Responsibility center

advertisement

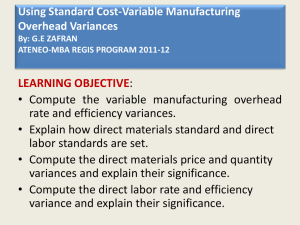

Part 1 Study Unit 7.6 -7.8 Review Cost Accumulations Methods How much is controllable / How much is uncontrollable? The production volume variance is due to A Inefficient or efficient use of direct labor hours. B Efficient or inefficient use of variable overhead. C Difference from the planned level of the base used for overhead allocation and the actual level achieved. D Excessive application of direct labor hours over the standard amounts for the output level actually achieved. The production volume variance is due to A Inefficient or efficient use of direct labor hours. B Efficient or inefficient use of variable overhead. C Difference from the planned level of the base used for overhead allocation and the actual level achieved. D Excessive application of direct labor hours over the standard amounts for the output level actually achieved. A fixed overhead volume variance based on standard direct labor hours measures A Deviation from standard direct labor hour capacity. B Deviation from the normal, or denominator, level of direct labor hours. C Fixed overhead efficiency. D Fixed overhead use. A fixed overhead volume variance based on standard direct labor hours measures A Deviation from standard direct labor hour capacity. B Deviation from the normal, or denominator, level of direct labor hours. C Fixed overhead efficiency. D Fixed overhead use. Correct Answer: B The fixed overhead volume variance measures the effect of not operating at the budgeted (denominator) activity level. It is the difference between budgeted fixed costs and the product of the standard fixed overhead application rate and the standard activity level for the actual output. A favorable variance means that activity was greater than expected and that fixed overhead was overapplied. It might be caused by, for example, hiring more workers to provide an extra shift. An unfavorable volume variance means that activity was less than budgeted (overhead was underapplied), for example, because of insufficient sales or a labor strike. Accordingly, the volume variance is usually outside the control of production management. Moreover, unlike other variances, it does not directly reflect a difference between actual and budgeted expenditure of resources. Cordell Company uses a standard cost system. On January 1 of the current year, Cordell budgeted fixed manufacturing overhead cost of $600,000 and production at 200,000 units. During the year, the firm produced 190,000 units and incurred fixed manufacturing overhead of $595,000. The production volume variance for the year was A $5,000 unfavorable. B $10,000 unfavorable. C $25,000 unfavorable. D $30,000 unfavorable. Cordell Company uses a standard cost system. On January 1 of the current year, Cordell budgeted fixed manufacturing overhead cost of $600,000 and production at 200,000 units. During the year, the firm produced 190,000 units and incurred fixed manufacturing overhead of $595,000. The production volume variance for the year was A $5,000 unfavorable. B $10,000 unfavorable. C $25,000 unfavorable. D $30,000 unfavorable. Correct Answer: D The application rate for fixed overhead is $3.00 per unit ($600,000 budgeted cost ÷ 200,000 budgeted units). The actual amount applied was $570,000 (190,000 actual units × $3.00 application rate). The production volume variance was thus $30,000 unfavorable ($570,000 – $600,000). Highlight, Inc. uses a standard cost system and applies factory overhead to products on the basis of direct labor hours. If the firm recently reported a favorable direct labor efficiency variance, then the A Variable overhead spending variance must be favorable. B Variable overhead efficiency variance must be favorable. C Fixed overhead volume variance must be unfavorable. D Direct labor rate variance must be unfavorable. Highlight, Inc. uses a standard cost system and applies factory overhead to products on the basis of direct labor hours. If the firm recently reported a favorable direct labor efficiency variance, then the A B C D Variable overhead spending variance must be favorable. Variable overhead efficiency variance must be favorable. Fixed overhead volume variance must be unfavorable. Direct labor rate variance must be unfavorable. Correct Answer: B Highlight uses direct labor hours as the driver for variable overhead application. Thus, if the direct labor efficiency variance was favorable, the variable overhead efficiency variance must be favorable as well since the two variances are based on the same standard and actual hours. The JoyT Company manufactures Maxi Dolls for sale in toy stores. In planning for this year, JoyT estimated variable factory overhead of $600,000 and fixed factory overhead of $400,000. JoyT uses a standard costing system, and factory overhead is allocated to units produced on the basis of standard direct labor hours. The denominator level of activity budgeted for this year was 10,000 direct labor hours, and JoyT used 10,300 actual direct