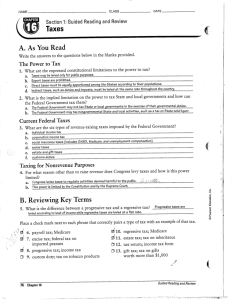

Chapter 9 Sources of Government Revenue

advertisement

Chapter 14: Government Revenue and Spending “The art of taxation is the art of plucking the goose so as to get the largest possible amount of feathers with the least possible squealing.” - Seventeenth-century French statesman Jean-Baptiste Colbert “Taxes are what we pay for civilized society” Oliver Wendell Holmes Jr., 1904 • 1. What is a tax? • 2. Define revenue. • 3. From what 2 sources may government revenue come? Taxes, Taxes, Taxes • Definition: System of raising money to finance the government • Cooking Oil, Foreigners, • Slaves (Ancient Egypt) • Sales, Inheritance, Imports, Exports (Ancient Rome) • Beards, Beehives, Boots, (Russia, 1702) • Bachelors (England,1695; Missouri, 1820) Taxes Fund Public Goods and Services Health Care for Elderly National Defense Social Services State and Local Police Public Education Financial Aid Taxes in US History • American Revolution caused debt • Tax was necessary to pay debt • Article 1, Section 8 of the U.S. Constitution granted Congress power to tax Protective Tariff 4. THINK: What is a tariff? War of 1812 Civil War Income Tax • Raise revenue • Increase productivity • Economic prosperity Conflicting Goals of Taxation • Be fair • Influence behavior 1913 Sixteenth Amendment • 5. Under what 2 principles are US taxes assigned? • 6. Identify the “benefits-received principle.” • 7. Identify the “ability-to-pay principle.” How to Measure Tax Fairness • Ability to Pay • Benefits Received Ability to Pay Principle Those who can afford it PAY Benefits Received Principle Those who receive the benefits PAY Tax Reform Criteria for Taxation Read page 411 8. Which criteria establishes fairness by uniformly applying the tax? Taxes and Equity • Horizontal Equity: “Equals should be taxed equally.” • Vertical Equity: “Unequals should be taxed unequally.” Simplicity 9. Which criteria assesses how easy it is for the taxpayer to understand and how easy for the government to collect? 10. What other two criteria are established for this standard? Efficiency • Efficiency differs for the government and the tax payer. – 11. How is it judged by the government? – 12. By the tax payer? – 13. Which tax do we have today which meets both criteria? The Federal Government Dollar- Where It Comes From Social Security, Medicare, and Unemployment and other Retirement Taxes 35% Personal Income Taxes 43% Excise, Customs, Estate, Gift, and Miscellaneous Taxes 7% Borrowing to Cover Deficit 8% Corporate Income Taxes 7% Chief Sources of Revenue Tax Bases and Structures 14. Which tax is based on an individual’s income from all sources? 15. What are the 4 primary sources for income? 16. Which tax is based on the value of designated goods or services at the TIME OF THE SALE? 17. Which tax is based on the value of an individual’s or business’s assets? • What Can Be Taxed? Wealth and Income The Federal Government DollarWhere It Goes Resource allocation – THINK! 18. What happens to the cost of production? 19. What happens to the supply? Law Enforcement and General Government 3% Social Security, Medicare, and other Retirement 38% National Defense, Veterans, and Foreign Affairs 20% Social Programs 21% Physical, Human, and Community Development 10% Net Interest on the Debt 8% Economic Impact of Taxes To stimulate the economy Accounts Receivable Tax Building Permit Tax CDL license Tax Cigarette Tax Corporate Income Tax Dog License Tax Excise Taxes Federal Income Tax Federal Unemployment Tax (FUTA) Fishing License Tax Food License Tax Fuel Permit Tax Gasoline Tax (currently 44.75 cents per gallon) Gross Receipts Tax Hunting License Tax Inheritance Tax Inventory Tax IRS Interest Charges IRS Penalties (tax on top of tax) Liquor Tax Luxury Taxes Marriage License Tax Medicare Tax Personal Property Tax Currently 47 Property Tax Real Estate Tax taxes listed Service Charge T ax Social Security Tax Road Usage Tax Sales Tax Recreational Vehicle Tax School Tax State Income Tax State Unemployment Tax (SUTA) Telephone Federal Excise Tax Telephone Federal Universal Service Fee Tax Telephone Federal, State and Local Surcharge Taxes Telephone Minimum Usage Surcharge=2 0Tax Telephone Recurring and Non-recurring Charges Tax Telephone State and Local Tax Telephone Usage Charge Tax Utility Taxes Vehicle License Registration Tax Vehicle Sales Tax Watercraft Registration Tax Well Permit Tax Workers Compensation Tax Tax Structures • Define the following structures of taxes: – 20. Proportional Taxes – 21. Progressive – 22. Regressive Proportional Tax Taxes reflect the level of income • 23. What else is a proportional tax called? • 24. Why? • 25. What famous college town collects a flat tax? = = Progressive Taxes • 26. Under a progressive tax a high-income person not only pays _____ in