are composed of 125 investment grade entities, and attempt to track credit default swap spreads on these underlying securities. These unmanaged indexes cannot be invested in directly. GDP(Gross Domestic Product) is the annual total market value of all final goods and services produced domestically by the U.S. The S&P U.S. Preferred Index measures the performance of a select group of preferred stocks listed on the New York Stock Exchange, NYSE Arca, Inc., NYSE Amex, NASDAQ Global Select Market, NASDAQ Select Market or NASDAQ Capital Market. The Mortgage Bankers Association Market Composite Index is a measure of mortgage loan application volume. The Bloomberg U.S. Corporate Bond Indexes are comprised of the "active" (most frequently traded) fixed coupon bonds represented by FINRA TRACE, FINRA's transaction reporting facility that disseminates all over-the-counter secondary market transactions in these public bonds. The Citigroup Investment Grade Bond Index measures the value of the broad U.S. investment-grade bond market, including over 6,000 U.S. Treasury, government agency, corporate and mortgage-backed securities. All bonds in this index must be investment grade (rated at least BBB- or Baa3), have a maturity of at least one year, and a total value outstanding of at least $200 million. The Markit CDX North America Investment Grade Index is composed of 125 equally weighted credit default swaps on investment grade entities, distributed among 6 sub-indices: High Volatility, Consumer, Energy, Financial, Industrial, and Technology, Media & Tele-communications. Markit CDX indices roll every 6 months in March & September. Ratings apply to the company's claims paying ability and not to the safety or performance of an investment. No representation is made as to an insurer's ability to meet its financial commitments. U.S. Treasury securities are guaranteed by the U.S. government and, if held to maturity, offer a fixed rate of return and guaranteed principal value. Taxable Equivalent Yield (TEY) is a method of comparing yields of tax-exempt bonds to those of taxable bonds on a pre-tax basis. TEY is the yield required on a taxable bond to equal the yield of a tax-free bond. It is calculated by dividing the tax-free yield by the reciprocal of the federal tax rate. The highest U.S. tax bracket of 39.6% is used in the illustration in this material. While interest on municipal bonds is generally exempt from federal income tax, it may be subject to the federal alternative minimum tax, or state or local taxes. In addition, certain municipal bonds, such as Build America Bonds (BAB), are issued without a federal tax exemption, which subjects the related interest income to federal income tax. Municipal Market Data (MMD) AAA generic curves evaluate non-AMT blocks of $2mln or more and assume a 10-year PAR call and a 5.00% coupon structure. The Bloomberg U.S. municipal general obligation curve includes bonds with an average rating of AZ+ from Moody’s and S&P. The option-free yield curve is built using option-adjusted spread models. The yield curve is comprised from contributed pricing from the Municipal Securities Rulemaking Board (MSRB), new issue calendars and other proprietary contributed prices. A basis point (BP) is a unit that is equal to 1/100th of 1%, and is used to denote the change in a financial instrument. Raymond James & Associates, Inc., member New York Stock Exchange/SIPC. Raymond James Financial Services, Inc., member FINRA/SIPC. Ref. 2013-003264 until 04/02/2015 © 2013 Raymond James & Associates, Inc., member New York Stock Exchange/SIPC © 2013 Raymond James Financial Services, Inc., member FINRA/SIPC Raymond James Corporate Headquarters ● 880 Carillon Parkway, St. Petersburg, FL 33716