December 31, 2015

Aggressive Growth Portfolio

OBJECTIVE & STRATEGY

Aggressive Growth Portfolio is a mutual fund that seeks to achieve high (greater than the stock market as a whole), long-term appreciation in the value of its

shares. Under normal market conditions, the Portfolio invests in stocks and stock warrants of U.S. and foreign companies that are expected to have a higher

profit potential than the stock market as a whole and whose shares are valued primarily for potential growth in revenues, earnings, dividends or asset values

rather than for current income. The Portfolio may invest in shares of companies of any market capitalization and intends that, at any one time, it will hold stocks

of issuers from at least twelve different industry groups and it ordinarily will hold the stocks of small-, mid- and large-capitalization companies.

TOP 15 HOLDINGS

PORTFOLIO CHARACTERISTICS

(as a % of net assets)

Maximum Sales Charge 1

No Load

Facebook, Inc. Class A

9.17%

Inception Date

Lockheed Martin Corporation

5.44%

Symbol

PAGRX

Amgen, Inc.

5.08%

CUSIP

714199304

FedEx Corporation

4.66%

Current NAV per Share

$58.48

Celgene Corporation

4.12%

Portfolio Turnover

5.06%

Air Products & Chemicals, Inc.

4.07%

Expense Ratio 2

1.20%

Costco Wholesale Corporation

4.04%

Minimum Initial Purchase

$1,000

Autodesk, Inc.

3.81%

Minimum Subsequent Purchase

Gilead Sciences, Inc.

3.49%

Disney (Walt) Company

3.29%

HollyFrontier Corporation

3.12%

Parker-Hannifin Corporation

3.04%

Morgan Stanley

2.99%

Illinois Tool Works, Inc.

2.90%

Williams-Sonoma, Inc.

2.74%

January 2, 1990

2

$100

Aggressive Growth Portfolio’s investment objectives, risks, charges and

expenses must be considered carefully before investing. The Prospectus

contains this and other important information. It may be obtained by calling

(800) 531-5142 or visiting www.permanentportfoliofunds.com. Read it

carefully before investing.

While Aggressive Growth Portfolio is no load, there are management

fees and operating expenses that do apply. Such fees and expenses

are described in the Fund’s Prospectus.

1

Portfolio Turnover and Expense Ratio are for the year ended January 31,

2015, as stated in our most recent Prospectus, dated June 1, 2015, as

amended January 22, 2016.

