to full article

advertisement

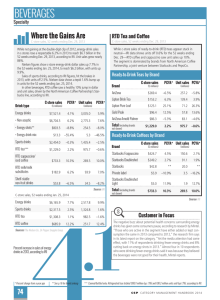

2012 Beverage Report A Six-Pack of Insights Consumer data to drive product placement and promotions as suppliers and research firms battle ‘insights desert’ By Steve Holtz || sholtz@cspnet.com W hether you want to call it a blessing or just a lot of pressure, it’s generally agreed that beverages are the biggest draw for getting customers into a convenience store. In fact, 58% of consumers reported buying a nonalcohol beverage on their most recent c-store visit, driving more traffic into the store than any other major category, according to consumer research specialists The NPD Group. And 64% of these purchases were packaged beverages. But that’s just the tip of the consumerdata iceberg. In this report, CSP aims to provide statistics, data points and consumer insights to apply to your store(s) based on typical traffic, demographics and other factors. Breaking It Down For every “universal” suggestion to help sell more beverages, there are three, four, probably more ideas that are going to be specific to a region, a convenience-store chain or even a store. “You clearly have a ton of traffic that’s going directly back to the cold vault to buy a beverage, but there’s also a significant subset [of consumers] that’s coming in just CSP F ebruary 2012 51 to pay for gas or to buy something else that haven’t made that voyage back to the cold vault,” says Brad Higginbotham, director of customer advisory services for The Coca-Cola Co., Atlanta. “Making the beverages as easy to access as possible is key. We’ve said for years we want to be within an arm’s reach of desire for the shopper.” Each of the vendors interviewed for this story devote considerable time and effort to collecting consumer-insights data, some of which they were willing to share, and others that they opted to keep close to the vest pending proprietary agreements. The convenience retail channel “is an insights desert compared to other channels in the amount of data that’s available to us,” admits Scott Finlow, vice president, shopper and channel insights for PepsiCo, Purchase, N.Y. “So our approach is more direct investment in understanding the channel and to make those investments directly in partnership with our customers so that we can get real-time learnings.” Consider it the result of the c-store industry once being the underappreciated mutt of retailing: It’s lovable, and always there when you need it, but it’s the first dog to get kicked to the curb in the fight for the dog bowl or, in this case, budgeting the funds to collect consumer insights. Shopper Opportunities But that’s changing as retailers, consultancies, researchers and suppliers realize the value of the c-store industry. “When we look at shopper behavior and what is driving shoppers to convenience and gasoline outlets vs. other choices that they have, beverage is the No. 1 reason that they’re going into a store,” says Jeff Jones, general manager for PepsiCo. “So what that means for our retail partners is: They need to think about the role that beverages can play in driving traffic to their outlets.” Adds Manny Zayas, vice president, small format for St. Louis-based Anheuser-Busch InBev, “If you think about a convenience store, the nature of it, it’s used for 100 different occasions throughout the day. Whether you’re talking about folks on their way home from work, or they’re headed out to a party or some other event, it’s an important thing to be prepared to service a lot of different shopper opportunities.” While such data can influence a retailer’s set, it is just as likely to direct one’s promotions. “If you have a cleaner, brighter, welllaid-out store, both Bubba and the professional are going to go in there,” says Steve Seager, senior retail marketing manager for Nestle Waters North America Inc., Stamford, Conn. “But we did some research on how these various segments would respond to different kinds of promotional offers. So it gets to what else they purchase and how they purchase and why are they buying in a c-store.” Higginbotham says Coca-Cola is doing the same. “We’re leveraging all those insights we have about the shopper, which channels they’re going to for which occasions and which need states, to then build out what is the right packaging and promotional strategy for each of those different channels.” David Portalatin of NPD says promotions appeal to today’s “value-driven” consumers. “That