Review Questions 1. If disposable income increases by $5 billion

advertisement

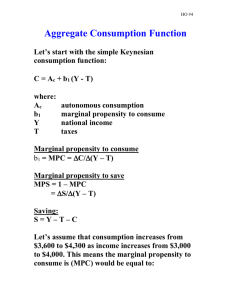

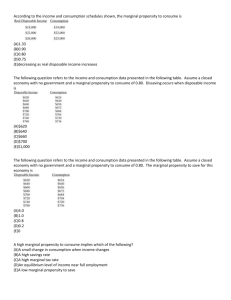

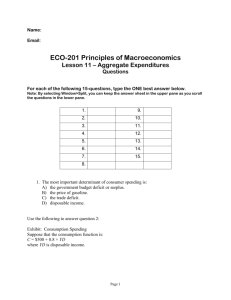

Review Questions 1. If disposable income increases by $5 billion and consumer spending increases by $4 billion, the marginal propensity to consume is equal to: A) 20. B) 0.8. C) 1.25. D) 9. 2. The spending multiplier is equal to: A) MPC / MPS. B) 1 / (1 – MPS). C) MPC + MPS. D) 1 / (1 – MPC). Use the following to answer questions 3-7: Figure: Consumption and Real GDP 3. (Figure: Consumption and Real GDP) The slope of the consumption function is called the: A) marginal propensity to save. B) average propensity to consume. C) marginal propensity to consume. D) marginal consumption increment. Page 1 4. (Figure: Consumption and Real GDP) The marginal propensity to consume in this example is: A) 0. B) 0.5. C) 1.0. D) 2.0. 5. (Figure: Consumption and Real GDP) If real GDP is $4 trillion, consumption is _______ trillion. A) $0.75 B) $1 C) $3 D) $4 6. (Figure: Consumption and Real GDP) If real GDP is $12 trillion, consumption is _______ trillion. A) $5 B) $7 C) $9 D) $11 7. (Figure: Consumption and Real GDP) If real GDP is $8 trillion, consumption is _______ trillion and saving is _______ trillion. A) $4; $4 B) $5; $3 C) $6; $2 D) $7; $1 Use the following to answer questions 8-10: Page 2 8. (Table: Individual and Aggregate Consumption Functions) Which of the following represents Andy's individual consumption function? A) C = 0.15YD B) C = 150 + 0.5YD C) C = 150 + 0.8YD D) C = 0.95YD 9. (Table: Individual and Aggregate Consumption Functions) Which of the following represents Fred's individual consumption function? A) C = 100 + 0.7YD. B) C = 100 + 0.5YD. C) C = 150 + 0.8YD. D) C = 0.80YD. 10. (Table: Individual and Aggregate Consumption Functions) Which of the following represents Mark's individual consumption function? A) C = 200 + 1.1YD. B) C = 450 + 0.5YD. C) C = 0.8YD. D) C = 200 + 0.9YD. Use the following to answer questions 11-15: Scenario: Consumption Spending Suppose that the consumption function is: C = $500 + 0.8 × YD, where YD is disposable income. 11. (Scenario: Consumption Spending) Autonomous consumption is: A) $500. B) 0. C) 0.8 of disposable income. D) $1,300 if disposable income is $1,000. 12. (Scenario: Consumption Spending) The marginal propensity to consume is: A) $500. B) 0. C) 0.8. D) 0.2. Page 3 13. (Scenario: Consumption Spending) The marginal propensity to save is: A) $500. B) 0 C) 0.8. D) 0.2. 14. (Scenario: Consumption Spending) If income increases by $2,000, consumption will increase by: A) $500. B) $2,000. C) $1,600. D) $400. 15. (Scenario: Consumption Spending) If disposable income is $1,000, saving is: A) –$500. B) $1,300. C) –$300. D) $300. 16. The marginal propensity to consume is 0.5, aggregate autonomous consumption is $10,000, and aggregate disposable income is $40,000. If disposable income is expected to increase in the future, the aggregate consumption function might take the form of: A) C = 10,000 + (40,000 × 0.5). B) C = 12,000 + (40,000 × 0.5). C) C = 10,000 + (40,000 × 0.7). D) C = 10,000 + (42,000 × 0.5). Page 4 Use the following to answer questions 17-18: Figure: Consumption Functions 17. (Figure: Consumption Functions) An economy's consumption function would shift from curve C to curve Cʹʹ when there is a(n): A) decrease in wealth. B) increase in the price level. C) increase in expected future disposable income. D) increase in wealth. 18. (Figure: Consumption Functions) An economy's consumption function would shift from curve C to curve Cʹ when there is a(n): A) increase in expected future disposable income. B) increase in expected future GDP growth estimates. C) drop in wealth. D) increase in the unemployment rate. 19. If the Federal Reserve increases interest rates to reduce inflation: A) planned investment spending is most likely to increase. B) planned investment spending is most likely to decrease. C) planned investment spending is most likely to remain the same. D) unplanned investment in inventories is likely to be negative. Page 5 20. The MPS plus the MPC must equal: A) zero. B) one. C) income. D) saving. Page 6 Answer Key 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. 15. 16. 17. 18. 19. 20. B D C B C B B A A D A C D C C B A A B B Page 7