2

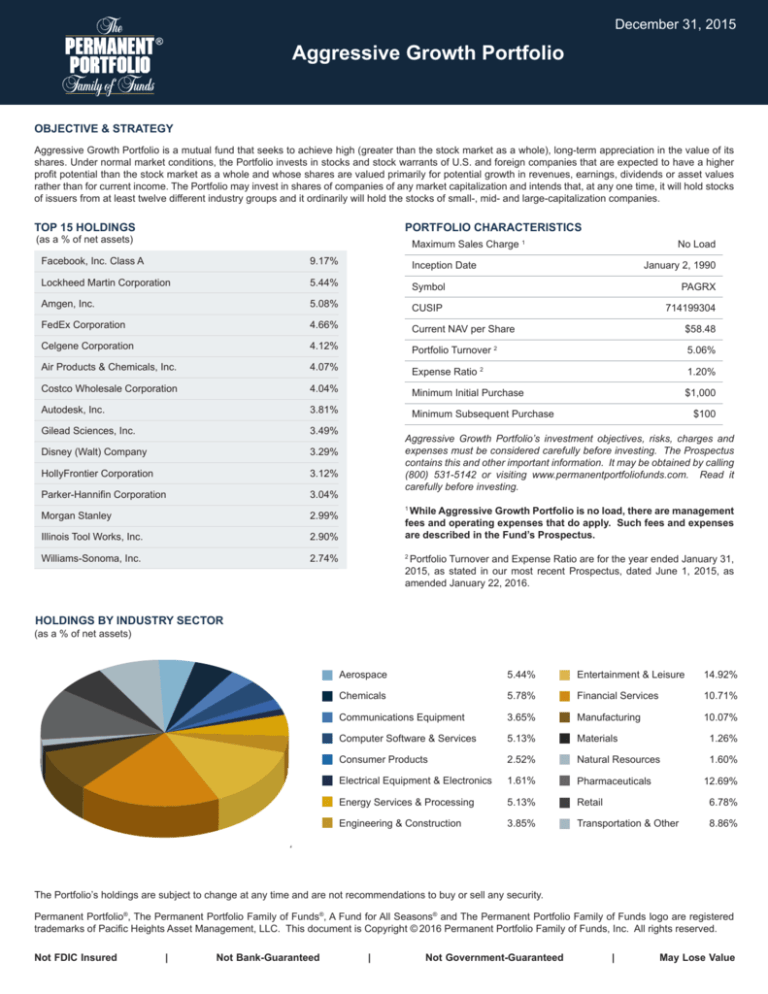

HOLDINGS BY INDUSTRY SECTOR

(as a % of net assets)

Aerospace

5.44%

Entertainment & Leisure

14.92%

Chemicals

5.78%

Financial Services

10.71%

Communications Equipment

3.65%

Manufacturing

10.07%

Computer Software & Services

5.13%

Materials

1.26%

Consumer Products

2.52%

Natural Resources

1.60%

Electrical Equipment & Electronics

1.61%

Pharmaceuticals

Energy Services & Processing

5.13%

Retail

6.78%

Engineering & Construction

3.85%

Transportation & Other

8.86%

12.69%

The Portfolio’s holdings are subject to change at any time and are not recommendations to buy or sell any security.

Permanent Portfolio®, The Permanent Portfolio Family of Funds®, A Fund for All Seasons® and The Permanent Portfolio Family of Funds logo are registered

trademarks of Pacific Heights Asset Management, LLC. This document is Copyright © 2016 Permanent Portfolio Family of Funds, Inc. All rights reserved.

Not FDIC Insured

|

Not Bank-Guaranteed

|

Not Government-Guaranteed

|

May Lose Value

December 31, 2015

Aggressive Growth Portfolio

LIPPER RANKINGS (for the periods ended December 31, 2015)

Category: Lipper Multi-Cap Core Funds

Annualized Total Returns

Rank

Percentile

1 Year

334/343

98%

3 Years

255/323

79%

5 Years

226/292

78%

10 Years

199/230

87%

Lipper Analytical Services, Inc. is an independent mutual fund research

and rating service. Each Lipper average represents a universe of funds

with similar investment objectives. Rankings for the periods shown are

based on fund total returns with dividends and distributions reinvested

and do not reflect sales charges. The highest percentile rank is 1 and

the lowest is 100. Lipper ratings are not intended to predict future results

and Lipper does not guarantee the accuracy of this information. Lipper

2016. Reuters. All Rights Reserved. Past performance is no guarantee

of future results.

AVERAGE ANNUAL TOTAL RETURNS (for the periods ended December 31, 2015)

Since Inception

5 Years 10 Years 15 Years January 2, 1990

Year-To-Date

1 Year

3 Years

Return Before Taxes

-11.37%

-11.37%

10.49%

8.52%

4.88%

5.71%

9.78%

Return After Taxes on Distributions

-12.61%

-12.61%

9.51%

7.66%

3.40%

4.60%

8.88%

-5.39%

-5.39%

8.21%

6.79%

3.94%

4.66%

8.57%

.21%

.21%

12.66%

11.30%

7.75%

5.80%

9.93%

1.38%

1.38%

15.13%

12.57%

7.31%

5.00%

9.22%

Return After Taxes on Distributions and Sale of Portfolio Shares

Dow Jones Industrial Average

Standard & Poor’s 500 Composite Stock Index

Performance data quoted represents past performance. Past performance (before and after taxes) is not a guarantee of how the Portfolio will

perform in the future. Investment returns and principal values of an investment will fluctuate so that an investor’s shares, when redeemed, may

be worth more or less than their original cost. Investment performance, current to the most recent month-end, may be lower or higher than the

performance quoted. It may be obtained by calling (800) 531-5142 or visiting www.permanentportfoliofunds.com.

