a. as you read

advertisement

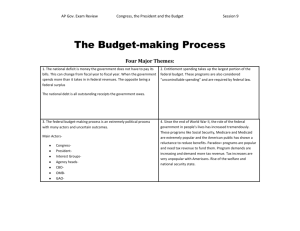

CLASS NAME DATE Section 1" 6uided Reading and Review Taxes A. As You Read Write the answers to the questions below in the blanks provided. The Power to Tax 1. What are the expressed constitutional limitations to the power to tax? a. Taxes may be levied only for public purposes. b. Export. taxes are prohibited. c. Direct taxes must be equally apportioned among the States according to their populations. d. Indirect taxes, such as duties and imposts, must be levied at the same rate throughout the country. 2. What is the implied limitation on the power to tax State and local governments and how can the Federal Government tax them? a. The Federal Government may not tax State or local governments in the exercise of their governmental duties. b. The Federal Government may tax nongovernmental State and local activities, such as a tax on State-sold liquor. Current Federal Taxes 3. What are the six types of revenue-raising taxes imposed by the Federal Government? a. individual incometax b. corporation incometax c. social insurance taxes (includes OASDI, Medicare, and unemployment compensation) d. excise taxes e. estate and gift.taxes f. customs duties Taxing for Nonrevenue Purposes 4. For what reason other than to raise revenue does Congress levy taxes and how is this power limited? a. Congress levies taxes to regulate activities deemed harmful to the public. ÿ, ? vÿ,ÿ4ÿ_ÿ., b. This power is limited by the Constitution and by the Supreme Court. o_: ff o B. Reviewing Key Terms 5. What is the difference between a progressive tax and a regressive tax? Progressive taxes are levied according to level of income while regressive taxes are levied at a flat rate, B kt.l O2 O.. @ Place a check mark next to each phrase that correctly pairs a type of tax with an example of that tax. d'" I'ÿ'ÿ payroll tax; Medicare excise tax; federal tax on imported peanuts progressive tax; income tax custom duty; tax on tobacco products 10. regressive tax; Medicare B/11. estate tax; tax on inheritance 3 12. tax return; income tax form CJ 13. gift tax; tax on gifts worth more than $1,000 .7 76 Chapter 16 Guided Reading and Review CLASS NAME DATE Section 2: Guided Reading and Review Nontax Revenues and Borrowing A. As You Read Answer the following questions as you read Section 2. Possible answers below Nontax Revenues 1. What are sources of interest that the government collects as nontax revenue? loans made by some federal agencies, canal tolls, fees for passports, copyrights, patents and trademarks 2. What is seigniorage? the profit made by the U.S, Mint; they can make money for more than its face value 3. What government corporation generates nontax revenue for the government? United States Postal Service Borrowing 4. For what three reasons does the government often borrow money? Itÿ borrows money to meet costs of crises, to finance large projects, and to pay for deficit financing. 5. Explain the process by which the government borrows money. The treasury issues securities to investors. These securities often take the form of treasury bills and the government promises to repay them with interest on a certain date. The Public Debt 6. What has been the trend of the public debt over the past 20 years? The public debt has increased tremendously. =0 "o uJ B. Reviewing Key Terms Define the following terms in the space provided. Q_ @ 7. interest a fee for borrowing money; generally a percentage of the amount borrowed 8. deficit the yearly shortfall between income and spending; when spending is higher than income 9. surplus the yearly excess between income and spending; when income is higher than spending the public debt is reduced 10. public debt the government's total outstanding indebtedness, including all ofthe money borrowed and not yet repaid plus the accrued interest Guided Reading andReview Chapter 16 7/ NAME CLASS DATE Section 3: Guided Reading and Review Spending and the Budget A. As You Read Complete the chart below by filling in the missing information in the blanks provided. Possible answers below Type of Spendinÿ Controllable Meaning 1. Congress and the President decide how Spending Uncontrollable Examples much will be spent on a specific item in b. aid to education the budget. c. environmental protection 3. spending that Congress and the Spending 2. a. military equipment 4. a. Social Security benefits President have no power to change b. food stamps c. Medicare As you read the section, fill in the answers to the questions below. 5. Who initiates the spending process? the President t 6. How does the federal budget serve as a political statement? It serves as a plan for the execution of public policy. 7. According to the chart on page 460, in what three categories has the government spent the most money since 1997? Social Security Administration, Department, of the Treasury, Department of Health and Human Services 8. Where does the budget-making process begin? It begins with each federal agency submitting its spending planstothe/0MB), , (dTÿ O IJJ g 9. How does Congress bedome involved in the tÿrocessa Congress reviews the budget with the Congressional Budget Office, and congressional committees stuÿly it, hold hearings, change it, and prepare appropriations bills. @ 10. What happens if the 13 appropriations measures are not passed by the beginning of the fiscal year? Congress passes a continuinq resolution to allow emergency spending. B. Reviewing Key Terms Explain the meaning of the following term and give some examples. 11. entitlement any benefit that federal law says must be paid to all those who meet the eligibility requirements; possible examples: OASDI, Medicare, Medicaid 78 Chapter 16 " Guided Reading and Review