Report to Shareholders - Parkland Fuel Corporation

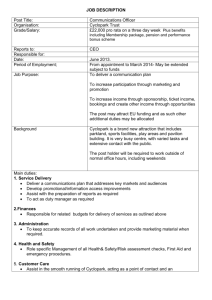

advertisement