Municipal bond tax exemption FAQ

advertisement

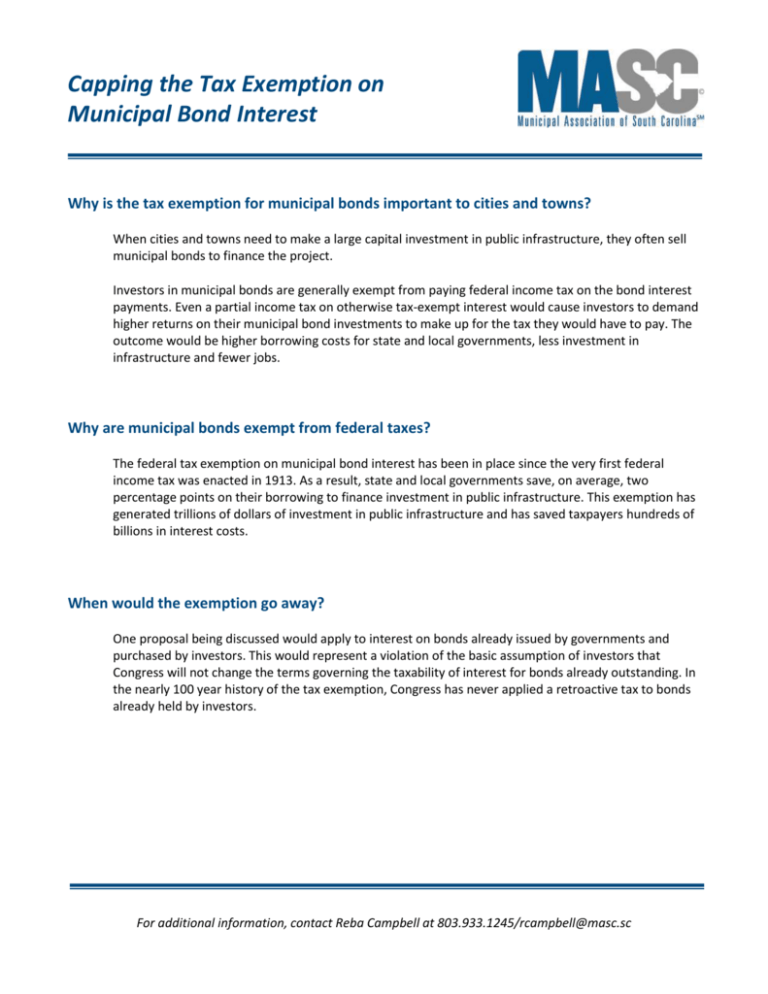

Capping the Tax Exemption on Municipal Bond Interest Why is the tax exemption for municipal bonds important to cities and towns? When cities and towns need to make a large capital investment in public infrastructure, they often sell municipal bonds to finance the project. Investors in municipal bonds are generally exempt from paying federal income tax on the bond interest payments. Even a partial income tax on otherwise tax-exempt interest would cause investors to demand higher returns on their municipal bond investments to make up for the tax they would have to pay. The outcome would be higher borrowing costs for state and local governments, less investment in infrastructure and fewer jobs. Why are municipal bonds exempt from federal taxes? The federal tax exemption on municipal bond interest has been in place since the very first federal income tax was enacted in 1913. As a result, state and local governments save, on average, two percentage points on their borrowing to finance investment in public infrastructure. This exemption has generated trillions of dollars of investment in public infrastructure and has saved taxpayers hundreds of billions in interest costs. When would the exemption go away? One proposal being discussed would apply to interest on bonds already issued by governments and purchased by investors. This would represent a violation of the basic assumption of investors that Congress will not change the terms governing the taxability of interest for bonds already outstanding. In the nearly 100 year history of the tax exemption, Congress has never applied a retroactive tax to bonds already held by investors. For additional information, contact Reba Campbell at 803.933.1245/rcampbell@masc.sc