doesn’t always mean the lowest available price,” he says. “Many consumers are looking for a ‘deal’ as a means to either get more (quantity) or trade up (quality). Consumers in c-stores are more likely than average to report buying a beverage on deal. Retailers can leverage this to increase basket size by offering bundles, two-for-one specials or incentives to upsize. They can also increase check size by offering attractive discounts on premium items.” So just whom should you be marketing to? Read on for the appropriate insights, data and statistics. Each of the vendors cited in these pages encourages retailers to contact their representatives with requests for additional info as needed. CSP F ebruary 2012 53 General Beverage Current C-Store Sales Trends For most of 2011, packaged-beverage sales in convenience stores saw some trends continue and new ones emerge. Carbonated soft drinks, in general, continue to struggle, while iced tea continues to break out as a must-have subcategory. Meanwhile, sparkling bottled water is seeing double-digit growth. The good news: The most volume growth came in subcategories that offer the largest margin (notably energy drinks and wine). And where there were declines in volume—small drops for both beer and carbonated soft drinks (CSDs)—there were still increases in dollar sales, thanks to price increases. Consumer Insights Nonalcohol-beverage sales account for more than $16 billion, with c-stores leading all channels in sales of single-serve beverages. Source: Nestle Waters North America/Mintel The cold vault is the top-shopped section and key trip driver for a c-store: ▶ 29% of c-store shoppers said they visit for the alcohol-beverage cooler. ▶ 21% visit for the nonalcoholbeverage cooler. Source: E & J Gallo Winery/SmartRevenue Overwhelmingly, the decision about beverage type, brand, flavor/ variety and size are all made before a shopper has entered the store. Source: Dr Pepper Snapple Group/LG&P Research 58% 24% 57% Percentage of consumers who bought a nonalcohol beverage on their most recent c-store visit, driving more traffic into the store than any other major category. Percentage of c-store shoppers who report buying from the cold vault on impulse; 16% report the purchase was a deal or special price. Percentage of all beverage buyers who said the beverage purchase was the “main reason” he or she visited a c-store that day. ▶ 64% of these purchases were a can or bottled beverage. ▶ 27% were machinedispensed. Source: The NPD Group Source: The NPD Group 80% Percentage of all beverage buyers who specifically planned to buy the beverage type they purchased before entering the store. Source: Dr Pepper Snapple Group/LG&P Research 2 Beverage Categories That Skew Female ▶ Bottled water ▶ Iced tea ▶ Juice ▶ Other noncarbonated beverages Beverage Categories That Skew Male ▶ Beer ▶ Energy drinks ▶ Sports drinks Source: The NPD Group Median number of times per month a c-store shopper buys a beverage. Source: Nestle Waters North America/Ryan Partnership Source: Dr Pepper Snapple Group/LG&P Research CSP F ebruary 2012 55 Beer Consumer Insights The Typical C-Store Beer Shopper is … ▶ Single ▶ Male ▶ 21-34 years old ▶ Blue collar ▶ Earning less than $40,000 a year ▶ Living in a metropolitan area ▶ Hispanic Three Shopper Motivations for Buying Beer in a C-store: ▶ Can buy as needed, managing Current C-Store Sales Trends Total cases of beer sold have slipped a bit, but dollar sales are up. Recession or not, a tip of the hat goes to those higher-margin craft beers and progressive adult beverages (think Four Loko), which may not deliver the volume but still pack a margin and market-basket punch. Of course, light beers and premium beers still rule the day, so don’t throw the baby out with the bath water. $15.3 billion Total c-store dollar sales for 52 weeks ending Nov. 27, 2011, up 2.23% compared to the previous year. 761 million portion control and wallet. ▶ Feels emotionally safe because the setting is familiar and nonjudgmental. ▶ It’s simple; not overwhelmed by choices. Beer Shopping ‘Occasions’: Shed the Day: Transitioning from the “world of work” to “beer time.” Bring the Beer: En route to a party or other social gathering. Chilling at Home: Relaxing alone or with friends/family. The decision to buy beer is often made earlier in the day, while the decision on the brand and pack size is made closer to the point of purchase. Beer-buyer trip frequency