the amount of taxes but also pays a __________ on income in taxes. • 27. To what principle is this type of tax closely linked? • 28. What is an example of a progressive tax in the US? Higher Income = Higher Taxes Personal Income Tax Brackets • tax on the income of individuals or families • applied to wages, salaries, tips, interest, and dividends • Also called personal income tax Regressive Taxes • 29. Why is sales tax regressive? • 30. What other type of taxes is also regressive? Everyone pays the same fixed amount Who Pays the Tax? • 31. Define incidence of a tax. • 32. What most often happens to taxes applied to a business? Circular Flow of Economy Including Taxes Effect of Elasticity on Taxes • 33. THINK: If a product has an elastic demand, who pays most of the tax? • 34. WHY? • 35. If the product has an inelastic demand, who pays most of the tax? • 36. WHY? Tax on CD Players Tax Incidence and Elasticity of Demand / Supply • 37. PerfectlyINELASTIC Demand: Buyer Pays Entire Tax • 38. Perfectly • 39. Perfectly Tax ELASTIC Demand: Seller Pays Entire Tax INELASTIC • 40. Perfectly ELASTIC Supply: Seller Pays Entire Supply: Buyer Pays Entire Tax Impact of Taxes on the Economy • 41. What happens to the cost of production if a tax is placed on a good or service? • 42. Where will this shift the supply curve? • 43. Why will the producer NOT pass the tax for luxury yachts on to the consumer? • 44. THINK – What will be the short term and long term effect of this tax on a luxury good? Increase Productivity and Growth • Taxes change incentives to: – – – – Save Invest Work Spend • 45. When taxes on interest and dividends are high what happens? • 46. How will this affect capital investment as well? • 47. How do economists believe high taxes affect labor? Effects of Tax on Labor Income Other Effects of Taxation 48. THINK: How is an underground economy affected by high taxes? 49. THINK: How will this affect the collection of taxes by the government? 50. THINK: What is a huge example of this today? Lowering taxes on labor will lead to more takehome pay, and also means that employers can set wages lower because workers will be satisfied by the higher percentage of money they take home after taxes - Used by Bush against Reagan Behavior Adjustment • 51. What is a tax incentive? • 52. What types of tax incentives may be used by the government? • 53. What is the largest tax credit given by the government today? • 54. What are sin taxes? • 55. What are some examples today of sin taxes? • 56. How does the elasticity for an item which carries a sin tax change as the tax increases? Tax Incidence and the Elasticities of Demand and Supply: Elastic Demand Tax Incidence and the Elasticities of Demand and Supply: Inelastic Demand Understanding the IRS • 57. How much revenue does the federal government take in from taxes each year? Congress has set a goal that 80% of all tax returns be filed electronically by the year 2007. Voluntary Compliance Requires Record Keeping Each person is responsible for filing a tax return. •Keep necessary records •Report income accurately •Correctly calculate tax liability • File returns on time •SAVE •Paycheck stubs •Bank statements •Completed tax returns and forms •Warranty information •Receipts •Credit card statements •Three methods for tax preparation? •Electronically •Tax Preparation Software •Manually Withholding on Form W-4 • 58. Why would it be difficult for the government to only collect taxes one time during the year? • 59. What is the type of tax taken from a worker’s paycheck called? Form W-2 • Shows how much employees earn • Copy must be attached to tax return • 60. The federal income tax is a ? Tax. • 61. This means people with ? Incomes not only pay ? In total taxes, but also pay a higher ? Of their income in taxes. • 62. On what is the amount owed based? Factors Affecting Tax Liability • 63. How can taxpayers reduce their tax burden? • Deductions: Expenses that can be deducted before determining taxable income – 64. How does family size make a difference in deductions? – 65. What are some other examples of items which may be deducted? Tax Breaks 66. What is a tax return? Deductions: Reduce income subject to tax Tax Exemptions: Part of income that isn’t taxed Tax Credits: Dollar for dollar reduction in tax 67. What is a requirement for a tax return? 68. Why might you have to pay additional taxes? Tax Avoidance versus Tax Evasion • Tax Evasion: Failure to pay legally due taxes • Tax Avoidance: Legal means of decreasing your tax bill Indexing • 69. What is a tax bracket? • 70. What is the purpose of indexing? 71. What does FICA stand for? Federal Insurance Contributions Act – – – – – Known as ‘Social Security’ or Payroll tax 2009 FICA Tax and Social Security Limits. FICA Tax Rate = 7.65%; Social Security Limit = $106800; Maximum Social Security Contribution = $6621.60 ... Medicare and Unemployment 72. What group benefits from Medicare 73. What is different about the collection of social security and Medicare? 