labor hours. Based on the output accomplished during this year, 9,900 standard direct labor hours should have been used. Actual variable factory overhead was $596,000, and actual fixed factory overhead was $410,000 for the year. Based on this information, the variable overhead spending variance for JoyT for this year was A B C D $24,000 unfavorable. $2,000 unfavorable. $4,000 favorable. $22,000 favorable The JoyT Company manufactures Maxi Dolls for sale in toy stores. In planning for this year, JoyT estimated variable factory overhead of $600,000 and fixed factory overhead of $400,000. JoyT uses a standard costing system, and factory overhead is allocated to units produced on the basis of standard direct labor hours. The denominator level of activity budgeted for this year was 10,000 direct labor hours, and JoyT used 10,300 actual direct labor hours. Based on the output accomplished during this year, 9,900 standard direct labor hours should have been used. Actual variable factory overhead was $596,000, and actual fixed factory overhead was $410,000 for the year. Based on this information, the variable overhead spending variance for JoyT for this year was A B C D $24,000 unfavorable. $2,000 unfavorable. $4,000 favorable. $22,000 favorable Correct Answer: D The standard application rate for variable overhead is $60.00 per direct labor hour ($600,000 budgeted ÷ 10,000 budgeted direct labor hours). The variable overhead spending variance can thus be derived by using the following formula: Variable overhead efficiency variance (AQ × SP) – Actual costs incurred (10,300 × $60.00) – $596,000 = $22,000 F Howard Company produces and sells replacement parts for cotton processing equipment. Which one of the following cost variances are least likely to be controllable by Howard’s production manager? A B C D Variable overhead spending variance. Labor efficiency variance. Materials quantity variance. Fixed overhead production volume variance. Howard Company produces and sells replacement parts for cotton processing equipment. Which one of the following cost variances are least likely to be controllable by Howard’s production manager? A B C D Variable overhead spending variance. Labor efficiency variance. Materials quantity variance. Fixed overhead production volume variance. Correct Answer: D The fixed overhead production volume variance is the difference between the static/flexible budget for fixed overhead and the amount allocated based on the budgeted allocation rate and the driver level allowable for the actual production level achieved. None of these factors are under the control of the production manager. Brannen Videotronics uses a four-way allocation of overhead, machine hours to allocate overhead, and years of experience as the main determinant for wage increases. The standards are set and revised on an annual basis. Due to a surge in competitive pressures, Brannen’s management decided to undertake downsizing. Brannen offered incentives that permitted a large number of senior employees to opt in the middle of the year for early retirement. As a result, Brannen had to bring in temporary replacements who were paid entry-level wages to see that work deadlines were met. Which one of the following is most likely to result from this situation? A B C D Unfavorable efficiency variances and favorable price variances. Unfavorable efficiency variances and unfavorable price variances. Favorable efficiency variances and unfavorable price variances. Favorable efficiency variances and favorable price variances. Brannen Videotronics uses a four-way allocation of overhead, machine hours to allocate overhead, and years of experience as the main determinant for wage increases. The standards are set and revised on an annual basis. Due to a surge in competitive pressures, Brannen’s management decided to undertake downsizing. Brannen offered incentives that permitted a large number of senior employees to opt in the middle of the year for early retirement. As a result, Brannen had to bring in temporary replacements who were paid entry-level wages to see that work deadlines were met. Which one of the following is most likely to result from this situation? A Unfavorable efficiency variances and favorable price variances. B Unfavorable efficiency variances and unfavorable price variances. C Favorable efficiency variances and unfavorable price variances. D Favorable efficiency variances and favorable price variances. Correct Answer: A The use of less-skilled workers will generally result in unfavorable labor efficiency variances. However, this is accompanied by favorable labor rate (or price) variances, which result from paying lower wages. Study Unit 8 Responsibility Accounting And Performance Measures By Jim Clemons, CMA 8.1 - Responsibility Centers • Centralized / decentralized organizations – Amount of freedom of decision making by managers. • Centralized – more effectively coordinated from the top. • Decentralized – Decision at lowest level. • Local manager makes more informed decision. 