BEVERAGES

advertisement

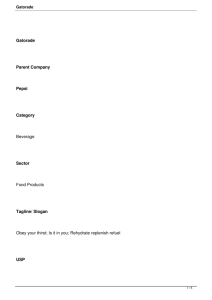

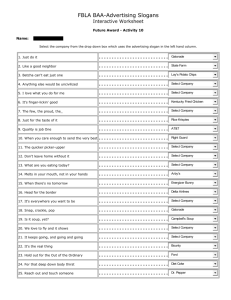

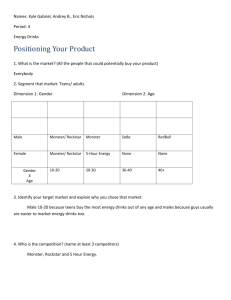

BEVERAGES Specialty Where the Gains Are RTD Tea and Coffee C-store sales, 52 weeks ending Dec. 29, 2013 C-store sales, 52 weeks ending Dec. 29, 2013 While not gaining at the double-digit clip of 2012, energy-drink sales in c-stores rose a respectable 6.2% in 2013 to reach $6.7 billion in the 52 weeks ending Dec. 29, 2013, according to IRI. Unit sales grew nearly 86%. Nielsen figures show c-store energy-drink dollar sales up 7.7% in the 52 weeks ending Jan. 25, 2014, to reach $6.2 billion, with units up 9.9%. Sales of sports drinks, according to IRI figures, hit the brakes in 2013, with units off 2.5%. Nielsen data shows a tepid 1.6% bump up in units for the 52 weeks ending Jan. 25, 2014. In other beverages, RTD coffee saw a healthy 10% jump in dollar and unit sales, driven by the North American Coffee Partnership’s Starbucks line, according to IRI. Drink type C-store sales ($ millions) PCYA* Unit sales (millions) PCYA* Energy drinks $7,521.4 4.1% 3,035.0 5.9% • Non-aseptic $6,704.5 6.2% 2,775.3 7.6% $803.5 –8.8% 254.5 –8.0% $13.3 –55.4% 5.3 –46.5% $2,454.0 –0.3% 1,435.4 –2.5% • Energy shots** • Energy-drink mix Sports drinks RTD tea*** $1,229.0 RTD cappuccino/ iced coffee $733.3 2.2% 10.3% 975.7 269.5 –0.6% 10.0% While c-store sales of ready-to-drink (RTD) teas appear stuck in neutral—IRI data shows units off 0.6% for the 52 weeks ending Dec. 29—RTD coffee and cappuccino saw unit sales up 10%. The segment is dominated by brands from North American Coffee Partnership, a joint venture between Starbucks and PepsiCo. Ready-to-Drink Teas by Brand $182.9 6.2% 93.9 7.0% Shelf-stable non-fruit drinks $53.8 –6.5% 34.5 –8.2% Source: IRI C-store sales, 52 weeks ending Jan. 25, 2014 –6.5% 257.2 –5.8% Lipton Brisk Tea $153.2 6.3% 139.4 3.9% Lipton Pure Leaf $125.1 25.1% 71.2 26.3% Gold Peak $96.4 12.5% 57.8 13.6% AriZona Arnold Palmer $86.3 –5.3% 83.1 –4.6% $1,229.0 2.2% 975.7 –0.6% Total (including brands not shown) Ready-to-Drink Coffees by Brand C-store sales Brand ($ millions) 4.5% 150.6 2.1% Starbucks Doubleshot $249.2 2.7% 91.1 1.9% $42.8 ** 20.0 ** Private label $5.9 –10.9% Starbucks Doubleshot Light $5.0 11.9% 1.9 12.7% $733.3 10.3% 269.5 10.0% Total (including brands not shown) Sports drinks $2,317.5 2.5% 1,324.8 1.6% RTD tea $1,308.3 1.1% $685.9 12.2% .1 Sources: The Nielsen Co., Dr Pepper Snapple Group Percent increase in sales of energy drinks in 2013, according to IRI ** See p. 16 for brand ranking 12.4% 3.5 –16.2% Source: IRI 9.9% 251.7 (millions) $424.7 2,517.8 RTD coffee PCYA* Unit sales PCYA* Starbucks Frappuccino 7.7% –1.6% (millions) $269.4 $6,165.9 982.5 PCYA* Unit sales PCYA* AriZona Energy drinks 74 ($ millions) Starbucks RTD milk/milk substitutes * Percent change from a year ago C-store sales