74. How are unemployment taxes funded? 75. THINK: Why is this an example of federalism? 76. Who pays the majority of unemployment tax? 77. THINK: What is the effect of unemployment tax on businesses? Tax Lesson 101 • Suppose that every day, ten men go out for dinner. The bill for all ten comes to $100. If they paid their bill the way we pay our taxes, it would go something like this: The first four men (the poorest) would pay nothing. The fifth would pay $1. The sixth would pay $3. The seventh $7. The eighth $12. The ninth $18. The tenth man (the richest) would pay $59. So, that's what they decided to do. What Happens When the Owner Reduces the Cost? • The ten men ate dinner in the restaurant every day and seemed quite happy with the arrangement, until one day, the owner threw them a curve. "Since you are all such good customers," he said, "I'm going to reduce the cost of your daily meal by $20." So, now dinner for the ten only cost $80. The group still wanted to pay their bill the way we pay our taxes. So, the first four men were unaffected. They would still eat for free. But what about the other six, the paying customers? How could they divvy up the $20 windfall so that everyone would get his 'fair share'? The six men realized that $20 divided by six is $3.33. But if they subtracted that from everybody's share, then the fifth man and the sixth man would each end up being 'PAID' to eat their meal. • To Reduce Each Man’s Bill So, the restaurant owner suggested that it would be fair to reduce each man's bill by roughly the same amount, and he proceeded to work out the amounts each should pay. And The The The The The The so: fifth man, like the first four, now paid nothing (100%savings). sixth now paid $2 instead of $3 (33% savings). seventh now paid $5 instead of $7 (28% savings). eighth now paid $9 instead of $12 (25% savings). ninth now paid $14 instead of $18 (22% savings). tenth now paid $49 instead of $59 (16% savings). Each of the six was better off than before. And the first four continued to eat for free. But once outside the restaurant, the men began to compare their savings. "I only got a dollar out of the $20," declared the sixth man. He pointed to the tenth man "but he got $10!" "Yeah, that's right," exclaimed the fifth man. "I only saved a dollar, too. It's unfair that he got ten times more than me!" "That's true!!" shouted the seventh man. "Why should he get $10 back when I got only $2? The wealthy get all the breaks!" And that, boys and girls, journalists and college professors, is how our tax system works. • "Wait a minute," yelled the first four men in unison. "We didn't get anything at all. The system exploits the poor!" The nine men surrounded the tenth and beat him up. The next night the tenth man didn't show up for dinner, so the nine sat down and ate without him. But when it came time to pay the bill, they discovered something important. They didn't have enough money between all of them for even half of the bill! The people who pay the highest taxes get the most benefit from a tax reduction. Tax them too much, attack them for being wealthy, and they just may not show up at the table anymore. There are lots of good restaurants in Europe and the Caribbean. Direct Tax Burden falls directly on the person or thing being taxed • Cannot be shifted to another person or thing. – Includes personal income tax or – property tax on a residence Indirect Taxes tax imposed on one person or thing but whose burden is borne indirectly by another Indirect Tax: • Can be recovered by charging higher prices or paying lower wages • Sales tax, business property tax, and payroll tax can be shifted Corporate Income and Other Taxes • A tax on the profits, or net income of corporations. 78. What is an Estate tax? – known as ‘death tax’ • What was supposed to happen to the estate tax in 2010? • Why will this not happen now? 79. What is taxed by the Gift tax? – on gifts received in excess of set sum What is an Excise Tax A user tax that generates revenue to build and maintain roadways 80. Why is gasoline a good source for an excise tax? 81. How can an excise tax be used as a sin tax? Customs Duty and User Fees 82. What is a Customs duty? 83. What is a user fee? 84. What is an example of a user fee? Property Taxes • Levied on property, especially real estate • Can also be levied on boats, RVs, business inventories • Fund schools, local services, welfare programs Transaction Taxes (Consumption Taxes) •Levied on economic transactions • Set on percentages or physical quantities • Support state and local services 85. What is an example on the state level of a transaction tax? The