Chapter 16 PPT - Ash Grove R

American

Citizenship

Financing Government

Chapter 16 Notes

Section 1

Taxes

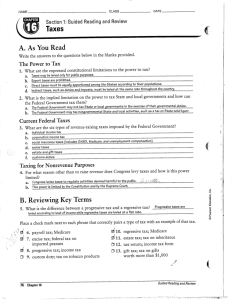

The Power To Tax

Power that was granted to Congress

“To lay and collect Taxes, Duties, Imposts and

Excises, to pay the Debts and provide for the common Defense and general Welfare of the

United States…”

Article 1, Section 8, Clause 1

The Power To Tax (Con’t)

Constitutional Limitations

Taxes must be used for public purposes only

Prohibition of export taxes

Can not tax goods sent out of the country

Direct taxes must be equally apportioned, evenly distributed, among the states

Any direct tax that Congress levies must be apportioned among the States according to their populations

Income Tax

Indirect taxes levied by the Federal Government must be set at the same rate in all parts of the country

The Power To Tax (Con’t)

The Implied Limitation

Federal Government cannot tax the States or their local governments, when those governments are performing social acts

Public Education, Furnishing Health Care,

Building Streets and Highways

Current Federal Taxes

Income Tax

Authorized by the 16th Amendment

A flexible tax that is levied on the earnings of both individuals and corporations

Progressive tax used today

The higher one’s income, the higher percentage of tax one pays

Current Federal Taxes (Con’t)

The Individual Income Tax

The Tax is levied on each person’s taxable income one’s total income in the previous year less certain exemptions and deductions

Deductions are things that help reduce the amount of taxes one pays

By April 15 of every year people must file a tax return a declaration of that income and of the exemptions and deductions he or she claims

Controlled by the Internal Revenue Service (IRS)

Most pay income taxes through withholding pay-as-you-go plan

Current Federal Taxes (Con’t)

The Corporation Income Tax

Corporations pay a tax on its net income

Social Insurance Taxes

Social Security Act of 1935

Medicare

Unemployment Compensation Program

All three are paid through payroll taxes

Tax that employees pay that are withheld from their paychecks

They are considered regressive taxes taxes levied at a flat rate, without regard to the level of a taxpayer’s income or their ability to pay them

Current Federal Taxes (Con’t)

Excise Taxes

Tax laid on the manufacture, sale, or consumption of goods and/or the performance of services

Estate and Gift Taxes

Estate Tax

A levy imposed on the assets of one who dies

Gift Tax levy imposed on the making of a gift by a living person

Custom Duties

A tax laid on goods brought into the United State from abroad

Taxing for Nonrevenue Purposes

Taxes can also be used to discourage or limit purchases or actions

Hunting license

Firearm sales

Etc.

Section 2

Nontax Revenues and Borrowing

Nontax Revenues

Most Nontax Revenues comes from earnings of the Federal Reserve System, mostly in interest charges

A charge for borrowed money, generally a percentage of the amount borrowed

Also made through the minting of coins and selling of special stamps

Borrowing

Congress has the power “to borrow Money on the credit of the United States” (Article 1,

Section 8, Clause 2)

Since the 1960’s, America has consistently borrowed money to pay for the annual deficit

The yearly shortfall between income and outgo

Since 1969, there was not a surplus , except for

1998-2001

Mostly due to a robust Economy

Generally the borrowing is done by the Treasury

Department, but Congress must authorize it

The Public Debt

The government’s total outstanding indebtedness

Due to the high amount borrowed, many are concerned about the weight the debt will have on future generations

In 2003, 1 in 5 every dollar went to interest on the debt

Current Debt

Section 3

Spending and the Budget

Federal Spending

Spending Priorities

SSA spends more money than any other

Federal Agency

Entitlements

Benefits that federal law says must be paid to all those who meet the eligibility requirements, such as being at a certain age or income level

Federal Spending (Con’t)

Controllable and Uncontrollable Spending

Controllable spending is any spending that

Congress and the President can make choices

Also known as Discretionary Spending

Uncontrollable spending is any spending that is mandatory

An example would be the interest payments

Also, Social Security Benefits, Food Stamps, and other entitlement programs

Nearly 80% of spending is considered uncontrollable

Federal Budget

Congress controls the purse strings, however the President initiates the spending process by submitting a budget at the beginning of each congressional session

It is a major political statement; a declaration of the public policies of the United States in financial terms

The President and the Budget

All agencies submit their proposals to the OMB (Office of Management and Budget), who determines whether they will be a part of the budget document

Federal Budget (Con’t)

Congress and the Budget

CBO (Congressional Budget Office) in both houses reviews the budget proposed by the

OMB

Congress tries to pass the appropriations (Bills) by October 1 (Beginning of next Fiscal year)

Continuing Resolution measure allows the affected agencies to continue to function on the basis of the previous year’s appropriations