Dow Jones Industrial Average is an average of the stock prices of thirty large companies and represents a widely recognized unmanaged portfolio of common

stocks. Standard & Poor’s 500 Composite Stock Index is a market-capitalization weighted index of common stocks and represents an unmanaged portfolio of

common stocks. Returns shown for these indices reflect reinvested dividends as applicable, but do not reflect a deduction for fees, expenses or taxes. You

cannot invest directly in an index. After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the

impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. In particular, after-tax returns

are not relevant to investors who hold their shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts.

GROWTH OF $10,000 INVESTMENT (December 31, 2005 through December 31, 2015)

$30,000

Dow Jones Industrial Average

$21,092

Standard & Poor’s 500 Composite Stock Index

$20,242

$20,000

$10,000

Aggressive Growth Portfolio

$16,515

$0

‘05

‘06

‘07

‘08

‘09

‘10

‘11 ‘12

‘13

‘14

‘15

The chart above illustrates the performance of $10,000 invested in Aggressive Growth Portfolio shares ten years ago compared to performance of

Dow Jones Industrial Average and Standard & Poor’s 500 Composite Stock Index over the same period and does not reflect the deduction of taxes an

investor would pay on Portfolio distributions or on the redemption of Portfolio shares. Returns for Aggressive Growth Portfolio reflect reinvestment

of all dividends and distributions and deduction of all fees and expenses, except the $35 one-time account start-up fee. If such start-up fee was

$30000

reflected, returns would be less than shown.

December 31, 2015

Aggressive Growth Portfolio

REASONS TO CONSIDER AGGRESSIVE GROWTH PORTFOLIO

High Profit Potential. Aggressive Growth Portfolio seeks to invest in stocks and stock warrants of U.S. and foreign companies that are expected

to have a higher profit potential than the stock market as a whole and whose shares are valued primarily for potential growth in revenues, earnings,

dividends or asset values rather than for current income. Such companies may include those involved in technology, medicine, capital goods, natural

resources, energy, construction, transportation, finance, entertainment or service, those developing or exploiting new industries, products, services or

markets, or those whose shares are otherwise undervalued. The Portfolio’s Adviser does not rely on any one of these factors, but instead considers

all of them.

Fully Invested in the Stock Market at All Times. Frequent switching of capital into and out of the stock market greatly magnifies the risk of investing

in stocks. Active switchers may suffer losses when the stock market declines and then miss out on profits when the market recovers. The result is

that losses – not profits – compound. By staying fully invested in stocks at all times, Aggressive Growth Portfolio avoids the unnecessary hazards of

switching. This policy creates greater potential for high profits in the long run. Tax Planning. Aggressive Growth Portfolio is managed to reduce the tax burden on you, the investor. The Portfolio chooses investments for capital

appreciation potential rather than for income and it plans investment purchases and sales, whenever practical, to minimize capital gain. In addition,

the Portfolio reinvests its profits to achieve further gains and makes only the minimum taxable distributions required for it to qualify for the favorable tax

treatment available to investment companies. All income and profits that are not distributed to you are added to the redemption value of your shares.

The money is available to you at any time – but is not subject to income tax until you decide to take it.

FOR MORE INFORMATION

FUND

INVESTMENT ADVISER

Financial Advisers

Institutional Sales Office: (866) 792-6547

Permanent Portfolio Family of Funds, Inc.