8.1 - Responsibility Centers • Responsibility center (SBUs) – A decentralized organization is divided into responsibility centers (or SBUs) • Used to facilitate local decisions. • Four types – Cost center – Responsible for cost only. » Cost drivers are relevant performance measures. » Disadvantages – LT disregard, allocations of SDs. » Service center that serve a specialized purpose. – Revenue center – Responsible for revenues only. » Performance measures are revenue drivers » Examples of RC is a sales department 8.1 - Responsibility Centers • Profit center – Responsible for both revenue and expenses. • Investment center – Responsible for revenues, expenses, and invested capital. – Allows for ROI analysis based on effectiveness of asset usage. – Can be easily compared to other Investment Centers or Invesments. • Each center under one manager – Measures designed to monitor performance of center 8.1 - Performance Measures and Manager Motivation • Controllability – Manager’s incentive items – Those that the manager can influence over time. • Some cost cannot be traced to particular activity • Not synonymous with variable cost • Level of influence goes up with title. – Common cost not under manager’s control. • Goal congruence – Measures designed to tie manager’s goals with company goals. – Suboptimization results when goals are in segment’s own interest – Manager must be granted enough authority factors that affect incentive package. 8.1 - Responsibility Centers • Cost Center and Revenue Centers – Most appropriate performance measurement technique for cost and revenue center managers is variance analysis. – PM should be based on cause-and-effect between driver and output. • Profit Centers – Contribution margin approach is useful in profit center performance measurement. • Isolates variable and fixed costs – Review page 294 SU 8.1 Question 1 Fairmount, Inc., uses an accounting system that charges costs to the manager who has been delegated the authority to make the decisions incurring the costs. For example, if the sales manager accepts a rush order that will result in higher-than-normal manufacturing costs, these additional costs are charged to the sales manager because the authority to accept or decline the rush order was given to the sales manager. This type of accounting system is known as A. B. C. D. Responsibility accounting. Functional accounting. Reciprocal allocation. Transfer price accounting. SU 8.1 Question 1 Answer Correct Answer: A In a responsibility accounting system, managerial performance should be evaluated only on the basis of those factors directly regulated (or at least capable of being significantly influenced) by the manager. For this purpose, operations are organized into responsibility centers. Costs are classified as controllable and noncontrollable, which implies that some revenues and costs can be changed through effective management. If a manager has authority to incur costs, a responsibility accounting system will charge them to the manager’s responsibility center. However, controllability is not an absolute basis for establishment of responsibility. More than one manager may be able to influence a cost, and responsibility may be assigned on the basis of knowledge about the incurrence of a cost rather than the ability to control it. Incorrect Answers: B: Functional accounting allocates costs to functions regardless of responsibility. C: Reciprocal allocation is a means of allocating service department costs. D: Transfer price accounting is a means of charging one department for products acquired from another department in the same organization. SU 8.1 Question 2 The least complex segment or area of responsibility for which costs are allocated is a(n) A. Profit center. B. Investment center. C. Contribution center. D. Cost center. SU 8.1 Question 2 Answer • Correct Answer: D A cost center is a responsibility center that is accountable only for costs. The cost center is the least complex type of segment because it has no responsibility for revenues or investments. Incorrect Answers: A: A profit center is a segment responsible for both revenues and costs. A profit center has the authority to make decisions concerning markets and sources of supply. B: An investment center is a responsibility center that is accountable for revenues (markets), costs (sources of supply), and invested capital. C: A contribution center is responsible for revenues and variable costs, but not invested capital. SU 8.1 Question 3 Overtime conditions and pay were recently set by the human resources department. The production department has just received a request for a rush order from the sales department. The production department protests that additional overtime costs will be incurred as a result of the order. The sales department argues that the order is from an important customer. The production department processes the order. To control costs, which department should never be charged with the overtime costs generated as a result of the rush order? A. B. C. D. Human resources