Brand Customer in Focus The negative buzz about potential health concerns surrounding energy drinks has given some consumers pause, according to research by Mintel. “Those who are active in the segment have either added or kept consumption the same in 2013 compared to 2012,” the research firm says in its latest report on the category. “Yet the media attention had some effect, with 11% of respondents drinking fewer energy drinks and 8% cutting back on energy shots in 2013.” Almost four in 10 respondents who were drinking fewer energy drinks said it was because they believed the beverages were not good for their health, Mintel reports. *** Canned/bottled only. Refrigerated teas totaled $189.1 million (up. 1.1%) and 108.2 million units sold (up 1.7%), according to IRI. C S P C ateg o ry Man a g emen t H a n d bo o k 2 014 BEVERAGES Specialty Energy-Drink Trends Red Bull gained nearly a point in share during the 52 weeks ending Dec. 29, 2013, to provide more than 38% of c-store energy-drink sales, according to IRI. Data for the last quarter of 2013 shows that the eight of the top 10 UPCs picked up dollar and unit sales, with the 16-ounce Monster the top-selling item. Market Share: Energy Drinks by Brand Energy Drinks by Brand C-store sales, 52 weeks ending Dec. 29, 2013 C-store sales, 52 weeks ending Dec. 29, 2013 Brand C-store sales PCYA* Unit sales PCYA* (millions) ($ millions) Brand Dollar share Point change ny Red Bull 38.7% 0.9 Red Bull $2,595.2 8.6% 896.4 10.7% ny Monster Energy 12.6% –0.7 Monster $847.9 0.8% 378.7 1.4% ny Monster Rehab 4.3% –0.4 Monster Rehab $289.1 –1.8% 130.1 –1.0% ny Java Monster 3.7% 0.2 Java Monster $251.0 12.0% 100.6 13.9% ny Nos 3.6% 0.0 Nos $244.2 7.5% 117.3 10.9% ny Monster Energy Zero Ultra 3.4% 3.0 Monster Energy Zero Ultra $231.0 662.8% 105.6 653.9% ny Monster Energy Lo-Carb 3.4% –0.9 Monster Energy Lo-Carb $231.0 –15.5% 97.1 –16.2% ny Rockstar 3.3% –0.4 Rockstar $222.1 –4.0% 108.9 –3.1% Monster Mega Energy $217.1 2.3% 70.9 3.1% Monster Energy Absolutely Zero $149.3 –21.2% 64.6 –23.3% $7,521.4 4.1% 3,035.0 5.9% Total (including brands not shown) Latest Quarter: Energy UPCs C-store sales, 13 weeks ending Dec. 29, 2013 Monster (16-oz.) $196.9 10.2% 89.6 9.5% Red Bull (12-oz.) $181.4 12.1% 62.4 12.4% Red Bull (8.4-oz.) $122.1 –3.5% 55.8 –4.0% Red Bull (16-oz.) $95.4 6.0% 25.0 5.9% $53.8 12.0% 17.6 13.2% (16-oz.) $52.7 76.2% 23.9 72.9% Red Bull (20-oz.) $49.5 4.4% 10.7 4.2% 5-hour Energy Extra Strength (berry, 1.93-oz.) $42.3 –10.0% 12.7 –9.6% Rockstar Energy (16-oz.) $39.7 3.2% 20.7 5.1% Red Bull (12-oz.) $39.6 7.0% 13.5 6.9% $1,807.1 7.9% 730.5 10.1% Monster Mega Energy (24-oz.) Monster Energy Zero Ultra Total (including UPCs not shown) Source: IRI 39+13+43222S ny Monster Mega Energy 3.2% –0.1 ny Monster Energy Absolutely Zero 2.2% –0.8 21.6% N/A ny Others**** Source: IRI Category Management Tip According to Nielsen data