is 45% higher than the average c-store shopper. Source: MillerCoors Craft beers are definitely growing, but premium beers continue to be the lion’s share of the business. So it’s really important to think very carefully about how you select your mix and have the right offering. Source: Anheuser-Busch InBev 50% $14.93 3 Percentage of shoppers who think of a convenience store as a place to buy beer. Average ring per c-store trip when craft beer is in the shopping basket. Median number of times per month a c-store shopper buys beer. Source: E & J Gallo Winery/SmartRevenue Source: Boston Beer/SymphonyIRI Source: Nestle Waters North America/Ryan Partnership 70%-80% Total c-store case sales for 52 weeks ending Nov. 27, 2011, down 0.34% compared to the previous year. Source: SymphonyIRI Group Source: MillerCoors CSP Source: E & J Gallo Winery/SmartRevenue Source: MillerCoors Approximate percentage of c-store beer transactions that are considered rote exercises with a goal of “little inconvenience or emotional drama.” 56 The alcohol-beverage cooler is most shopped from 6 to 8 p.m. F e br u a ry 2 0 1 2 32% Percentage of c-store consumers who buy beer at least once a week or more from a particular store. Source: E & J Gallo Winery/SmartRevenue $11.49 Average ring per c-store trip when beer is in the shopping basket. Source: Boston Beer/SymphonyIRI Bottled Water Current C-Store Sales Trends Bottled-water sales trends have turned based on health reports, they’ve turned based on eco-friendly efforts, and they’ve turned based on the economy. Results from 2011 sales suggest a return to growth for the subcategory, with unit sales of PET still water up a healthy 5% even as dollar sales dipped a smidge. On top of that, sparkling-water sales grew double digits in c-stores, most likely on Nestle Waters’ rollout of its regional brands in sparkling formats. Consumer Insights Top reason consumers give for why they are drinking more bottled water: health. Top reason consumers give for why they are drinking less bottled water: cost. Source: Nestle Waters North America Promotional Concepts Most Acted On: ▶ Discount price on bottled water with purchase of gasoline ▶ Discount price with purchase of two bottles of water ▶ Discount price on bottled water with purchase of another beverage ▶ Discount price on bottled water with purchase of a food item Source: Nestle Waters North America/Ryan Partnership Suggested Target Consumer for Pack Sizes: 20-ounce: 25- to 44-year-olds 700 ml. sport cap: Females 25-44 years old 1 liter: Males 25-44 years old 1.5 liter: 25- to 44-year-olds 1 gallon: Males 35 and older; outdoor workers 3 liters: Females 25-44 years old 24-pack: 35 and older; families Source: Nestle Waters North America $2.6 billion 88% 76% Total c-store dollar sales of PET still water for 52 weeks ending Nov. 27, 2011, down 0.36% compared to the previous year. (Sparkling/mineral waters were up 15.66% to $45 million.) Percentage of c-store bottled-water buyers who plan their water purchase prior to entering the store. Percentage of bottled-water buyers who said it is “important” that a c-store carry their preferred package size. 1.8 billion 21% Total c-store unit sales of PET still water for 52 weeks ending Nov. 27, 2011, up 5.1% compared to the previous year. (Sparkling/mineral waters were up 14.33% to 30 million units.) Percentage of bottled-water buyers who had “no particular brand in mind” until after entering the store. Source: SymphonyIRI Group 58 CSP F e br u a ry 2 0 1 2 Source: Nestle Waters North America Source: Dr Pepper Snapple Group/LG&P Research 20% Percentage of bottled-water consumers who said they would not purchase water in a c-store where their preferred package size was not available. Source: Nestle Waters North America CSDs Current C-Store Sales Trends In an age when health and anti-obesity initiatives are the rule of thumb, carbonated soft drinks remain challenged in c-stores and beyond. Still, through ambitious marketing and promotional campaigns by the major manufacturers, volume growth was down only a bit (0.36%), while price increases bumped dollar sales up slightly (0.75%). Top 5 ‘Benefits’ That Drive CSD Sales: ▶ Cool and refreshing ▶ Good by itself, without any food to go along with it ▶ Comforting to drink ▶ Can drink without feeling guilty ▶ A special treat Source: Dr Pepper Snapple Group/LG&P Research Top 5 Other Products in the Market Basket of PackagedCSD Purchasers: Candy or gum 41% Gasoline 39% Lottery tickets 37% Salty snacks 36% Tobacco products 34% Source: Dr Pepper Snapple Group/LG&P Research 85% Percentage of CSD buyers who specifically planned to buy a CSD before entering the store. 