600 Montgomery Street, Suite 4100

San Francisco, California 94111-2702

Telephone: (415) 398-8000

www.permanentportfoliofunds.com

Pacific Heights Asset Management, LLC

Michael J. Cuggino, President & Portfolio Manager

600 Montgomery Street, Suite 4100

San Francisco, California 94111-2702

Telephone: (415) 398-8000

Individual Investors

Shareholder Services Office: (800) 531-5142

Transfer Agent: (800) 341-8900

December 31, 2015

Aggressive Growth Portfolio

ANNUAL RETURNS SINCE INCEPTION

Return Before

Taxes

Return After

Return After Taxes

Change in

Taxes

on Distributions and Net Asset Value

on Distributions

Sale of Portfolio

Shares

Capital Gain

Distributions

(Long-Term)

Non-Dividend

Distributions

Ordinary

Income

Dividends

2015

-11.37%

-12.61%

-5.39%

-$11.60

$2.74

$0.00

$0.95

2014

6.54%

5.83%

4.28%

$2.41

$1.79

$0.00

$0.21

2013

42.86%

42.01%

24.95%

$19.09

$1.39

$0.00

$0.33

2012

20.67%

26.26%

13.94%

$7.40

$0.61

$0.00

$0.46

2011

-7.52%

-8.43%

-3.64%

-$6.48

$2.63

$0.00

$0.32

2010

17.71%

17.26%

12.09%

$6.10

$1.11

$0.00

$0.11

2009

30.73%

30.73%

19.98%

$9.77

$0.00

$0.00

$0.00

2008

-39.10%

-41.54%

-22.52%

-$47.06

$11.77

$3.19

$0.09

2007

4.59%

3.03%

5.12%

-$4.89

$8.87

$0.00

$0.00

2006

9.10%

4.62%

12.02%

-$21.92

$31.93

$0.10

$0.10

2005

20.73%

20.58%

13.68%

$17.41

$0.90

$0.00

$0.00

2004

13.32%

11.54%

8.60%

$6.71

$3.94

$0.00

$0.00

2003

37.45%

37.45%

24.34%

$22.23

$0.00

$0.00

$0.00

2002

-24.69%

-24.69%

-15.16%

-$19.44

$0.00

$0.00

$0.00

2001

.92%

.84%

.64%

$0.47

$0.32

$0.00

$0.00

2000

.71%

-1.09%

2.09%

-$7.10

$7.41

$0.00

$0.00

1999

31.49%

31.49%

19.02%

$20.50

$0.00

$0.00

$0.00

1998

13.81%

13.81%

8.34%

$7.91

$0.00

$0.00

$0.00

1997

32.61%

31.16%

20.94%

$11.70

$2.89

$0.00

$0.19

1996

14.47%

14.19%

8.76%

$5.49

$0.05

$0.00

$0.25

1995

32.50%

31.02%

20.20%

$8.57

$1.51

$0.00

$0.11

1994

.97%

.91%

.59%

$0.27

$0.02

$0.00

$0.03

1993

21.84%

21.29%

13.40%

$5.15

$0.47

$0.00

$0.02

1992

19.84%

18.97%

13.67%

$3.77

$0.47

$0.00

$0.13

1991

30.32%

30.28%

20.92%

$5.12

$0.00

$0.00

$0.02

2-Jan-90

-15.62%

-15.62%

-11.25%

-$3.10

$0.00

$0.00

$0.00

Performance data quoted represents past performance. Past performance (before and after taxes) is not a guarantee of how the Portfolio will

perform in the future. Investment returns and principal values of an investment will fluctuate so that an investor’s shares, when redeemed, may

be worth more or less than their original cost.

After-tax returns are calculated using the historical highest individual federal margin income tax rates and do not reflect the impact of state and local taxes.

Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. In particular, after-tax returns are not relevant to investors

who hold their shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts.

Aggressive Growth Portfolio’s stock market investments will fluctuate, sometimes rapidly and unexpectedly. Aggressive growth stock

investments are subject to greater market risk of price declines, especially during periods when the prices of U.S. stock market investments, in

general, are declining. The Portfolio invests in smaller and medium capitalization companies, which will involve additional risks such as limited

liquidity and greater volatility. The Portfolio also invests in foreign securities, which will involve greater volatility and political, economic and

currency risks and differences in accounting methods.

Mutual fund investing involves risk; loss of principal is possible. The Fund is distributed by Quasar Distributors, LLC, a member of FINRA.