covering the 24 weeks ending Jan. 25, 2014, tea dollar sales in c-stores are growing, with premium teas accounting for the bulk of the increase. Ivan Alvarado, director of category management for Dr Pepper Snapple Group, says retailers can drive margin by enhancing the position and space of premium teas. “Focus on brands that will help drive profitability (penny profit) for your tea category by placing them in more visible positions and ensure sufficient space is provided to these brands,” says Alvarado. **** Brands with less than 2% share C S P C at e g o ry M a n agement Handb ook 2 0 1 4 75 BEVERAGES Specialty Sports-Drink Trends C-store sales, 52 weeks ending Dec. 29, 2013 After strong gains in 2012, sports drinks saw sales decelerate in 2013, according to figures from IRI and Nielsen. PepsiCo’s Gatorade Perform supplied more than two-thirds of dollar sales in the 52 weeks ending Dec. 29, 2013, and nine of the top 10 UPCs in the final quarter of the year, IRI reports. Quarterly Look: Sports Drink UPCs C-store sales, 13 weeks ending Dec. 29, 2013 C-store sales UPC PCYA* ($ millions) Unit sales PCYA* (millions) Gatorade Perform Thirst Quencher (Lemon Lime, 32-oz.) $24.5 –1.8% 12.3 –3.2% Gatorade Perform Thirst Quencher (Orange, 32-oz.) $21.6 –1.9% 10.8 –3.3% Gatorade Perform Thirst Quencher (Cool Blue, 32-oz.) $21.5 –0.4% 10.7 –2.1% Gatorade Perform Thirst Quencher (Fruit Punch, 32-oz) $21.5 –3.2% 10.7 –5.1% Gatorade Perform Thirst Quencher Frost (Glacier Freeze, 32-oz.) $19.2 4.7% 9.6 3.8% Gatorade Perform Thirst Quencher (Glacier Cherry, 32-oz.) $16.2 N/A 7.9 N/A Powerade Ion4 (Mountain Berry Blast, 32-oz.) $16.1 –4.2% 11.1 –0.2% Gatorade Perform Thirst Quencher (Fruit Punch, 20-oz.) $15.9 5.0% 11.1 4.1% Gatorade Perform Thirst Quencher (Lemon Lime, 20-oz.) $14.9 8.2% 10.4 6.7% Gatorade Perform Thirst Quencher (Cool Blue, 20-oz.) $14.6 15.7% 10.3 14.5% $453.4 6.4% 262.6 5.5% Total (including UPCs not shown) Sports Drinks by Brand** Market Share: Sports Drinks by Brand Brand Dollar share Point change C-store sales Brand ($ millions) ny Gatorade Perform 66.6% –0.7 Gatorade Perform ny Powerade Ion4 14.7% –2.8 ny Gatorade G2 Perform 6.3% –0.8 ny Gatorade 5.7% 4.9 ny Powerade Zero Ion4 2.6% –0.4 ny Powerade 2.4% 1.7 ny Others*** 1.7% N/A 76 66+15+632 PCYA* Unit sales PCYA* (millions) $1,629.0 –1.3% 908.7 –2.9% Powerade Ion4 $359.3 –16.1% 256.6 –15.1% Gatorade G2 Perform $153.6 –12.1% 86.9 –14.3% Gatorade $138.7 596.5% 67.6 590.7% Powerade Zero Ion4 $62.7 –12.8% 42.4 –11.1% Powerade $59.6 235.9% 44.5 227.4% Private label $10.0 0.0% 9.1 18.1% Gatorade G2 $9.6 3.0% 5.3 –1.1% Bodyarmor $7.3 73.7% 3.1 85.0% Gatorade X Factor $3.6 30.0% 1.7 20.7% $2,447.0 –0.3% 1,433.0 –2.4% Total (including brands not shown) Source: IRI * Percent change from a year ago ** Brands with less than 2% share *** Non-aseptic only C S P C ateg o ry Man a g emen t H a n d bo o k 2 014