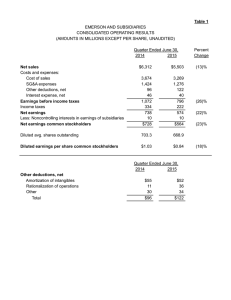

Table 1 EMERSON AND SUBSIDIARIES CONSOLIDATED OPERATING RESULTS

advertisement

Table 1 EMERSON AND SUBSIDIARIES CONSOLIDATED OPERATING RESULTS (AMOUNTS IN MILLIONS EXCEPT PER SHARE, UNAUDITED) Quarter Ended March 31, 2014 2015 Net sales Costs and expenses: Cost of sales SG&A expenses Gain on sale of business Other deductions, net Interest expense, net Earnings before income taxes Income taxes Net earnings Less: Noncontrolling interests in earnings of subsidiaries Net earnings common stockholders $5,812 $5,400 3,417 1,394 — 137 47 817 263 554 7 $547 3,234 1,318 932 136 40 1,604 625 979 6 $973 Diluted avg. shares outstanding 705.2 684.1 Diluted earnings per share common stockholders $0.77 $1.42 Quarter Ended March 31, 2014 2015 Other deductions, net Amortization of intangibles Rationalization of operations Artesyn equity loss Other Total $58 21 34 24 $137 $53 44 — 39 $136 Percent Change (7)% 96% 77% 78% 84% Table 2 EMERSON AND SUBSIDIARIES CONSOLIDATED OPERATING RESULTS (AMOUNTS IN MILLIONS EXCEPT PER SHARE, UNAUDITED) Six Months Ended March 31 2014 2015 Net sales Costs and expenses: Cost of sales SG&A expenses Gain on sale of business Other deductions, net Interest expense, net Earnings before income taxes Income taxes Net earnings Less: Noncontrolling interests in earnings of subsidiaries Net earnings common stockholders $11,418 $10,987 6,787 2,838 — 232 101 1,460 429 1,031 22 $1,009 6,541 2,723 932 200 86 2,369 861 1,508 10 $1,498 Diluted avg. shares outstanding 706.7 689.4 Diluted earnings per share common stockholders $1.42 $2.17 Six Months Ended March 31 2014 2015 Other deductions, net Amortization of intangibles Rationalization of operations Artesyn equity loss Other Total $115 34 34 49 $232 $108 53 — 39 $200 Percent Change (4)% 62% 46% 48% 53% Table 3 EMERSON AND SUBSIDIARIES CONSOLIDATED BALANCE SHEETS (DOLLARS IN MILLIONS, UNAUDITED) Quarter Ended March 31, 2014 2015 Assets Cash and equivalents Receivables, net Inventories Other current assets Total current assets Property, plant & equipment, net Goodwill Other intangible assets Other Total assets $2,724 4,563 2,233 683 10,203 3,692 7,875 1,810 766 $24,346 $3,256 4,299 2,107 682 10,344 3,570 6,805 1,555 694 $22,968 Liabilities and equity Short-term borrowings and current maturities of long-term debt Accounts payables Accrued expenses Income taxes Total current liabilities Long-term debt Other liabilities Total equity Total liabilities and equity $2,661 2,522 2,583 66 7,832 3,836 2,153 10,525 $24,346 $3,358 2,407 2,595 410 8,770 3,272 1,958 8,968 $22,968 Table 4 EMERSON AND SUBSIDIARIES CONSOLIDATED STATEMENT OF CASH FLOWS (DOLLARS IN MILLIONS, UNAUDITED) Six Months Ended March 31 2014 2015 Operating activities Net earnings Depreciation and amortization Changes in operating working capital Gain on sale of business, net of tax Other, net Net cash provided by operating activities Investing activities Capital expenditures Purchase of businesses, net of cash and equivalents acquired Divestitures of businesses Other, net Net cash (used by) provided by investing activities Financing activities Net increase in short-term borrowings Principal payments of long-term debt Dividends paid Purchases of common stock Purchases of noncontrolling interests Other, net Net cash used by financing activities Effect of exchange rate changes on cash and equivalents Increase (decrease) in cash and equivalents $1,031 419 (273) — 89 1,266 $1,508 412 (530) (528) 67 929 (397) (576) 268 (55) (760) (359) (145) 1,391 (86) 801 1,090 (321) (606) (596) (574) (37) (1,044) 854 (251) (647) (1,351) — (20) (1,415) (13) (208) (551) 107 Beginning cash and equivalents 3,275 3,149 Ending cash and equivalents $2,724 $3,256 Table 5 EMERSON AND SUBSIDIARIES SEGMENT SALES AND EARNINGS (DOLLARS IN MILLIONS, UNAUDITED) Quarter Ended March 31, 2014 2015 Sales Process Management Industrial Automation Network Power Climate Technologies Commercial & Residential Solutions Eliminations Net sales Earnings Process Management Industrial Automation Network Power Climate Technologies Commercial & Residential Solutions Differences in accounting methods Corporate and other Interest expense, net Earnings before income taxes Rationalization of operations Process Management Industrial Automation Network Power Climate Technologies Commercial & Residential Solutions Total $2,108 1,232 1,171 1,041 460 6,012 (200) $5,812 $2,042 1,034 1,063 982 465 5,586 (186) $5,400 $383 187 96 186 99 951 60 (147) (47) $817 $299 144 34 170 91 738 53 853 (40) $1,604 $5 3 6 7 — $21 $22 2 13 4 3 $44 Table 6 EMERSON AND SUBSIDIARIES SEGMENT SALES AND EARNINGS (DOLLARS IN MILLIONS, UNAUDITED) Six Months Ended March 31 2014 2015 Sales Process Management Industrial Automation Network Power Climate Technologies Commercial & Residential Solutions Eliminations Net sales Earnings Process Management Industrial Automation Network Power Climate Technologies Commercial & Residential Solutions Differences in accounting methods Corporate and other Interest expense, net Earnings before income taxes Rationalization of operations Process Management Industrial Automation Network Power Climate Technologies Commercial & Residential Solutions Total $4,149 2,381 2,474 1,827 926 11,757 (339) $11,418 $4,141 2,186 2,182 1,882 945 11,336 (349) $10,987 $756 349 179 293 199 1,776 117 (332) (101) $1,460 $691 308 113 296 194 1,602 111 742 (86) $2,369 $8 5 10 10 1 $34 $25 4 14 6 4 $53 Reconciliations of Non-GAAP Financial Measures & Other Table 7 The following reconciles non-GAAP measures (denoted by *) with the most directly comparable GAAP measure (dollars in millions, except per share amounts): Q2 sales change Underlying* Acq/Div FX Reported Process Industrial Mgmt Auto 2% (2 )% —% (8 )% (5 )% (6 )% (3 )% (16 )% 2015E sales change Underlying* Acq/Div FX Reported ~0-2% ~(2)% ~(5)% ~(7)-(5)% Network Power (3 )% (1 )% (5 )% (9 )% Climate Comm & Tech Res Solns (3 )% 3% —% —% (3 )% (2 )% (6 )% 1% Q2 2014 $0.77 — $0.77 Q2 2015 $1.42 ($0.77) $0.65 Total —% (2 )% (5 )% (7 )% EPS Reported Gain on sale of power transmission solutions Adjusted* % Change 84% (100)% (16)% Note: Underlying sales and orders exclude the impact of acquisitions, divestitures and currency translation.