variance overhead

advertisement

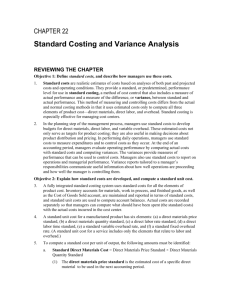

Using Standard Cost-Variable Manufacturing Overhead Variances By: G.E ZAFRAN ATENEO-MBA REGIS PROGRAM 2011-12 LEARNING OBJECTIVE: • Compute the variable manufacturing overhead rate and efficiency variances. • Explain how direct materials standard and direct labor standards are set. • Compute the direct materials price and quantity variances and explain their significance. • Compute the direct labor rate and efficiency variance and explain their significance. - Using Standard Costing: • Standard costing means assigning the expected, budgeted costs to the goods manufactured, the goods in inventory, and the goods sold. In other words, the amounts assigned are the costs that should occur when manufacturing products. • The actual costs are then compared to the standard costs and any differences are reported as variances. Since the standard costs are often tied to the company's annual profit plan, a variance is also an indicator that the actual profit will be different from the planned amount. - Following Definition: • Standard Cost- detailed listing of the standard amounts of inputs and their cost that are required to produce a unit of a specific product • Standard Cost per Unit- standard quantity allowed of an input per unit of a specific product, multiplied by the standard price of the input • Standard hours allowed- the time that should been taken to complete the period’s output. It is computed by multiplying the actual number of units produced by the standard hours per unit. • • • • • Standard hour per unit-the amount of direct labor time that should be required to complete a single unit of product . Standard price per unit- the price that should be paid for an output. Standard rate per hour- the labor rate that should be incurred per hour of labor time. Variable overhead efficiency variance- the difference between the actual level of activity (direct labor-hours, machine-hours, or some other base) and the standard activity allowed, multiplied by the variable part of the predetermined overhead rate. Variable overhead variance-the difference between the actual variable overhead cost incurred during a period and the standard cost that should have been incurred base on the actual activity of the period. - Compute the variable manufacturing overhead spending and efficiency variances. INPUTS (1) Std. Qty or Hr (2) Std Price or Rate Std. Cost 1x2 Direct Materials 1kg 60.25 60.25 Direct Labor P/kg 1kg 17.18 17.18 Vqriqble Mfg Overhead (VMO) .54 10 5.4 TOTAL STANDARD COST/UNIT 82.83 Variable Manufacturing Overhead Variances Example KENPO FOODS has the following direct variable manufacturing overhead labor standard for its Siomai production. .9 standard hour per kg siomai at P82.43 per hour Last month, employees actually worked 240 hours to make 266.40kg siomai. Actual variable manufacturing overhead for the month was P19,783.20 VMO=82.43 per kg (8.hrs x 30 days) VMO=19,783.20 EXHIBIT 11-7 Variance Analysis-Variance Manufacturing Overhead Actual hours Of Input, At the Actual Rate (AH x AR) 240 hrs x P9 per hr = P2160 Actual Hours of Input, at the Standard Rate (AH x SR) 240 hrs x P10 per hr =P2400 Rate variance, P240 F Efficiency variance, P2.4 F Total variance, P237.6 F _________ *266.40 kg x .90 hr per kg = 239.76 F = Favorable ; U = Unfavorable Standard Hours Allowed for Actual Output at the Standard Rate (SH x SR) 239.76 hrs* x 10 per hr = P2397.6 Variable Manufacturing Overhead Variances Summary Actual Hours × Actual Rate Actual Hours × Standard Rate 240 hours × P83 per hour 240 hours × P82.43 per hour = P19, 920 Standard Hours × Standard Rate 239.76 hours × P82.43 per hour = P19,783.20 = P19, 763.42 P19,920 240 hours = P83 per hour Spending variance P136.8 unfavorable Efficiency variance P19.78 favorable Variable Manufacturing Overhead Variances Summary Actual Hours × Actual Rate Actual Hours × Standard Rate Standard Hours × Standard Rate 240 hours 240 hours 239.76hours × × per kg siomai × .90 hour P83 per hour 266.40 $4.00 persiomai hour = 239.76 $4.00 per hour kg of hours = P19,920 = P96,000 = P94,000 Spending variance P136.8 unfavorable Efficiency variance P19.78 favorable Variable Manufacturing Overhead Variances: Using Factored Equations Variable manufacturing overhead spending variance VMSV = AH (AR - SR) = 240 (P83 per hour – P82.43 per hour) = 240 hours (P.57 per hour) = P136.8 unfavorable Variable manufacturing overhead efficiency variance VMEV = SR (AH - SH) = P82.43 per hour (240 hours – 239.76 hours) = P82.43 per hour (.24 hours) = P19.78 unfavorable Variance Analysis and Management by Exception How do I know which variances to investigate? Larger variances, in dollar amount or as a percentage of the standard, are investigated first. Exhibit 9-9 A Statistical Control Chart Warning signals for investigation Favorable Limit • Desired Value • • • • • • Unfavorable Limit • • 1 2 3 4 5 6 Variance Measurements 7 8 9 Advantages of Standard Costs Promotes economy and efficiency Management by exception Advantages Simplified bookkeeping Enhances responsibility accounting Potential Problems with Standard Costs Emphasizing standards may exclude other important objectives. Standard cost reports may not be timely. Invalid assumptions about the relationship between labor cost and output. Potential Problems Favorable variances may be misinterpreted. Emphasis on negative may impact morale. Continuous improvement may be more important than meeting standards. -