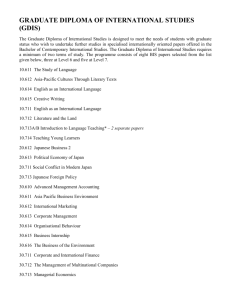

91553NSW Graduate Diploma of Insurance Services Take your

advertisement

91553NSW Graduate Diploma of Insurance Services Take your career to a new level The Graduate Diploma of Insurance Services fills an important gap in the educational options for senior insurance and risk professionals who want to develop their management skills across key areas such as risk and compliance management within their organisation. This qualification is particularly suited to insurance brokers or insurance company managers who are already working at management level including business unit head. Participants in this program are likely to be subject to professional licensing obligations and the course satisfies ASIC compliance requirements for licensee or responsible manager organisational capability. Participants in this program will typically hold, or be on course to hold, a senior role within their organisation where they are likely to be responsible for establishing and monitoring policies and procedures, managing business resources and business development activities, as well as some specialist functions. Entry for Graduates and Experienced and Qualified Candidates NIBA College is committed to ensuring that its programs are accessible to all suitable candidates. Individuals can begin a Graduate Diploma program at any age as the minimum standards for entry are based on the capacity to undertake formal study at this level. Entry to the course will be for those risk and insurance professionals who have achieved: A degree from a recognised University or other equivalent higher education institution and a minimum of two year’s relevant work experience; or Extensive work experience and evidence of a capacity to undertake tertiary studies in insurance services such as completion of a relevant professional qualification at the diploma or advanced diploma level. Professional Recognition Certain units may be required to progress to membership of relevant professional organisations. Candidates should establish such requirements where they apply in order to make appropriate choice of study program. Length of Study The standard practice is for candidates to enrol in one major at a time. So, as a busy working professional you will generally take two years part time study to complete the full qualification. Applying for Course Credits or Advanced Standing Candidates who have completed qualifications or courses in a relevant field can apply for course credits or exemptions from Graduate Diploma coursework. Details of how to apply for recognition of prior learning are on the NIBA College Graduate Diploma website pages. If a flexible approach to tertiary studies fits in with your world NIBA College has the answer… Structured Distance Study NIBA College’s online distance education format allows you to complete your work in your own time. We know that the ultimate in flexibility may also be the ultimate trap for you. So, the College has put some key milestones in place to keep you on track. As a distance student you receive a package of readings at the start of the program and guidance on how to pace yourself. Only the assignment deadlines are fixed so you have considerable flexibility in choosing the most convenient times for your study and in adjusting your study load to accommodate work and family commitments. This style of learning is ideal for insurance and risk professionals because you may be able to choose an area of study that is particularly relevant to your work and which would demonstrate your practical problem solving and business skills. Learning Support As a tertiary level candidate you are expected to work through the learning resources as an independent learner. You will participate in learning activities that develop your theoretical understanding which is then applied to work based projects. There is a strong emphasis on developing projects that are directly relevant to your work needs and professional interests. Studying at tertiary level can be challenging especially if you have not studied for some time. NIBA College has a number of support services available to make the study experience easier. Course materials consist of readings and self-study activities designed to introduce candidates to theoretical knowledge in each study area and to apply this knowledge to on-the-job practice. There are also links to industry information and legislation relevant to the study area. Learner guides provide advice on how to approach the course material and organise study time and assessment tasks. Online forums are available for each major study area so that participants can share ideas. Telephone or online tutorials allow students to confer with their course tutor to assist in choosing theoretical approaches that are appropriate to the development of sound practice in each major area of study and design of their work based project. Progressing to University The NIBA College Graduate Diploma of Insurance Services can be used as credit towards university studies. Each university has its own recognition and accreditation rules. NIBA College will assist you by providing details of your course to the university to help them determine credits, if required. 2 MODULE OUTLINES ORIENTATION MODULE The orientation module provides you with key research skills that will you to complete the module requirements. This subject focuses on undertaking research and is an assessable component. Principles of professional practice This topic covers core competency unit FNSINC401A Apply principles of professional practice to work in the financial services industry. This covers the skills and knowledge required to identify industry professional approaches to procedures, guidelines, policies and standards, including ethical requirements and model and meet expectations of these in all aspects of work. Participants who have completed this unit in other industry programs may be eligible to receive recognition of prior learning or credit transfer. BLOCK 1: INSURANCE SERVICES MANAGEMENT This block of study covers the mandatory units for this qualification: • NIBINSV801B Review strategic implications of portfolio and claims management performance This topic covers the application of portfolio management skills to monitoring, analysing and developing strategic responses to trends in underwriting and insurance portfolio products or services. • NIBRISK802B Develop organisational risk management systems This topic covers the application of risk management principles and organisational policies to develop and improve the risk management system of an organisation. • FNSPRM605A Establish or review marketing, client services and supplier relationships This topic covers the skills and knowledge required to establish or review marketing, client services and supplier relationships which support the provision of insurance services to clients. • FNSPRM606A Establish or review human resources, administration and information support This topic covers the skills and knowledge required to establish or review human resources, administration and information support systems in an insurance organisation. 3 BLOCK 2: MANAGING ORGANISATIONAL RISKS Participants choose 4 of the following elective units to complete this block of study: • BSBMGT617A Develop and implement a business plan This topic covers the skills and knowledge required to run a business operation and the steps to develop and implement a business plan. • NIBICPRO801B Develop a financial product This topic covers the skills in developing a plan to market and launch a new insurance product. • NIBRISK803B Facilitate development of a risk management organisational culture This topic is suitable for managers or technical specialists whose role includes the development of an appropriate risk management culture in the organisation. • NIBCOMP803B Identify and address organisational compliance and capacity issues This topic covers the identification and addressing of compliance issues on an organisational level with specific regard to the obligations of responsible managers. • BSBREL701A Develop and cultivate collaborative partnerships and relationships This topic covers the skills and knowledge required to establish collaborative partnerships and relationships with business and industry stakeholders. • NIBICGEN801B Conduct complex negotiations This topic covers the skills and knowledge needed for more difficult negotiations where there are complex technical issues, significant financial or powerful conflicting interests involved. If you have any further questions regarding the Graduate Diploma of Insurance Services please feel free to visit the NIBA College website www.nibacollege.com.au or contact us on: 02 9459 4300 or email qualifications@nibacollege.com.au 4