Operating Income Sales

advertisement

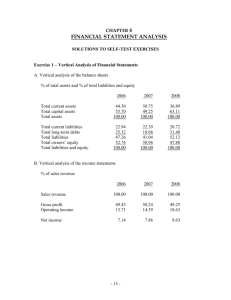

Chapter 4 Evaluating a Firm’s Financial Performance Chapter Objectives Financial Ratio Analysis Dupont Analysis Limitations of Ratio Analysis Firm Performance and Shareholder Value Financial Ratios Accounting data stated in relative terms Financial Ratios Help identify financial strengths and weaknesses of a company by examining: – Trends across time – Comparisons with other firms’ ratios Financial Ratios Examine: How liquid is a firm? Is management generating adequate operating profits on the firm’s assets? How is the firm financing its assets? Is management providing a good return on the capital provided by the shareholder? How liquid is a firm? Liquidity is the ability to meet maturing debt obligations Measured by two approaches: – Comparing cash and assets that can be converted into cash within the year with liabilities that are coming due within the year – Examines the firm’s ability to convert accounts receivables and inventory into cash on a timely basis Measuring Liquidity: Approach 1 Compare a firm’s current assets with current liabilities – Current Ratio – Acid Test or Quick Ratio Current Ratio Compares cash and current assets that should be converted into cash during the year with the liabilities that should be paid within the year Current Assets / Current liabilities Acid Test or Quick Ratio Compares cash and current assets (minus inventory) that should be converted into cash during the year with the liabilities that should be paid within the year. More restrictive than the current ratio because it eliminates inventories (Current assets – inventory) / Current liabilities X Company Balance Sheet Assets Cash $75 Accounts Rec. $150 Inventory $175 Equip/Bldg $1,200 Acc Dep <$100> Total Assets $1,500 Liabilities and O.E. Accounts Pay $600 L-Term Debt $500 Total Liabilities $1100 Owner’s Equity Common Stk $200 Retained Earn. $200 Total O.E.$400 Total L + OE $1,500 X Company Income Statement Sales (All Credit) Cost of Goods Sold Gross Profits Marketing and Admin Depreciation Total Operating Exp Operating Profits (EBIT or Operating Income) Interest Expense Income Before Taxes Taxes Net Income $2,000 $1,200 $800 $80 $70 $150 $650 $50 $600 $100 $500 X Company Ratio Analysis Current Ratio current assets/current liabilities 400/600 = .667 Acid-Test Ratio (Current assets – inventory) / current liabilities (400 – 150) / 600 = .416 Measuring Liquidity: Approach 2 Measures a firm’s ability to convert accounts receivable and inventory into cash Average Collection Period Accounts Receivable Turnover Inventory Turnover Cash Conversion Cycle Average Collection Period The conversion of accounts receivable into cash, is measured by calculating how long it takes to collect the firm’s receivables Accounts Receivable / Daily Credit Sales X Company Ratio Analysis Average Collection Period 150 / (2,000 / 365) = 27.38 Accounts Receivable Turnover 2,000 / 150 = 13.33 Inventory Turnover 1,200 / 175 = 6.86 Accounts Receivable Turnover How many times accounts receivable are “rolled over” during a year Credit Sales / Accounts Receivable Inventory Turnover How many times is inventory rolled over during the year? Cost of Goods Sold / Inventory Cash Conversion Cycle Sum of the days of sales outstanding (average collection period) and days of sales in inventory less the days of payables outstanding. Cash Days of Conversion = Sales Cycle Outstanding + Days of Sales in Inventory - Days of Payables Outstanding Days of Sales Outstanding Average Collection Period Accounts Receivable / (Sales / 365) Days of Sales in Inventory Average age of the inventory or average number of days that a dollar of inventory is held by the firm Inventory / (Cost of Goods Sold / 365) Days of Payables Outstanding Average age in days of the firm’s accounts payable Accounts Payable / (Cost of Goods Sold /365) Cash Conversion Cycle for X Company Days of Sales Outstanding = Accts Rec (Sales/365) = 150 (2000/365) = 27.37 Days of Sales In Inventory = Inventory (Cost of Goods Sold/ 365) = 175 (1200/365) = 53.23 Days of Payables Outstanding = Accts Payable (Cost of Goods Sold/ 365) = 600 (1200/365) = 182.50 Is Management Generating Adequate Operating Profits on the Firm’s Assets? Operating Income Return on Investment (OIROIO) Operating Profit Margin Total Asset Turnover Fixed Asset Turnover Return on Assets Operating Income Return on Investment Level of profits relative to the assets or Income generated per $1 of assets OIROI = Operating Income/Total Assets or OIROI = Operating Profit Margin X Total Asset Turnover Operating Profit Margin Examines operating profitability Operating Income / Sales Total Asset Turnover How efficiently a firm is using its assets in generating sales Measures the dollar sales per $1 of Assets Sales / Total Assets Fixed Asset Turnover Examines investment in fixed assets for sales being produced Measures the dollar sales per $1 of fixed assets Sales / Fixed Assets Alternate OIROI OIROI = Operating Profit Margin X Total Asset Turnover OIROI = Operating Income Sales X Sales Total Assets Return on Assets ROA = Net Income / Total Assets X Company Ratio Analysis OIROI Operating Profit Margin Total Asset Turnover Fixed Asset Turnover Alternate OIROI 650 2000 ROA 650 / 1500 650 / 2000 2000 / 1500 2000 / 1100 X 2000 = .433 = .3250 = 1.333 = 1.82 = .433 1500 500 / 1500 = .333 How is the Firm Financing Its Assets? Does the firm finance assets more by debt of equity? Debt Ratio Times Interest Earned Debt Ratio What percentage of the firm’s assets are financed by debt? Total Debt / Total Assets Times Interest Earned Examines the amount of operating income available to service interest payments or The number of times the firm is earning or covering its interest payments Operating Income / Interest X Company Ratio Analysis Debt Ratio Times Interest Earned 650 / 50 1100 / 1500 = 73.33% = 13 Is Management Providing a Good Return on the Capital Provided by the Shareholders? Return on Common Equity Return on Common Equity Accounting Return on the common stockholders’ investment Net Income / Common Equity X Company Ratio Analysis Return on common equity Net Income / Common Equity 500 / 400 = 1.25 or 125% DuPont Analysis An alternative method to analyze a firm’s profitability and return on equity Allows management to see more clearly what drives return on equity and the interrelationships among: net profit margin, asset turnover, and common equity ratio. Return on Common = ROA / Common Equity Equity Total Assets ROA Alternative Calculation ROA = Net Income / Total Assets or Net Profit Margin (Net Income Sales) X X Total Asset Turnover (Sales Total Assets) DuPont Equation Net Income Sales X Sales Ttl Asts 500/2000 X 2000/1500 ( .25 1.33 ) X / / Cmn Eqty Ttl Asts / 400/1500 .267 = 1.245 Limitations of Ratio Analysis Difficulty in identifying industry categories or finding peers Published peer group or industry averages are only approximations Accounting practices differ among firms Financial ratios can be too high or too low Industry averages may not provide a desirable target ratio or norm Use of average account balances to offset effects of seasonality Economic Value Added (EVA) Measures a firm’s economic profit, rather than accounting profit Recognizes a cost of equity and a cost of debt EVA = (r-k) X C where: r = Operating income return on invested capital k = Total cost of capital C = Amount of capital (Total Assets) invested in the firm