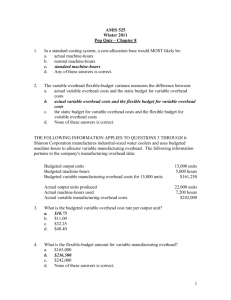

Ch 6, 7, 8 Quiz KEY

advertisement

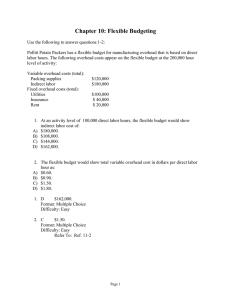

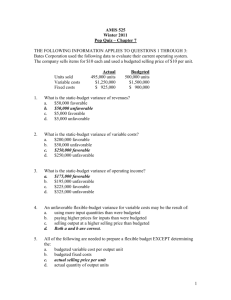

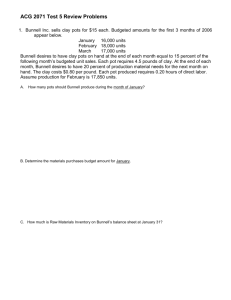

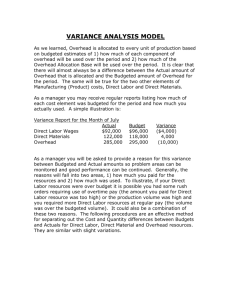

1. Budgeting is used to help companies: a. plan to better satisfy customers b. anticipate potential problems c. focus on opportunities *d. All of these answers are correct. 2. Financing decisions PRIMARILY deal with: a. the use of scarce resources *b. how to obtain funds to acquire resources c. acquiring equipment and buildings d. preparing financial statements for stockholders 3. A good budgeting system forces managers to examine the business as they plan, so they can: a. detect inaccurate historical records *b. set specific expectations against which actual results can be compared c. complete the budgeting task on time d. get promoted for doing a good job 4. For next year, Galliart, Inc., has budgeted sales of 60,000 units, target ending finished goods inventory of 3,000 units, and beginning finished goods inventory of 1,800 units. All other inventories are zero. How many units should be produced next year? a. 58,800 units b. 60,000 units *c. 61,200 units d. 64,800 units 60,000 + 3,000 – 1,800 = 61,200 units 5. The master budget is: a. a flexible budget *b. a static budget c. developed at the end of the period d. based on the actual level of output 6. Management by exception is the practice of concentrating on: a. the master budget *b. areas not operating as anticipated c. favorable variances d. unfavorable variances 7. The following items are the same for the flexible budget and the master budget EXCEPT the same: a. variable cost per unit b. total fixed costs *c. units sold d. sales price per unit 8. A favorable efficiency variance for direct materials might indicate: a. that lower-quality materials were purchased *b. an overskilled workforce c. poor design of products or processes d. a lower-priced supplier was used 9. An unfavorable efficiency variance for direct manufacturing labor might indicate that: a. work was efficiently scheduled *b. machines were not properly maintained c. budgeted rate standards are too lax d. more higher-skilled workers were scheduled than planned 10. Robb Industries, Inc. (RII), developed standard costs for direct material and direct labor. In 2004, RII estimated the following standard costs for one of their major products, the 10-gallon plastic container. Budgeted quantity Budgeted price Direct materials 0.10 pounds $30 per pound Direct labor 0.05 hours $15 per hour During June, RII produced and sold 5,000 containers. They bought 500 pounds of direct materials at an average cost per pound of $32. They used 490 pounds of direct materials and 250 direct manufacturing labor-hours at an average wage of $15.25 per hour. June’s direct material price variance is: a. $980 unfavorable b. $300 favorable c. $680 favorable *d. $1,000 unfavorable. 5000 x ($32 – $30) = $1,000 U 11. Use the information in question 10 (above) for both this question and questions 12 and 13 below. June’s direct material efficiency variance is: a. $980 unfavorable *b. $300 favorable c. $680 favorable d. None of these answers are correct. $30 x (490 – 500) = $300 F 12. June’s direct manufacturing labor price variance is: *a. $62.50 unfavorable b. $62.50 favorable c. $3,811.75 unfavorable d. None of these answers are correct. 250 dlh x ($15.25 – $15.00) = $62.50 U 13. June’s direct manufacturing labor efficiency variance is: a. $62.50 unfavorable b. $62.50 favorable c. $3,811.75 unfavorable *d. Zero. [250 dlh – (5,000 x 0.05)] x $15 = Zero 14. Ruben’s Camera Shop has prepared the following flexible budget for September and is in the process of interpreting the variances. F denotes a favorable variance and U denotes an unfavorable variance. Flexible ------------Variances------------Budget Price Efficiency Material A $20,000 $1,000F $3,000U Material B 30,000 500U 1,500F Direct manufacturing labor 40,000 500U 2,500F The MOST likely explanation of the above variances for Material A is that: a. a higher price than expected was paid for Material A *b. lower-quality raw materials were used than were planned c. the company used a higher-priced supplier d. Material A used during September was $2,000 less than expected 15. A single variance: a. signals the cause of a problem b. should be evaluated in isolation from other variances *c. may be the result of many different problems d. should be used for performance evaluation 16. Overhead costs have been increasing due to all of the following EXCEPT: a. increased automation b. more complexity in distribution processes *c. tracing more costs as direct costs with the help of technology d. product proliferation 17. Roberts Corporation manufactured 100,000 buckets during February. The overhead cost-allocation base is $5.00 per machine-hour. The following variable overhead data pertain to February: Actual Budgeted Production 100,000 units 100,000 units Machine-hours 9,800 hours 10,000 hours Variable overhead cost per machine-hour $5.25 $5.00 What is the variable overhead efficiency variance? *a. $1,000 favorable b. $1,450 unfavorable c. $2,450 unfavorable d. None of these answers is correct. [9,800 – 10,000] x $5.00 = $1,000 favorable 18. An unfavorable variable overhead efficiency variance indicates that: a. variable overhead items were not used efficiently b. the price of variable overhead items was less than budgeted *c. the variable overhead cost-allocation base was not used efficiently d. the denominator level was not accurately determined 19. Jenny’s Corporation manufactured 25,000 grooming kits for horses during March. The fixed-overhead cost-allocation rate is $20.00 per machine-hour. The following fixed overhead data pertain to March: Actual Static Budget Production 25,000 units 24,000 units Machine-hours 6,100 hours 6,000 hours Fixed overhead costs for March $123,000 $120,000 What is the fixed overhead spending variance? a. $1,000 unfavorable b. $2,000 favorable *c. $3,000 unfavorable d. $5,000 favorable $123,000 actual costs – $120,000 budgeted cost = $3,000 unfavorable 20. Using the information for Jenny in 19 (above) what is the fixed overhead production-volume variance? a. $1,000 unfavorable b. $2,000 favorable c. $3,000 unfavorable *d. $5,000 favorable AQ = 6,000 SQ = (25,000 x .25) = 6,250 (6,000-6,250) x $20 = $5,000 favorable