U.S. Constitution Divides Government Powers Federal Responsibilities State Responsibilities Local Responsibilities Tax Freedom Day How Taxes Evolve House Ways and Means Committee Full House Senate Finance Committee Full Senate Joint Conference Committee Senate/House Compromise bill President vetoes bill Veto override fails Veto override passes President signs bill Tax law enacted Taxation Around the World A recession is when your neighbor loses his job. A depression is when you lose your job. History of Taxation in the United States Trouble Brewing with Tax Reform • Value-added tax A percentage tax on the value added to goods or services at each stage of production and distribution. As with general sales taxes, consumers bear the final burden of value-added taxes “The income tax law is a lot of bunk. The government can’t collect legal taxes from illegal money.” Al Capone Failure to pay legally owed taxes can result in fines or imprisonment for tax fraud or tax evasion. Al Capone, a man remembered as one of the most notorious criminals of the twentieth century, was imprisoned for tax evasion in June, 1930. Spiro Agnew, our thirty–ninth vice president (1969–1973), resigned from office after being fined for tax evasion. Be smart: Pay all taxes owed to the government Federal Government Spending 86. Define mandatory spending 87. Define discretionary spending 88. Define entitlements 89. What are three important types of entitlements? Federal Expenditures 90. What is discretionary spending? 91. What are the 5 main categories of this spending? 92. Which part of this budget is the largest? Federal Budget Discretionary 2009 • • • • • • • • • • • • • $70.4 billion - United States Department of Health and Human Services $45.4 billion - United States Department of Education $44.8 billion - United States Department of Veterans Affairs $38.5 billion - United States Department of Housing and Urban Development $38.3 billion - State and Other International Programs $37.6 billion - United States Department of Homeland Security $25.0 billion - United States Department of Energy $20.8 billion - United States Department of Agriculture $20.3 billion - United States Department of Justice $17.6 billion - National Aeronautics and Space Administration $12.5 billion - United States Department of the Treasury $11.5 billion - United States Department of Transportation • • • • • • • • • • • • $10.6 billion - United States Department of the Interior $10.5 billion - United States Department of Labor $8.4 billion - Social Security Administration $7.1 billion - United States Environmental Protection Agency $6.9 billion - National Science Foundation $6.3 billion - Judicial branch (United States federal courts) $4.7 billion - Legislative branch (United States Congress) $4.7 billion - United States Army Corps of Engineers $0.4 billion - Executive Office of the President $0.7 billion - Small Business Administration $7.2 billion - Other agencies $39.0 billion(2008*) - Other Off-budget Discretionary Spending The financial cost of the Iraq War and the War in Afghanistan are not part of the defense budget; they are appropriations. What does the Constitution say about Taxes? • U.S. Constitution, Article 1, Section 8: • “The Congress shall have power to lay and collect taxes, duties, imposts and excises, to pay the debts and provide for the common defense and general welfare of the United States … Establishing the Budget • The president presents his budget proposal to Congress in early February. • Congress is free to adopt or reject any of the president's recommendations. 93. What is the fiscal year? 94. Who prepares the President’s budget? What Happens in Congress? • Congress adopts a budget resolution establishing targets • Thirteen appropriations subcommittees divide the funds 95. What are appropriations? 96. What must occur if Congress does not pass a budget by the start of a new fiscal year? Impact on our Economy 97. In what 3 ways does federal spending impact our economy? Federal Debt as Percent of GDP 98. Explain resource allocation. Myth: Today’s Debt is at Historic Levels. Fact: Today’s Debt Burden is Not that Large in Historical Context. US Gross Federal Debt • This chart reflects gross federal debt from 19402007 in unadjusted dollars. • Note that for half of this period, the debt remained fairly stable. • It is not until 1981, with the tax cuts and military spending that marked the Reagan Administration, that the debt began its current trajectory. How big is the Debt? The National Debt is $19 Trillion! State and Local Taxes and Spending • When the federal government shares it is called Intergovernmental Revenues – funds collected by federal government and distributed to states and local 99. What is the primary tax for most states? 100. What goods are often exempt from these taxes?