83% Percentage of packaged-CSD buyers who planned to purchase a specific CSD brand before entering the store. Source: Dr Pepper Snapple Group/LG&P Research $8.7 billion Most Coke-Friendly Major Markets: Most Pepsi-Friendly Major Markets: Los Angeles Atlanta Houston Washington, D.C. Miami El Paso, Texas Bakersfield/Delano, Calif. Baton Rouge, La. Memphis, Tenn. Fresno, Calif. Source: Buxton Source: Buxton Most Dr PepperFriendly Major Markets: Tulsa, Okla. Nashville, Tenn. Knoxville, Tenn. Louisville, Ky. Pittsburgh Source: Buxton 60 CSP F e br u a ry 2 0 1 2 Total c-store dollar sales for 52 weeks ending Nov. 27, 2011, up 0.75% compared to the previous year. 5.3 billion Total c-store unit sales for 52 weeks ending Nov. 27, 2011, down 0.36% compared to the previous year. Source: SymphonyIRI Group Energy Drinks Current C-Store Sales Trends A few years ago, energy drinks took the c-store industry by storm, offering an entirely new—and highly desirable—subcategory of beverages that attracted key c-store demographics and high margins. More recently, sales growth began to slow as those key consumers grew up, the recession took away discretionary spending and energy shots stole the thunder. In 2011, sales growth was easily in the double digits for both subcategories. Consumer Insights “Selection” is becoming more important for c-store shoppers and is notably important for energy-drink and teacategory buyers, meaning retailers wanting to grow these categories may need to broaden the assortment. Source: The NPD Group 79% C-stores are by far the primary channel for energy drinks. Percentage of energy-drink The other main outlets for purchase are in bars, restaurants buyers who specifically and clubs. A growing number of consumers also purchase planned to buy an energy in grocery/mass/club stores for take-home packs. drink before entering a c-store. Source: Red Bull 71% Percentage of energy-drink buyers who planned to purchase a specific energydrink brand before entering the store. Source: Dr Pepper Snapple Group/ LG&P Research $5.4 billion Total c-store dollar sales for 52 weeks ending Nov. 27, 2011, up 16.40% compared to the previous year. (Energy shots were up 17.74% to $887 million.) 2.2 billion Total c-store unit sales for 52 weeks ending Nov. 27, 2011, up 16.90% compared to the previous year. (Energy shots were up 16.17% to 282 mil- 14-39 lion units.) Source: SymphonyIRI Group Age range of the majority of energy-drink buyers. Gender split is around 70/30 for the category. 65% buyers who visit a c-store ▶ Nothing else ▶ Another energy drink five to 20 times every four Source: Red Bull Percentage of energy-drink weeks; 14% visit fewer than five times, while 21% visit more than 20 times. Source: Red Bull 62 CSP F e br u a ry 2 0 1 2 Top 2 Other Products in the Market Basket of Energy-Drink Purchasers: Iced Tea Wine Current C-Store Sales Trends Current C-Store Sales Trends 19% Consumer Insights Percentage of shoppers Wine shoppers spend who think of a c-store as a more time in a c-store place to buy wine, the same than most other percentage who thinks of a category shoppers do, c-store as a place to buy milk. averaging 140 seconds per visit. Source: E & J Gallo Winery/ SmartRevenue 36% Percentage of consumers who “never thought $1.1 billion Total c-store dollar sales for 52 weeks ending Nov. 27, 2011, up 2.55% compared to the previous year. 72% Percentage of iced-tea buyers who specifically planned to buy an iced tea before entering the store. Source: Dr Pepper Snapple Group/ LG&P Research 910 million $447 million Total c-store dollar sales for 52 weeks ending Nov. 27, 2011, up 11.60% compared to the previous year. 5.7 million Total c-store unit sales for Total c-store unit sales for 52 52 weeks ending Nov. 27, weeks ending Nov. 27, 2011, 2011, up 5.1% compared up 14.09% compared to the to the previous year. previous year. Source: SymphonyIRI Group Source: SymphonyIRI Group 64 CSP F e br u a ry 2 0 1 2 about purchasing wine” in “general market” c-stores, compared to 24% in “affluent stores.” 50% Percentage of customers in “affluent” c-stores who like when the store provides information about wines. Percentage is 38% in “general market” c-stores. Source: E & J Gallo Winery/SmartRevenue