department. Production department. Sales department. Shared by production department and sales department. SU 8.1 Question 3 Answer Correct Answer: A The sales department should be responsible for the overtime costs because it can best judge whether the additional cost of the rush order is justified. The production department also may be held responsible for the overtime costs because charging the full overtime cost to the sales department would give the production department no incentive to control these costs. However, the human resources department would never be charged with the overtime costs because it has no effect on the incurrence of production overtime. Incorrect Answers: B: To control costs, the production department may be charged with the overtime costs. C: To control costs, the sales department may be charged with the overtime costs. D: The sales department and the production department may be charged with the overtime costs. 8.2 - Performance Measures • Cost Centers and Revenue Centers – Variance analysis is the most appropriate for cost and revenue centers – Performance measures should be based on cause and effect – Can be quantitative or qualitative • Profit Centers – Contribution margin is a good metric for profit centers, which isolates effects of variable and fixed costs (which are manages choices) – Can show various intermediate measures (see example) 8.2 - Performance Measures • Segment Reporting – Is a product line, geographical area, or other meaningful subunit of the organization. • CM analysis most useful for decision making. • Examples include product, office or customer • Review page 295 - 296 b, c and d SU 8.2 – Question 1 The segment margin of the Wire Division of Lerner Corporation should not include A. Net sales of the Wire Division. B. Fixed selling expenses of the Wire Division. C. Variable selling expenses of the Wire Division. D. The Wire Division’s fair share of the salary of Lerner Corporation’s president. SU 8.2 – Question 1 Answer • Correct Answer: D Segment margin is the contribution margin for a segment of a business minus fixed costs. It is a measure of long-run profitability. Thus, an allocation of the corporate officers’ salaries should not be included in segment margin because they are neither variable costs nor fixed costs that can be rationally allocated to the segment. Other items that are often not allocated include corporate income taxes, interest, company-wide R&D expenses, and central administration costs. Incorrect Answers: A: Sales of the division would appear on the statement. B: The division’s fixed selling expenses are separable fixed costs. C: Variable costs of the division are included. SU 8.2 – Question 2 When using a contribution margin format for internal reporting purposes, the major distinction between segment manager performance and segment performance is A. Unallocated fixed costs. B. Direct variable costs of producing the product. C. Direct fixed costs controllable by the segment manager. D. Direct fixed costs controllable by others. SU 8.2 – Question 2 Answer • Correct Answer: D The performance of the segment is judged on all costs assigned to it, but the segment manager is only judged on costs that he or she can control. Some fixed costs are imposed on segments by the organization’s upper management, and they are thus beyond the segment manager’s control. These direct costs controllable by others make up the difference between segment manager performance and segment performance. Incorrect Answers: A: Unallocated fixed costs do not affect either performance measure. B: Direct variable costs affect both performance measures. C: Direct fixed costs controllable by the segment manager affect both performance measures. SU 8.2 – Question 3 Harris Co.’s income statement for profit center No. 12 for August includes Contribution margin Manager’s salary Depreciation on accommodations Allocated corporate expenses A. B. C. D. $84,000 24,000 9,600 6,000 The profit center’s manager is most likely able to control which of the following? $84,000 $68,400 $60,000 $44,400 SU 8.2 – Question 3 Answer • Correct Answer: A A profit center is a segment of a company responsible for both revenues and expenses. A profit center has the authority to make decisions concerning markets (revenues) and sources of supplies (costs). However, the profit center’s manager does not control his/her salary, investment and the resulting costs (e.g., depreciation of plant assets), or expenses incurred at the corporate level. Consequently, profit center No. 12 is most likely to control the $84,000 contribution margin (sales variable costs) but not the other items in the summarized income statement. Incorrect Answers: B: The profit center manager does not control depreciation on accommodations ($9,600) or the allocated corporate expenses ($6,000). C: The profit center manager does not control his/her $24,000 salary. D: The profit center’s manager does not control the listed period expenses and therefore does not control the profit center’s income.